Suresh Iyer appointed as the new MD & CEO

CEO resigned in Sep 2022 and now …

Misappropriation of funds

Disclosure: Invested

This post is Not specifically about CanFin Homes but about the ENTIRE Housing Finance Niche it operates in. It aims to provide a Quantitative overview of competition and Industry level nuances.

This is a second half of a post I wrote somewhere else FYI in case there are any disconnects in the text.

A Quantitive Analysis of 15 Listed Housing Finance Companies in India

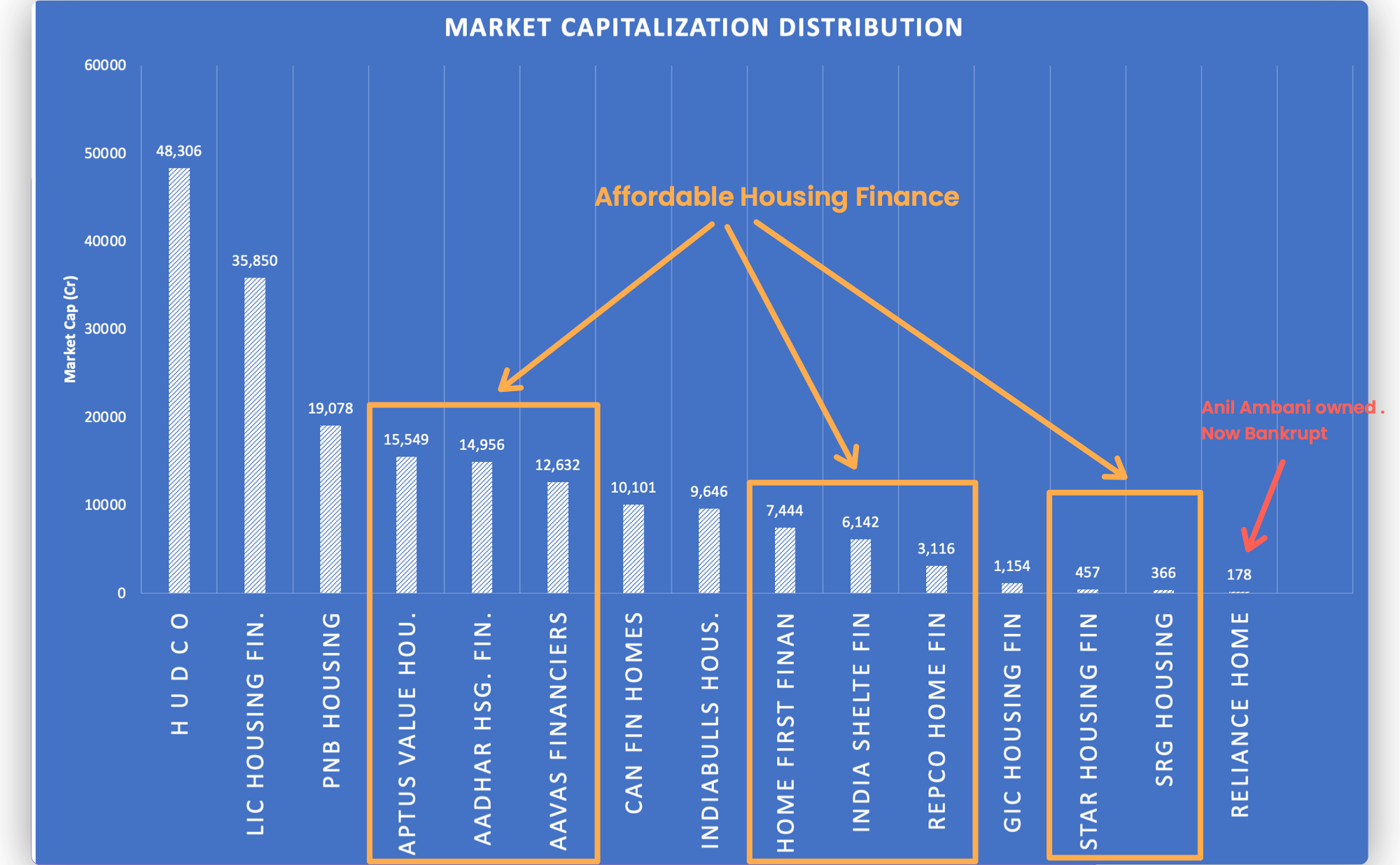

First, let me introduce the contenders :

Of the 15 HFCs shown above, 8 operate in the Affordable HL segment , out of which Aadhar Housing Finance and India Shelter Finance are recently listed.

And the remaining are larger players as measured by ATS - Avg. Ticket Size.

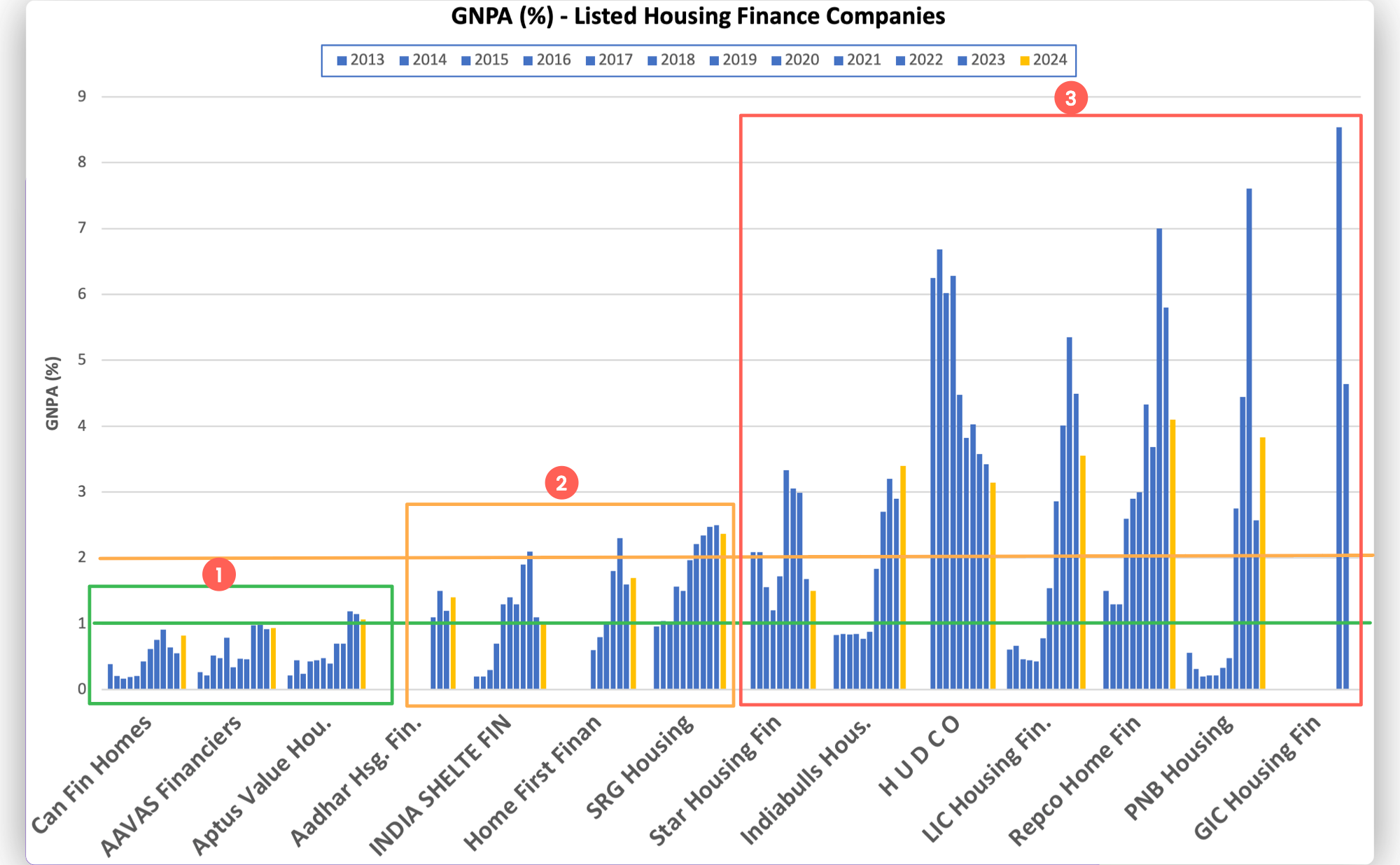

Next, let’s see how they have fared across cycles in terms of Asset Quality.

- Gross Non-Performing Assets (%)

While it is true that Housing and Gold are possibly the safest lending segments given the presence of valuable collateral, and that Write-offs (actual losses) are a very small percentage of GNPA, the market ascribes valuation multiples (P/Bx) based on the lenders’ ability to maintain Good asset Quality (amongst other factors such as Growth & ROE)

“Good” is defined by what the best players can achieve “over cycles”

We can broadly categorise the Listed HFCs in our pool into 3 NPA buckets as shown below.

The A Players consist of - Can Fin, Aavas Financiers, and Aptus

The B Players - Aadhar, India Shelter finance, Home First & SRG Housing.

And The remaining lot - C Players.

But NPA ratios are not the only way the market values Lending Institutions. The directional change, the absolute levels vs peers and the extent to which they impact ROE is what matters.

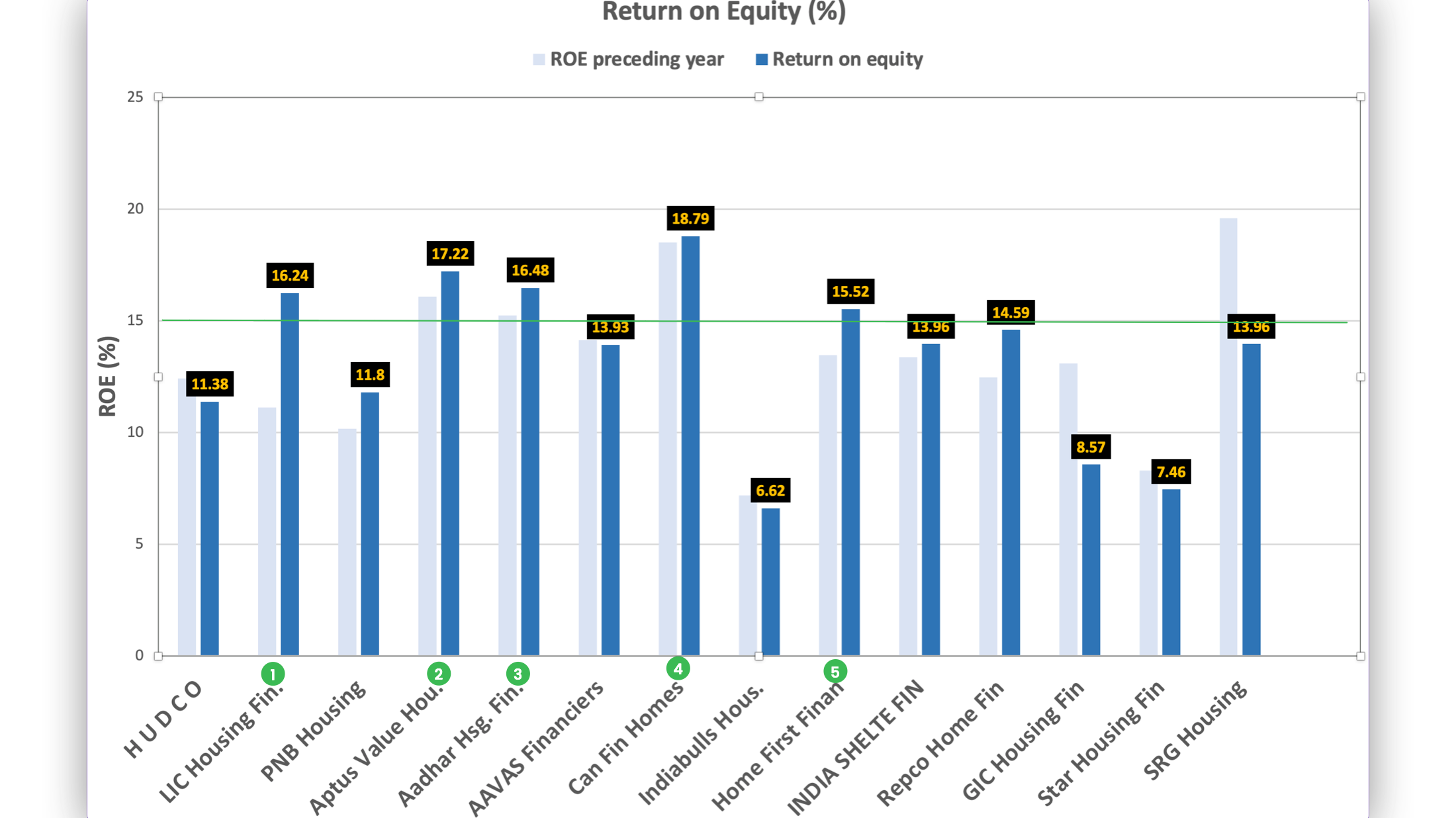

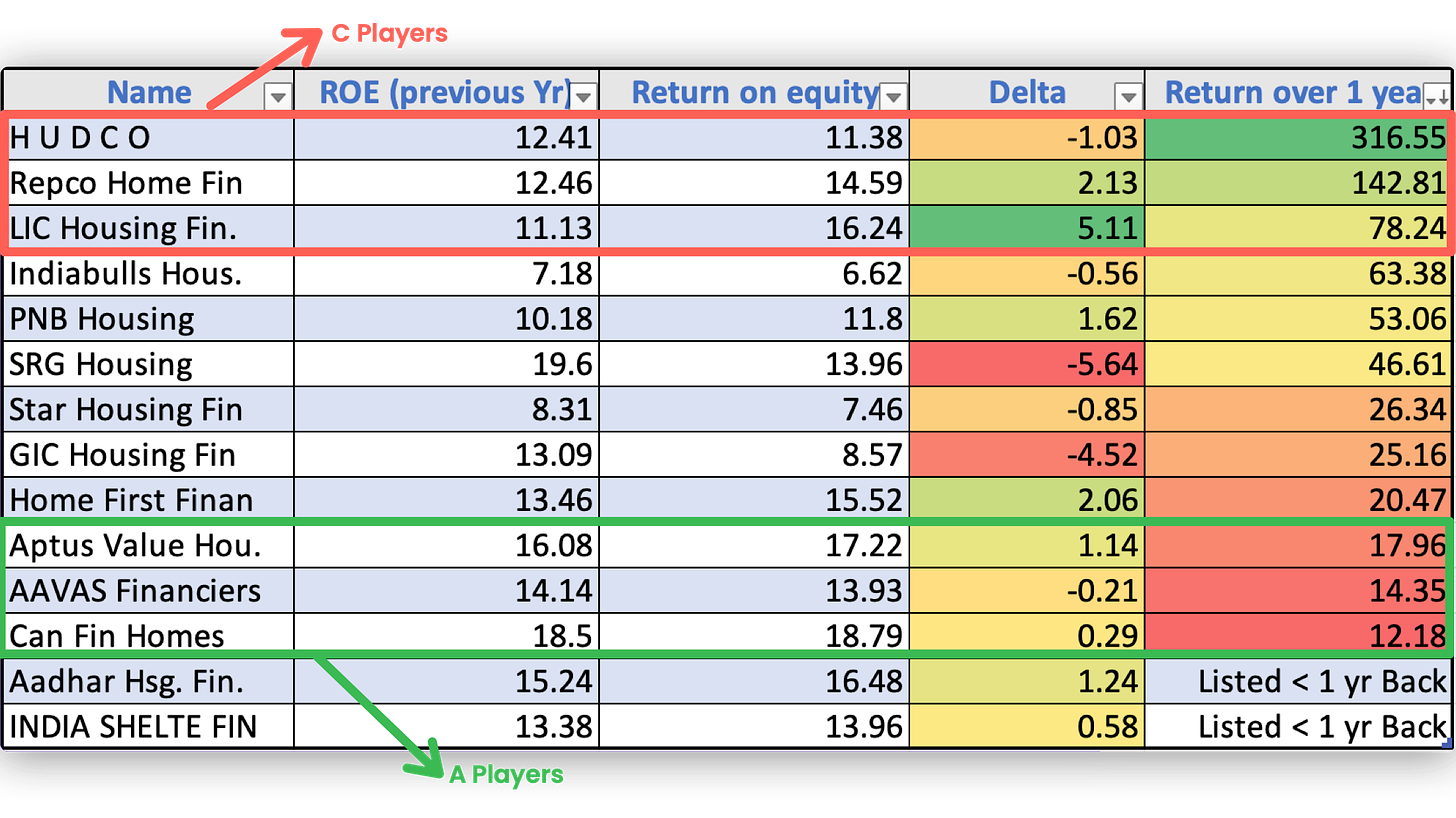

- Return On Equity (%)

8/14 HFCs have managed to expand their ROE over the preceding year.

but only 5/14 have remained over 15% in FY23/FY24.

The A Players (by GNPA) also enjoyed 15% + ROE.

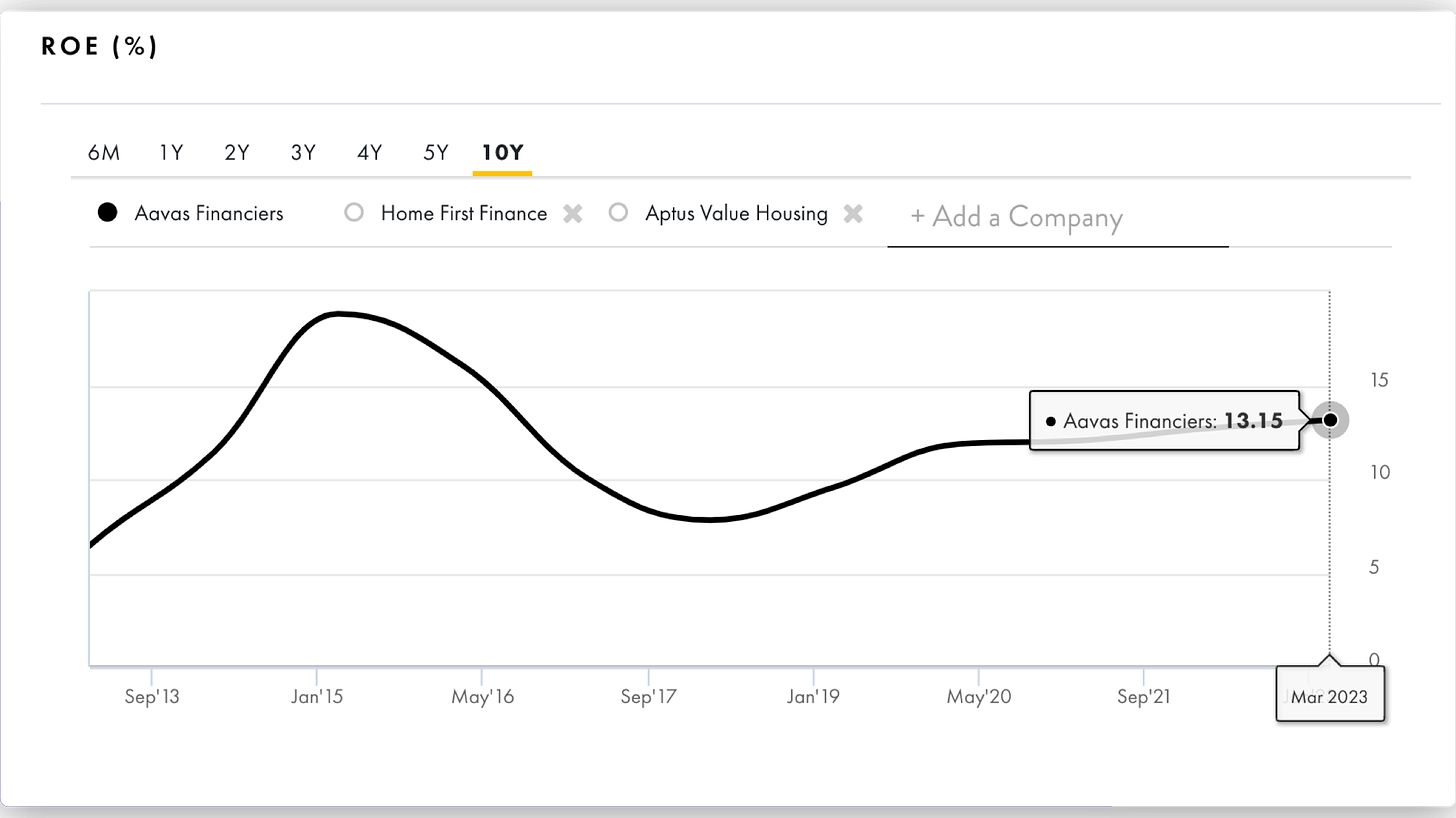

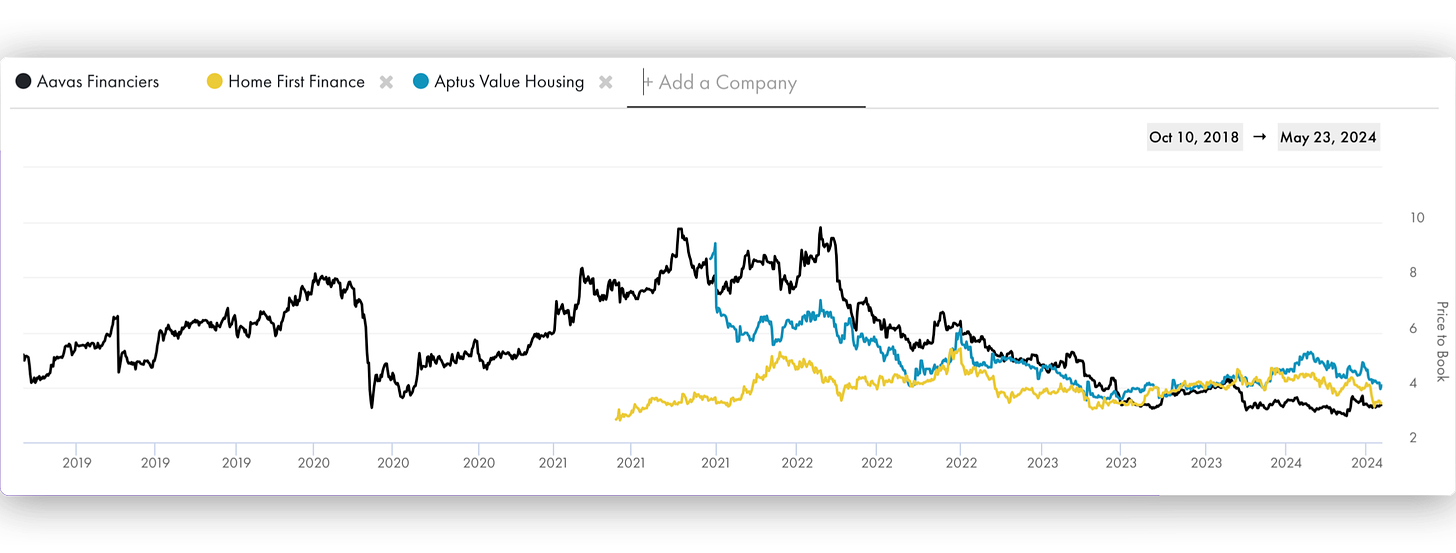

The Exception was Aavas Financiers. In fact, Aavas has never hit an ROE of 15% since it got listed in October 2018 but despite that has enjoyed steep valuations for most of its trading history, mainly because of High consistent growth and Pristine Asset Quality.

Currently, however, because of a combination of factors (Top Management Exit, PE Firms exiting, lower disbursement growth etc) Aavas currently trades at a valuation that is cheaper than it was during the crash of March 2020.

Which raises an interesting question !

Should we conduct an ‘Aavas Financiers - Deep Dive’?

- Yes

- No

Can Fin Homes is another player with Stellar GNPA history. It also has the highest ROE among the pack. However, the problems plaguing CanFin are twofold :

A. Growth - With an ATS of ~25 Lacs, it is competing with Banks and other Large HFCs - LIC Housing, PNB Housing, Bajaj Housing etc.

B. CEO change and Weak Governance - There was an incidence of Fraud in Ambala about 1 year back, post which the stock crashed and has been trading in a range since then. P/B went from 3.1X (July 23’) to 2.3X today.

As for Delta in ROE, which in my view can be an important predictor of generating Alpha , here’s the table.

Notice something Interesting?

The worst players by Asset Quality offered the highest returns (Last 1 year) and my hypothesis for why that is the case is because In a benign credit environment, GNPAs reduction leads to lower provisions and/or write-backs, both of which lead to outsized PAT Growth vs AUM Growth.

In the case of HUDCO, an additional idiosyncratic phenomenon might be playing out too - The PSU Bubble ![]()

Poor Starting valuations are also another factor.

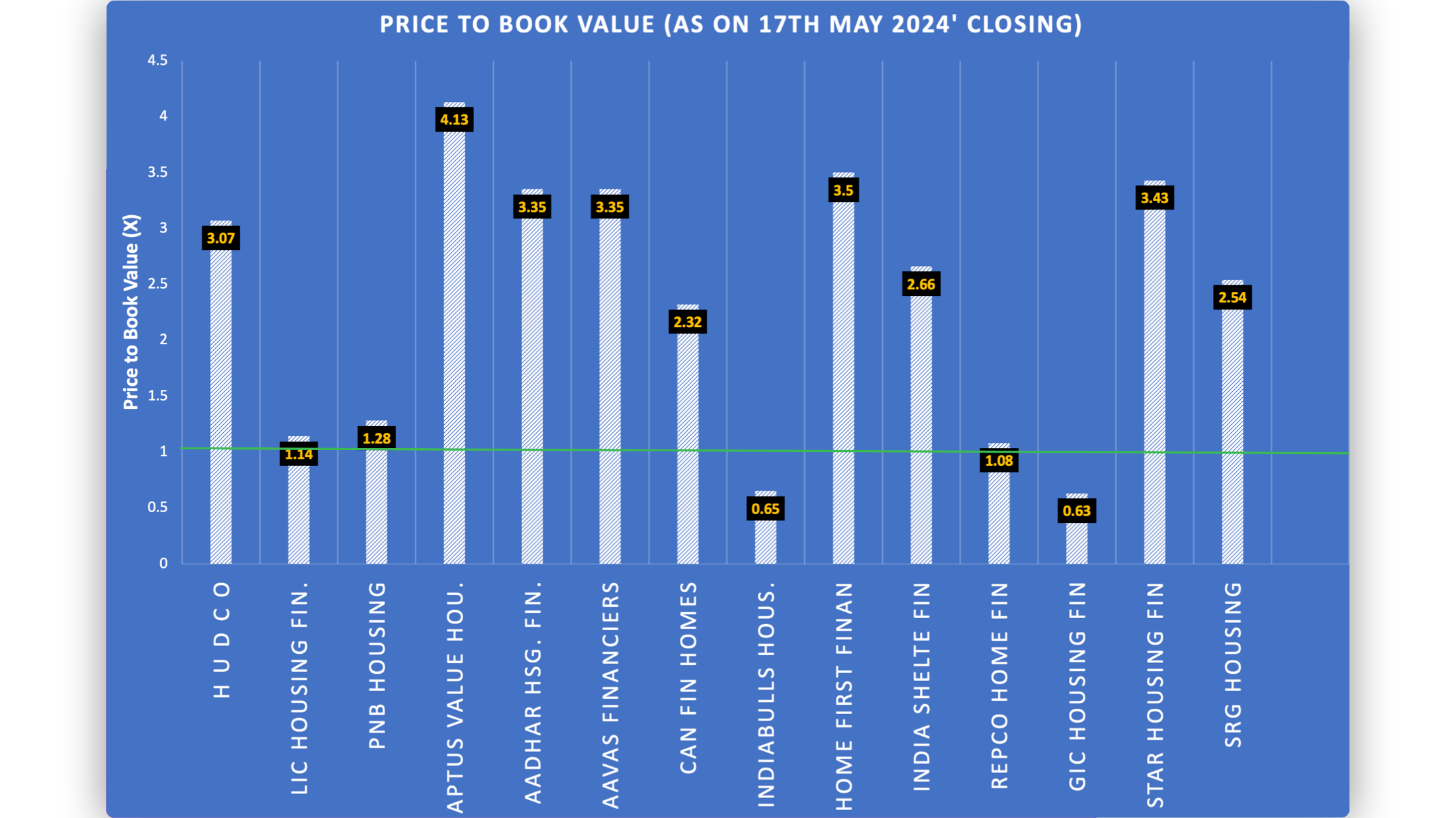

which raises the question, what are current P/Bx multiples? :

The P/Bx of 1 has been marked because Book value is meaningful for a Bank/NBFC/HFC as a metric for judging valuation (unlike for normal businesses).

Since the book value of a bank reflects the actual fair values of Assets and Liabilities (both are Marked-to-Market), a book value of < or close to 1 is considered ‘cheap’ and it implies that :

![]() There are Hidden Asset Quality issues i.e. Fair value of Assets (Loans) itself is Dicey.

There are Hidden Asset Quality issues i.e. Fair value of Assets (Loans) itself is Dicey.

![]() There will be minimal to No Growth.

There will be minimal to No Growth.

But with Banks/NBFCs/HFCs we are NOT just looking for cheaper valuations !

What we would prefer ideally is a combination of P/Bx of ~1 + an ROE of 12-15% (trending upwards) + improving GNPA + Improving Disbursement Growth?

So, with that context in mind, here’s a little homework for you.

Which co’ qualifies for the above metrics? Can you tell me in the poll below?

POLL

Would you like to guess which Co’ qualifies for the above metrics?

- LIC Housing

- PNB Housing

- Repco Home

- IndiaBulls Housing

Also let me know in the comments WHY you picked the HFC you picked.

Hope this has been fun.

Rahul

First Principles Investing