Read a good article. Viewers may please read Does Buy & Hold Strategy work in Momentum Investing ? | by MomentumLAB | Medium

Please note that swing trading is primarily about chasing liquidity and momentum. What I’ve discussed above is fundamentally different. I’m firmly against trading based solely on momentum and liquidity—it lacks a sound investment foundation in my view and does not align with rational, value-based investing.

@Ravi_Hundal you’re quoting Warren Buffett. Could you tell me how many people have even gotten closer to becoming an ace investor like him after following in his footsteps? Not many. His methods won’t work today simply because the market has changed drastically, and it reacts much quicker than it did during his time.

The topic itself is a Sophie’s choice. With due respect to Warren Buffett, he’s like penicillin to today’s infections (don’t mean he’s obsolete), everyone may have to read Buffett to know a great investing style but much water has flown under the bridge. Internet has democratized the information in science and investing/trading. My two cents.

It seems from many of the comments here that the thing lacking in an investor’s arsenal is ‘Patience’. It is, ironically, a very good news for long term investors.

IMO, the discussion in this thread is going nowhere, as the comments are very diverse and people only want to see what they wanted to see.

Again I go back to what I said in my initial post. If you are able spot and hold fundamentally strong companies say over 10 or 20 years, historically it gave compounding returns and built massive wealth for the investors. Just take few examples like HDFC bank, Pidilite Ind, Bajaj finance, Titan, Asian paints…and the list is long. Imagine if you had patiently held these stocks for past 10 to 20 years.

IMO, Buy & Hold vs. Rotating the profits are two different investment styles.

Buy & Hold style investment: Compounding power is high, requires low time & effort for monitoring, low emotional stress, moderate skills needed, less frequent taxes.

Rotating profit style investment: Compounding power gets interrupted, high time & effort required for monitoring, high emotional stress, high skills needed to reinvest in other opportunities, frequent taxes.

I think one should do what best suits to their investment style and goals.

@sameernics Great insights but you still didn’t answer my question. What’s the real wealth builder? Buy & Hold or Rotating profits?

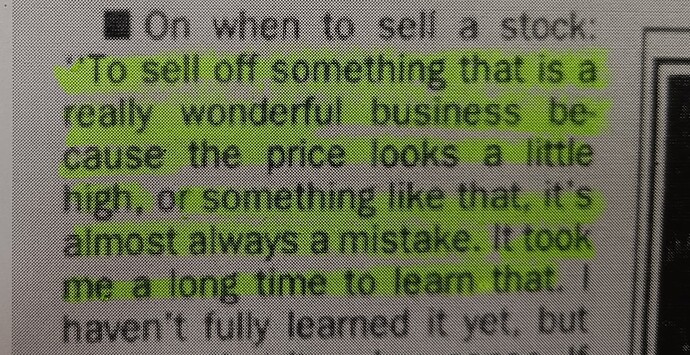

I’ve studied Warren Buffett’s investment approach in great detail. It’s too extensive to explain fully here, but I recommend looking into how he invested during his partnership years—particularly his ‘cigar butt’ strategy and how he evolved to buying quality businesses with the intent to hold them forever.

@firefueled My answer clearly lies in the second para of my post. I gave examples how compounding power creates massive wealth for the patient investors. So, going by the history of wealth creators, the short answer is Buy & Hold fundamentally strong company with patience.

I think its none (individually) Real wealth building requires many more things than any good strategy or skill. Capital allocation, part of networth into equity, actions/inactions during extreme market crashes, incremental capital allocation strategy, capital

preservation etc. are some other deciding factors and you cannot paint it with same brush. Thus although simple, its not so simple and always a work in progress..

Building wealth is not rocket science. There have been countless stories of people with no knowledge of complex concepts in finance and still making a fortune. The simpler your approach, the faster you’ll reach there. You just need to be consistent with your strategy!

my last post on this thread, you got this part right, no complex concepts of finance needed

I think buy and hold strategies would find it hard to give above par returns in present era highly volatile markets with companies’ lifecycles getting shorter and highly unpredictable with rapid technological changes in almost each sector. I am keeping 30-40 fundamentally strong small companies in my portfolio quarterly and cutting out financially bad performing ones with better and new ones. Right now portfolio is not old enough to judge its performance but i am sure it will yield impressive results.

I think portfolio size and age also determines what you follow. If you have a steady going company which is already a 2 bagger for you, every 1% increase is actually 2% increase from your pov. However, it might be difficult to find such in a bull markets. So it might depend on when you buy.

Regardless of when you buy, it is also difficult to find more and more opportunities.

Thus it is easier to buy at right price and then hold. If not possible, maybe have cash and keep looking at opportunities. Whenever opportunity is found, pour a substantial chunk into that.

False. If you’re doing Buy & Hold on individual stocks, there’s no guarantee that you’re holding winners or DUDs. Remember even in Warren’s case only a handful of winners created lion share of returns, had he missed those he’d just be a mediocre manager.

If people are serious about buy and hold and are patient enough, stick to index mutual funds.

Is there a way to use AI/ML or even todays tools like ChatGPT or Gemini to research and identify the stocks by creating rules we follow to screen the stocks manually? Has any one ever tried it?

Who are the richest people in the world? Permanent owners or people who rotate profits? If you buy quality companies at sensible prices and hold them for long, some of them will be huge winners over time.

Lets end the discussion for once and for ever! It is already proven about a hundred years ago that buy and hold is the best strategy. I am quoting texts from the book of Robert.G.Hagstorm- The Warren Buffett Portfolio- Mastering the stretegy of focused investing which Charlie himself mentioned in AGM that he considers this as the best book written about warren buffet investing principles.

The Amazing Effect of Compounding

Start with a $1 investment that doubles in value every year.

- Sell the investment at the end of the year, pay the tax, and

reinvest the net proceeds.

Do the same thing every year for twenty years.

End up with $25,200 clear profit.

Or - Don’t sell anything.

At the end of twenty years, end up with $692,000 after-tax

profit.

would gain $692,000 after paying taxes of approximately $356,000.

A cold look at the numbers makes a couple of observations clear. You end up with a great deal more profit if you don’t take your gain each year but just let the money compound. At the same time, your lump-sum tax bill at the end of twenty years will take your breath away. That may be one reason people seem to instinctively feel it’s better to convert the gain each year and thereby keep the taxes

under control. What they fail to appreciate is that they are missing out on a truly awesome difference in return.

For their article, Jeffrey and Arnott calculated the point at which turnover begins to negatively impact the portfolio. The answer, surprisingly, is counterintuitive. The greatest tax damage to the portfolio occurs at the outset of turnover.

“In investment management today,” explains Charlie Munger, “everybody wants to not only win, but to have a yearly outcome path that never diverges very much from a standard path except on the upside.” Well, says Charlie, "from the viewpoint of a rational consumer, the whole system is bonkers and it draws a lot of talented people into socially useless activity.‘’

Guys, just going to leave it here, considering the discussion on Warren Buffett in this thread, that Warren Buffet has invested in about 480 to 500 stocks in his lifetime, and has held on to only 5 stocks over his entire investing career. Only 5 that were bought and never sold.