Chlor Alkali: Tightness in supplies help firmness in Caustic soda prices

Global chlorine production has improved, that had seen cut back in production towards the end of 2011, due to lower chlorine demand. Chlorine and caustic soda are co-products that are evenly produced by the chlor-alkali industry. Since chlorine cannot be stored, chlor-alkali plants are operated in line with demand for chlorine.

Domestic caustic prices have remained firm as the capacity utilization in the chlor-alkali industry capacity was affected due to the low chlorine offtake and also due to high international prices. On the other side chlorine prices had declined to abnormal levels. Electro Chemical Unit (ECU) realizations of chlor-alkali players have grown at a healthy pace in the last one-year upto March 2012, due to higher caustic prices. However, the ECU realizations have dipped for some players during the quarter ended March 2012, when compared with the previous quarter. Though the caustic soda prices have increased in the last one-year, it has been offset by higher cost.

The factors that had lead to the increase in price over the last one year have been the increase in energy and salt cost for the manufactures. On the other hand, anti-dumping duty imposed on caustic soda imports led to prices strengthening in the short term. Moreover, the sharp rupee depreciation, lead to rise in the landed cost of import, enabled companies to raise domestic prices.

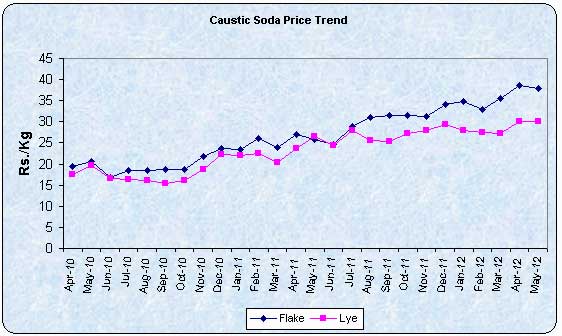

Sequentially, retail average caustic soda flake prices remains elevated on y-o-y basis for 18 months in succession since December 2010 through May 2012. Sequentially prices have been gyrating, with intermediate ups and downs.