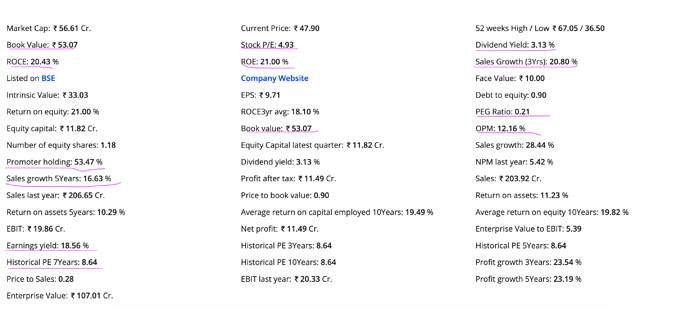

A company with a market cap of below 56cr as today (10th Jan 2020) having ROE of 21%, ROC of 20%, sales growth of 20% forced me to look into this company.

So let’s analyze the company

Before analyzing any company of market cap less than 200cr. It is essential/mandatory to analyze the promoter/company owner first.

Promoters of Company is Mr. Anil Choudhary, Mr. Mohanlal Choudhary and Super Sack Private Limited

Mr. Anil Choudhary :

• Experience of more than 30 years

• Has been the director of the company since it’s incorporation so comsyn is the baby of Anil Choudhary

• Holding a degree of BSc from the University of Indore, M.A(Economics), Diploma in Marketing Management.

• Mr. Anil Choudhary’s age is around 60 years (This is a little sign of worry I prefer the company to be lead by a young person but they have their son onboard Pramal Choudhary and Ravindra Choudhary). Although Pramal Choudhary in his linked profile mentioned his position as Director of comsyn. In their company page, the designation is Chief Operating Officer (Just FYI nothing to conclude roles are almost same anyways)

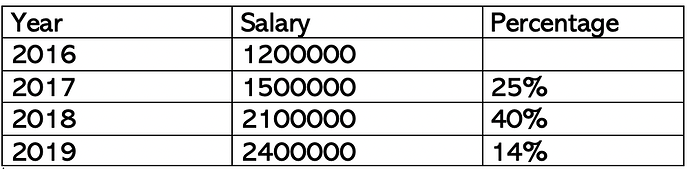

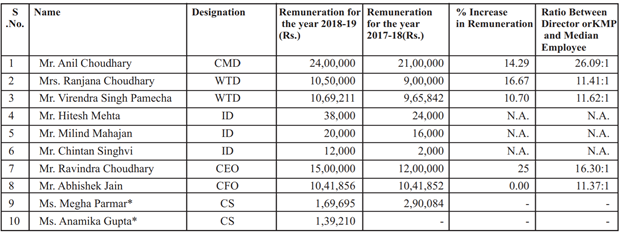

• Salary :

So jump of 40% salary from 2017 to 2018 I think it’s on higher side but one silver line is during the tough years he has taken an increment of 14% Only which is Ok but if you consider it whole salary of director 24 lakh is on very minimum side because in MNC(IT) an Employee of 8 years experience gets more than this.

Mrs. Ranjana Choudhary:

She is there with the company from 2011 She has completed her graduation in commerce from North Maharashtra University, Jalgaon. She has also completed her Masters in Computer Management from North Maharashtra University, Jalgaon. She has experience of more than five years in the plastic packaging industry. She looks after the day to day affairs of the Company. Why I highlighted in red here is there is someone on the board who has just 5 years of experience so is there any effective value addition to the company. Although her annual salary is 10 lakh and one more thing a micro-cap company with annual sales of 200 cr is It really adding value to the company to have two whole-time directors?

Mr. Virendra Singh Pamecha (Whole Time Director) :

Mr. Virendra Singh Pamecha, is appointed as Whole Time Director of the Company w.e.f. March 26, 2016. He acts as occupier of the company‘s factories and is entrusted with control of affairs of the Company’s factories at Pithampur. His salary is also around 10 lakh I didn’t get much detail about him so if someone has please let me know I will be happy to add here

Mr. Ravindra Choudhary, Chief Executive Officer :

Mr. Ravindra Choudhary is designated as Chief Executive Officer of the Company w.e.f May 12, 2016. He has done his Diploma in Finance & Tax Management and Diploma in Import Export Management. He is responsible to look after the strategic growth of our Company. His annual salary is 15 lakh

Mr. Pramal Choudhary, Chief Operating Officer :

Mr. Pramal Choudhary, is designated as Chief Operating Officer of the Company w.e.f May 12, 2016. He has done his Master of Business Administration from The ICFAI University, Dehradun. He is responsible to look after the operational and overseas marketing activity of our Company. His annual salary is 18 lakh

In total salary given two key managerial people is around 1 crore 40 lakh which is I believe Ok for a company of sales 200 crore and net profit of 11 crore

One thing I noticed here is company employee benefits expense is around 24 crore for total no of employee 1571 and if you divide the amount by no of employee it is coming around 1.5 lakh per person per annum which looks decent as shareholder point of view. The one reason to pay such a low salary could maybe work doesn’t require any special skill set.

But if you compare with Emmbi Industries limited there Employee benefit expense is 15 crore so in that manner Emmbi looks more economical because after spending 15 crores on Employee they can generate 289 Crore of sales and 17 crores of profit whereas comsyn has spent 24 crores on Employee but getting sales of 200 crore and net profit 11 crore something management has to retrospect is there any overstaffing?

Note : All source of information is Annual Report of Comsyn and Emmbi. Numbers can be completely wrong as I am very naïve investor please verify yourself all the numbers.

So all and all I didn’t find anything suspicious about management, about there salary with the limited public information available.

If you look at the company Mr. Anil Choudhary ‘s age is 60 years so Pramal and Ravindra have enough time to learn from their father.

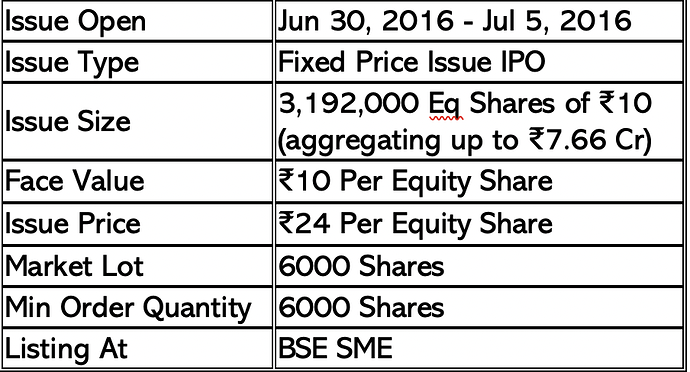

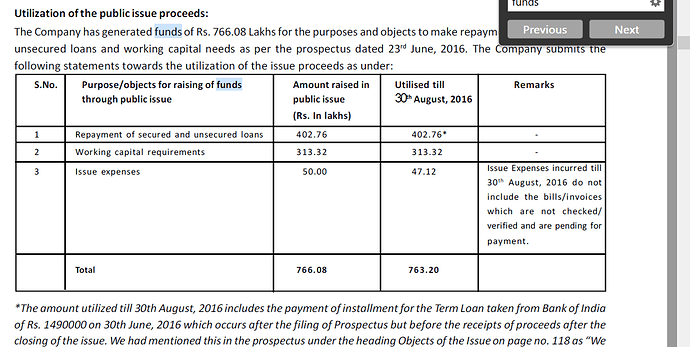

Now let’s look at the key statement made by the company during IPO filling

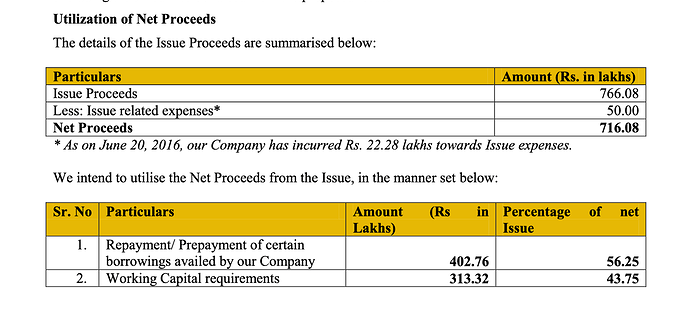

They came with an IPO on 30th June 2016. The purpose of the IPO is to do debt reduction and meeting a working capital requirement. I don’t like when the company takes money from the market to reduce debt or to meet the working capital requirement because that shows a basic weakness in the business at the same time if the company takes money from the market for capacity expansion I feel comfortable in that anyways let’s move forward below is the details.

The below also there was one reason mentioned

This is what the company promised what they will do of 7 crore, repayment of 4 crores and rest 3 crore is for working capital

Now let’s check have they done it?

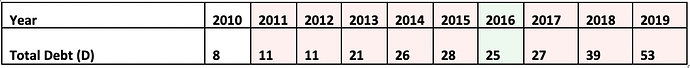

So IPO came in 2016 and my sense is the debt should be reduced by 2017

So data from the screener suggest otherwise the company took money from the market but debt didn’t decrease we need to ask from the management about it.

Few questions till now.

- Why two whole-time directors in the company?

- Why there is a whole-time director with only experience of more than 5 years.

- Why there is a jump in salary of the director of 40% from 2017 to 2018

- The company has promised to reduce debt from the 7 crore amount which the company has received from the market during IPO why the company has not reduced debt?

- In general, we can see the business is capital intensive so earlier you taken money from the market and still, the debt to equity is around 0.9 how are you planning to manage the working capital in future and also the debt because money without interest option (IPO) has already been taken.

Enough talking on management now let’s talk about the business. Let’s move forward

What is the business ?

Comsyn is a manufacturer of FIBC, Tarpaulin, Woven Sacks, and BOPP Bags, located in Indore, a city in Central India. The product company made is mainly used for bulk transportation of material.

Sales figure : 75% Export and 25% Domestic market. So company is vulnerable to the currency fluctuation and any other business policy change in any country

FIBC Conductive Bags Market: Introduction

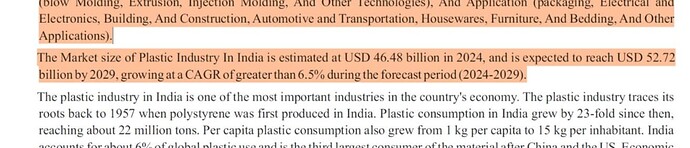

Total world market for FIBC bags stands approx. at 7.5 MMT. Flexible Intermediate Bulk Container (FIBC) bags are also called as Type C bags, which are also known as jumbo bags in market. These are industrial flexible containers, play a vital role in transporting hazardous chemicals, granules, powders etc. which are prone to electrostatic discharge hazardous events. The fast loading and unloading of the explosive or flammable chemicals, granules and powders may induce static charge on their surfaces, which in turn can cause sparks or hazardous events. FIBC bags are made up of polypropylene (PP). Elongating supply chains and increasing industrial activities creating more demand for FIBC conductive bags, which are lightweight and cost efficient. China, Turkey and India are the highest producers and exporters of FIBC conductive bags. Buy consumption Americas, China, Europe stands at the top places.

FIBC Conductive Bags: Market Dynamics

FIBC conductive bags are extensively used in industrial material handling or transportation which occurs in bulk quantities. These bags are nothing but a conductive jumbo bags, used in industries where the surroundings may likely contain explosive material, which might be ignited due to presence of ESD. Growing safety awareness, government regulations are driving the FIBC conductive bags market. These bags are interwoven with conductive threads (grounded) and non-conductive PP threads. The sewing is done in grid pattern. A grounding point is built on the body of the bag to safely discharge the accumulated static charges to the ground. Growing agriculture activities, which demand higher utilization of fertilizers, growing infrastructure development and mining activities influencing the growth of FIBC conductive bags market. Space optimization can be achieved in industrial material handling and inventory storage in warehouses using these flexible bags. FIBC conductive bags are used in food & beverages, cement, sugar, agro products, PTA chips, etc. Each FIBC can carry up to 1000 times its own weight, 75% of each FIBC has integral lifting loops, eliminating the need for pallets. Excellent printability, efficient use of space with specific designs, simple to use and cost effective. Very strong yet flexible, low per mt packaging cost, variety of dimensions available, variety of filling, discharging and lifting facilities, can be used for hazardous chemicals as specified in the UN Chapter 6.5. Recommendations are the factors making FIBC conductive bags market to grow at a healthy CAGR.

FIBC Conductive Bags: Market Segmentation

The global FIBC conductive bags market is segmented on the basis of grade, product type and end-use. On the basis of end-use, the global FIBC conductive bags market is segmented into food & beverages, agricultural products, Chemicals, building & construction, industrial and others. On the basis of product type, the global FIBC conductive bags market is segmented into Type B, Type C, and Type D FIBC conductive bags. On the basis of grade, the global FIBC conductive bags market is segmented into food grade and others. On the basis of packaging design the market is segmented into woven and non-woven.

FIBC Conductive Bags Market: Regional outlook

FIBC conductive bags market has been segmented on the basis of region into North America, Latin America Eastern Europe, Western Europe, Asia Pacific Excluding Japan (APEJ), Middle East & Africa (MEA), and Japan. FIBC Conductive Bags market in APEJ is expected to be the fastest growing market due to high demand and preference towards flexible packaging.

FIBC Conductive Bags Market: Key players

Some of the players in the global FIBC conductive bags market are FIPCO Filling & Packaging Materials Manufacturing CO., Gulf Plastic Industries Co. SOAG, GOLSAN BAFT COMPANY, Greif – Division Flexible Products and Services, LASHEEN PLASTIC INDUSTRIES S.A.E, Chuangda Plastic Industry Co., Limited, Fairdeal Jumbo Packaging Pvt. Ltd., Polychroic Petrochemicals Pvt. Ltd., Boxon GmbH, Carbognani S.r.l., Cesur Ambalaj San. Ve Tic. A.S., CLIMESA, CONTERRA S.A., Emmbi Polyarns Limited, Daphne Europe GmbH, EURO-PAK 2000 S.A, GPK PRODUCTS and others.

Source : transparencymarketresearch/ fibc-conductive-bags-market.html

Company has not given breakup of revenue among the products or at least I didn’t find if someone finds please let me know so company in a business of making bags which helps to transport bulk material, saves space for you so business is not very niche like Electric Vehicle or something but will not have much headwind or disruption in future that is my take on the business and the demand of the products will be there in the market as reports suggested.

Few Points about the business

- Business is capital Intensive

- Working Capital Requirement is more

- Not a Niche Business

- Not very disruption going to happen at the same time

- All and all an average business

So far Management is OK (Until we get our questions answered)

Business is Average

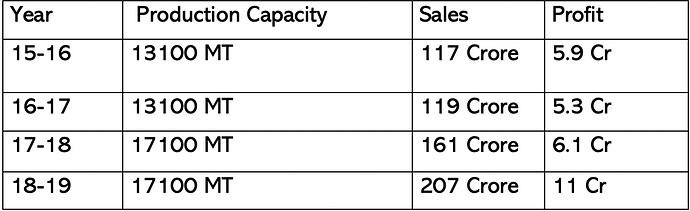

Now let’s look at the capacity expansion done by the company during past 4 years and how the sales and profit associated with it

Now they are doing expansion of additional 3540 MT which will be ready by April 2020 so in 2021 or in 2022 it is fair to assume by looking at trend company can clock a net profit of around 20 crore if all goes well and if they are able to clock the same margin as they are doing now but keeping the same margin looks difficult we will get to know about it by a report from ICRA

But all these expansion comes at a cost of debt increase , equity dilution

Question for management when they are planning to reduce debt? After expansion ?

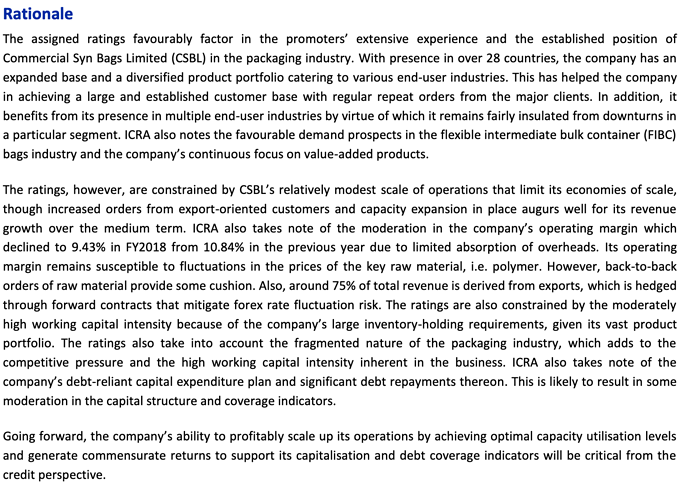

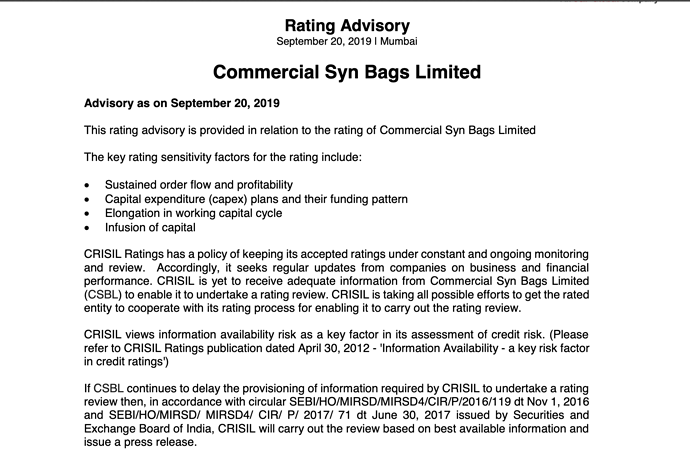

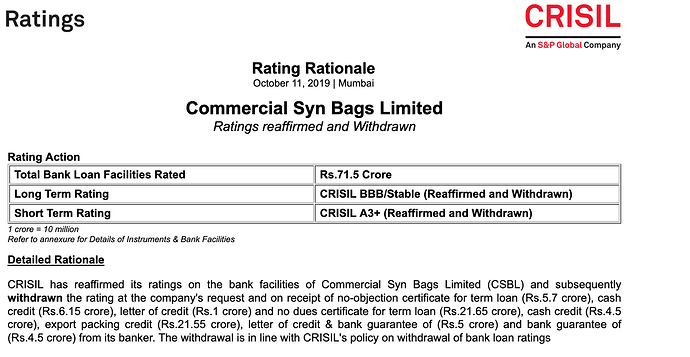

What our rating agencies says ?

A report by ICRA

They also pointed out the declining margin and the company’s requirement of inventory holding due to the nature of business and hence it directly affects working capital

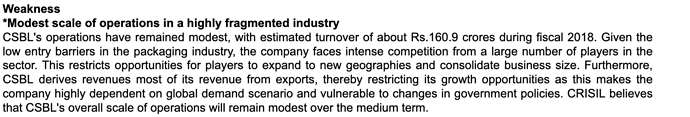

Weakness mentioned by Crisil

One major Red Flag

Company has not provided information to the Crisil in Sep 2019 and in Oct 2019 rating has been withdrawn

Need to ask the management why they have not provided information to the CRISIL and why the rating has been withdrawn

Their Debt has increased exorbitantly

So far we talked about

• Management

• Business

• Rating Agency View

• Capacity Expansion

• Working Capital and Debt

Now let’s talk about numbers and conclude with few open questions left to the management

So far we have talked about mostly negative now lets see some positive side

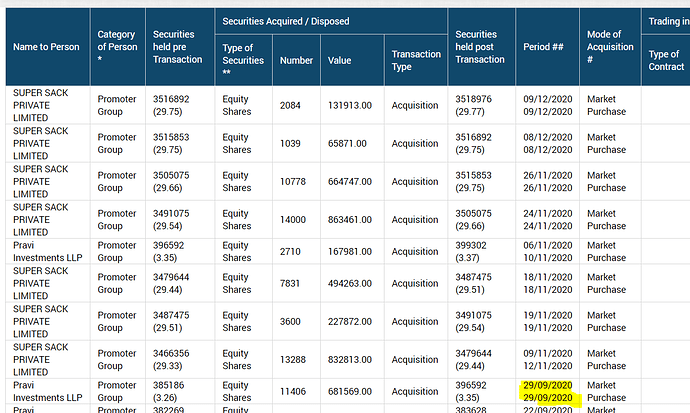

- Promoter Holding :

As latest Promoter Holding released on 9th Jan 2020 is 56% which has been increased from 52.15% in 2016 so promoters are buying their shares from the market

- There ROC, ROE, Book Value, PE, Sales Growth looks good a clear case of undervalued stock if we just look at the number

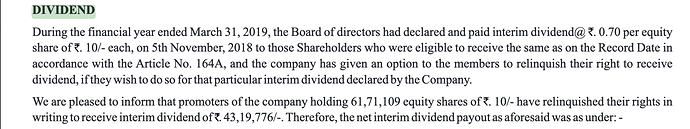

- A big positive - Only In this year company has declared dividend no that is not a big positive hang on company has given a 3% dividend to CMP(48) no this is also not positive the biggest positive is which I have seen in very less companies.“The promoter is not taking dividend which company has declared “

Now I will conclude this blog with few open questions to Promoters and I will mail them and update here if I get anything

-

Why Information has not been given to rating agency because of that they withdrawn the rating.

-

Why dividend has been declared when company’s debt is increasing and company is in expansion phase

-

How are you planning to tackle the debt

-

Why two whole time directors in the company?

-

Why there is a whole-time director with only experience of more than 5 years.

-

Why there is jump of 40% in salary of director from 2017 to 2018

-

Company has promised to reduce debt from the 7 crores which company has received from the market during IPO why company has not reduced debt ?

-

In general we can see the business is capital intensive so earlier you taken money from market and still the debt to equity is around 0.9 how are you planning to manage the working capital in future and also the debt because money without interest option (IPO) has already been taken.

-

When there is no barrier entry to the business and cut throat competition and how you are planning to go ahead and what is your future plan to tackle the same

-

What is your expected margin going forward as ICRA pointed out there will be impact on your margin going forward

In Summary

Promoter: Ok

Business : Average

Valuation : Undervalued

Red Flag : I would say Orange Flag till we heard from management

Disclousure : I hold a tracking position in the company around Rs 48

This is my first post in Valuepickr so definitely i might made some mistake please forgive me and let me know i will correct it

Please forgive me also for two things

- My Financial Knowledge as i am not from finance background and started investing just 3 years before

- English in the post i know the english will be poor and will have lot of grammatical mistakes