Caplin Steriles Limited (Caplin), a Subsidiary Company of Caplin Point Laboratories Limited has been granted final approval from the USFDA for its ANDA Ketorolac tromethamine Ophthalmic Solution 0.5% (eye drops), a generic therapeutic equivalent version of (RLD), ACULAR Ophthalmic Solution of Allergan Inc.

Adding on Guatemala Point:

Two points, they were covered on concall: A) Sending Goods from FOB to CIF B) Strategic advantage of Guatemala.

A) & B) being a corporate group we are able to optimize the freight cost and as we are able to pool the goods and our container formatting will happen faster than earlier right and then availability of ship also will be faster and then we will be able to reach the goods earlier to the port. As we have mentioned in the past, we have a warehouse in Guatemala. The other countries can be serviced from there. Once the goods reach to Guatemala some of the countries it goes by road. One country it will go by ship. The El Salvador and for other countries it can go by maximum of two to three days. When we are able to pool the goods for Guatemala, we are able to get earlier consignment, earlier ships availability and then also freight advantage.

What is checking on each quarter and yearly basis?

we are comfortable giving out is that our gross margins are always between 55% to 57% and our EBITDA and PAT and everything have been very similar 35% to 36% and then PAT has always been hovering around the 25%. We are today a global company right in whatever small size we are still; we are still a global company.

So, all our calculation, with this numbers. Keep in our mind and reach to the numbers!!!

Add one another point, which one interesting on commentary

We have around

Rs.800 Crores. Even if you spend Rs.300 Crores to Rs.400 Crores to Rs.500 Crores in the next two years we will have Rs. 1,000 Crores. That is the time you will think of acquisitionof brands, acquisition of companies for domestic business and in addition to that we always look for something unique in the form of acquisition of distribution companies which will make us understand where we will have to sell our generics because generic is a business there is nothing in the form of marketing. Generic business is based on supply and demand.

You only need to understand how many products we have, what is the cost at which we will be able to supply and the quality wise once it is approved by USFDA everybody thinks quality will not be an issue. It is true also. So what is important is the distribution channels and the places where this can be reached by avoiding the intermediaries. Then coming back to one more thing in the form of LATAM, I am sure in five to six years from now we will be the number one company.

Open Eye for such kind of events / steps of the company !!!

Caplin Steriles Ltd has received final approval from the United States Food and Drug Administration (USFDA) for an eye infection treatment drug. The approval received is for Ofloxacin Ophthalmic Solution, used in treating eye infection.

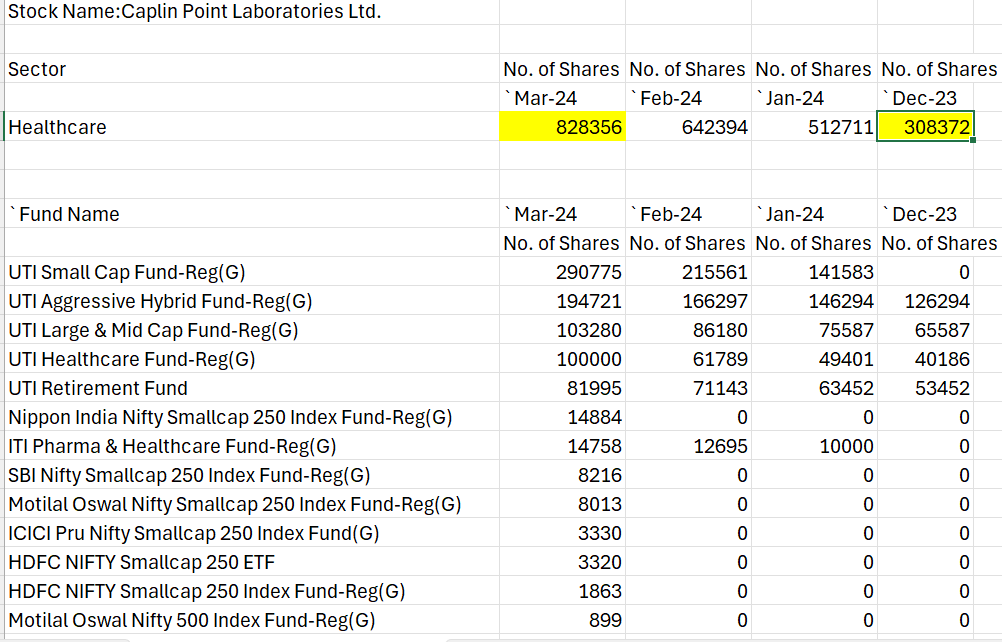

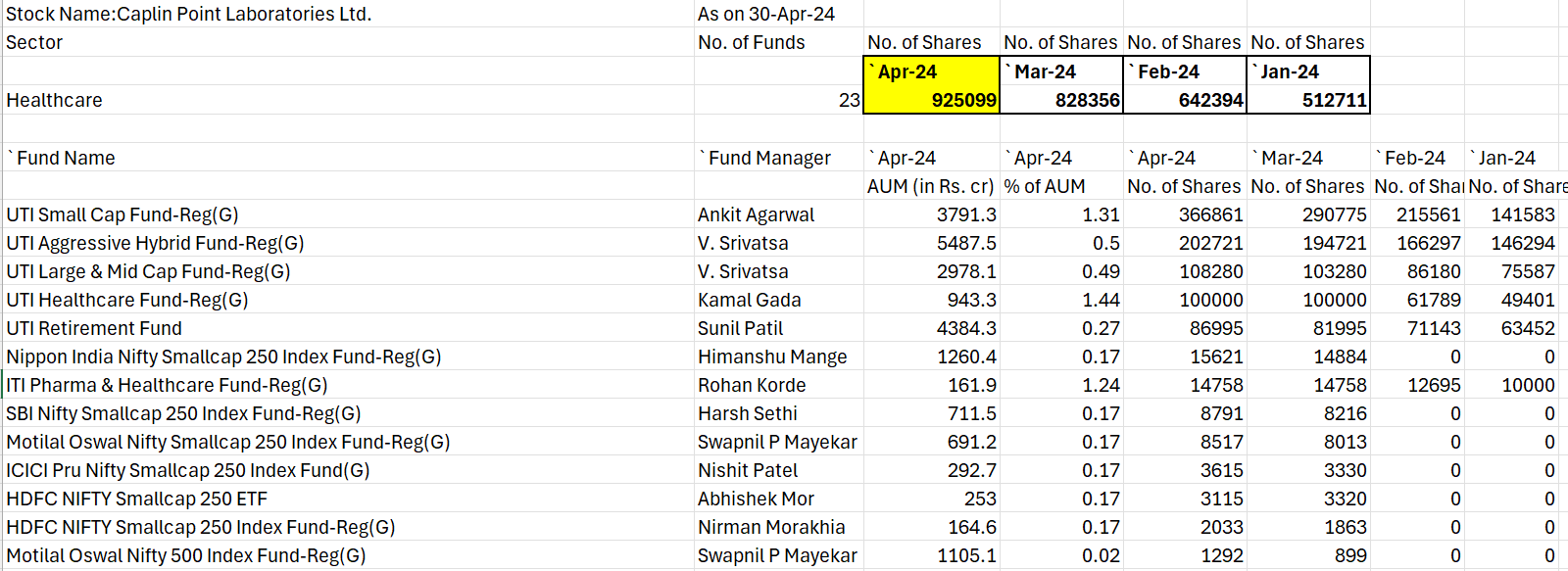

In the Q3FY24 meet the management had said that the H2FY24 will be better compared to H1FY24 due to commissioning of new plant/lines and also expected approvals of pending ANDAs also the holdings of institutions are steadily going up from last 4-5 quarters.

Disc : Not SEBI Registered. Not a buy/sell advice

Invested so can be biased

What would be a good comparison to make to this company? In terms of product profile and the mode of business that they are operating in?

Are they a Generics manufacturer? Are they comparable to Natco?

Any 101 on this would be great for me to start looking at this a little deeply

What got my attention is them almost doubling their Fixed Asset Base and at the same time having about 800 cr. + cash on books

There is no close peer as it followed blue Ocean Strategy targeting markets in LATAM and Africa,where no other players dared to enter giving them an edge in margins. Only recently they have started in US with injectibles.

Natco manufactures and markets complex products for niche areas which is a strong entry barrier for other players. Where Caplin Point manufactures all kinds of regular products.

So there is no comparison between Natco and Caplin. They both have their own products and strategies.

Thanks - 100% of their business is export sales?

Thanks Mohit - and how would you categorise Caplin in terms of dependency on a particular therapy?

yes no sales in India as far as i know and nothing has been planned

not dependent on any one therapy quite diversified

Pharma Export Formulations : 76%

Domestic Formulations : 13%

API: 6%

Agchem : 2%

You can check on caplin point website

Caplin Point has received Colombia’s INVIMA approval for its Softgel Capsules division at

Puducherry.

Disc: invested

Domestic Institutional investors have added almost 96000 shares in April-2024

DII holding data as on 30-April-2024.

Disc: invested

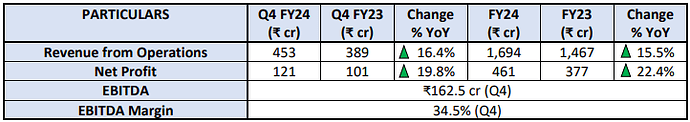

Caplin Point continues to be a consistent performer with Q4 results.

Summary of q4 concall:

Caplin Point Laboratories reported a 15.5% YoY revenue growth and a 22.4% YoY increase in profit after tax. Contribution margins improved by approximately 3%

Caplin Steriles achieved over 50% revenue growth in the US-focused regulated market business, contributing 75% of product revenue.

Challenges in attracting the right talent have led to some delays in completing API projects. The company is also exploring direct sales to hospitals and clinics in the US market and actively seeking acquisition opportunities.

Gross Margin for Q4 FY24 is 57.8% compared to 54.6% in Q4 FY23 and 12M FY24 is 57.3% compared to 54.8% in 12M FY23

EBITDA Margin for Q4 FY24 is 34.5% compared to 33.8% in Q4 FY23 and 12M FY24 is higher at 35.1% compared to 32.6% in 12M FY23, aided by new product launches across existing and new markets in the current year

Basic EPS increased by 21.3% to ₹60.19 in 12M FY24 compared to ₹49.62 in 12M FY23

Cash Flow from Operations in 12M FY24 is ₹318 Crores as compared to ₹271 Crores in 12M FY23

Free Cash Flow is ₹172 Crores (after Capex investment of ₹146 Crores) in 12M FY24 as compared

to ₹78 Crores (after capex investment of ₹194 Crores) in 12M FY23

Geographical revenues: Latin America and Rest of World 82%, US 18%

Caplin Steriles Ltd (“CSL”) revenue crosses ₹100Cr for the first time in Q4 FY24. 12M FY24

Operating Revenue of ₹313.36 Crores, with 51% Y-o-Y growth

CSL’s revenue composition demonstrates a balanced mix of Product Supply and Milestone + Profit

Share, with the split for 12M FY24 in the range of 75% and 25% respectively.

As of 31st Mar 2024, Inventories (including in-transit inventory) are at ₹363 Crores and Free Cash

Reserves are at ₹910.50 Crores. The total Liquid Assets of the Company (Inventory + Receivables +Free Cash Reserves) are at ₹1,816 Crores. Receivable days are at 114 days.

Overall inline number and book value per share Rs 309/-

CAPLIN POINT LABORATORIES LIMITED Concall Summary Date: 16 May 2024

FINANCIAL HIGHLIGHTS

During the quarter, the company delivered a strong performance augmented by their benchmark cash flows and their existing markets.

The overall growth in profits was on account of higher contribution margins by 3%, strong EBITDA, and increased other income.

Gross margins expanded by 320 bps YoY to 57.8% in Q4 FY24, aided by new product launches across existing and new markets

The expansion in gross margins during the year was 250 bps to 57.3%.

EBITDA increased by 20% on a YoY basis during Q4 FY24. In FY24, it was higher by 24% to ₹618.4 crore.

EBITDA Margin for Q4 FY24 increased on a YoY basis by 70 bps. For FY24, the EBITDA margin was 35.1%, up from 32.6% in FY23. This improvement is attributed to new product launches across existing and new markets.

The company had set aside an overall capex budget of around ₹600-₹650 crore for ongoing investment projects, most of which are nearing completion (~50%-55%). This capex is aimed at expanding existing production capacities, diversifying the product range, and achieving backward integration for a majority of the products. The CAPEX was financed mostly through internal accruals, and the company aspires to remain net cash positive throughout the process.

Since the last 4 years, the capex and opex stood at ₹800 crore and ₹1,000 crore respectively.

The receivable days stood at 114 days.

As of March 2024, inventories stood at ₹363 crore (including in-transit inventory). Further, cash reserves stood at ₹910.5 crore.

The free cash flow during FY24 was ₹172 crore, post capex outlay of ₹146 crore, while the same was ₹78 crore in FY23 post the capex of ₹194 crore.

Cash flow from operations in FY24 was ₹318 crore v/s ₹271 crore in FY23.

The company has liquid assets of ₹1,816 crore as of date, showcasing a very healthy balance sheet.

The total R&D (research and development) spend was ~16.4% of the PAT in FY24. As a % of revenue, it was 4.5%, similar YoY.

It declared a dividend of ₹2.5 per share.

BUSINESS HIGHLIGHTS

-

The geographical breakup of sales as of the year was as follows: Latin America (LATAM) & Rest of the World (ROW) 82% and United States (US) 18%.

-

The product mix in terms of consumption during FY24 was: 45% Outsourced and the remaining 55% in-house.

-

The capacity utilisation during the year was ~90%-95%

EMERGING MARKETS

The LATAM business model continued to drive growth in both top and bottom lines, accompanied by improvements in cash flow cycles.

Revenue breakup across business segments in FY24 for LATAM was: wholesalers 55%, direct to retail 25% and institutional 20%.

The revenue mix in terms of business verticals in FY24 was: Generics 75% and Branded Generics 25%.

The company received approval from Colombia’s INVIMA (National Institute for Food and Drug Surveillance) for the Softgel line at the CP-1 site in Puducherry, providing access to key target markets of Mexico, Chile, and Colombia in this niche segment. They already have a notable presence in the Softgel segment in existing markets of Central America.

They have shortlisted 25 Softgel products to be filed in Mexico over the next 24 months, with all studies being done at Amaris Clinical, the in-house CRO (contract research organization) facility of the company.

It has 6 Injectable products approved in Mexico with a further 23 products under review. The company plans to file 50 products overall in the next 12 months, both from internal pipeline and outsourcing partners, a repeat of Caplin’s collaborative strategy in Central America.

They draw up plans to enter niche segments of Biosimilars and other Biologics such as Insulin, initially with a “Fill-Finish” concept, which would be manufactured in line with requirements from Regulated markets.

US & REGULATED MARKETS

They have delivered robust and consistent growth in the US, with revenue growing 51% over the last year.

Caplin Steriles (CSL) (one of their subsidiary) has experienced strong revenue growth, driven by the expanded capacity resulting from the addition of Line 5. The revenue generated from it crossed ~₹100 crore, during Q4 FY24 for the first time. Revenue for FY24 at ₹313.4 crore, up by 51%.

During the year, CSL’s EBITDA and PAT stood at ₹61.2 crore and ₹18.3 crore respectively.

CSL’s revenue composition demonstrated a balanced mix of product revenue supply & milestone plus profit share of 75% and 25% respectively for FY24.

CSL made progress with nearly 25 out of 50 state licenses available already. The company aims to launch its own labeled product in the US by Q2 FY25.

It received 3 ophthalmic product approvals from the FDA (Food and Drug Administration), with one product launched and the other 2 to be launched in Q2 FY25. The total number of approved ANDAs (abbreviated new drug applications) under Caplin’s name was 21.

The company has filed its first injectable suspension ANDA and its first Plastic Vial ANDA with the US FDA.

The company currently has 14 ANDAs under review, and it anticipates receiving approvals for 3-4 of these in the coming months.

The products currently under review include a combination of injectables, vials, ready-to-use bags, and ophthalmic products.

Line 6, (the robotic pre-filled syringes line), is currently in the qualification process and is anticipated to become operational within the next 3-4 months.

UPDATES

The company’s oncology division under Caplin One Labs goes commercial. They expect the entity to turn profitable within 6 quarters since multiple product registrations were already available in existing markets. The monthly opex stood at ~₹1-₹2 crore.

On the digitization journey, the company has taken on a project to automate all manual systems at the plant to fully automated systems, including e-logbooks and e-Batch Records over the next 12-18 months. Several functions at CSL are already completely digital, such as Quality Control, Microbiology, Documentation Management, and others.

Construction is set to begin soon on a new OSD (oral solid dosage) plant and oncology API (active pharmaceutical ingredient) facility near Chennai. The facility aims to be commissioned by the end of Q1 FY26, to triple the existing OSD capacity. This expansion is intended to meet the growing demand from larger Latin American markets like Mexico and Brazil, along with regulated markets such as the US and EU (European Union).

FUTURE OUTLOOK

The growth in FY25 would be in a similar trajectory for both revenue and margins. However, they are confident of growing consistently on account of market growth, new product launches, and capacity building.

The company has filed several products in non-US markets such as Canada, Australia, Mexico, South Africa, China, etc., and some approvals and launches are expected within FY25 for these.

They will launch 11 new products in the US in FY25, in several niche segments of Injectables, including Ready-To-Use Bags, PP Vials, Injectable Suspensions, and Ophthalmic Solutions.

The focus would continue on cash flows, bottom as well as top-line growth along with focused investment into technology in products, facilities, and markets.

The remaining state licenses would be received in FY25.

The cash balances have continued to increase and the management plans to maintain this for future acquisitions focused on forward integration, if any.

The company believes US business to be one of its primary markets that will drive growth in FY25 and FY26.

In 2 years, the Mexico market would contribute significantly to growth as well as profitability.

By FY28, the aspiration remains intact to expand its presence in all regulated markets.

Hi Mohit,

So based on the updated provided by management can CP do sales of 5,000 Cr in 3 years time-frame?, can it get a valuation of 50Kcr from current 10kcr? Whats ur thought.

Am invested in CP and holding since5years +

maybe or maybe not. But we have to watch on company’s results and make decision