Investor Presentation for Q1 Fy2021:

Loving the discussion on Care Ratings. I recently wrote a blog post on why I like Care Ratings. Would love to hear from some bears who can poke a hole in my narrative ![]()

# Should you invest in Care Ratings? The investment thesis.

Updated: Aug 13 2021

About the business

Suppose you have a company and want to raise 100 crore as debt capital - you can do it via two broad options – borrowing from a bank or raising a corporate bond. A company with good prospects of repayment will get the loan at 10% and another that is perceived as risky will get it at 15%. You will have to convince investors/banks why your business is low risk and you deserve a loan at 10%. Now there are 2 ways to do it -

- Without Ratings Agency - You go to lenders and say - “We are looking to get a loan at 10%, we think we are a low-risk business. You can analyze and assess this yourself”.

- With Ratings Agency - “We have got a reputed credit rating agency (or CRA like Crisil, CARE, Fitch) to analyze your business in detail and give an independent rating. They understand our business, understand the industry, have interviewed our management, analysed our books, checked our accounting policies and then come up with an opinion. So we are looking for a loan at a 10% rate, and we think this is a fair ask because Crisil has given us a top AAA rating based on their analysis.”

The second approach (with rating agency) is more likely to succeed and is also the reason why you would be ready to pay money to an agency to rate your business.

By getting ratings from a third party agency, you get the following benefits -

- Adds credibility to your pitch

- The lender (bond investor or bank) will have to do ‘lesser’ analysis work as the report from the rating agency will give the broad analysis.

- Ratings are used as a shortlisting criterion and will get you interest from more lenders.

- Often, having the loan/bonds rated is a mandatory regulatory requirement.

The companies that give ratings are called credit rating agencies (CRAs). There are 5 major agencies with the leader being Crisil followed by CARE Ratings at #2 spot. You can think of CRAs as a business similar to Audit/Accounting firms, with the following similarities -

- It’s all about having the best people and processes.

- Reputation is very very important - once lost, it can break the business.

- The top players take disproportionate market share - like big 4 in accounting and big 3 (Crisil, CARE and ICRA) in credit ratings. They also charge a higher price.

- Business growth is linked to overall economic activity in the economy.

- The value add is from 2 sources - 1) Trust from third party analysis and 2) Helping to meet regulatory requirements.

- Scale is a competitive advantage - as now you can hire the best people, invest in the best technology v/s peers and have lower fixed cost as % of revenue.

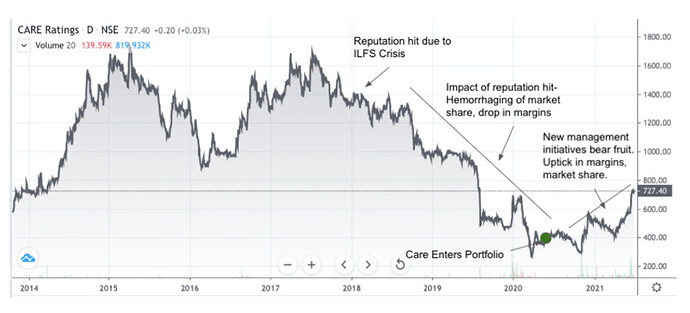

The story has 4 phases phases -

Phase 1 2014 to 2018 - All is good: - After the IPO, CARE was growing well (profit growth of 50% in 4 years), maintaining high margins and market share. The markets were loving the company valuing it at 35x earnings. But they say the true test of a business (and an investment portfolio) comes in times of crises.

Phase 2 - 2018 - ILFS Crisis Hits - In 2018, the Indian banking NBFC sector was hit by “ILFS crisis”. Essentially ILFS - an NBFC - had taken 90,000 crores worth of debt and defaulted on some repayments. The word realized that the ILFS management is not in a position to repay its debt, thereby risking the spread of contagion in the NBFC/Banking space. The government had to step in and do a bail-out. Government investigations also found fraud and started bankruptcy proceedings.

CARE had regularly provided ratings for ILFSS and just before the default - the last rating it had assigned was the highest rating of AAA - a rating reserved for blue-chip companies with a very strong ability to repay loans. The investors and lenders were incensed – “if something rated AAA by CARE can default so quickly, then do these ratings even add any value?” - the investors wondered. Not just ILFS, CARE was also seen giving high ratings for some other companies that defaulted. A big reputational damage had been done.

Phase 3 - 2018-2020 - Aftermath of reputation hit - from 2018 to 2020, the company’s profit plunged by 50%, driven by both drop in revenue and a precipitous decline in margin. The company’s share price also took a massive hit dropping by ~75% from peak to trough. CARE found it very difficult to get new business from clients who had lost faith.

SEBI did an investigation and found that CARE had failed in its responsibility of properly evaluating credit risk and had overly relied on the claims of the management, rather than evaluating the facts independently. Barring Crisil (the market leader), two other rating agencies got investigated by Sebi and were penalised. ILFS’ auditor - Deloitte - the audit agency - also came under investigation but lapses on its part were not found to be not that serious.

After some denial, the company board had it enough and put the CEO of CARE on mandatory leave. New management and reorganisation were on the cards.

Phase 4 - 2020-2021 - New management sets things right - the new CEO was announced and over a period of 4 quarters the markets analysed his performance to see if he’s actually walking the talk. The latest quarter results and conference call had some good updates for the investors -

- Loss of market share had been arrested and a small uptick was seen.

- Margin loss had been reversed with an uptick in the recent quarters, along with some promise to improve further.

- The management is positioning CARE as a quality player and not a low-cost value player.

- Not just top management, but many middle management leaders had also been replaced with new faces - which helps with addressing reputation damage.

- Salary of employees was raised to get it in line with market and retain top talent.

- Started investing in technology for low ticket SME loan ratings and other tasks that can be automated – results of this investment will be seen over the next few years.

- Investing in new kinds of fee-based services that should generate 30 to 40% of the company’s business in the next 3 to 4 years.

Why invest in CARE ?

The Simple Investing’s flagship - Value and Momentum Picks Smallcase - is a mix of up to 15 stocks split equally between value and momentum picks. CARE falls under the value bucket of the strategy.

We invested in the company in the second quarter of 2020. At that time the market was super pessimistic and CARE was showing up as a deep value investment - a company with 250 crore cash and earning 100 crores per year - available at 1,200 crore market cap. Even if CARE continued to lose market share, there was not much to lose from an investment at that price.

Like a typical value pick – the stock languished and underperformed the market for a long time before the market noticed it and bid the share up. It’s up 87% from the purchase price.

There is still value in the stock and we continue to hold. CARE trades at 17x earnings v/s 55x for Crisil and 38x for ICRA - so yes it’s cheap on a relative basis. More importantly, it trades at a discount to my DCF-based estimate of fair value.

Thanks. I too had looked at the financials after ilfs fiasco and had come to the conclusion that market was overreacting. Also, with new management, I felt it deserved to be given a second chance. Lastly, I read recently that guy spier (acquamarine hedge fund) has also a significant stake in care ratings. I admired his book “the education of a value investor” and I feel he has a long term orientation

Sharing the podcast where Guy Spiers talks about CARE investment that I found useful.

The key takeaway or crux of Guy’s thesis is:

-

Unlike rest of world, India will not end up with rating agency duopoly. Regulators want a competitive market and even after ILFS scam, they let CARE off with a fine instead of dismantling it

-

Indian credit market has a very long runway ahead

-

CARE is relatively cheap vs CRISIL. He regrets selling CRISIL but will not buy near current valuations. CARE provides valuation comfort to play this market.

-

New Management seems to have right intent and need time to see how they steer CARE

-

In his view, he would prefer if CARE invests in the its employees (eg pay them Best in class salary) - even if that means depressed margins for a few years. That will propel CARE to gain credibility / market share.

Hi,

I am studying CRISIL, CARE and ICRA for few months now, and considering that, there are 3 rating agencies in India, it has generated interest for me.

I am curious to know how such “lethargic indifference and needless procrastination and laxity” of these rating agencies, is penalized in developed nations like USA? What is there stand in such cases?

Considering that, even after deep crisis like IL&FS, the regulator has allowed them to continue working with only 1 Cr as penalty, what is the gurantee that now they have improved?

I would like to know if there are visible signs of rating improvement now after 2019/2021, Can an individual investor trust these rating agencies now?

Today, individual investors are still investing directly in NCD/Bonds/FD(s) which have AAA rating from these agencies, but are there any new stringent financial parameters based on which such high rating is given OR they more or less same as were in 2018?

I have been reading some reports of CRISIL/CARE/ICRA from past 2-3 months but I am not sure on these points of improvement; hence curious to know if there is any major qualitative improvement in the functioning of these rating agencies post 2019 or not.

Disclosure : Not invested in any rating agency.

There are India Ratings from Fitch and Brickwork Rating which also rate bonds, and the bonds are purchased by mutual fund companies, along with the 3 listed rating agencies.

And then there are also 2 more, Acuite Ratings & Research and Infometrics Valuation and Rating, which I don’t remember seeing, rating bonds which are purchased by mutual fund companies.

India’s bond market is small is illiquid and should grow along with the economy because companies need debt, so there will be a need for rating agencies.

From a retail investor’s stand point, one can check the process and efficiency of these rating agencies by checking how they have downgraded bonds in the past which created a situation or panic, have they been vigilant at forecasting the problems. Because in every such situation, investors of bond funds redeem and the problem gets bigger. It is one thing to trust the group or the company that issues the bonds and another to trust a ratings company in such situations, say a ratings agency has downgraded a bond to B, do investors think, D has not yet happened, so no need to worry.

Fortunately or unfortunately there have been multiple instances where such credit downgrades have happened in the last few years and one can get good understanding of rating companies and then compare them with S&P, Moody’s and Fitch.

Unprecedented move from SEBI … CARE’s former management also mentioned

FY22Q2 concall notes:

- Want to increase ratings business market share by 1% p.a. and go to high 20s in the next 3-4 years

- Do not expect any large changes on the employee front in ratings business

- Both Indian subsidiaries (expect significant growth) are performing well on the employee front

- Plan is to reach 1/3rd of total business (in terms of sales and profits) from other business lines by FY25

- Don’t see a change in the competitive environment in ratings business (1’000 - 1’200 cr. market size distributed among 7 companies, high competition)

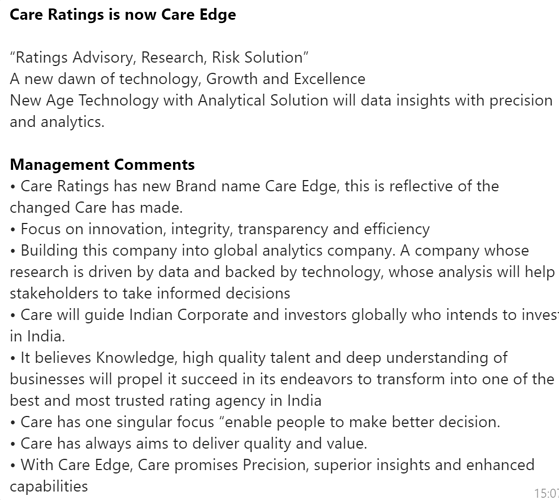

- Rebranding: New logo coming

- Do not book revenue from non-cooperating clients

Disclosure: Invested (position size here)

Flattish numbers from the company, de-growth in IT subsidiary led to muted performance. Ratings business growth in-line with the industry. Here are detailed notes.

- There is significant growth in new ratings business (to newer corporates). Seeing challenges in the surveillance segment. Revenue growth has been largely in-line with the industry (~7% for 9MFY22 in-line with ICRA)

- New ratings business is always loaded towards the second half of a fiscal year whereas surveillance business is more dominant in Q2 and Q4 of a fiscal year

- In terms of surveillance business, 90% of revenues are accounted in the month that surveillance is completed. Some competitors recognise surveillance revenue uniformly over 12 months which is not CARE’s practise

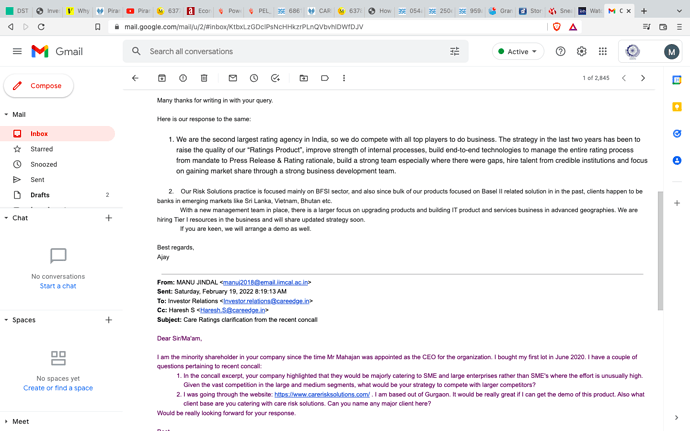

- Care’s presence is smaller in the SME segment with most of its presence in large to medium sized companies. Don’t believe rating industry pricing is right for SME segment

- In ratings business, Care is focusing on business from infrastructure, BFSI, and corporate clients. A lot of commodity companies have deleveraged with strong balance sheet. In that segment, mid-sized companies are the ones who are raising bank funding (and not the larger companies)

- Buyback is still not at the board level

- Objective is to move business mix towards capital market (from bank loan ratings which can be impacted during the Basel III norms)

- Other businesses: 9M revenues in African subsidiary grew to 5 cr. (from 3.29 cr.), Nepal business grew by 7.24%, advisory business (CART) grew to 5.7 cr. (from 3.68 cr.). The IT subsidiary did badly (-16% in 9FY22) due to exodus of tech talent and inaccessibility of certain geographical markets due to covid.

Disclosure: Invested (position size here)

Revisted my views of Credit Rating companies and thought to share:

Till when was CARE rating debts of ABG Shipyard that is behind the biggest bank fraud? What are the repercussions for CARE Ratings?

Disclosure: Invested

Care Ratings update: I bought my first lot in Nov 2020. I started covering the firm from July 2020. I covered my article here: https://www.gsninvest.com/post/care-ratings-deep-value-or-value-trap

- The first lot was bought at 302. At the peak, it reached 800 and is back at 542. Recent concall transcripts cover what is happening:

- While standalone revenues increased by 1% to 54.83 crores, PAT was down to 14.9 crores by 6%. On the consolidated basis, revenue (62.96 cr) and PAT (14.9 cr) were down by 1% and 21% respectively

- In the ratings segment, the growth was 6%. However the company had written off Rs 2.67 crores as covid provisions due to lockdown in March 2020 (the time span was till Dec 2021). Considering the write back of 2.67 cr, the rating business grew by 7.1%

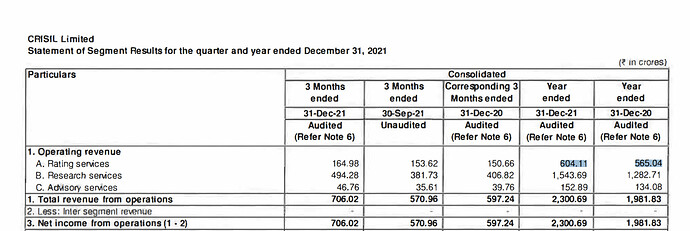

- From the macroeconomic scenario, bond issuance saw 15% decline whereas commercial papers saw 46% increase in issuance. This was the reason given by Mr Ajay Mahajan for the decline in growth which is in line with competitors (ICRA & CRISIL)

- While the ratings initially had a niche in SME segment, now the focus is on medium and large enterprises. In SME, the revenue does not offset costs in substantial manner. On the contrary, there is a competition from ICRA & CRISIL in large and medium segment

- Biggest highlight was the rebranding done by the name of CARE EDGE. Why? This is because ratings and surveillance business is reputation oriented. Given their past with IL&FS crisis and the focus of Mr Mahajan on diversification to risk solutions and advisory, it was need of the hour

- **Regarding playing the pricing game in the new segment, Mr Mahajan had the view of playing cost+margin game rather than burning the money to retain the client.

- On the focus part, the ratings would focus on Infra sector because even though you have a strong internal accruals, you have to resort to debt in this segment. The next focus would be on BFSI sector

- Buyback is still not on cards although the company has enough cash to buy 30% of the company. The reason would be the capital allocation happening in two new business verticals: Risk Solution & Advisory

- African subsidiary grew by 53%, Nepal by 8%. The IT subsidiary witnessed the decline of 16% due to talent churn and lockdown of European countries which lead to revenue reversals

- Employee cost went up due to ESOP’s granted in 2017 which were due for vesting. Also there is a focus on diversification as the capital employed in new businesses is growing QoQ

- Currently 95% of the revenues come from rating and surveillance businesses. With diversification, the company wants to de-risk the revenue %’s from rating and surveillance

- In revenue recognition, the company recognises 12 months of surveillance revenue in the 12th month and hence Q3 is generally weaker as compared to Q4.

- With regards to inorganic growth, I believe the company is focussed on getting the right opportunity at the right price and hence not in hurry to acquire any company at exorbitant price

- With regards to employee policy, the company is not a paymaster in the industry as admitted by Mr Mahajan. But it issues ESOP’s timely to keep the employees remain in the company

- With respect to new businesses, they have rolled out the new website: https://www.carerisksolutions.com/consulting. With respect to the products, they cater to majorly and banking and BFSI sector

- Considering the past experience of Mr Mahajan (ex BoFA), there can be a significant traction to these businesses in the coming quarters

- Current price: 540, cash on books 220 per share. Two levers: Mr Ajay Mahajan focus and fructification of diversification, setting the right processes and policies within the organization and working towards restoring the lost credibility

- Although the road is vast, but I am again buying this in my portfolio again as a turnaround story due to its attractive valuation

They last rated ABG in 2008

At least till 2013 they were rating ABG.

Jul 1 (Reuters) - Below are the ratings awarded by Credit Analysis and Research Ltd. (CARE)

for local debt instruments as of June 28, 2013.

COMPANY INSTRUMENT RATING AMOUNT MOVEMENT

(RS.MLN)

SHORT TERM RATINGS:

ABG Shipyard Ltd CP / ST Debt CARE A4 5000 Revised from

CARE A3

CRISIL’s CY21 ratings revenue growth is exactly in-line with Care and ICRA (~7%). This means CARE is no longer losing market share.

CARE, ICRA and CRISIL are still the whales in this industry in India. CRISIL is an orca whale. Is this an ok way to understand this industry as it is now? So, CARE should be able to make decent profits and have a decent market share to warrant a good market valuation in the future as they are still trading at a discount when comparing P/E ratios of ICRA and CRISIL.

However, I am concerned about the blow to their reputation because of IL&FS. As an investor, I am hoping they can bounce back and reclaim/remake their reputation. Also, is the turnaround entirely on the shoulders of the CEO/MD Ajay Mahajan? If he stays long enough and is able to pull the company to growth and profitability, that’s great. If he decides to part ways in the near future, then what?

There is no single large promoter for CARE. So we have to hope that the board has members who will take the right decisions for all major and minor shareholders. CRISIL still holds 8.85% (decreased from 8.9% as per screener.in).