Mohnish Pabrai has famously said “On my gravestone, I want them to write, ‘He loved to play games, especially games he knew he could win.’ Cloning is a game.”

He has famously copied Warren Buffet’s partnership structure and made stupendous wealth for his investors and himself. Here is an interesting article he wrote for Forbes back in 2017.

Applying Shameless Cloning In India

SEBI has made it compulsive for Public Listed Companies to publish all investors who hold a stake of greater than 1%, every quarter.

The portfolios of multiple top investors are available here on Trendlyne.

Selecting Investors To Clone

I request everyone to recommend investors who are noteworthy with a good reputation to clone below!

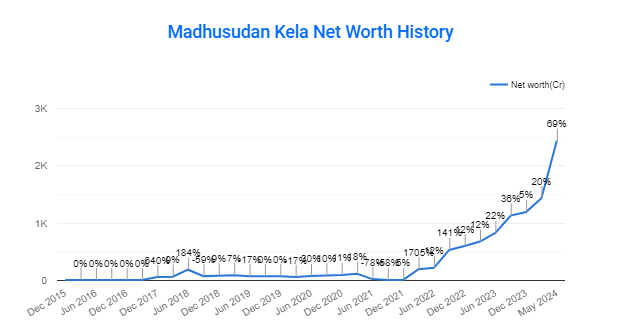

Candidate 1 - Madhusudan Kela

Madhusudan Kela publicly holds 12 stocks with a net worth of over Rs. 2,429.5 Cr. He has an impeccable track record and his portfolio has grown at an exponential rate recently.

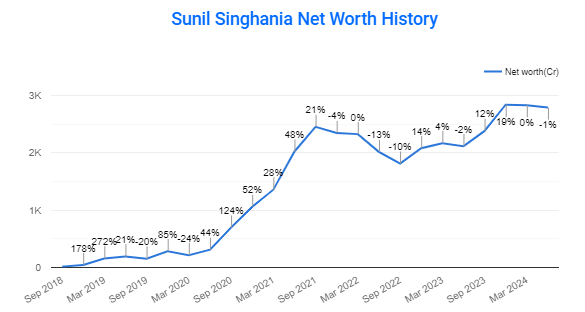

Candidate 2 - Sunil Singhania

Sunil Singhania publicly holds 24 stocks with a net worth of over Rs. 2,752.4 Cr. His portfolio has grown by large amount of the last 5 years, with relatively little drawdown.

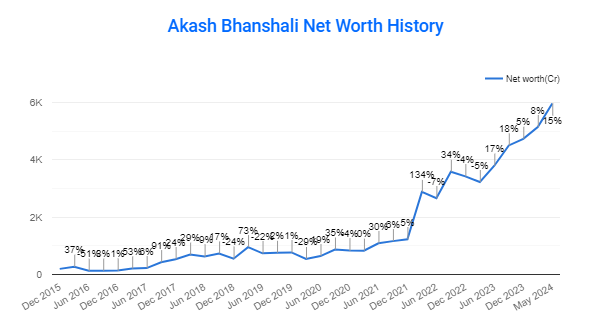

Candidate 3 - Akash Bhanshali

Akash Bhanshali publicly holds 21 stocks with a net worth of over Rs. 5,965.7 Cr.

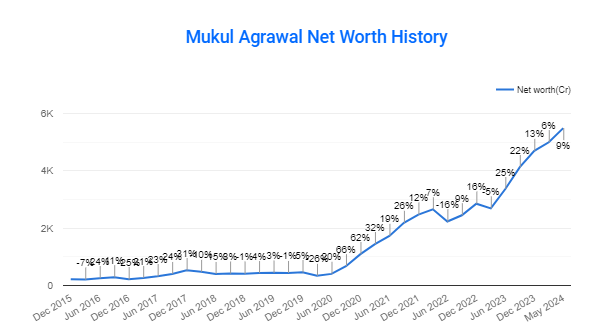

Candidate 4 - Mukul Agrawal

Mukul Agrawal publicly holds 57 stocks with a net worth of over Rs. 5,403.9 Cr.

Approach

I have not finalized the investors I plan to clone neither the approach, but I am looking for investors with relatively high portfolio growth and low drawdown, who are slightly on the aggressive side. Further, I plan to make a portfolio of around the top 5 high conviction bets of all these investors. I will sell stocks either as the investors sell them, or as they are no longer one of the top 5 high conviction bets.

(Edit - I am still deciding a way to measure conviction)

This has been inspired from a YouTube video I recently saw, and highly recommend for all.

In the video, Shankar Sir claims that the portfolio made an XIRR of 40%! However, I still need to tweak my approach and back test, and I was hoping that my fellow investors on this platform can help me develop a foolproof strategy.

Drawbacks

The shareholding pattern is released with a delay of around 1 month after the quarter ends. So we may be very late to exit a stock!

Further, most Superstar investors’ portfolios only give stupendous returns in a bull market and sometimes they face huge drawdowns in other conditions!

Closing Note

I hope everyone can contribute to this strategy and help develop it by sharing their thoughts, ideas and potential investors to clone!