Background

CDSL was initially promoted by BSE Ltd. which has thereafter divested its stake to leading banks as “Sponsors” of CDSL. There are currently two share depositaries in India . NSDL (National Securities Depository Ltd) and CDSL (Central Depository Services India Ltd)

NSDL was promoted by some giant institutions including the likes of IDBI Bank, UTI, NSE and some other institutions, while the CDSL was also promoted by some solid institutions including the likes of Bombay Stock Exchange, Bank of Baroda, Bank of India, HDFC Bank

The initial public offering (IPO) of Central Depository Services (India) Ltd (CDSL) received overwhelming response and got listed in June 2017.

CDSL is listed only in NSE (as BSE owns stake in it ) . NSDL is yet to come up with IPO hence CDSL is the only listed depository currently in the Indian market.

Financials

CDSL clocked a revenue of @225 crore for period ending March 2018 which is 20% increase from previous year end revenue of @186 crores . The PBT was 141 crores vs 116 crore and net profit is 103 crore vs 86 crores

Plus

- Currently there are only 2 DPs and there is a huge entry barrier for new players.

- The number of demat shareholders are expected to increase as many people / fund houses are entering the stock market.

- Expenses are expected almost to be same and the upside revenue to grow y-o-y.

- They are also getting into academic demat & discussion are on about unlisted indian companies being dematerialized

Minus

-

SEBI plays a major role in framing policies and CDSL is expected to adhere to them including the tariffs .The charges are fixed by SEBI and CDSL has limited options to show exceptional increase in revenue.

-

SEBI is considering allowing corporates to enter the depository business based on the recommendations of the panel under RBI Deputy Governor R Gandhi.

-

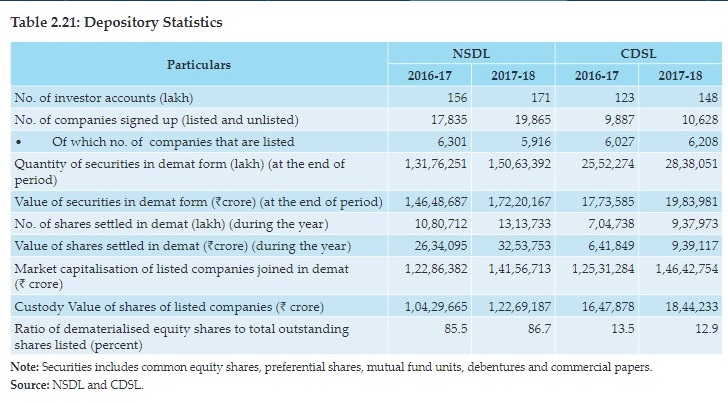

NSDL, continues to lead with a market share of around 57 percent, but CDSL has been consistently gaining market share from NSDL.

-

e-KYC norms and any new disruption based on any new government policies.

Disclosure:

Invested in CDSL and opinion may be biased. Kindly do a thorough analysis before investing.

Popular Links

https://www.cdslindia.com/aboutcdsl/introduction.html

Notes:

This is my first post of company analysis. Feedback for improvements are welcome.

The details of CDSL are very limited seen in internet and i read it on of valuepickr post about it and started SIP in it. On account of it , its titled on similar lines mentioned in the post. Thank you valuepickr and team member for highlighting the stock .