I just started reading about the company today , as i felt its undervalued … below are my points

Promoters ::

Pros::

shares holding has been raising 52.15 % IN 2016 to 57.74 % IN Mar2020

3 decades of industry experience

Cons ::

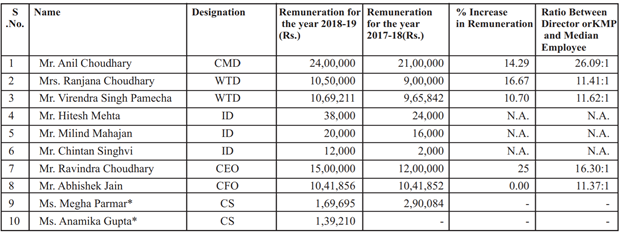

its completely promoter run company (AR FY 19)

Rent to promoters have be increase at exorbitant rate

eg : Mr. Ravindra Choudhary rent 35k in 2017 is increassed to 3 lac in 2019

Mrs. Vidhya Choudhary rent 4.5 l in 2018 to 9.2 l 2019

not sure why the rent has been increased at such rates

Unsecured loans to promoters and its groups

i have noticed loans to tune of 50 lacs in most AR’s

Business :

- lots of capex needed and most of the funding is by debt

- no pricing power

- as per AR fy 19 → New allotment of leased land 40000 sq meters @Pithampur which means there would be either equity dilution / debt funded capex

FY 2016-17 the Company was appointed as Del Credre Agentcum-Consignment Stockist (DCA-cum-CS) of ONGC Petro-additions Limited (OPaL) for Madhya Pradesh

at Indore for a period of 3 years vide its letter dated 30th March, 2017

not sure what this means … it would be great if some one can explain

Valuation : it looks like undervalued…

but commodity nature of the business and future CAPEX (debt funded /equity diluted ) are major concern

along with few red flags on the promoters based on rent and unsecured loans