I think @adityanahata has done a good job in describing what Chembond does. Here is my take on the story:

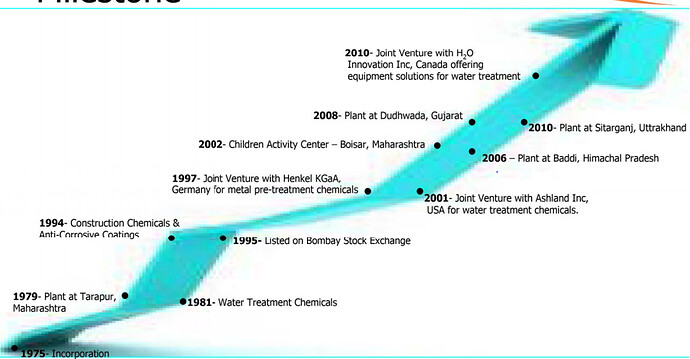

Chembond was established in 1975 and got listed on BSE in 1995. It provides speciality chemicals and solutions. This is how the company has evolved since incorporation:

The company was founded by Dr Vinod Shah and is currently being managed by Mr. Nirmal Shah and Mr. Sameer Shah, Dr. Vinod’s son. During the last two decades the company partnered with multiple MNCs and has ventured into various segments ranging from Metal treatment (partnership with Henkel), Water Chemicals (partnership with Ashland/Solenis), Water equipment, Construction Chemicals, Enzymes, Animal Nutrients, Polymaides, Industrial coatings, Adhesives and Sealants etc.

On a first glance it looks that a company with 300 cr turnover is trying to too many things at a time. But for most of the things that company is doing there seems to be some thread emerging out of current existing business. For example the company one had an Enzyme division which it used to supply to Wockhardt and this business lead them into the animal nutrient business.

Key Events in last few years:

Divesting Stake in Henkel JV: Chembond divested its entire stake in JV for 184 cr. As part of this the company retained the manufacturing operations and started doing contract mfg. for Henkel at zero margins. The no compete and supplying agreement will come to an end in this quarter.

Acquiring the remaining 45% stake from Solenis in water treatment chemicals JV: Post divestment in Henkel the company acquired 45% stake from Solenis in April 2017 for around 50 cr.

Buying Phiroze Sethna Private limited (PSPL) : Chembond bought a private company which supplies sealants and adhesive to auto oems a related area in which Chembond operates. CHembond paid around 40 cr for PSPL.

Both the acquisitions are profitable with high ROCE’s and great price paid and full cash indicating good capital allocation.

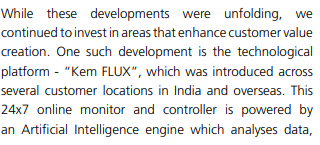

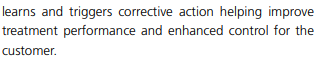

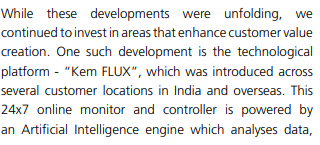

R&D focus: At first glance Chembond looks like a company with 300 cr sales and into too many different and unrelated areas. But if one looks deeply one can find threads leading from one area to another for example the animal nutrition business emerged from the enzyme business which the company used to do for Wockhardt at one point of time. The way I see it is the company has seeded multiple business and have consistently tinkered around and have come up with newer innovative products at the same time keeping the balance sheet healthy with working capital ranging between 45/60 days. If one looks inside ARs one can see the various products that company has innovated every year.

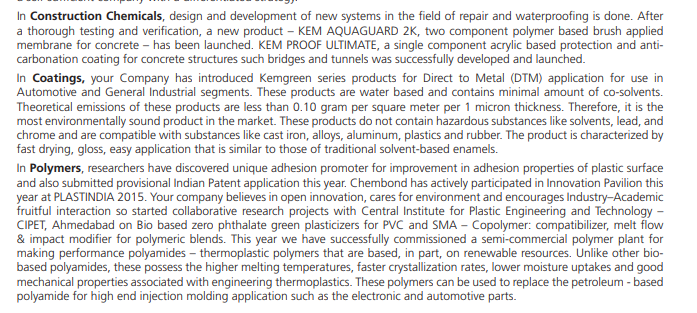

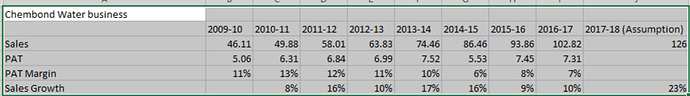

For example from FY17 AR:

From FY16 AR:

From FY15 AR

The company has two R&D labs one at Dudhiwada focusing on Polymers and the other at Mahape, Mumbai.

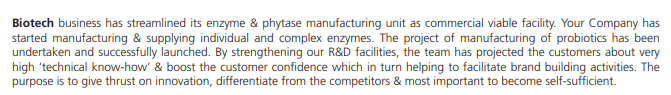

How do I look at the company?: The company does too many things but the way I look it is to focus on the higher order bits and what is changing. This is from the company’s latest presentation:

Assuming an annual topline of 300 crores this is the current split:

| Toll |

96 |

| Water Technologies |

126 |

| Construction |

18 |

| Industrial Technologies |

18 |

| Animal Nutrition |

30 |

| Trading |

12 |

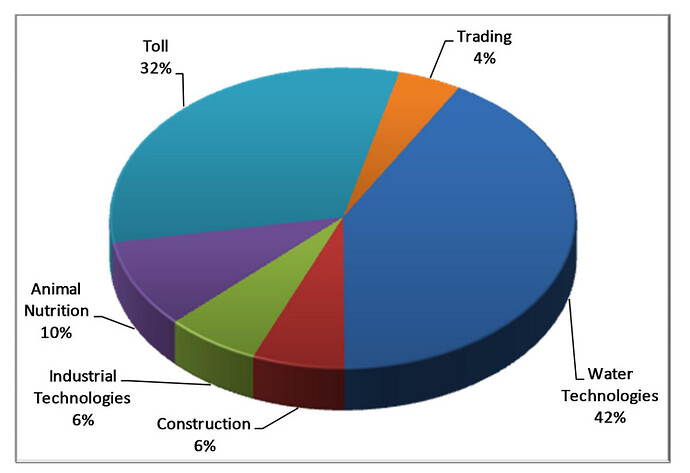

Chembond has many subsidiaries but except for water technologies most have negligible contribution. The standalone business which is of around 170 cr consists of everything from the above list except Water technologies. Ignoring other income operationally standalone business has contributed pretty much nothing in last 2/3 years and this is due to the fact that the toll business operates at zero margins and other business are also incubating. The water technologies subsidiary can be looked at individually:

In the standalone numbers although there are no operational profits but there is a payout of 1.25 cr and 3 cr for FY16 & FY 17 respectively in terms of Legal & Professional Fee to Dr. Vinod Shah for his services in the Henkel deal. . This fee has ended in the September 2017 qtr and wont recur going forward.

Chembond purchased PSPL, if one looks at the books of PSPL, PSPL had an operational PAT of 3 cr in FY17 and sales of 30 cr…

Along with the above Chembond still carries around 40cr/50cr cash on its books.

All the above should constitute the base income and the historic growth rate has been around 12%.

What is changing?:

Animal Nutrition: The current share of animal nutrition in 9M is 10%. In an earlier presentation post Q1 the animal nutrition had a share of 6% assuming an annual sales of Chembond at 300 cr the animal nutrition business has had a run rate of 8/10 cr for last two quarters. An initial look at the products suggest that there is little Indian competition.

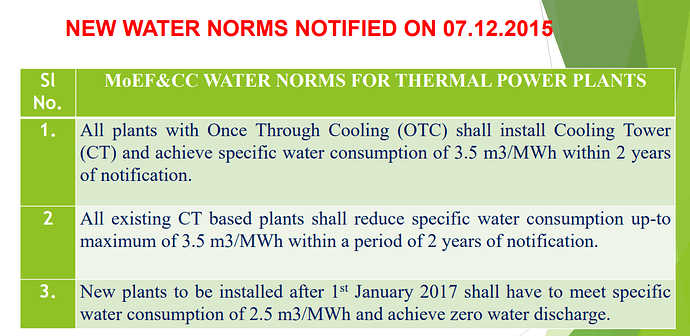

Revival in the water treatment segment driven by NTPC and other PSUs: The water treatment segment can grow very sharply for the next two to three years since the govt is now becoming extremely focused on pollution control. Anyone tracking GE Power would be aware of NTPC tenders related to pollution control norms. The other aspect here is that government bodies & PCBs have become extremely stringent with matters related to effluent discharge/recycling/reuse. As per MoEF the following are the newer water norms:

Chembond is a market leader in the coolant technologies.

Exports of water chemicals Earlier due to agreement with Ashland the company was not allowed to go into markets outside South Asia. A lot of opportunities are now opening up for company in export markets too.

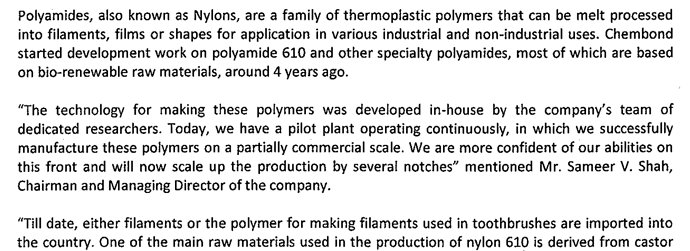

Polyamides: The company in a recent disclosure stated that they have been successfully able to commercialize PA 610. From the company’s disclosure:

The company is looking to setup an initial production facility with a capex of around 10 cr. The R&D on these polyamides is being carried out at Dudhiwada near Baroda. The company might also be working on more polyamides. They have been testing this product for a while now and now that they have commercialised it they have big plans over the next 2-3 years for this business in regards to capex.

Synergy between PSPL and existing coatings business: : PSPL and Chembond’s coatings and adhesive business are complimentary and both supply to auto OEMs but in different segments. Going ahead this could help Chembond

Toll Business going away: Post Henkel buying out the company’s stake in JV the company had a 3 year no compete clause and also that the company would do toll manufacturing for Henkel at zero margin. This is the last quarter for this arrangement and after quarter the company can launch and market its own product. The plant capacity is fungible.

Risks

As mentioned earlier the company is into speciality chemicals and solution what this implies is that unlike bulk chemical companies which have large operating leverage coming by the incremental margins would be more limited. Management has been quite clear of not investing in any commodity business.

Some of the bulk chemical companies like Atul/Aarti have done exceptionally well in the last decade and have grown significantly. Chembond’s track record as compared to some of the leaders is mediocre.

The management is attempting to do too many things which can lead to unnecessary diversions. Some of their forays like the one into construction chemicals have not done well. This is the only business which has been around for long and hasn’t picked up but the reason for the same is the biz requires capital and lot of Working capital requirement and you have to let go margins, which Chembond is not comfortable with hence letting it run the way it is without infusing more capital.

Although I see some of the segments at tipping point over the next two to three quarters there could still be some parts moving (Henkel toll going away)which can impact P&L.

The demand due to NTPC and PSU generally gets delayed and is far more unpredictable.

Company’s earlier attempt to commercialize PA 610 faced competitive pressures due to the prices of alternate raw materials coming down. The development and success of PA segment should be monitored over a period of time and cannot be taken for granted.

Due to toll business going away the company could face topline erosion and building inroads and competing with Henkel can also take significant time.

Purely from a valuation perspective it is difficult to see how market values it. Generally there is a significant conglomerate discount.

Finally I think it would be really helpful if we can pick a segment and disseminate it. Focusing on individual segments/relevant products (out of a plethora) and looking at the opportunity and competitive intensity can help us move forward here.

Discl: Holding forms more than 5% of my portfolio.