@jitenp I would like to know what is the current tea price. Also I understand that United Nilgiri Tea is selling specialised tea. Awaiting your thoughts on United Nilgiri Tea. I have not seen much discussion on UNT in VPF.

Hello @jitenp jiten bhai.are you tracking fertilizers and cement sectors.how is demand and supply for both sectors.

i am not tracking closely enough. in previous messages, I have said, that it os one sector which I tend to avoid.

Good demand in both the sectors.

Hi @jitenp : Aluminum and copper prices are hitting 7 years high… Can you please share us your thoughts on this?

- Will this be sustainable or its just a market trend?

Copper & Aluminum plays a major role in next generation vehicles.

As I had mentioned before, this was a great contra play. I was expecting some of the huge liquidity and QE to move to commodities, utilities. Seems to be happening. I think there is still some way to go. How long can the cycle lasts, very difficult to say. Will depend on how demand picks up. One must have an exit strategy too.

For me, there is profit booking even currently due to allocations. And I do follow strict portfolio allocations to different sectors.

@jitenp thanks for sharing your knowledge on cyclicals. Saw your presentation and youtube video, big thanks

On copper, hind copper seems to be the only direct mining play available, and supply shock is there to stay for some time. Are there opptys in copper outside of mining too? E.g. shivalik bimetals… My understanding is that when raw material price goes up, downstream businesses don’t benefit since margins typically contract…is this understanding correct?

Any sectors that are in red right now, and sort of neglected according to you? Due to covid recovery, its very difficult to understand this since everything is going up

In my recent interviews, I had talked about paper sector as a contra bet. Where I found valuations very favorable. Though some are already up 20-30%, I still think valuations are in favor. But one has to patient.

@jitenp Sir, Would really appreciate your view on this…

Why Goldman Sachs Research Expects a Bull Run for Commodities in 2021 https://www.goldmansachs.com/insights/podcasts/episodes/12-15-2020-jeff-currie.html

Hello @jitenp,

Thanks a lot for sharing the ppt and starting this thread.

Which paper sector companies can I research more on?

What are your views on Hindustan Copper and NALCO, if any?

Best Regards,

Please understand that I will not be able to share any views on individual companies. At best, I can share about sector. Which I regularly do.

Understood. Where do you see the Paper Industry going in the next 2-3 years? Where do you think we are in terms of the cyclicity of the industry?

Have gone through the pdf you shared on Paper Industry and it was quite insightful.

Kindest Regards,

@jitenp bhai… I watched your ET Now interview where you pointed to Paper sector as a contra-bet. The valuations are mid/high Single digits no doubt but where / when do you expect the triggers. Demand in Writing & Printing paper is still weak, pulp prices are low, industry leaders sitting on ample unused capacity. Would be great to understand where you see the green shoots.

Disc. Pondering to re-enter.

I don’t see greenshoots currently. It’s a pure bet on valuations. Nothing might happen soon. To look at current valuations and making a decision, might not be right. Look at what can happen when cycle turns, and it may take a while. Some companies were available at 2x EV/peak EBITDA. This is a contrarian bet. And investing at “peak pessimism”.

please can u share ET NOW interview link of jitenji .

Thanks @jitenp bhai and fair enough. I was reading through earnings call transcripts of various stakeholders in paper supply chain to gauge outlook. One thing that caught attention is S. Chand pointing out that New National Curriculum Framework that will be implemented as of 2021 will lead to creation of new textbook content. This is corroborated by Century paper mills CEO who stated that they expect tailwinds in W&PP due to NCF change. If correct, this should pan out over next 3 years starting q3 FY22. What’s your take - do you see this having a material impact on demand growth?

Also, what source can one use to reliably track pulp prices and monitor China demand?

@jitenp Hello jiten bhai.how is fertilizers sector for medium term say 2 to 3 years.what will be impact of low natural gas prices on fertilizers sector.

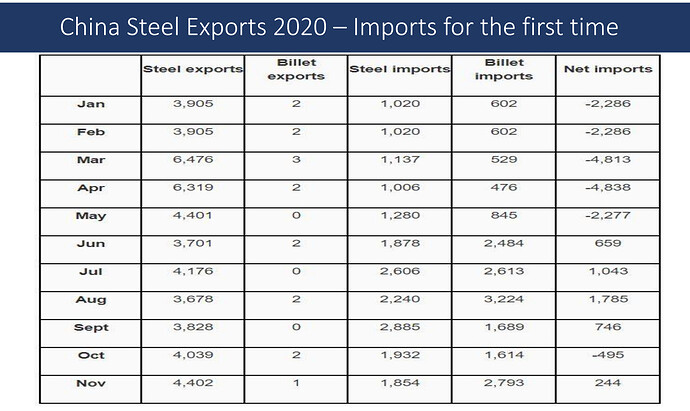

The main reason driving steel prices globally is that China has turned importer for first time in last 20years

Source:https://s3.ap-south-1.amazonaws.com/goindiaconnect/UPLOADS/InvestinginSteelSectorJan2021.pdf