Dr Agarwal Eye Hospital Limited

Founded by Dr Jaiveer Agarwal in 1957 under Agarwal group of eye hospitals, fun fact – he was the first in India to introduce Refractive keratoplasty (Basically a surgery which many of us or our family member might have undergone through to cure our eye deficiency in order to view without the need of glasses, he was the owner of Padma Bhusana Award for the same in 2006, he was the President of the All India Ophthalmological Society in 1992.

Currently Prof. Amar Agarwal Son of Dr. Jaiveer Agarwal undertakes the operations of the group companies, his education qualifications: He completed M.B.B.S. degree in February 1983 from Madras Medical College, Madras University. His further qualifications include M.S.(Ophtha) in July 1986 from Ahmedabad Civil Hospital, University of Gujarat, FRCS in October 1986 from the Royal College of Surgeons of Edinburgh, United Kingdom and F.R.C.Ophth in October 1988 from Royal College of Ophthalmologists, London, United Kingdom.

He is the first to remove cataracts through a 0.7 mm tip with the technique called Microphakonit. He has also discovered No anesthesia cataract surgery and FAVIT a new technique to remove dropped nuclei.

He is also the first surgeon to implant a new mirror telescopic IOL (LMI) for patients with age related macular degeneration. He has also been the first in the world to implant a Glued IOL

In this a PC IOL is fixed in an eye without any capsules using fibrin glue. The Malyugin ring for small pupil cataract surgery was also modified by him as the Agarwal modification of the Malyugin ring for miotic pupil cataract surgeries with posterior capsular defects. Dr. Agarwal’s eye hospital has also done for the first time an Anterior segment transplantation in a 4-month-old child with anterior staphyloma

Hospital sector’s tailwind

In 2023 private market and public market saw a huge amount and quantum of deals for

Hospital sector 🡪 30,000 crores to be precise in private market itself

Majority of them being led by Blackstone, TPG and Temasek Holdings,

Infact as per above article Temasek is likely to invest 10 more billion in India where in 2023 it spent 20% of it (2 Billion) in acquisition of 59% of Manipal hospital

Source: https://x.com/bastionresearch/status/1778057029694914974

Some of the interesting deals:

- Manipal Enterprise Health: In April 2023, Temasek Holdings (Private) Limited a Singapore’s based sovereign wealth fund acquired a 41% stake in Ranjan Pai led Manipal Enterprise Health for Rs. 16,000 Cr. This took the total stake held by the sovereign wealth fund from 18% to 59% and valued the company at Rs. 40,000 Cr making it the largest healthcare deal to date.

- CARE Hospital: In October 2023, private equity giant Blackstone acquired a majority stake in CARE Hospitals which in turn had inked a definitive agreement to buy KIMS health. The deal was worth ~$1 Bn ($700Mn for CARE and $360-420Mn).

- General Atlantic had acquired Ujala Cygnus, a leading hospital chain in northern India. Though the financial details are not disclosed, the deal has valued the chain at Rs. 1,600 Cr.

- Parent entity of Dr. Agarwal Eye Hospital limited 🡪 Dr Agarwal Healthcare limited 🡪 Raised money from TPG and Tamsek 🡪 Now they are aiming for the IPO of around 3000 crores of Share Sale 🡪 where the entity will be valued itself at 16-18k crores, the consol revenue of the group entity is around 1000 crores (Out of which listed subsidiary’s revenue is around 300 crores) assuming that since listed entity operates under asset light model and giving 20-30% discount on upper price band the proportionate value allocation of subsidiary should be around 3.5K crores against the value current of 1.5K crores + Capex coming in live can make the bet more attractive

Idea Generation:

Traveling to work last few days have been seeing poster of Dr Agarwal Hospital on every 2nd bus of Best, I thought i must be imagining it but turn out i wasn’t, I noticed this pattern during 4 days of office in a week and every day Near Rickshaw Stand i witnessed multiple best bus passing with Hospital’s advertisement, While traveling in Rickshaw i noticed that, that Rickshaw also had the same poster and I asked for the review, apparently the hospital is going all in on Marketing, according to the driver, they are going big in Mumbai and wanted to get hold of the public,

Quite incidentally my spotify subscription had expired and being too lazy to renew it, I kept using it as it was and Dr Agarwal’s Advertisement popped up in spotify too,

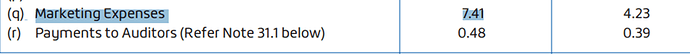

I checked their 2023 marketing expenses immediately (2024 aren’t out yet) and not surprisingly they are up 3.5x.!!!

Checks out that they were big in South but now they are going big in Mumbai and hence heavy marketing.

I checked google review for Mumbai hospitals and see the reviews → 15K reviews and average rating is 4.9…!

If they go big in Mumbai and Gujarat and They go successful this will be my biggest winner in Hospitals after Artemis and Kovai

Thesis:

As the economy’s per capital income grows beyond 2,500-3000$ the incremental expenses towards health increases that’s common observation among the economies which have transformed from developing to developed economy.

Most of the hospitals have had dream run up some of my favorite in this field where Artemis and Kovai, Kovai has had the best practice in terms of business operations and Artemis has followed them a long way!

Specifically Kovai has had dream run in last 10 years, anyways moving towards the Main topic, unlike other hospitals eye care hospitals are way different, why?

Because eye surgery are generally for very short span of time, may be for 1-2 hours and 99% of surgery don’t require patients to stay in the hospital after the surgery and if they do the ALOS may be even 1-2 day meaning the requirement of the extended facilities is very minute for them. The space requirement is also far less and hence capital requirement of such business model is very less comparing the same to Full fledged hospital.

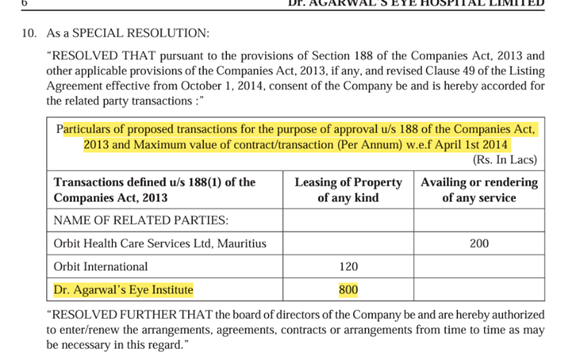

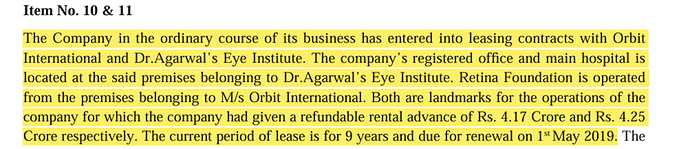

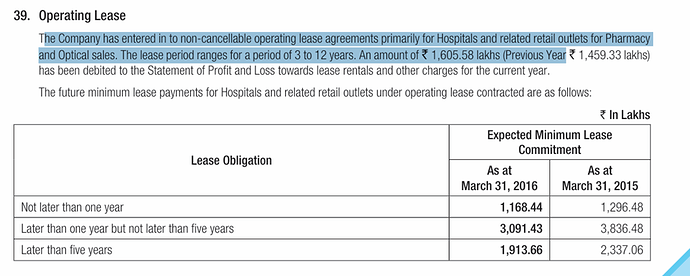

The group structure of this entity is such that Agarwal Health care limited the holding company is also involved in the same business activity but the good part is as follows, unlike other hospitals which put up their capital, buys the hospital, operates it and breaks even at PBP level 7-8 years time period here they lease up the land/building from the Holding company and it’s associates consideration of which is rent this allows them to make money before their competitor, Now I know that the Brand is the core competitive advantage for the hospitals but they are trying something new in terms of maintaining the cashflow for the company and scaling it fast,

The holding company is backed by 2 of the biggest funds, TPG and Tamsek, together they own 60% of the holding company, it’s highly unlikely that they’ll sell/Fuck up the subsidiary which gives them 30%-35% of the revenue,

The company is backed by some of the best and visionary founders, they have contributed to the society more than any promoter in Hospital field that i know of. This makes me believe in the high corporate governance standard, there’s nothing concerning that i found in last 17 year’s annual report too.

the books checks out corporate governance checks out,

Asset base is expanding quickly they could have more than 500 crores of assets in less than a year generating enough revenue even at 1x asset turnover,

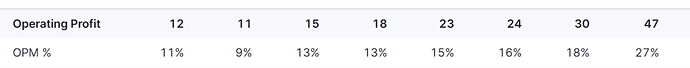

they’ll generating revenue equivalent to 500 crores and 150 crores EBITDA, although this isn’t normal hospital but one can still assume that they can be sold at 20-25x EBITDA, which is equivalent to the proportionate value that we arrived allocating the value of holding company to the subsidiary,

Only anti thesis:

Holding company is in the same business, why will the corporate structure be kept messy if the holding company and it’s subsidiary is in the same business sharing the same name?

Chances of both company merging and since subsidiary trading at discount to the allocated value the swap potentially harming to the listed company’s shareholder might be the concern,

As taking the benefit of the inefficiency is something most of this PE funds do, hence something to look out for

Summary

It’s a company backed by some of the mind who added huge value for the people of bharat. Whether it be the Founder or his Son both of them contributed greatly in the medical field, not only that Amar Agarwal bought in Investors tuning in his business mindset, helping the holding company grow to the size of $2 billion.

Now they are growing the company fairly with a huge speed expanding asset base to 500 crores the value buy kicks in.

There’s immense value in the company backed by professional management.

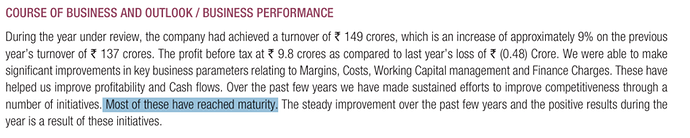

It possesses the highest level of capital efficiency, It generates ROE north of 30% from Day 1 where other hospitals require 8-10 years to reach that level. It’s fairly new operation model if it’s successful it’ll be generating the flush of cash, much larger than any hospital in it’s early stage and will be able to roll on cashflow for new investment and since Major part of new investment will just be upfront lease deposits + equipments, the scale will be much much faster, net of leases they generated around 60 crores of Free cash flow in 2024 alone, considering the same it’s not hard for them to earn 100 crores of FCFE in next 3-4 years, even faster in 2 years if Capex goes as per plan, they are going aggressive as mentioned in the Idea generation section. I wouldn’t have it any other way, If Holding company’s IPO is supposed to come it’s fairly certain they’ll bring it when the company’s is in best possible case, for that they’ll require Subsidiary to be in the best earnings and that part is still pending,

I personally see this entity worth half a billion at least in next 2 years

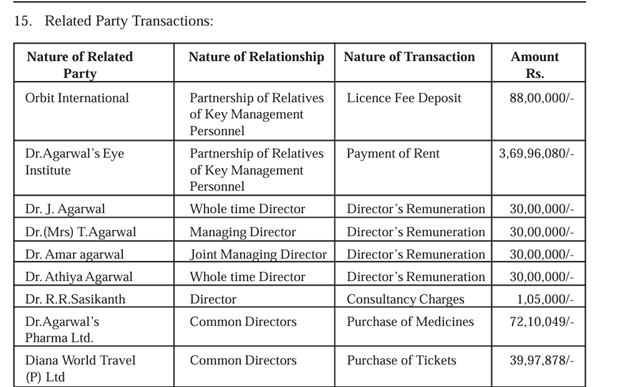

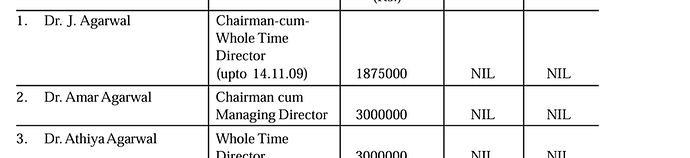

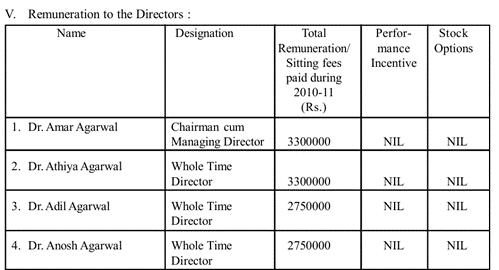

Annual Report – 2009

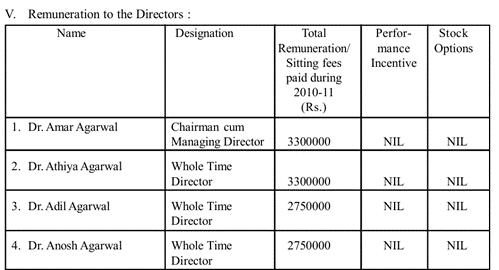

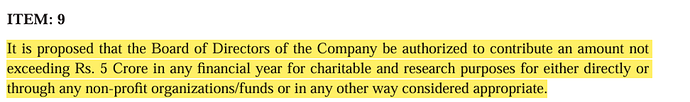

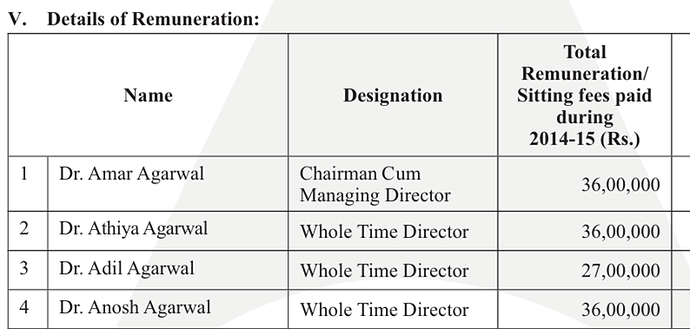

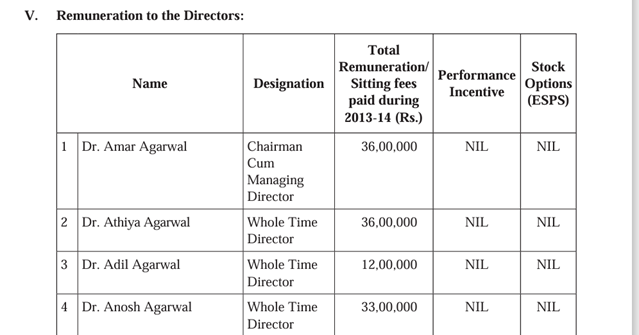

Compensation – Dr. Amar Agarwal – MD at that point – 2,50,000 p.m. 🡪 PAT + Depreciation was merely 5.5 crores than why such high remuneration (taking into account 30 LPA is just for one board member)? Total remuneration paid to family members = 1.2 crores out of 5.5 crores of cash earned

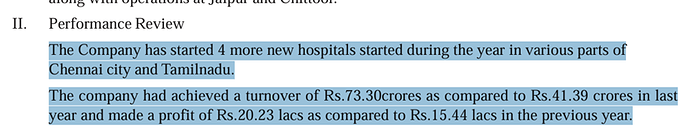

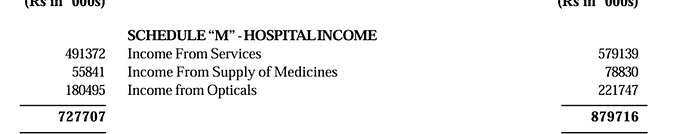

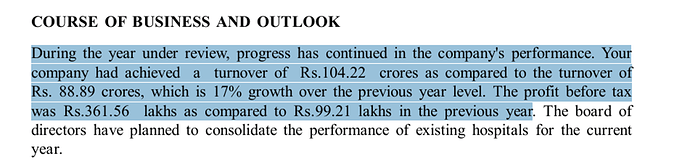

Turnover in 2009 🡪 73 crores to 2024 🡪300 crores, what took so long for the company

2009 🡪 Performance analysis

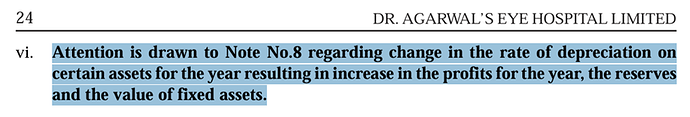

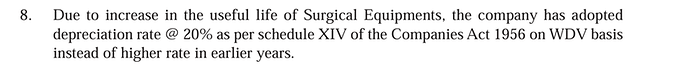

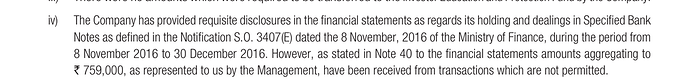

Auditor’s concerns:

Note: 8

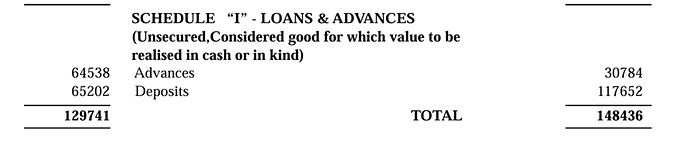

FS – Analysis

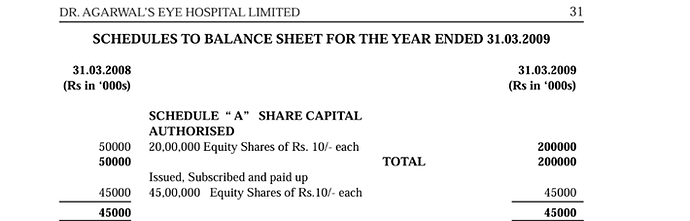

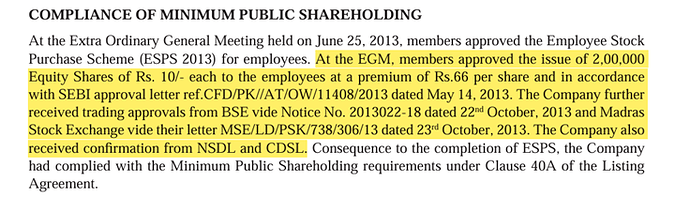

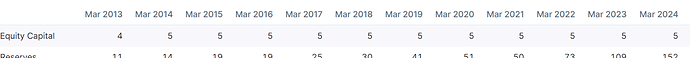

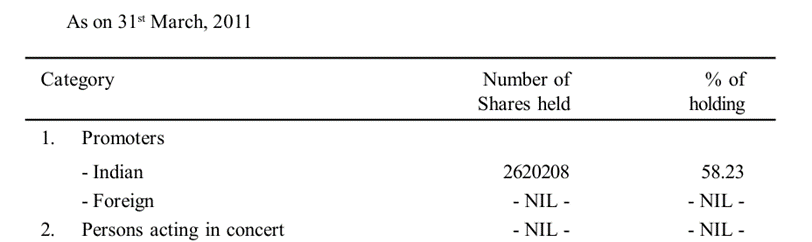

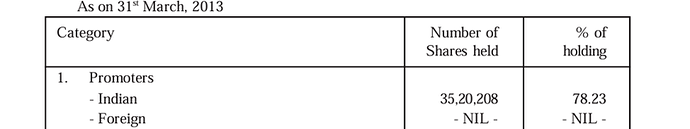

There has been no dilution in equity in last 17 years, apart from mandatory MSP criteria of SEBI implemented in 2011 due to which dilution took place in 2014!!!

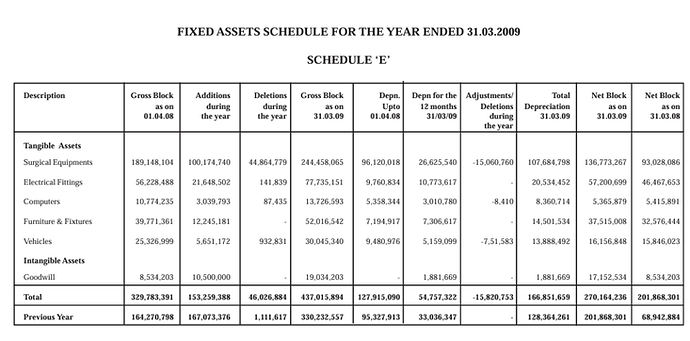

Looking at the Fx Assets schedule – Weird thing is there’s no building which is one of the core asset of the hospitals as they are quite asset heavy and require 7-8 years of PBP – SOIC – this can be one of the core thesis of investment refer in Thesis section

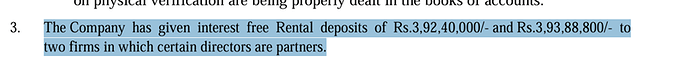

Rough reason is their parent company is a big hospital chain they lease out their buildings from them: deposit is a part of the same only

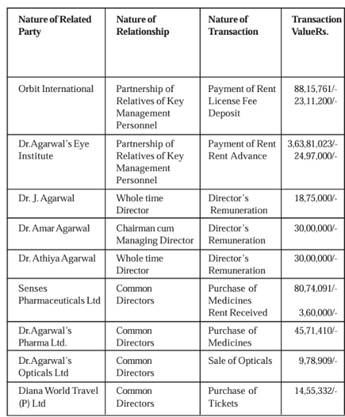

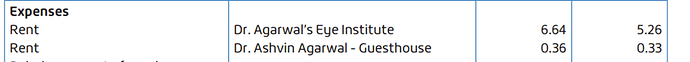

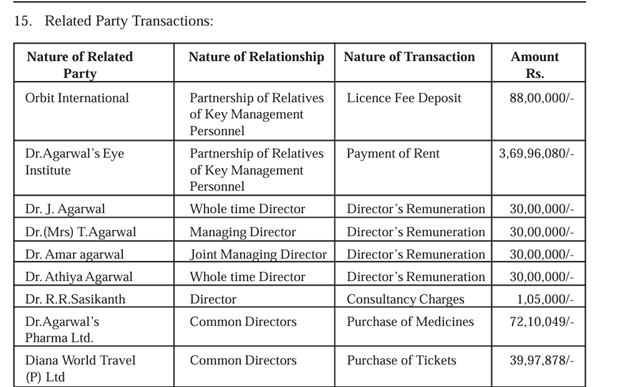

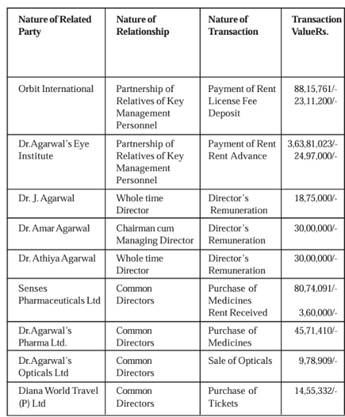

More than 3.69 crores were paid in rents 🡪 the same goes to promoters through parent entity More than 3.69 crores were paid in rents 🡪 the same goes to promoters through parent entity

More than 3.69 crores were paid in rents 🡪 the same goes to promoters through parent entity More than 3.69 crores were paid in rents 🡪 the same goes to promoters through parent entity

Annual Report – 2010

Resolutions required to increase the remuneration of Dr. Amar and Athiya from 2,50,000 to 3,00,000 a month each? And Anosh Agarwal 2,50,000 a month

The reason might be both Founder and his wife who used to draw their salary of 30 LPA died during the year, total family remuneration will be 78,75,000 which is less than 1.2 crores withdrawn 🡪 Green flag, cause if they wanted they would have compensated for the same through tits bits here or there

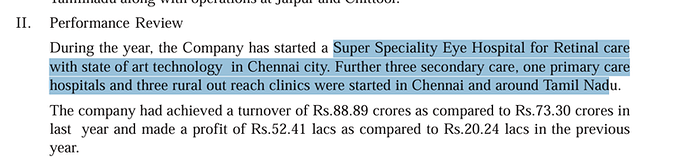

Performance analysis for FY:

Total network of hospitals 🡪 30

FS – Analysis

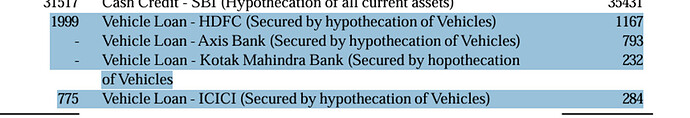

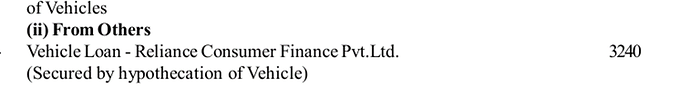

All though very very minuscule amount not even 25 lakhs but why is vehicle loan outstanding for a eye chain hospital, I mean this has to be for promoters right cause generally eye chain don’t have ambulance

Trend I observed 🡪 Income from optical increasing as a % of revenue, generally that’s a higher margins business

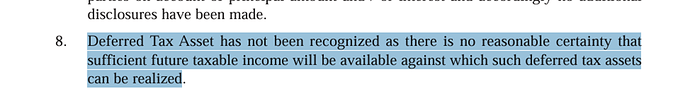

Why so unconfident lol…!

there are significant increase in RPT

Annual Report – 2011

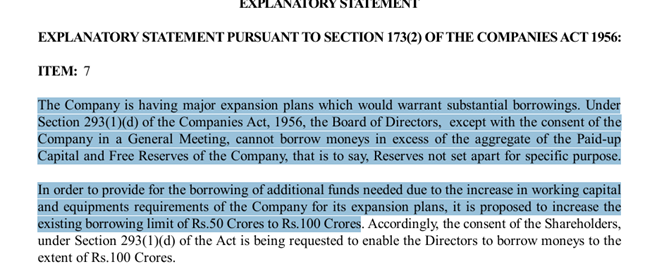

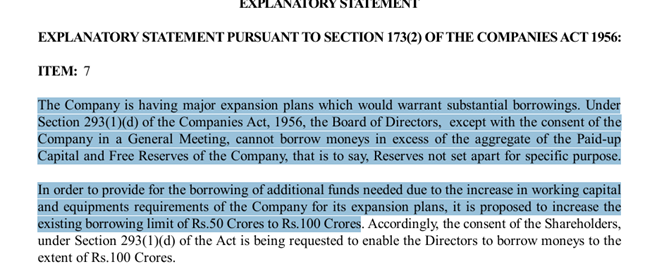

Expansion announcement through borrowings:

Increase in word of mouth it seems

Current year’s remuneration of family – Works around 1.2 crores, Lol, seems too early to declare as a green flag but anyways in last 3 years they have scaled a lot due to operating leverage seems fair enough that they haven’t increase remuneration at family level i.e., 1.2 ka 1.2 only

FS – Analysis

Again a vehicle loan

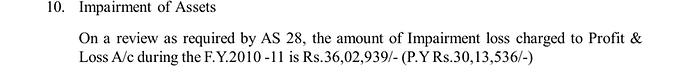

Impairment loss charged to surgical appliances

Annual Report – 2013

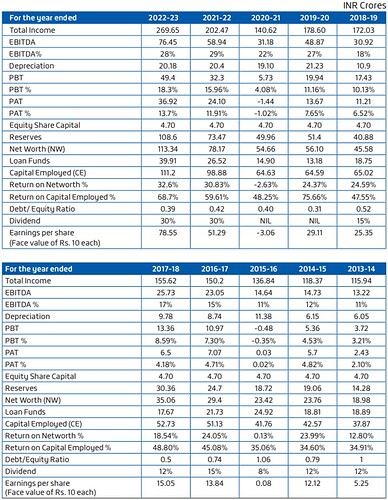

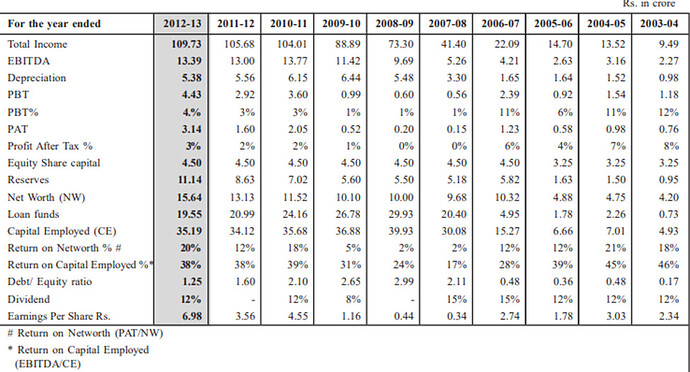

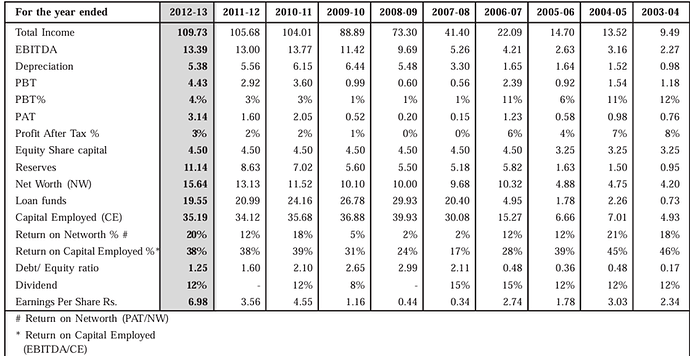

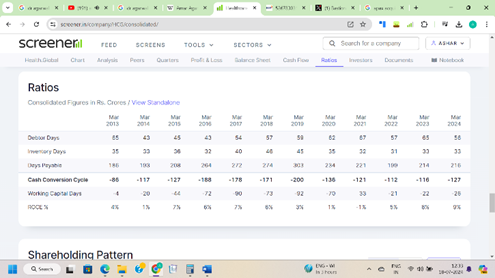

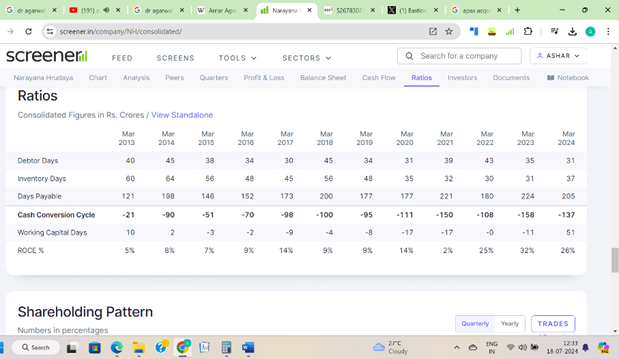

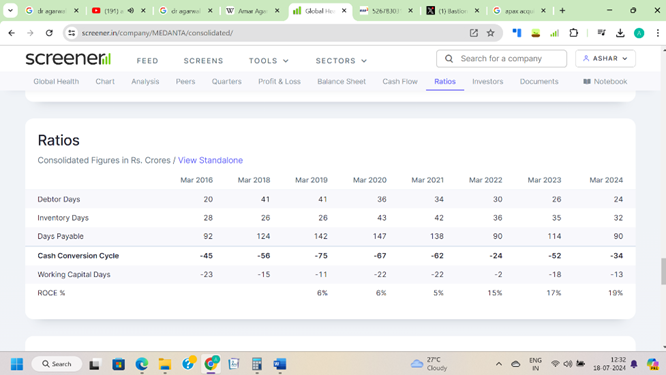

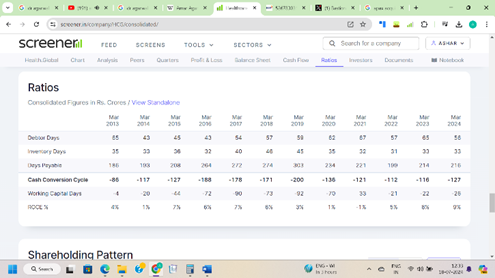

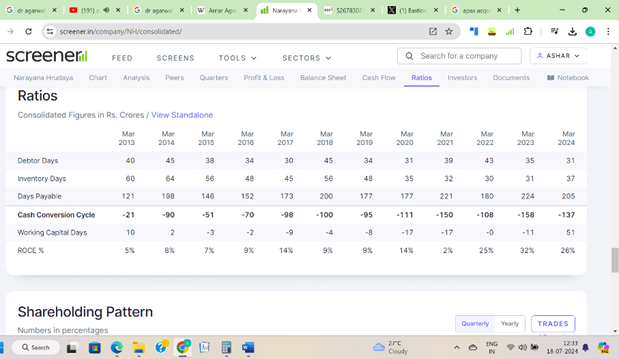

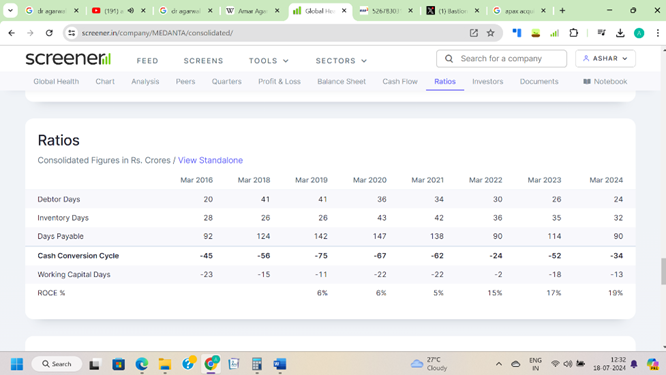

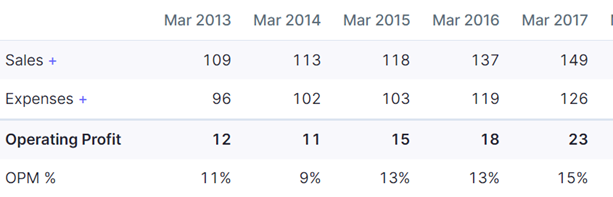

Look at ROCE and ROE no’s whenever the hospital’s in it’s beginning phase it’s very unlikely it’ll earn ROCE more than 10-15% even the giant like Medanta, NH, HCG aren’t able to do so, but their business model and way it operates makes it lucrative for them to earn consistently above average ROCE and ROE (Refer below exhibits for Comparable ROCE and ROE to understand the differentiating factor in business model)

HCG

NH

Medanta

In compression of above all there’s Dr Agarwal earning 35% ROE (Comparing ROCE with ROE as major hospital chain stated above own and operates their own building hence there’s no need of lease adjustment but here major capital structure item consists of Lease liability, hence considering the same ROE is taken as KPI)

Network of hospital 🡪 50

In 2012 the company’s promoters increased their stake through open offer

Annual Report – 2014

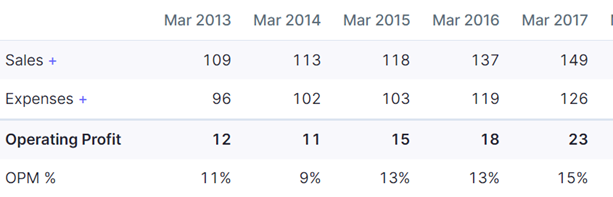

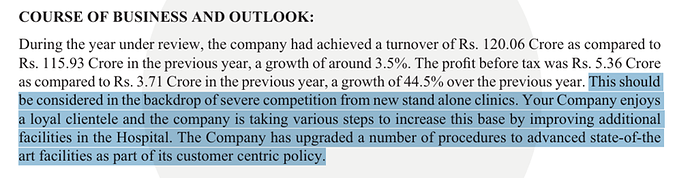

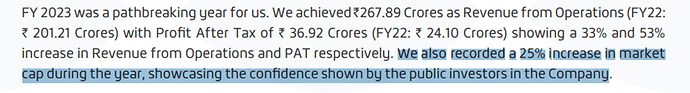

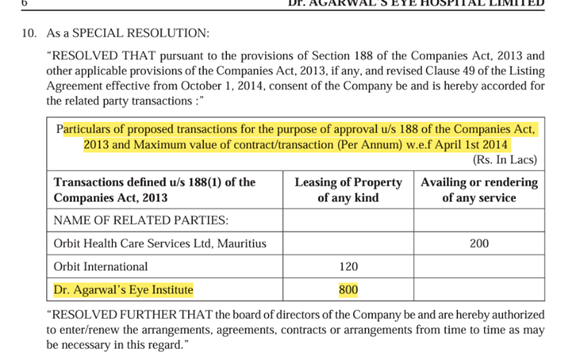

Post asking for increment in leasing cap limit – the Ramp up was good almost 20% CAGR in next 2 years (From 2015)

Why??

There has been no increase in promoter remuneration in past 6 years?

Apart from lease of course but that are at FMV.

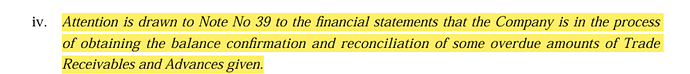

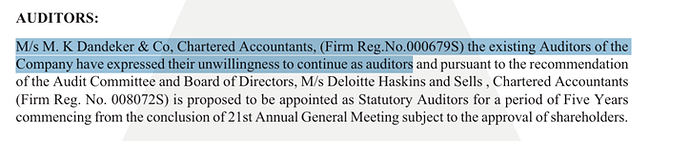

Auditor’s concern

Annual Report – 2015

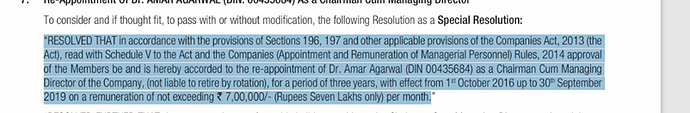

New CAPEX based on leases Special resolution

PAT + Depreciation from 2008 to 2015 almost doubled but the remuneration of family hovers around the same range.

Annual Report – 2016

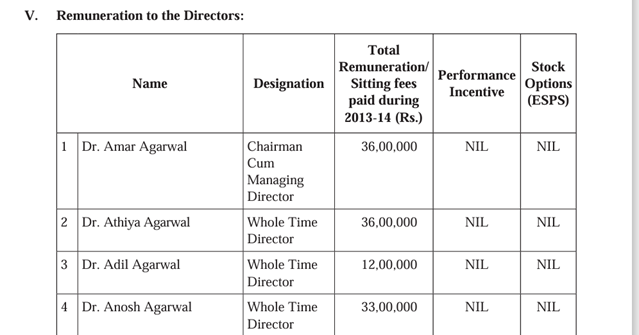

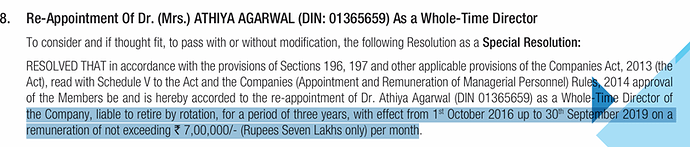

From 300,000 to 700,000? May be due to the fact that Adil and Anosh Agarwal (Family members) retired from the company, but still 1.6 crores seems excessive on cashflow of 11-12 crores

Note: Major hospitals 🡪 Vellore and Jaipur (Very big in south India as they are from TN and Rajasthan which isn’t surprising since Agarwal means they are more likely to be Marwadi hence Rajasthan seems to be a good place for familiarity )

Operating in 22 location in India

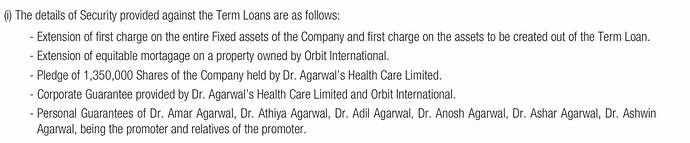

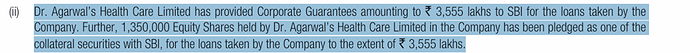

The Charge against the company’s loan 🡪 Equitable mortgage on property held by director/owner

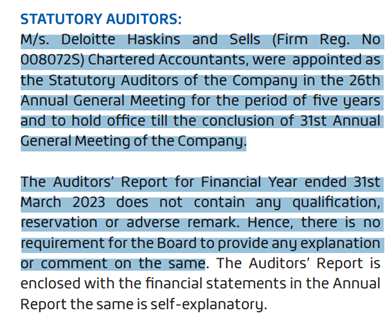

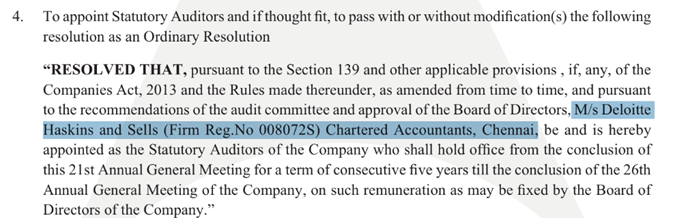

Jump in auditor’s remuneration by almost 3x 🡪 Quite understandable actually as Auditor is Big 4

Expansion

Annual Report – 2017

As explained in thesis part building hospital is part of core brand building 🡪 you’ll require a significant time to even build a reputable hospital, for example if I’m going to Fortis as a regular person for my annual check up, it’s very unlikely that I’ll change it to Kovai or Say Artemis.! We can observe the significant improvement in margins post 2017-18 from 16 to 20% and they are currently at 30%.! Maturities of investment highlighted here should be considered here

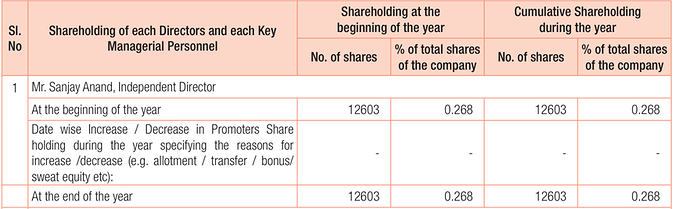

Question: If My Sanjay Anand is Shareholder how is he Independent? same goes for CS of the company

Auditor’s concern:

My personal view: it’s of demonization times: for a company doing revenue of 150 crores INR 759,000 of old notes compliance lapse isn’t big deal practically

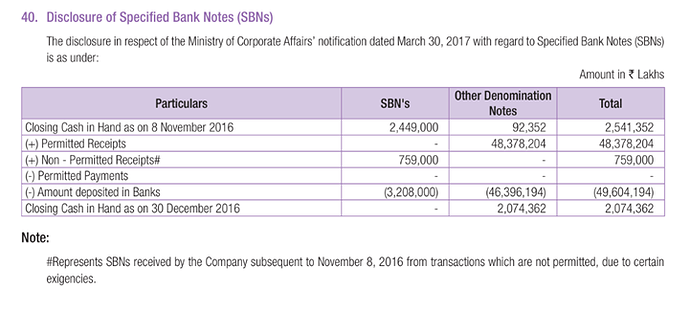

Annual Report – 2023

Why would you say something like this in the first place, your work is to do business and make bottom line and not to worry about what investors are doing to the stock price.

Part of major expansion plan?

Books clean as they can be

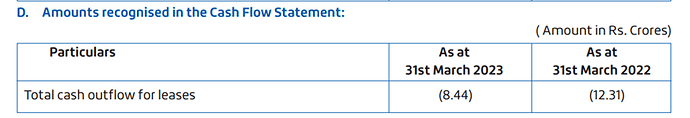

Total Rent expenses v/s RPT rent expenses

Roughly the cash outflow = Rent expenses in total 🡪 so roughly out of 8 crores, 7 crores is RP rent which is a good thing as mentioned in above section of thesis

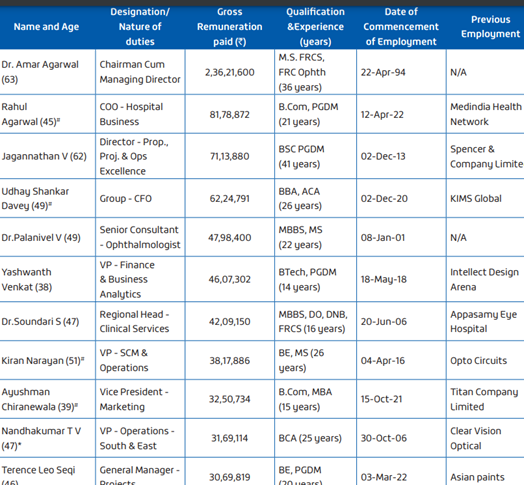

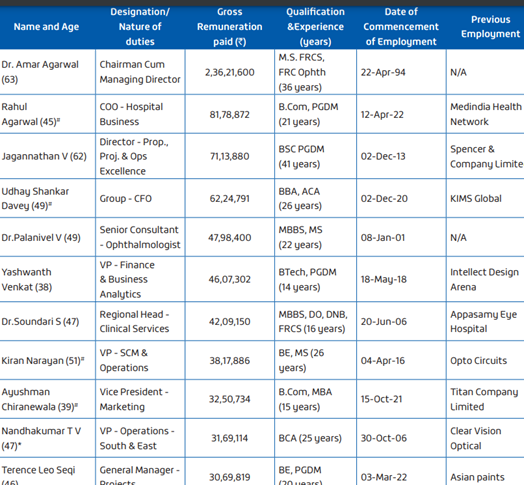

Some of Board’s remuneration: Special look at previous employment history

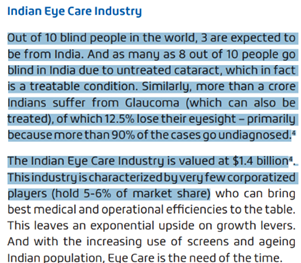

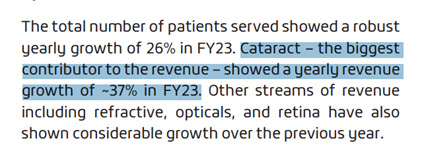

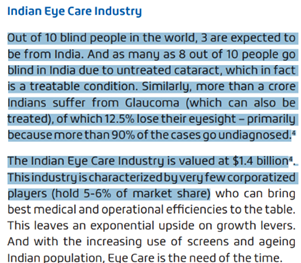

Industry overview:

Disclaimer → Not Invested still contemplating about my purchase, I can buy it at any time and sell to, Do consider your risk and rewards while investing into the company based on my data complied.