once they shift to land in goa revenues might double and so shall profit also increase connectivity to sikkim shall boost profitability apart from online biz gains looks very attractive discl invested for last one yr

The Q2 results are out

http://www.bseindia.com/corporates/anndet_new.aspx?newsid=7edba6be-a663-4fdb-b968-0bb4722e133b

The company is scheduled a conference call on 17th October 2017

http://www.bseindia.com/xml-data/corpfiling/AttachLive/1ac3ae96-34cd-4fa7-b7cd-8cfeba86d5c6.pdf

Going by the concall, There are many growth drivers present.

-

Within 12 months they will have a casino in Nepal having 15k sq ft area almost one third of total area in India currently.

-

New onshore gaming zone in Goa could be game changer as it will remove all seating constraints in offshore casinos hopefully 3 yrs from now. They aim to create 4-5x tables/seats in onshore gaming zone with 30% reduction in operating costs.

-

Sikkim Casino not picked up yet as new airport is not up and running. Should inaugurate in Oct/Nov

-

Online gaming is growing very very strongly - 50% yoy growth in FY18e and will likely continue after launch of Rummy and fantasy games.

-

They could have 500cr cash in hand and zero debt by the end of FY18e which makes them fully valued on FY18 on ex cash basis.

Disc - Invested with 10% PF

Q2Fy18 Concall Highlights

Management commentary:

• Growth will be much stronger in Q3 due to festive season & holiday.

• Focus on asset light model

• Not focus on hospitality & Water Park

• Kathmandu casino; tied up with marriott hotel -Next year operational

• Online gaming:

• 30 cr revenue but reported is 24cr (bonus given to players while they deposit money to buy chips & as per accounting policy that bonus have to knock off from expenses)

• We expect 30cr revenue in Q3 & 100 cr kind year as whole.

• EBITDA: 10cr

• PAT: 6 cr

• Has potential to grow online business as much as offline.

• 50% yoy growth in FY18e and will likely continue after launch of Rummy and fantasy games.

• Rummy: reasonable contribution in next 6 month

o Expect 40-50cr topline in 1st year

• Fantasy sport: Software is ready

o Mid Jan-Test model

o Expect to start before IPL

o Cautious on model

o No plan of inorganic route

• Only co. to have poker rummy & fantasy sport on 1 platform.

• Poker market share: 200-250cr

• Adda52 market share: 100-130Cr

• Revenue in Q2: 30cr vs 30cr in Q1

• Onshore casino:

• Will get clarity in government winter session

• Already identify land parcel

• Licenses are given in lieu of offshore licenses

• no fresh licenses are issued

• on like to like basis 25% cost will come down. Power and fuel cost is cheaper

• time frame to convert offshore casino to online: 3 yrs as per Government

• New onshore gaming zone in Goa could be game changer as it will remove all seating constraints in offshore casinos hopefully 3 yrs from now. They aim to create 4-5x tables/seats in onshore gaming zone with 30% reduction in operating costs.

• Sikkim casino: airport to be operational from November

• Sikkim casino not operational in Q2.

• Sale of non-core assets:

o Sri Lanka land parcel: difficult market.

o Advani Hotels: efforts are on

• 420cr cash in hand

• No need to raise capital

• Capex:

• Acquisition of land: 125 cr for next 3 yrs

• Development of offshore casino -125cr

• Expenses or spend on rummy & fantasy sport-50 cr each per year

• Total tax outflow (Gaming tax & entry tax)-26.5%

• GST impact-1.5%

o 35 cr total GST paid by delta.

• Bonus act revised. Effective from this quarter so onetime cost hit P&L.

• 4-5 cr onetime expenses

• Whole impact on margin: 8%

• Capacity utilization; 75-80% on weekends holidays & peak season

• Otherwise 65%

Ace investor Rakesh Jhunjhunwala’s wife Rekha Rakesh Jhunjhunwala sold 25 lakh shares in Delta CorpBSE -0.65 % on November 7 at Rs 280.35 per share.

According to bulk deals data available with the NSE, Aarti J Mody Trust also sold 36.40 lakh shares at an average price of Rs 280.39 per share.

Read more at:

//economictimes.indiatimes.com/articleshow/61560821.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

Has the share gone too expensive?? P/e at 120.Is there any chance of considerable increase in revenue to justify the very high p/e without includin deltin daman .

I think so. I have a tracking position and love the long runway ahead, Delta being best positioned to capitalise on increased gambling/gaming options goong forward. But not adding meaningful positions due to valuation concerns.

Visitations have grown ~38% cagr to 1000 a day from just 50 in last 10 years!!

Once on land they can create 10x capacity vs current.

Operating costs like Marine staff, generators, jetties etc to reduce significantly as they move out of river.

But management has no idea when this shifting will take place.and the offshore casinos seems to be running at 75 % capacity scaling up is not going to be easy immediately as far as footfalls are considered.obviously per head revenue is increasing. I used to hold it from much lower levels but sold off just before real gains started to happen.want to buy again ,but totally confused…

I myself witnessed this year and biz was really good. I almost saw madness when people were pushing and shoving each other to place bets on many tables. Like stock market most of them were losing eventually. Good for shareholders though

Disc: Invested

A similar article as CalvinAyre’s with a little more detail. Bottomline: Onshore gaming can see a surge of revenues for Delta Corp and other casino companies.

And now brokerages seem to be taking note:

Discl: I have invested from lower levels.

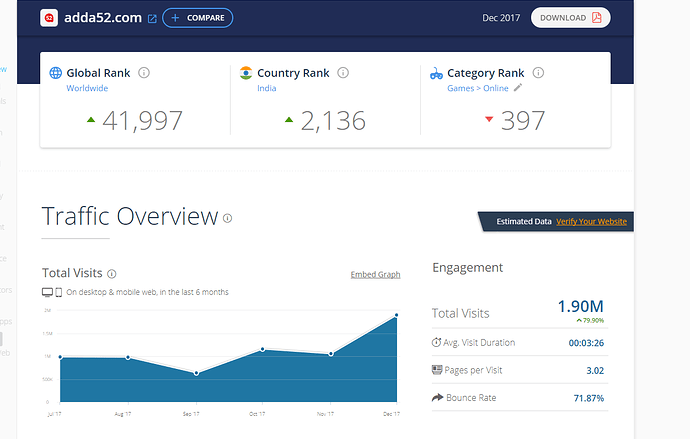

I Did some research on Delta Corp to understand why it is growing so fast, in Sept 2016, Delta Corp Ltd had acquired Gauss Network, which owns adda52.com, I tried to look up the traffic statistics for Adda52 Here is what I was able to find…

Disc: Started Invested small amounts at 382+ levels.

Is 397 category rank a good thing? In my opinion, internet gaming has a very short shelf life because you’ve so many of them out there that it takes a week for the users to move on. So a 397 rank could convert to 3970 overnight unless the Company has specific plans to retain its audience.

The Rank here is 397 in the World !!

I also noticed that Adda52 is a site which has continued to engage the Online card playing community since 2013/14 (pls. read Quora for details from these players).

Meanwhile there are several other sites which have faded away since that time.

Disc: I have started Invested small amounts from 382 levels

very wel said current rank of adda.52 you can find at

https://www.alexa.com/siteinfo/adda52.com

Mostlly traffic from india and graduates males surffing from Home and office.

reward wil be huge if they can add more Capex on the Online Gameing field

Disc: Not Invested due to very high PE not having margin of safety as per my apetite

Regards

YourRaj

For year ended December 2017 the license cost is 12 cr and it’s 5 percent of sales. Now it is increased around 4.5 times so it’s a huge expense for them