Introduction : Here I have tried to understand and summarize the concept of Instruments that can provide Asymmetric Returns by Mr. Rajeev Thakkar (PPFAS Mutual Funds). There is a series of such brilliant videos uploaded on his YouTube Channel from which we as students can learn and understand various financial concepts in an easy way with the help of various diagrams and PPTs shown by him.

Credits: “I don’t know” - Investing for “I don’t know” dummies - YouTube

Earning Asymmetric returns basically means investing in something which has a potential to earn unlimited profits and has almost negligible odds of incurring a loss.

Before we understand the Asymmetric Returns structure, let’s look at the normal operations in plain vanilla case Equity Investing.

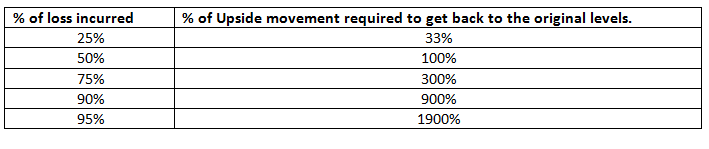

Let’s say we invest Rs. 100 in a stock of a company and unfortunately, the price happens to slide then, in order to come back to the original investment level, the stock price has to perform in a greater proportion to the amount of price decline it has had after we have invested the amount.

It is depicted in the table below:

Thus, we come to a conclusion that by investing in the following instruments we cannot expect to have asymmetric returns:

- Vanilla Equity Shares

- By Leveraging or the Futures route

- By having a concentrated portfolio of stocks.

- By making Big bets in a single/few stock with no diversification etc.

Especially in point no. 3 and 4, the loss incurred in individual stocks get converted into portfolio loss. Thus, it is very essential to diversify and spread the holdings in various uncorrelated sectors.

Secondly, it is a fact that the share prices of a company largely depend on the future scenarios and expectations. However, even the promoters or the owners cannot tell with certainty that the future holds and the scenarios that will affect the performance of the respective companies.

Thus, investing is a game of probabilities and not of certainties. Higher the probability of profits higher will be its expected return and vice versa.

Thus, to counter this problem of uncertainty, investing in instruments that can provide asymmetrical returns is recommended. Asymmetrical returns are like A Free-Hit in a game of cricket wherein there is an opportunity to earn huge profits i.e. hit a six and virtually no downside i.e. one cannot get out. Thus, one can get a Free-hit when the market bowls a No Ball i.e. Special Instruments issued by the companies.

There are a few examples of instruments with a potential to earn asymmetric returns. They are:

- Convertible Bonds/Debentures.

- Bonds coupled with Options/Warrants.

- Convertible Preference Shares.

- ESOPs etc…

One can construct an instrument that can provide asymmetric returns as follows:

Step 1 – Invest Rs. 7,680 at the interest rate of 8% for 3 years. Thus Rs. 1980 in total interest will be earned at the end of 3 years of cumulative deposit.

Step 2 – Buy call option at the Nifty Level of Rs. 9,600 at a premium of Rs. 1,980 and keep the principle of Rs. 7,680 aside by investing in a safe asset like a Bank FD.

Thus here, if the odds are in your favour and the price of the stock goes up then, there is unlimited potential and if in case the price falls then there is a loss of the premium price at the maximum.

One such instrument was issued by HDFC Bank for Rs. 5,000 crores. It had issued a bond coupled with warrants that can be converted to equity at a certain price after a certain period. The structure was that it had issued a bond with a coupon rate of mere 1.5% along with warrants that can be converted to equity after a certain period. Thus, by this way, it had a Net Interest Margin (NIM) of nearly 8% and also, the net profits were inflated due to such huge margin. Though eventually, it had done it at the cost of the current shareholders whose equity was diluted due to warrants being exercised later on. Also, if it had issued both of them separately then, it would have to pay interest of say at least 7% to the bondholders and the profits from issue of warrants would have no effect on Profit/Loss a/c and it would be considered in reserves in Balance Sheet. Thus, via this route, it booked the interest expense of mere 1.5% though the actual market rate was around 7%. There was in form nothing wrong from accounting or law point of view however in substance it was Mens Rea.

Also, around the year 2010 the route of FCCBs was similar as the borrowing companies never used to consider the Exchange rate fluctuation in the profit/loss a/c thus inflating the margins when the rupee depreciated.

Thus to conclude, though it is said that F & O are the weapons of mass financial destruction if done for pure speculation purposes, however if used smartly, they can provide huge returns via leverage.

However, for proper construction of such instruments, following conditions should prevail:

- High Interest rates should prevail in the market so that we can earn sizable interest income in the Bank FD.

- The options should be reasonably priced. Else the interest earned above will not suffice.

It is to be noted that such complex and risky instruments are structured mostly during periods of high volatility as in the bullish market, investors will be better off by investing in Good stocks available at reasonable prices.

THANK YOU & HAPPY INVESTING!!