There were some very good posts on Ddev in Kalpena Industries’ VP thread summarizing long term nos and highlighting a few potential governance issues in the company.

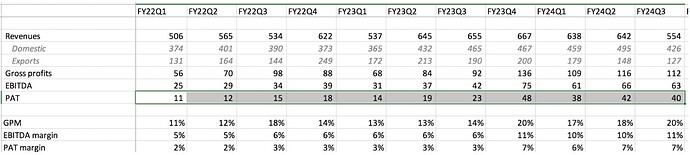

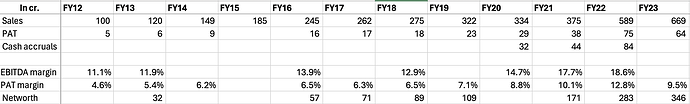

I am interested in the stock because they have done exceedingly well in this cycle, growing profits by 4x and are still trading at 10.5x PE.

Also, their main domestic peer (Shakun Polymers) has done exceptionally well in the past few years.

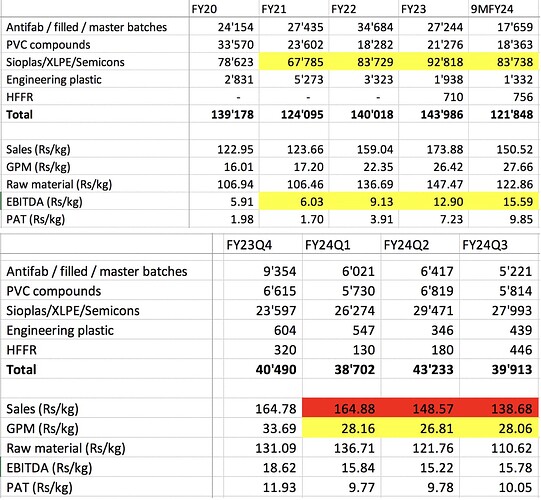

In past few years, Ddev’s GM/kg has really picked up. These high margins have been maintained even when realizations have come down. I am trying to ascertain if their higher GMs will persist going forward.

I am sharing my notes on the company below.

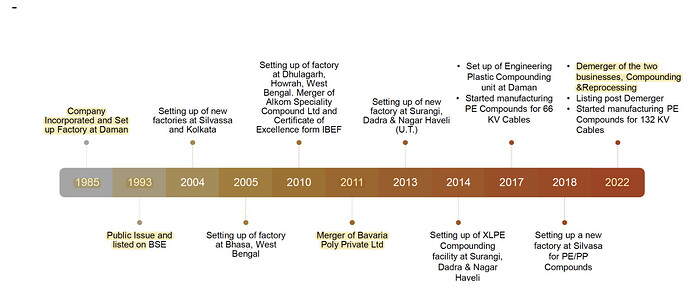

History

- Setup a Polyvinyl chloride (PVC) compounds manufacturing plant in Daman in December, 1985

Products

- Operates in polymer compounding business (PE compounds, PVC compounds, Filled compounds, Master Batches, Footwear compounds, Pipe compounds, Peroxide compounds

- End users: power cable industry (majorly used in coating of cables to provide insulation and sheeting to cable wires; 70% of their sales), pipe industry, furniture industry, footwear industry and packaging industry

- PVC products is low margin

- Improvement in margins is due to shift from low margin PVC products towards higher margin products within the segment and also increase its share of high margin XLPE compounds

- Largest polymer compounder with the widest portfolio in India with leadership in PE compounds for low- and medium-voltage power cable industry

- ~50% market share in Sioplas and ~33% in XLPE compounds

- Launched XL HFFR (Cross Linkable HFFR) Compound for Solar/Photovoltaic cable

- FY23Q3: Received approval for WTR XLPE for 72 KV applications, which is expected to be launched in FY24

- Only domestic player manufacturing coating compounds for 132 KV cables, with rest being imported

- Sole manufacturer of HFFR in India. Ongoing shift from PVC cables to the new standard IS 17048:2018 for halogen free flame retardant (HFFR) cables

Raw material

- Linear low-density polyethylene (LLDPE)/low-density polyethylene (LDPE) and Polyvinyl Chloride (PVC) resin

- Sources RM from cos in vicinity to their plants

- Imports significant portion of raw materials

Raw material imports (% consumption)

- FY22: 346 cr. (18%)

- FY23: 573 cr. (27%)

Capacity & manufacturing

- 5 manufacturing facilities strategically located on east and west coasts of India (West Bengal, Daman, and Silvassa). Results in lower freight costs and inventory cycle (20-40 days)

Peers:

- Domestic: Shakun Polymers, KLJ Polymers and Chemicals, BLS Polymers, Plastiblends in masterbatches and Bhansali Engineering Polymers Ltd. in engineering compounds

- Global giants such as Borealis AG, Dow Chemical Company, and Solvay SA. Mainly cater to specialty grade compounds focused more on high- and extra-high-voltage power cables

- HFFR compounding market in India is catered by major players like Shakun Polymers, AEI polymers, Solvay. Shakun polymers is the leading manufacturer of HFFR compounds in India.

- Kingfa Science and Technology is in similar business but more into end products like masks

Demerger

- In March, 2022, Kkalpana Industries Limited (KIIL) received NCLT approval for demerging its compounding business into Ddev Plastiks Industries. Ddev listed on 26.07.2022

- Their remaining business comprises of a Reprocessing Business Unit located in Falta, West Bengal, and it holds a license for reprocessing plastic waste which has restriction on transferability. A similar license is also held by a Dubai-based wholly owned subsidiary of KIIL

26.02.2024 ET & ET Swadesh

- Going to manufacture products up to 132 KV in next few months (first time in India). Focus is to manufacture more value added compounds

- R&D is focusing on going up to 400 KV

- Have benefitted from growth in cable manufacturers (20% CAGR in last 3-years; likely to grow at 9% CAGR)

- Discount from suppliers is recorded in Q4, so margins are generally higher in Q4

- Capex: Plan to invest 300 cr. in next 3-years

Exports

- Middle East is their key export market

- FY22: 671 cr.

- FY23: 777 cr.

R&D

- FY22: 0.83 cr. (0.41 cr. capitalized)

- FY23: 1.92 cr. (1.66 cr. capitalized)

Disclosure: Not invested (no transations in last-30 days)