That looks interesting. I remember, this was suggested by a participant during the Q1 earnings con-call. The new management is super nimble and have a solid plan to stand shoulder to shoulder with NSE by 2025.

AJ

Disclosure: Remain invested.

BSE market share in the equity derivatives segment reached 3.4% in August (vs. zero in April). BSE expiry day market share has reached ~11% without any liquidity enhancement scheme (LES)

The share price of BSE has been rising for the past couple of months on the back of the exchange’s rising derivative volumes and also on market rumours of possible merger with commodity exchange MCX. In these couple of months, going pureply by the official filings of BSE and MCX, there has been no official communication from both the exchanges denying the rumours of a merger between them. The fact that MCX was desperate for technology-related solutions for its trading platform and could benefit from BSE’s technology and that BSE could strengthen its position if it got the support of MCX commodity volumes has encouraged market players to take the rumours seriously and push up the share price, brokers said.

The opportunity in BSE.

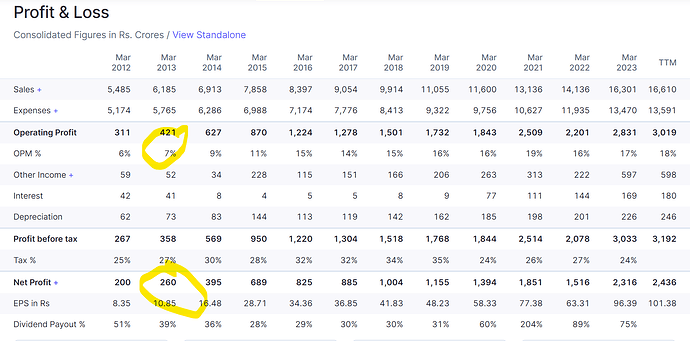

BSE is a special situation (Management change). Mr. Sundararaman Ramamurthy joined BSE on 4th Jan’23 and by 7th Feb, he started the first ever post Q3 result concall and handed most of it single handedly. He is an old seasoned hand at exchange business, having served 20 years in senior leadership role at NSE. Could his entry be similar to the Varun Berry episode for Britannia ? Let’s explore the possibilities !

Varun Berry joined Britannia in Feb 2013 as vice president & COO and was appointed as MD in April 2014. The rest, as they say is history.

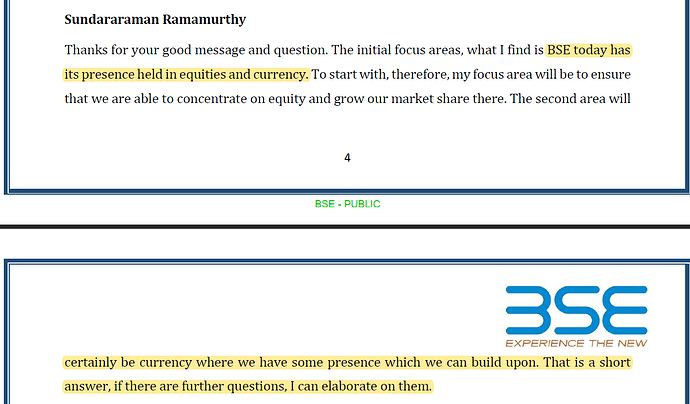

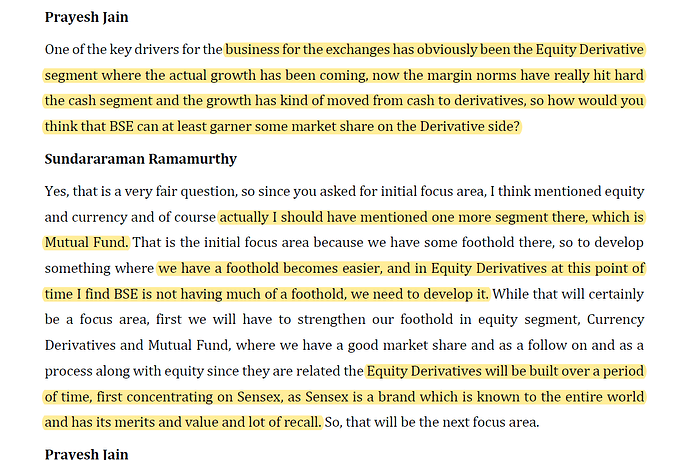

BSE has been losing market share in cash segment since years and held just 7% share at end of last year. It’s derivatives segment was a non-starter and never took off. It’s major saving grace or growth engine was it’s star-MF platform which held 50% market share. Trouble is, derivatives are the mainstay of income for exchange business and there was no mgmt. focus on this segment till that point. Even in the first call, when Mr. Sundar was asked for his 3-4 top priority, derivatives was not in the list and it seemed like an after thought as he referred to it later in the call.

However, one thing came clearly even in that very first call, the power that be, don’t want India to be a single exchange country. 2 thriving exchanges is in best national interest

This point has been reiterated by Mr. Sundar as well as SEBI Chairman on different forums (as shared other posts in this thread).

Both of them also referred to multiple steps that will be taken during the course of time to improve the situation for BSE. Let’s explore the steps taken so far and what might be already cooking in the background.

Step No. 1

By the time of Q4’23 call Mr. Sundar had got his priorities refined. Not only equity derivatives featured in his top 3 list, but he had already re-launched a revamped derivatives segment having done all the background work on this in the last quarter.

To his credit, it’s been showing result and how ? Just in 3.5 months since launch, BSE has done volumes which are 3.5% of NSE’s volume. That’s remarkable, specially, given how they are doing in cash segment.

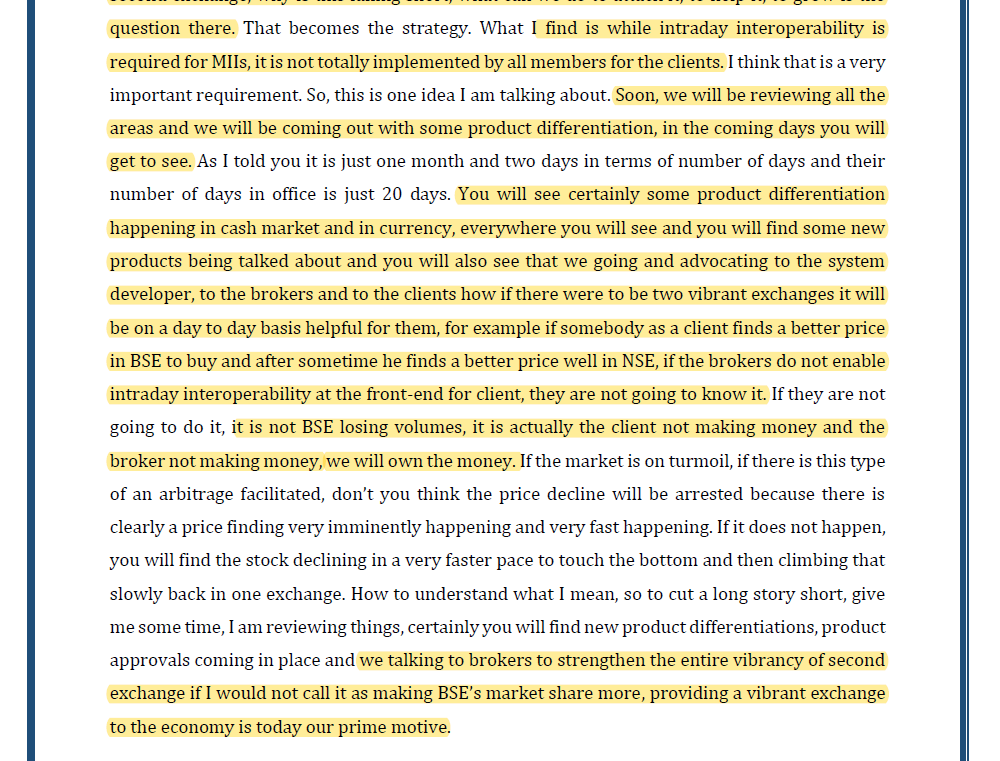

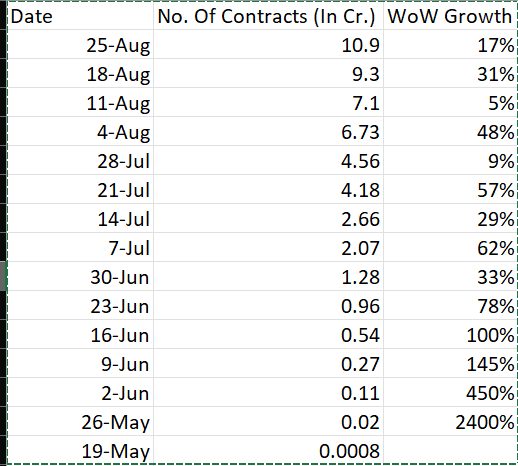

Last column stands for Week On Week growth.

HDFC Sec report estimates that by FY24 end BSE could reach 10% market share. i,e, ~3x current volume in next 7 months. Even today, not all major brokers have enabled the BSE derivatives trading. There is backend work that is required to be done by software vendor and then brokers to enable the processes for the derivatives trading. For example, Kotak just started last week https://twitter.com/kotaksecurities/status/1695000451534696596?s=20

and then there is the most important part, where participants want to see the volume before they join the bandwagon. Then at some point the network effect takes over I guess and it’s more a hard sell. Given all this background i think the results so far are nothing short of outstanding. Management deserves kudos for it.

In Q1’24 call, BSE said that they did a revenue of about 26 lacs for the week of 4th Aug in which they did 6.73 cr. contracts. This is while they are charging 1/7th the price of NSE (as per HDFC Sec report). NSE gets nearly 10,000 cr. revenue from this derivatives segment, with option derivatives accounting for nearly 99% of the derivatives volume.

So one can imagine the possibilities.

Step 2:

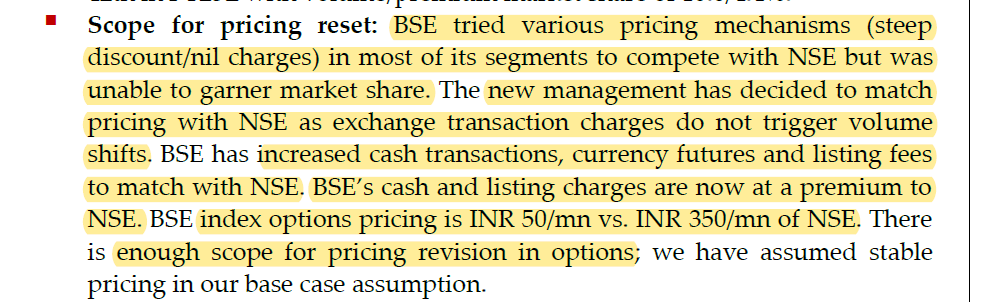

There is a new found aggression on the pricing front. BSE no longer wants to be the poor cousin of NSE and charge less for everything.

Example ? This is from HDFC Sec report.

Also, see this,

In fact I got this clarified in the Q1 call, and this was the response. They have about 70k AP’s on their system and this straight away adds about ~15% of current bottom line. IMHO there isn’t any commensurate additional expenses for this. It’s just a toll which both exchanges decided to extract and the AP’s are just price takers. Some of them drop off, but others will swallow it as cost of doing business.

So at some point that will charge appropriately for the derivatives too

Step 3:

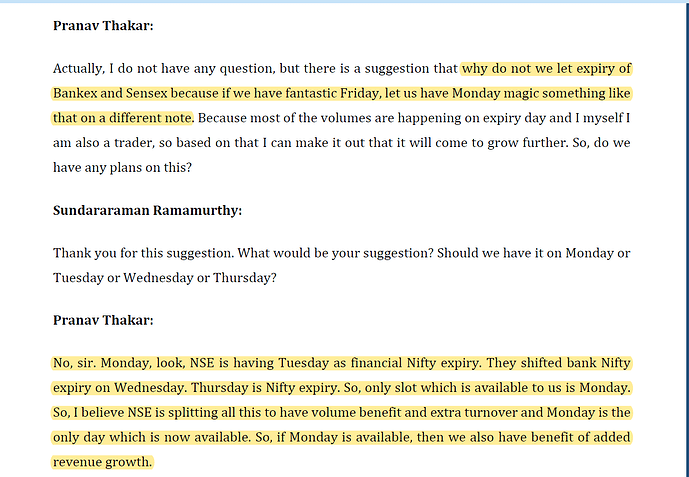

Having tasted success with this Sensex options, now the aggression is visible even in bankex

Best part, the mgmt. suddenly seem to be listening to participants voice and doing changes as a market player should do.

What could be future steps ?

Step 4

He has been batting for intraday interoperability for sometime now. My understanding is this could give a boost to volumes in cash segment for BSE.

All this for a price of ~14k cr Mcap. Of course they also hold nearly 15% of CDSL which is valued at ~12k cr. Mcap and some cash on books. NSE did an EBITDA of 10,426 cr. for a revenue of 12,765 cr. in FY23. The derivatives volumes in FY24 are just going through the roof for NSE too. nearly doubled since beginning of the year.

Step 5

Focus on SME listing ?

Disc: Invested from 550 levels and have added more along the way .

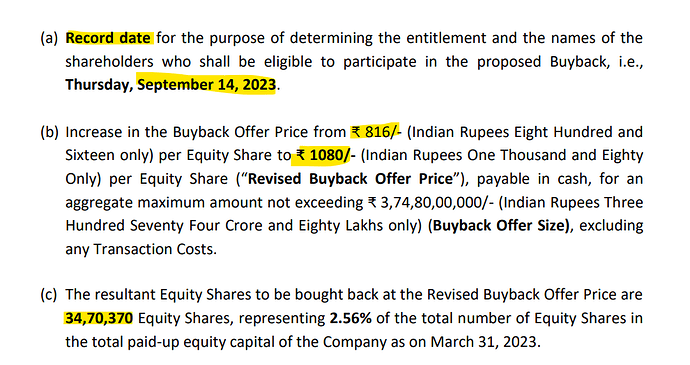

Buyback Update: Record date is Sep 14, Buyback price revised upwards to 1080 from 816. Challenge is the price today is 1100+.

34.7L shares to brought back,accounting for 2.56% of equity capital.

Can someone please explain - how does it work ? And if it benefits us ? Which are the listed ETF’s in Gift city exchange that qualify for capital gain tax exemption? And how to invest in such ETF’s?

“benefit us” as a Individual investor or as a BSE shareholder?

BSE does have a exchange arm in the GIFT city, but NSE also has its own arn operating there. The REIT’s, ETFs, InvITs will be listed, so there will be some listing and trading revenue, but it will be small in the beginning. In future it could be huge, if our REIT/InvIT market becomes like US. US is 2/3rds of all the REIT/InvIT market in the world, ~1.1Trillion USD out of Global ~1.7Trillion USD (little dated as of 2016).

The govt intent is to get foreign specialists + develop the market in managing REIT/InvIT to own/manage assets in India. What this will do is get loads of capital (foreign - pension funds, long term funds, etc as well as Indian) to own hard assets in India, which is kind of sticky in nature. Assets in India will not be financed more in equity form rather than debt, possibly avoiding financial stress and less leverage.

So overall if this takes off in coming decades, we will have a sustainable funding of Infra assets, with the needed safeguards.

As a Indiavidual investor, we will be able to invest in some of these well managed REIT/InvITs with regular income and no capital gains. We do have to see the operational challenges, since for a Indian Investor GIFT city is like a foreign location, you need to have a separate accounting for all money/assets transferred there.

As we end Q2, i think it would be interesting to have a relook at how some of the key verticals has performed during the quarter:

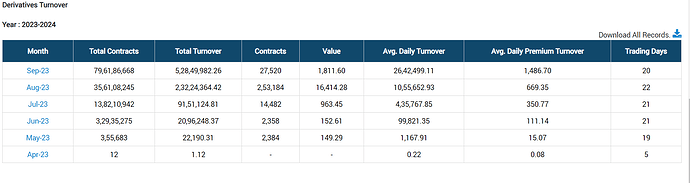

Derivatives: The numbers are roughly doubling month over month. I expect the revenue to be >2.5 Crore based on the existing pricing model of Rs. 500 per premium turnover of 1 Crore.

Derivatives Turnover

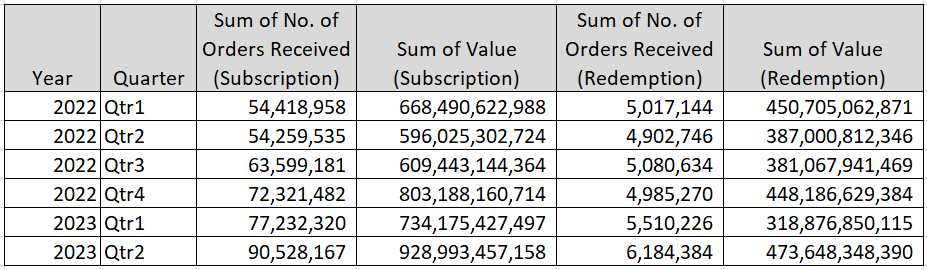

Star Mutual fund update:

The subscription orders have roughly grown by about 17% as compared to Q1 2023 and 66% compared to Q2 2022. Expect the revenue growth to be roughly in line with volume growth.

Star Mutual Fund Data

The IPO market being as robust as it is and significant growth in derivatives and Star Mutual fund, we are most likely going to see the best quarterly results(after removing one offs) since listing.

For the coming quarter we should continue to look out for the growth in Sensex derivatives and see if the Bankex can get any traction post the change in expiry date effective mid October.

It would also be interesting to see the fate of the buy back announced.

Thanks,

AJ

Disclaimer: Remain invested. Have a positive outlook.

very interesting read on BSE and Mr. Ramamurthy Magic ![]()

This has been the game changer till now. Will it continue ?

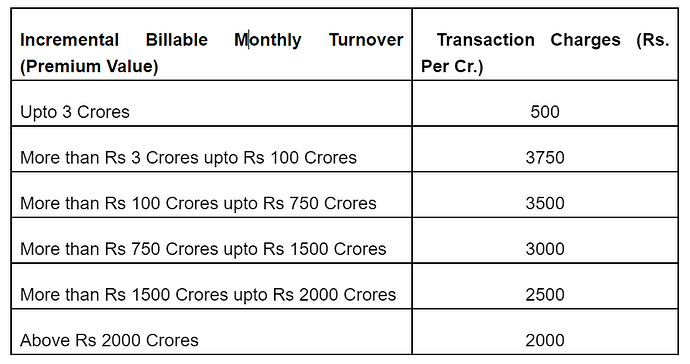

BSE to revise transaction charges in equity derivatives segment effective 1st November 2023

The revised charges applicable to SENSEX Options are as below:

See the notification here.

While the charges for small traders remian same as earlier. The big players will now start paying about 4 times or greater compared to existing charges going forward.

AJ

Disclosure: Remain invested. Views are biased.

Looks like they are going too fast to match NSE. NSE charging 5k/1 cr. These limit won’t affect to retail but might affect to Prop desk & FII. Also they have tactically done it only for nearest expiry. So that if someone wants to play 0/1DTE might pay high or if they wants lower charges then they can go for monthly expiry.

Volumes are very dry except nearest expiry. These move can fetch dual benefit.

Looks like Bankex derivatives are gaining traction. Today Bankex has achieved a total volume exceeding 52 lakh - note that today was the third weekly expiry of Bankex with the new expiry.

It may only be a matter of time for Bankex to catch up with Sensex derivatives in terms of volume.

AJ

Disclosure: Remain invested. Opinions are biased.

Can you please share the link where we can see the nof of options traded

You may use this link and download all the reports you need.

AJ

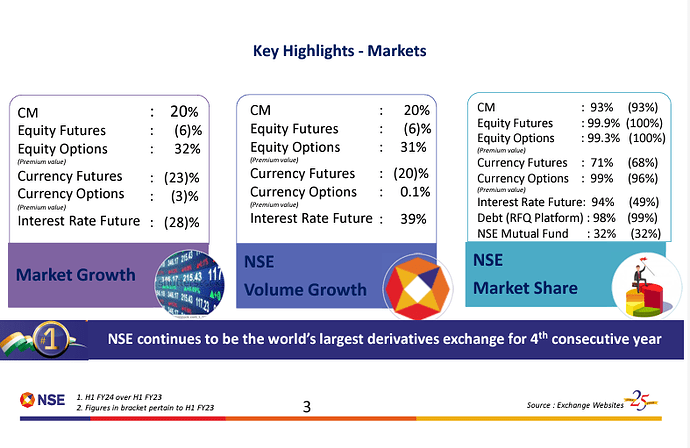

This is a slide from Q2 & H1 FY24 results of NSE published yesterday. NSE’s market share has only marginally come down during H1FY24 from near 100% in H1 FY23. Given the rising derivative volumes at BSE, I was expecting the market share gains for BSE to be much more than what is coming out.

Any thoughts? Am I reading this right?

I think effect will be visible from next quarter result. Market share of BSE Vs. NSE in derivatives.

https://twitter.com/darshanvmehta1/status/1714503015473033348

Worrisome part for me is BSE is loosing in other parts - currency (After last quarter result, i wrote it here), Interest rate derivatives & even loosing market share in SME Ipo.

Also if anyone analysed NSE’s result, SGF expense has rise to 1000% due to increase in volume & volatility. For BSE also i suspect there will be increase in SGF expense due to derivatives volume.

Not sure if the comparison is mangoes to mangoes.

NSE has about 185 stocks on F&O apart from the Index F&Os (Nifty, Bank Nifty and Fin Nifty being the most prominent ones) as against Sensex F&O being the only F&O product that is being actively traded in BSE. Bankex is still in its nascency.

Eitherway I believe comparing the market share of any of these product is a futile exercise as the products are all different and have independent standalone reason why market participants trade in each of these.

BSE management has done an excellent job in convincing the market participants on the underlying strength and purpose of trading in Sensex contracts. We are currently seeing early signs of Bankex contracts also gaining momentum(though Bankex is not significantly different from Bank Nifty in terms of its underlying).

BSE has a huge opportunity in front of it both on derivatives and cash as they have negligible presence currently. Its all about listening to market, introducing the right products, making the trading attractive for participants, providing seamless connectivity and delivering fool proof infrastructure support.

The current management is driven by a purpose to make BSE a vibrant place to invest, trade and hedge by the year 2025 – market seems to be convinced by the actions of the management so for, which is visible from the way price has moved over the last 3-4 months. Now all they need to do is to keep the momentum going and continue to capture the imagination of the participants.

AJ

Disclosure: Remain invested. Views are biased.

Bankex derivaties volume for the day exceeded 1.3 Crore. More than double as compared to last monday. The stock reacted with a 4% upside today.

AJ

Disclosure: Remain invested. Views are biased.