Orient Cement - Coming out of a 4 year downtrend. Valuation is cheap compared to other cement companies at around 12 times earnings and 6 times EV/EBITDA. Capacity utilization appears to be in the mid 70s so there is scope for growth in the numbers but this is primarily a valuation catch-up play in the infra space. Recent numbers including Covid hit Q2 have been very good. Recently got past its 52 wk high but trading far below all time highs while earnings are close to all time highs.

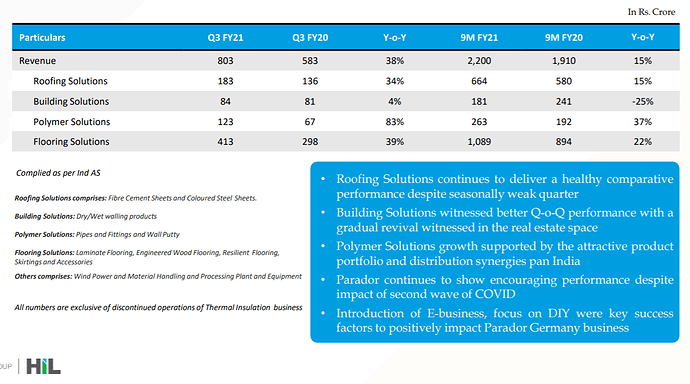

HIL - Another cheap infra/capex play. What I really liked about the recent numbers is that pretty much every segment from roofing, pipes and flooring (primarily international) is showing significant topline growth. They have also reduced debt by 250 Cr which implies that the cash flows are healthy (They took on huge debt to finance the Parador acquisition).

Valuation is still very cheap at 8 times earnings and 5 times EV/EBITDA.

Update on KNR Cons and Tata Motors posted earlier based on speculative fundamental shifts - both these are now playing out and there is possibility of a multi-year strength here. Some of the speculation I had last year on infra spends by govt. and the way it might be financed are coming true now and we could be in for a capex/infra led economic growth due to low interest rates.

Tata Motors latest update shows strength in CV segment as well along with PV which is going great guns. KNR Cons has been growing its order book handsomely last couple of quarters although the market has taken fancy only post budget.

Disc: Bought Orient Cement post results last week and again post budget this week. HIL bought this week. Holding KNR Cons and Tata Motors from last year (No recent trades).