CMP: 6000.00

Market cap: 869 Cr.

Disa India Limited(DIL) supplies moulding machines, sand mixers and surface preparation machines to foundries or OEM with foundry division to make metal casting.

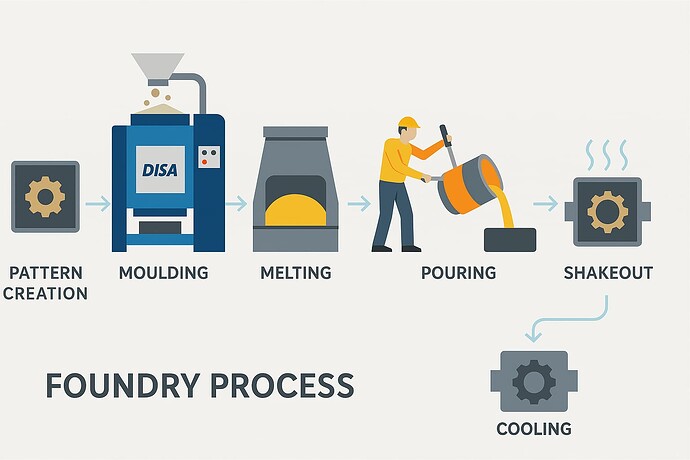

Little introduction about foundry/casting:

Foundry are facilities which produces metal castings and offer casting related services. Metal is melted to liquid state and poured into mould of desired shape, mould material or casting is removed after the metal solidifies on cooling. These casting will have certain impurities/rough surface which has to be removed and smoothened by shotblasting.

Most common metals which undergo casting are iron and aluminium. Other materials include steel,bronze, zinc and magnesium. Watching the video from the recent movie Avengers-infinity, the scene of hammer making by Thor may help us understand it better Stormbreaker Making Scene | HD | Groot Helps Thor to make stormbreaker | Avengers: Infinity War 【HD】 - YouTube

Foundry is considered as mother of all industries. Approximately 90% of all manufactured goods depend on metal castings for component parts, with cars and trucks being the largest market. Castings are used virtually everywhere including household appliances which are used in daily life like cookers,plates,cups…etc. In the order of preferences, casting are used mainly in automobiles(32%), agriculture equipment, earth moving equipments, aerospace, railways, shipping, heavy equipment, mining, defence equipments, pumps, compressors…etc

DISA INDIA mainly caters to ferrous casting industries which are used in heavy commercial vehicles and tractors by providing complete foundry machines and solutions.

Wheelabrator division provides shot blasting machines for surface cleaning of castings produced at foundry.

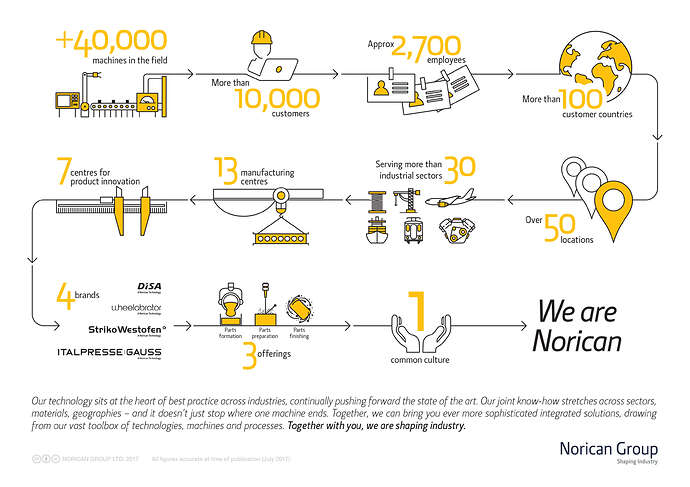

DIL is an Indian arm of Denmark-based promoter company DISA HOLDINGS which owns 74.8% stake and in turn operates under the umbrella of NORICAN group. NORICAN group formed by Disa ltd, Wheelabrator, Italpresse Gauss and Striko Westofen.The following images gives overview of the Norican group.

Disa India ltd(DIL) is a leading equipment manufacturer with advanced foundry and surface preparation technology. It supplies complete foundry system by integrating international range of moulding machines and sand mixers with proper combination of sand plant equipment.

Investment thesis:

Changes in Indian foundry industry:

Around 4,000 to 5,000 foundries are present in India with estimated capacity of 13 million ton capacity. The no. of foundries have reduced from around 6,000 to present no. due to bad economic condition in last few years. The total production of casting for last few yrs is :

2015-16: 9.8 million tons

2016-17: 10.3 MT

2017-18 : estimated around 11MT

With capacity utilisation of foundries going up, they need to expand for further growth which should benefit the market leader DIL.

Automation and manpower reduction: Indian foundries are facing problem with lack of skilled manpower and increasing labour cost. Disa offers complete automatic solutions to foundry industry which requires minimal manpower supply,reducing manpower cost and improves productivity. Currently out of 5,000 foundries, only around 300 are automated which gives DIL good opportunity.

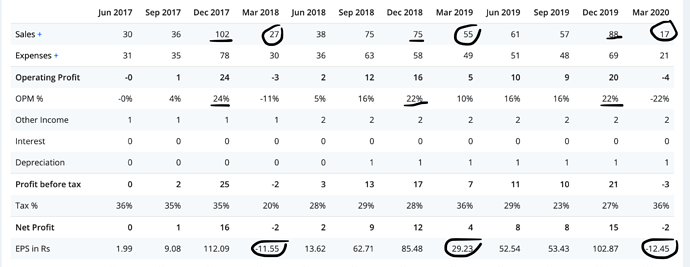

Disa India growth is directly linked to growth of manufacturing industry and capacity expansion by various sectors like auto, agri, infra, engineering goods. Around 32% of foundry industries output goes to auto sector. After reaching peak sales in 2011-12, auto industry has suffered for next few years with slow economic development which in turn had adverse effect on foundry growth. Now with record sales of auto /tractors in FY18, foundry industry should be looking for further capacity expansion. This should automatically benefit Disa India. If we track the order book for last two years it is getting better with each quarter.

order book(in Cr) Q1 Q2 Q3 Q4

FY17 87 92 53 70

FY18 113 118 91 126

FY19 155

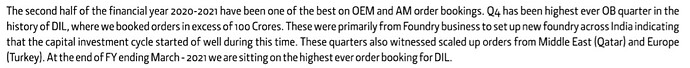

DIL as global supplier to Group companies: due to low cost of manufacturing at India, parent company considers DIL as manufacturing hub for its global supply. In the year 2016-17, it has passed resolution to increase transaction limit with other group companies for expected increase in exports from DIL.

Disa Industries A/s(Denmark) - 75cr

Disa Changzhou(China)- 20 cr

Wheelabrator Czech( Czechoslovakia)-20 Cr

Wheelabrator merging with DIL: In 2009, DISA group merged with Wheelabrator group which is leader in manufacturing of shot blasting machines. As a result of global merger, wheelabrator products are represented in India exclusively by Disa India ltd. Wheelabrator technology has been localized for production in India and marketed under wheelabrator brand by DIL.

Bhadra cast alloys: DIL acquired a local foundry in 2016 and renamed as Bhadra castalloy to supply casting to wheelabrator products and for global supply which has started contributing to growth. For fy18 it has net revenue of 9.8 cr and net profit of 0.4cr.

Filters: Filters contributes to around 15% of revenue. DIL is selling these products with foundry machines and as stand alone products. With strict environmental norms the use of filters is expected to improve.

Norican has acquired light metal casting solutions(LMCS)group in 2017 which is an equipment manufacturer and service provider for light metal casting alloys of aluminium, manganese and zinc alloys. This acquisition is contrast to present Disa focus on grey iron casting(ferrous segment). LMCS provides new opportunities for group in nonferrous segment. How this is going to benefit DIL needs to be watched.

Being in cyclical industry it has managed headwinds of economic downturn very well in last ten years by reporting positive net profit and remaining cash rich( 75Cr) which is the hallmark of quality company with good management in challenging business scenario.

Negatives:

Cyclical business:DIL depends heavily on foundry industry, manufacturing heavy casting for HCV and tractors. With economic downturns business may suffer.

Increase in raw material cost: with increase in Iron ore price, the offtake from foundries will reduce as the end customer will not easily accepts price increase. In January/ February of this year there are certain reports that how the utilisation of foundry industry went down with spike in iron ore prices.

Environmental issue: as most of foundries release poisonous gases, the Govt may impose certain restrictions which can further dampen the growth of foundry industry (it may turnout to be an opportunity for DIL)

Company doesn’t have much space to expand at the existing factory sites. It may have spend more on land /new factory when it takes up expansion.

China import effect on foundry industry: around 1-2 lac of casting is imported from China which in increasing every year. It’s difficult for Indian foundries to compete with China as govt provides 40% subsidiary.

I think the focus was shifted more to India as ex. MD Viraj Naidu moved up to global position in the group company. If he decides to quit, Will the parent company remains bullish on DIL needs to be seen.

Equity base of company is small and illiquid.

Discl: invested around 9% of Portfolio.