Rural-focussed auto should do well. Especially the tractor guys. And maybe rural-focussed 2 wheeler manufacturers.

Hi Jiten

Any idea on how to assess the tea cycle? Apparently prices have risen for the first time in many years. Labour shortage due to covid and poor rainfalls in Assam has also led to low production. And obviously the demand is constant here. Take a clean company like Goodricke, the margins in the last cycle went upto 12% and the cycle lasted for 3-4 years. Currently the margins are only at 4%. Also it is consolidating its leadership, having acquired tea estates from Mcleod Russell & Godfrey Phillips recently. Is there any change in demand supply dynamics you pick up currently?

Hi @jitenp,

What is your view on the steel cycle? Companies like Tata Steel, Jindal Steel have reached multi year lows.

Tea is one sector which I avoid. Have observed that it’s really difficult to make big money in the sector.

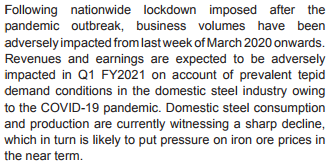

Is the Steel sector turning around - https://www.livemint.com/market/mark-to-market/price-hikes-and-rising-demand-make-a-good-therapy-for-metals-stocks-11596705718559.html?

Jiten bhai ,Which are some good aluminium stocks one can look at ?

Whats your view on rain inds ?

A followup on the previous article

@jitenp Is the coronavirus likely to push paper into a downcycle fast? I read the article by Divya but it is dated and so am looking for your views on writing/printing and packaging board papers in these times.

I’m asking in connection with NR Aggarwal Industries which seems to be trading at ridiculously cheap valuations (200 rupees with a TTM EPS of 68). Profit and margins have been increasing steadily over the past 4 years. Will it start tapering off?

Hi all

In my previous post, I asked if anyone has views on the tea cycle. But I am guessing, not many people track it (and for good reason). So here is my ‘back of envelope’ thinking on what’s happening

- Tea prices in India have been the same for a long time now. At least from 2012, till date, prices have been between Rs. 130 - Rs. 160 per kg.

- The industry has been in horrible shape for years.

- Mcleod Russel, the largest company is bankrupt

- Most other tea estates are making losses, especially in the regions of Assam, WB and Sikkim

Why am I interested in Goodricke now

- There is one company at this time, that not only has it’s head above water but is also adding capacity. Goodricke has been buying stressed assets over the years.

- It has a clean balance sheet and is clearly the most efficient player

- It’s now either the largest or the second largest producer of tea in India.

- Tea prices have increased dramatically due to COVID-19. Realizations/kg have increased between 50 - 100% in the current auctions

- Goodricke is the last man standing, and has committed to constantly add capacities over the next 3-4 years, while others are selling their assets

- While tea demand only increases at 2-3% pa, note that this is a very consistent and predictable demand. Also it is a perishable commodity. This means that unnecessary high supply creation is not lucrative. This also means that short term demand-supply matches can be very lucrative

- Production in India has been down due the the pandemic. From my sources I hear that for the first time, in the auctions, the demand is way more than the supply and all inventory is being lapped up

- Less out of home demand has been more than compensated by at-home demand

- From interviews of the heads of Jayshree tea & Mcleod Russel, it seems like finally they are set to have a profitable year. This means that the most efficient player, Goodricke should have a great year

- Goodricke commands the highest average realisation/kg in India

- It has a MNC promoter, Camellia Group (UK) and high promoter holding of 74%

- Branded tea & premiumization is an optionality and I’m not banking on it

- Exports as a % is constantly increasing for Goodricke, and it offers better realizations

- This quarter’s results indicate that the margins have been the highest for a June quarter in years, increasing my optimism in the thesis

Risks

- Production in Kenya & Vietnam has increased. It could be possible that India is flooded with imported tea and hence this thesis does not play out

- Once the pandemic is over, supply increases again and prices come down dramatically. So this favorable price trend is only for the very short term

- This is only a trading/short to medium term opportunity and selling needs to be done smartly

Disclosure: Small investment in Goodricke, in June

Hindalco

KeyHighlights: Volumes back to pre-COVID levels

Beverage can demand remained strong. Automotive volumes recoveredgradually and are back to pre-COVID levels. The company has achieved record-high automotive volumes in China during 1QFY21.

Among the newly acquired portfolio from Aleris, performance of Aerospace is likely to remain muted whereas Building & Construction is likely to improve with recovery in the economy. Specialty continues to do well, led by

strong demand from electronics and EVs.

EBITDA is guided to improve in the ensuing quarters. Management expects sustainable EBITDA/t of USD450-475.

Interest cost is expected at USD260-270m for the full year (v/s USD240m in FY20), which is lower than expected due to the lower prevailing interest rates.

Capex (incl. Aleris) for FY21 has been guided in the range of USD450-500m, including sustenance capex of USD250m for Novelis and Aleris.

Novelis’ capacity (post Aleris acquisition) stands at 4.0mtpa (implying Aleris capacity of 0.6mtpa, which excludes divestment of Duffel and Louis Port). It would increase to 4.2mtpa post completion of 200kt expansion in China.

Anyone tracking iron ore companies?

Fortunately I am having KIOCL and it’s showing good traction since last few months

China has started spending huge on infrastructure after pandemic

I have a take on commodities where end product is construction/infra. Given the slowdown in economic activity and particularly real estate, the upmoves in these commodities would be temporary. For a sustainable upmove in commodities - end demand should be higher and should structurally move up.

Counter views welcome.

Lots of Infra push China 620 Billion , also only way to recover jobs and work is infra and in my view nations across the globe will follow

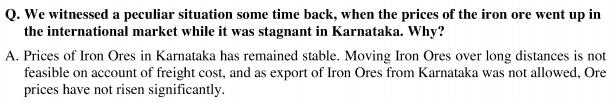

Below is snapshot from a regional player’s current annual report (Sandur Manganese)

Another excerpt from a previous conversation:

Hi,

After having done a detailed analysis and decent portfolio allocation to Jindal Steel Power (avg buying price 80Rs, added in March crash) , we now revisited our analysis on comparison between the top 3 private players. The idea was to find triggers for share price appreciation in steel, comparative valuation and identifying potential to extract more from these steel companies. Below is a quick data analysis we did, along with some of our takeaways.

Some takeaways:

- JSPL is still undervalued on installed capacity basis. With their debt coming down, PAT and ROE going up - they still can be 2X from here. At that point their Macap to Capacity will be inline with Tata Steel and JSW steel

- Tata steel is performing well on standalone basis and is in bad shape due to Europe. If they sell their European operations, and we compared Consolidated JSW against Standalone Tata Steel, then in that case tata steel is again undervalued.

- JSW has been the gold standard in capex execution, OPM and Mcap so far. We dont see that changing in future, hence, upside is limited in JSW.

So, we could continue to stay invested in Jindal Steel and once things improve on Tata Steel in UK, we will start booking Jindal Steel and move those funds to Tata Steel. Overall bullish on Steel cycle.

To add, Tata Steel is doing some amazing stuff in data analytics, capex almost getting completed and many more things to add to Topline and Margins.

Feedback and counterview is appreciated.

Nikhil & Akash

Hello jiten bhai.please share your views on aluminium foils packaging companies and Tin packaging companies. Few companies in this sectors looks cheap on price to book basis.

yeah. JSPL’s EV today market cap -iRs20k cr , debt Rs35 k cr. In two years, debt wll be down by 17-20k cr . So the composition will likely shift towards market cap. It has very little capex (800 cr in 2-3 years). Its power PPAs may be higher in two three years. So many positives.

On the flip side, steel prices have run up too fast and hereon it looks like they may remain rangebound in the near term. So, its tough to take a two year view on steel prices. Its now mainly a play on deleveraging. Other smaller things are also favourable- volume growth, better operating efficiency with Angul plant ramp-up, Oman plant sell-off.

Disc: Tracking, not invested yet

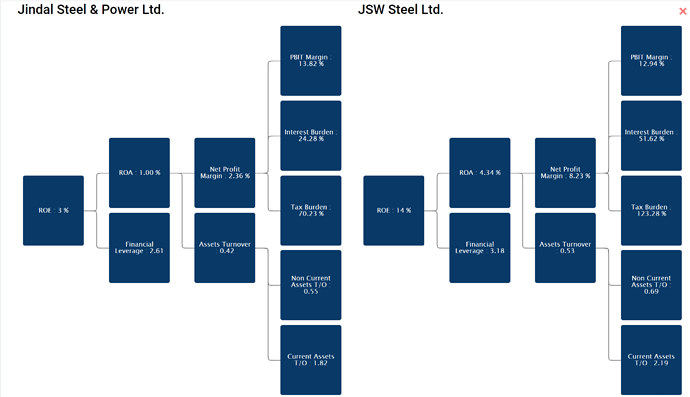

JSPL has burnt it’s fingers overstretching itself on capex. Now they have started consolidating their operations, stopped capex and started repaying debt from internal cashflows. Still a long way to go. Below is the comparison of Dupont analysis for both JSW and JSPL. Interest burden is the key difference in the two.

Agree with your analysis on it. Looking from opportunity perspective, we found JSPL better from risk reward perspective. Also, they have new management which is performing better so far, have good business from railways and debt coming down. There are very few levers to move in JSW; hence, found JSPL better from return potential perspective. Our avg buying price is close to March 2020 crash price - hence, downside limited for us.

Regards,

@goyal_nike and Akash

@jitenp sir - what’s your view on textile industry ? Also, what are the key factors to track for the sector as well as companies ? Thank you.