Hello I’m new to the company. Can you please mention why it was reporting losses and what are the headwinds faced by it?

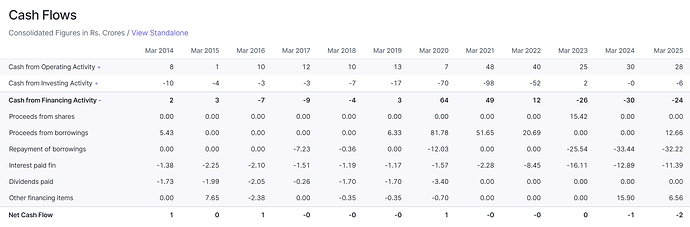

As per my understanding it faced high freight and fuel cost and capex coming live causing margins go down.

Google “times of India + dye intermediates + demand”

Quite a few articles from last year and early this year

What is your take on Vidhi speciality considering ?Would you be bullish on it as well?

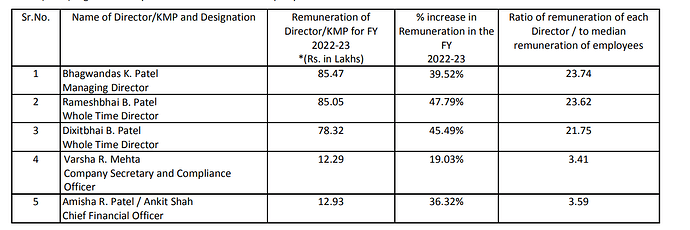

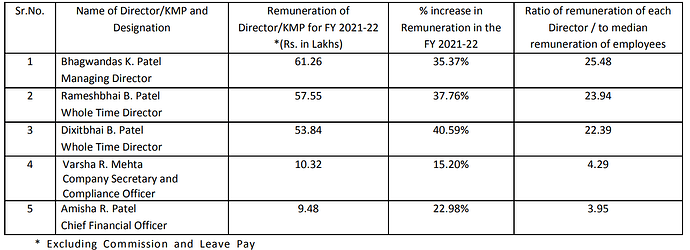

During tough times, management rewarding themselves generously !!

From - 2023 AR.

From - 2022 AR.

Its good to have component of variable pay associated with performance of the company rather than having fixed pay.

@jitenp sir - How do you evaluate this kind of behaviour ?

I have always maintained this.

Managements who take higher remuneration (within permissible limits) are better than promoters who take low pay, but siphon a lot.

I have had many experiences like these. I would prefer the former, as quantum is known. In 2nd case it’s a black box.

Also, for many this is itheir only source of income.

Hi Jiten Sir,

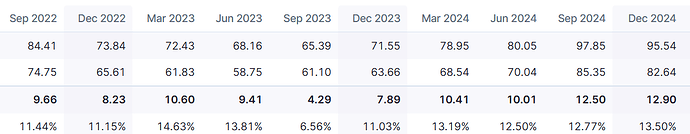

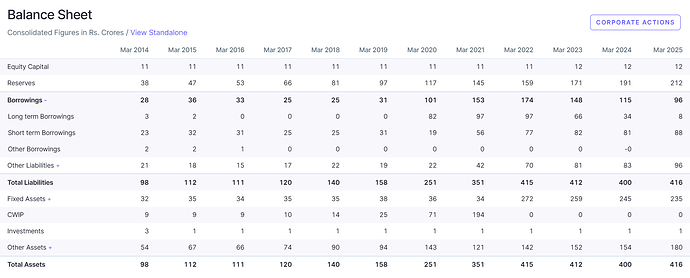

I’ve been looking into Vidhi Speciality recently and observed their fixed assets have nearly tripled in the last quarter, rising from ₹47cr to ₹121cr, alongside a reduction in debt from ₹52cr to ₹40cr. However, the demand appears to remain subdued. I would really appreciate your insights on this situation.

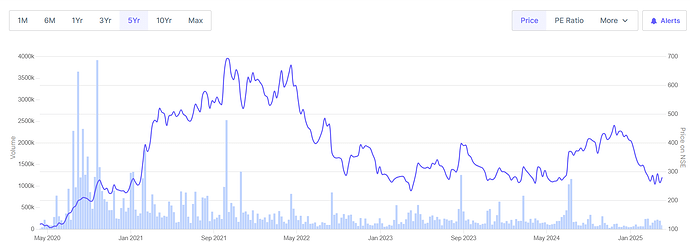

Price is also 3-4x in last 3 years. It is already priced in I suppose

I may be wrong but from the screener chart since Jan 2022 stock hasn’t given any returns, Capex & Debt reduction happened between Mar 2023 and Sep 2023. Correct me if i am wrong.

I have done a comparison between vidhi and dynemic, and find dynemic cheaper to Vidhi:

| P/B | P/S | Capacity- Food Colouring | Dye intermediates | |

|---|---|---|---|---|

| Dynemic Product | 1.77 | 1.23 | 6120 | 16500 |

| Vidhi Speciality | 8.13 | 6.46 | 8100 | - |

Dynemic is going to use half of dye intermediates for captive consumption. Vidhi seems to be costly comparative to Dynemic but execution wise vidhi has done well last few years before that both companies were equally placed. It is possible that costly become costlier and cheap becomes cheaper.

Disclosure: Invested in Dynemic around 275, no sell, buy recomendation

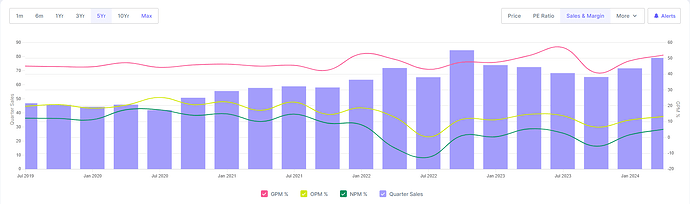

Vidhi continues to report decent results with impressive recovery in gross margin this time. Vidhi also have a 3x capacity planned in fy25.

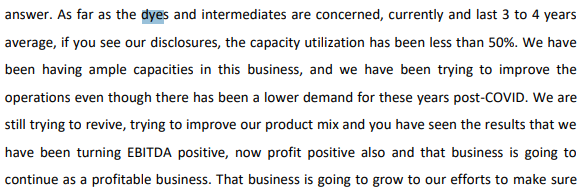

Why is Dynemic product still struggling to make good use of their new capacity? If its chinese overcapacity, shouldnt it be affecting vidhi too, which doesnt look to be the case. Hope there are some good updates in annual report which is due for submission by june 30.

They don’t speak much in AR. Conservative in words. Demand revival will be met with huge capacities built causing increased production. Increase in sale plus margin improvement plus increased realisation !![]()

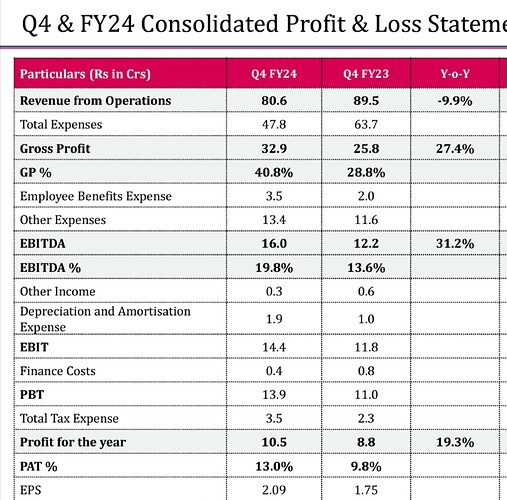

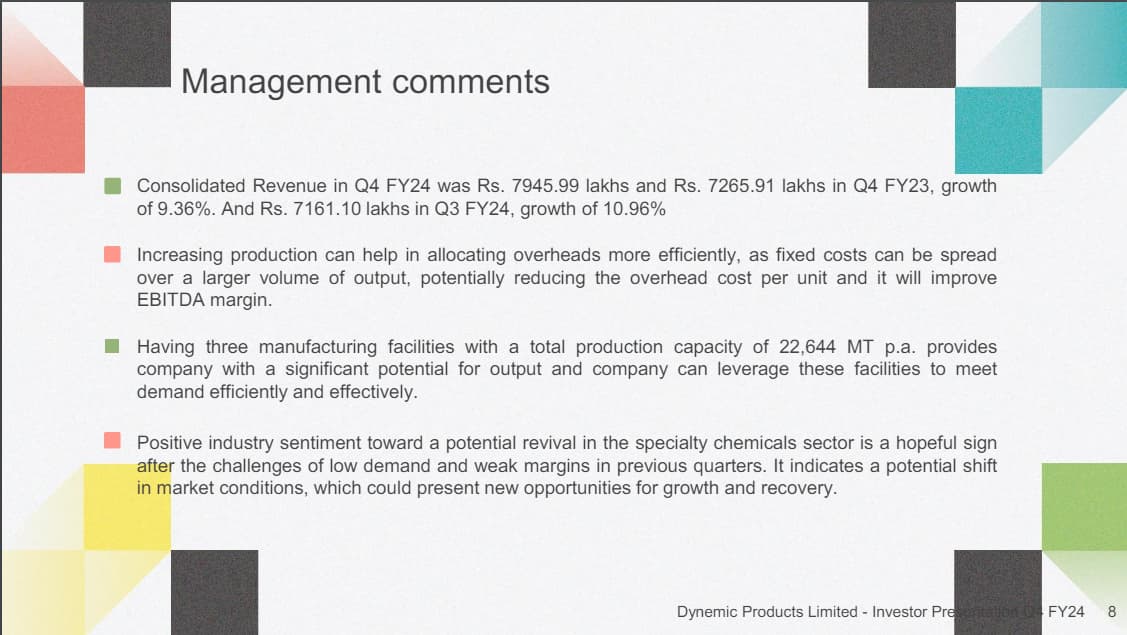

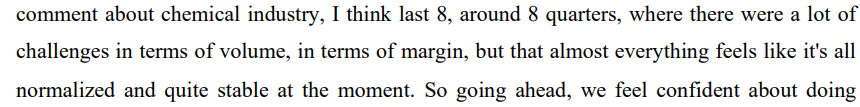

Finally some positive commentary from the management. Hopefully the worst is behind us now.

Significant margin improvements over the last 2 quarters post the Sep-2023 lows

In recent con call of Vidhi specialty, they didn’t mention Dynemic products as their competitor. Is there any significant difference in their products ?

Hello respected members anyone who has attended today’s AGM please share notes , thanks

Third successive quarter of healthy revenue/EBITDA growth..after 8 challenging quarters..

Positive commentary from various players..

Operating Leverage..

Interest cost + depreciation roughly 75% of EBITDA. Peak revenue potential of Rs. 650 crores with high-teens operating margin.

Debt reduction..

Stock price near 5-year lows..valuations even lower..

Seems to be ticking the right boxes

The company has given good results in Q4 and for the year…

Company seems to be reducing debt…

By end of next year debt may be around 70 cr…

According interest and depreciation will be less which will further boost profits…

Now it needs to be seen how operating margin expands…

Company looks at typical inflection point..

HEAD I WIN, TAIL I DONT LOSE type…

lets see how it pans out…

Company has mentioned that 28 cr debt will be coming for repayment this year…which will make debt in the vicinity of 70 cr by year end subject to company generates enough cash flows… considering past track record, it looks plausible…

Accordingly, interest cost will be approx 7-8 cr…

depreciation may be approx 14-15 cr…

Above will result in direct increase in PAT BY 5-6 crores…

if margin goes to 15% then PAT will further boost by 6-7 cr…It looks a possible scenario, considering history and competitor’s margins…

further if capacity utilisation increases(which should) approx by 10% then further PAT will be increased by 5-6 cr…

so, a lot of optionalities are there…

if all things click then profit may exceed 30 cr…else 22-25 cr may not be over expectation…

just plain math…

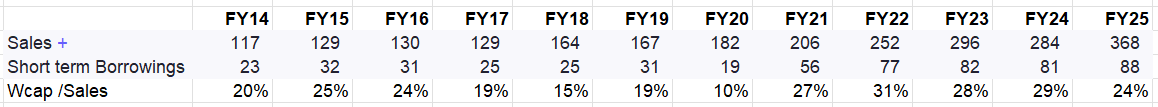

What about short term borrowings? Don’t they generally have high interest rate? Increasing from last 4 years. Looks like short term borrowings are frequently made for daily operations as core business is not able to generate enough cash.

Your opinion?

@satishwe @adminph2 This is super suspicious, someone deleted my above post from the admin side. Kindly look into this.

Reposting again.

Company has already paid off 90 Cr LT debt, only 8 Cr is left

This is corroborated with last 3 years cash flows,

Expect drastic reduction in interest rates, with growing sales and increasing margins should yield a bumper profitability over F26-F27

While Long Term debt is linked to Capital Asset (Capex) consider it as more of a fixed cost obligation. In downturn this hurts the most. Dynemic has been able to prudently use the cash flows to pay off this commitment and will be LT debt free by end of Q1F26.

Short Term debt linked to Working capital financing should be considered as a variable cost linked to sales, it should always be monitored with respect to sales and not as a standalone figure. If you see the table below, it is inline with historic ranges and will only change proportionately with sales. In other orders it will go down with lower sales and not act as a fixed deterrent.