I had found this company interesting and was looking into it. But was put off because of the information that I got from the below article in equitymaster.

(http://www.equitymaster.com/outsideview/detail.asp?date=07/29/2013&story=12&title=Chemfab-Alkalis–Not-a-professionally-run-firm-Luke-Verghese)

Note:Below is a July 2013 article.

Chemfab Alkalis: Not a professionally run firm

_A company which waxes and wanes intermittently as the years’ pass by

On the roll again

__Chemfab Alkalis__ is a low key operator of 30 years vintage with its factory at Puducherry. The company did sparkle briefly under the arc lights some 2 decades ago, before hastening to seek cover under the shade for whatever reason. The company is a member of the Chlor Alkali industry which involves the manufacture of caustic soda, chlorine, hydrogen, sodium hypo chlorate and hydrochloric acid. The company per-se manufactures caustic soda lye, chlorine and an item categorised as aothers’ for sale. The last mentioned is a significant contributor to revenues. So how does it qualify for the tag of others please? The three key ingredients for the successful functioning of the plant are consistent power supply, a reasonable power tariff, and a good domestic market is the learned observation of the present chairman, Suresh Krishnamurthy Rao, son of the late founder chairman. One cannot fault the chairman’s observations on this count.

The accounts however have some interesting notes on two of the chairman’s observations. One, it did export finished products. The company exported finished goods worth Rs 7.2 m during the year-good domestic market or not. But at the same time the export effort was minimalistic given that the gross revenues from operations for the year amounted to Rs 1.3 bn. On the other it has contingent liabilities of Rs 19.8 m for disputed fuel surcharge under The Electricity Act which is now lying with the Appellate Tribunal.

Iron clad grip

One may add here that the promoters have an iron clad grip on the company, and boy oh boy are they enjoying quite a bit of fun while the sun is still shining on the Rao empire. They hold directly or indirectly a shade less than 74.99% of the outstanding equity of Rs 45.86 m. Thus the __floating stock__ is limited to put it mildly. (It appears that the company has not made a single bonus issue in its lifetime). This holding pattern does not however fully cover the extent of the grip that the management wields. There are three closely held group companies which exercise a significant influence over the company. They are Dr Rao Holdings Pte Ltd based out of Singapore, Titanium Equipment and Anode Manufacturing Company Ltd and Teamec Chlorates Ltd. The latter two appear to be based out of India. These companies benefit in myriad ways. The Singapore concoction is a significant holder of the promoter’s equity, and benefited to the tune of Rs 22.85 m by way of dividend during the year. Titanium Equipment bought and sold plant and machinery to / from the company and Chemfab also gave corporate guarantees of Rs 6 m or is it Rs 7.5 m to the customs on behalf of Titanium Equipment. Chemfab also bought revenue goods worth Rs 8.9 m from Titanium. Further, Chemfab paid an annual maintenance charge of Rs 6.7 m to Titanium. This is really swell-the way the promoters have engineered the deal! Titanium also received dividends to the tune of Rs 4.4 m due to the promoters. Further, Chemfab has deposited Rs 30 m as rental deposit with Titanium.

The other group company Teamec Chlorates is also a significant beneficiary. Chemfab sold plant and machinery to Teamec and bought revenue goods from the parent. It also placed an inter-corporate deposit of Rs 100 m with Teamec. What on earth does this pertain to please? There is a rental deposit of Rs 30 m --the same as previously --paid to Titanium Equipment And Anode Manufacturing Company. This is money for jam. What is the need to pay such a deposit to closely held group company please? Then there are the dividends paid to the present chairman and his mother Mrs K M Padma - but that is basically due to their shareholding in the company. Besides, the new chairman gets a commission of Rs 2.5 m for services rendered to the company. The total commission to all directors added up to Rs 10 m. Several of the directors are well into their 70’s. It is all in the family and it is all planned right down to the letter T.

A finely tuned ship

But one must also add that the company is a finely tuned ship at the end of the day. For starters the piddling paid up capital is backed up by humungous reserves of Rs 1 bn plus. The gross revenue from operations was sharply higher at Rs 12.95 bn against **Rs 8.64 bn **previously. (The sales in the preceding year were affected due to the chlorine gas leak and the subsequent closure of the factory). The company was able to achieve the higher sales figure on significantly lower raw material input costs. The total consumption cost of materials including stock in trade fell to Rs 59.4 m from Rs 100 m previously. In this the consumption basket the cost of salt fell to Rs 30 m from Rs 66.4 m previously. It also consumed Rs 5 m worth of caustic soda to make the caustic soda lye.

For power intensive units like caustic soda (or soda ash, aluminium, or charge chrome also known as ferro chrome, or steel produced by electric arc furnaces for that matter) the largest revenue cost by far is the cost of power consumed. The cost of power amounted to Rs 4.63 bn against **Rs 2.85 bn **previously, and is the single largest revenue expense. Does the change in the consumption pattern of raw materials have anything to do with the company changing the manufacturing technology from membrane cell to what the company calls the latest bi-polar BiTAC technology? The company also adds that the present caustic soda concentration plant is also being changed to the state of the art caustic soda concentration plant with flaker unit.

Anyways, during the year, the company deleted Rs 138 m worth of gross block (the retirement includes Rs 108 m worth of P&M) and added** Rs** 145 m worth of gross block (Rs 59.4 m of P&M, and significantly Rs 75.6 m of additional land). The additional land input would imply that the company is also simultaneously expanding capacity or something. The retirement also includes the sale of land valued at Rs 4.4 m for **Rs 17 m **resulting in a profit

of** Rs 12.6 m. **The gross block at year end stood at Rs 1.43 bn with capital work in progress of Rs 20 m, and capital advances of Rs 46.3 m.

The other income factor

The company also generated sizeable other income of Rs 36.3 m against a lower Rs 21.1 m previously. The largest constituent of other income is dividend income of Rs 18.5 m followed by profit on sale of fixed assets of Rs 8.7 m. There is also the interest of Rs 4.6 m on inter-corporate deposits that it has affected.The company is not only debt free but is also __cash rich__ like hell which enables it to toss money over to group affiliates like confetti for self conceived reasons. At year end it boasted investments in mutual funds to the tune of Rs 2.63 bn besides the ICDs mentioned earlier. Separately, it also had cash resources of Rs 28 m at year end. The gross block expansion is being financed entirely through internal generation of resources. The company generated net cash of Rs 311 m from operations, and it was more than sufficient to defray the capex costs of Rs 182 m for the year.

After all expenses the company toted up a pre-tax profit of Rs 348 m against Rs 119 m previously. After tax provision of Rs 113 m against Rs 43.8 m previously, the net profit amounted to** Rs 235 m **against Rs 74.7 m previously. The earnings per share was a very healthy Rs 25.60 .The share price oscillated form a low of Rs 37.25 in May 2012 to a high of Rs 108 in January 2013. The company paid a dividend of Rs 5 per share on a face value of Rs 5.

In spite of the promoter management indulging in self aggrandisement schemes to fatten closely held group companies; this is a share that can be looked at closely._

_A company which waxes and wanes intermittently as the years’ pass by

On the roll again

__Chemfab Alkalis__ is a low key operator of 30 years vintage with its factory at Puducherry. The company did sparkle briefly under the arc lights some 2 decades ago, before hastening to seek cover under the shade for whatever reason. The company is a member of the Chlor Alkali industry which involves the manufacture of caustic soda, chlorine, hydrogen, sodium hypo chlorate and hydrochloric acid. The company per-se manufactures caustic soda lye, chlorine and an item categorised as aothers’ for sale. The last mentioned is a significant contributor to revenues. So how does it qualify for the tag of others please? The three key ingredients for the successful functioning of the plant are consistent power supply, a reasonable power tariff, and a good domestic market is the learned observation of the present chairman, Suresh Krishnamurthy Rao, son of the late founder chairman. One cannot fault the chairman’s observations on this count.

The accounts however have some interesting notes on two of the chairman’s observations. One, it did export finished products. The company exported finished goods worth Rs 7.2 m during the year-good domestic market or not. But at the same time the export effort was minimalistic given that the gross revenues from operations for the year amounted to Rs 1.3 bn. On the other it has contingent liabilities of Rs 19.8 m for disputed fuel surcharge under The Electricity Act which is now lying with the Appellate Tribunal.

Iron clad grip

One may add here that the promoters have an iron clad grip on the company, and boy oh boy are they enjoying quite a bit of fun while the sun is still shining on the Rao empire. They hold directly or indirectly a shade less than 74.99% of the outstanding equity of Rs 45.86 m. Thus the __floating stock__ is limited to put it mildly. (It appears that the company has not made a single bonus issue in its lifetime). This holding pattern does not however fully cover the extent of the grip that the management wields. There are three closely held group companies which exercise a significant influence over the company. They are Dr Rao Holdings Pte Ltd based out of Singapore, Titanium Equipment and Anode Manufacturing Company Ltd and Teamec Chlorates Ltd. The latter two appear to be based out of India. These companies benefit in myriad ways. The Singapore concoction is a significant holder of the promoter’s equity, and benefited to the tune of Rs 22.85 m by way of dividend during the year. Titanium Equipment bought and sold plant and machinery to / from the company and Chemfab also gave corporate guarantees of Rs 6 m or is it Rs 7.5 m to the customs on behalf of Titanium Equipment. Chemfab also bought revenue goods worth Rs 8.9 m from Titanium. Further, Chemfab paid an annual maintenance charge of Rs 6.7 m to Titanium. This is really swell-the way the promoters have engineered the deal! Titanium also received dividends to the tune of Rs 4.4 m due to the promoters. Further, Chemfab has deposited Rs 30 m as rental deposit with Titanium.

The other group company Teamec Chlorates is also a significant beneficiary. Chemfab sold plant and machinery to Teamec and bought revenue goods from the parent. It also placed an inter-corporate deposit of Rs 100 m with Teamec. What on earth does this pertain to please? There is a rental deposit of Rs 30 m --the same as previously --paid to Titanium Equipment And Anode Manufacturing Company. This is money for jam. What is the need to pay such a deposit to closely held group company please? Then there are the dividends paid to the present chairman and his mother Mrs K M Padma - but that is basically due to their shareholding in the company. Besides, the new chairman gets a commission of Rs 2.5 m for services rendered to the company. The total commission to all directors added up to Rs 10 m. Several of the directors are well into their 70’s. It is all in the family and it is all planned right down to the letter T.

A finely tuned ship

But one must also add that the company is a finely tuned ship at the end of the day. For starters the piddling paid up capital is backed up by humungous reserves of Rs 1 bn plus. The gross revenue from operations was sharply higher at Rs 12.95 bn against **Rs 8.64 bn **previously. (The sales in the preceding year were affected due to the chlorine gas leak and the subsequent closure of the factory). The company was able to achieve the higher sales figure on significantly lower raw material input costs. The total consumption cost of materials including stock in trade fell to Rs 59.4 m from Rs 100 m previously. In this the consumption basket the cost of salt fell to Rs 30 m from Rs 66.4 m previously. It also consumed Rs 5 m worth of caustic soda to make the caustic soda lye.

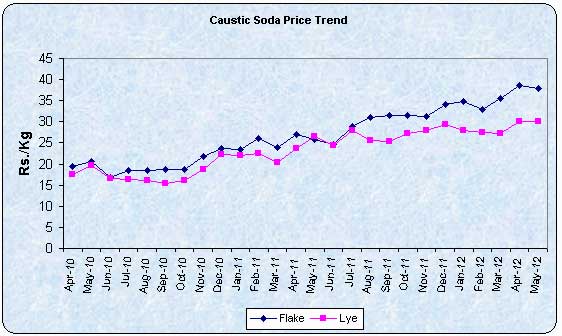

For power intensive units like caustic soda (or soda ash, aluminium, or charge chrome also known as ferro chrome, or steel produced by electric arc furnaces for that matter) the largest revenue cost by far is the cost of power consumed. The cost of power amounted to Rs 4.63 bn against **Rs 2.85 bn **previously, and is the single largest revenue expense. Does the change in the consumption pattern of raw materials have anything to do with the company changing the manufacturing technology from membrane cell to what the company calls the latest bi-polar BiTAC technology? The company also adds that the present caustic soda concentration plant is also being changed to the state of the art caustic soda concentration plant with flaker unit.

Anyways, during the year, the company deleted Rs 138 m worth of gross block (the retirement includes Rs 108 m worth of P&M) and added** Rs** 145 m worth of gross block (Rs 59.4 m of P&M, and significantly Rs 75.6 m of additional land). The additional land input would imply that the company is also simultaneously expanding capacity or something. The retirement also includes the sale of land valued at Rs 4.4 m for **Rs 17 m **resulting in a profit

of** Rs 12.6 m. **The gross block at year end stood at Rs 1.43 bn with capital work in progress of Rs 20 m, and capital advances of Rs 46.3 m.

The other income factor

The company also generated sizeable other income of Rs 36.3 m against a lower Rs 21.1 m previously. The largest constituent of other income is dividend income of Rs 18.5 m followed by profit on sale of fixed assets of Rs 8.7 m. There is also the interest of Rs 4.6 m on inter-corporate deposits that it has affected.The company is not only debt free but is also __cash rich__ like hell which enables it to toss money over to group affiliates like confetti for self conceived reasons. At year end it boasted investments in mutual funds to the tune of Rs 2.63 bn besides the ICDs mentioned earlier. Separately, it also had cash resources of Rs 28 m at year end. The gross block expansion is being financed entirely through internal generation of resources. The company generated net cash of Rs 311 m from operations, and it was more than sufficient to defray the capex costs of Rs 182 m for the year.

After all expenses the company toted up a pre-tax profit of Rs 348 m against Rs 119 m previously. After tax provision of Rs 113 m against Rs 43.8 m previously, the net profit amounted to** Rs 235 m **against Rs 74.7 m previously. The earnings per share was a very healthy Rs 25.60 .The share price oscillated form a low of Rs 37.25 in May 2012 to a high of Rs 108 in January 2013. The company paid a dividend of Rs 5 per share on a face value of Rs 5.

In spite of the promoter management indulging in self aggrandisement schemes to fatten closely held group companies; this is a share that can be looked at closely._