I did not know that I’d get so many questions. ![]()

I don’t follow the buy-and-forget approach, If I find any red flags or degrowth or stocks that seem damn expensive then I’ll exit or book some profit. I know I might lose some good stocks but that is better than a big loss.

I invested in it for 5-6 months. I could have averaged it but there is something that I follow, cut your losses/losers early. Investing in stocks is a probability game, now this stock has become too risky for me to hold after declaring results + red flags and if it goes to even 150 I won’t be surprised.

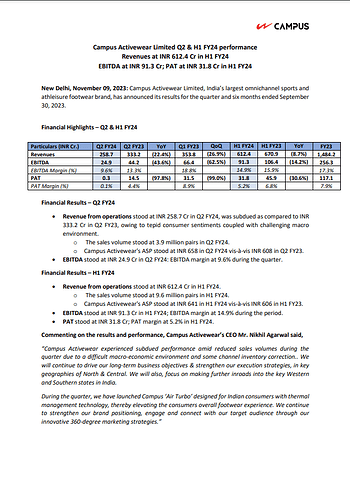

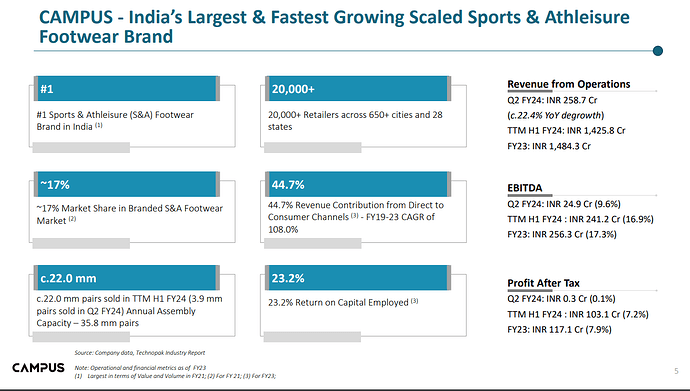

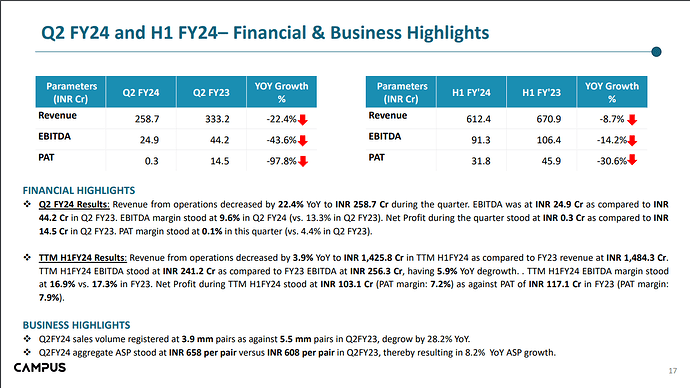

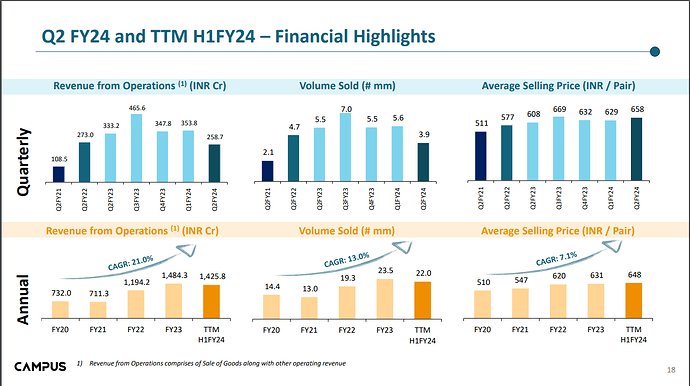

Better means, they might earn some profit but that profit amount may not be enough to justify this PE. For example, their current profit was ~0 Cr, any number here will be better than zero, 2cr, 5cr, and so on will be better than zero.

As per my understanding, when a stock trades at a high PE it means their earning growth is expected to be good. If you don’t see any earning growth then there is no point in paying for this high PE. This type of stock usually keeps hitting a 52-week low.

I’m not against this stock, it’s just that it seems expensive to me at the moment as per its earning growth. I might even re-enter this stock if it goes to reasonable PE as per the earning growth. Please don’t ask what should be the reasonable PE according to me.

I have better stocks in my tracklist to invest in than waiting for this stock to bounce back which may not happen. Please don’t ask about my tracking list.

Note: I might be wrong here, it’s just that I don’t take too much risk.