A slightly detailed look into the drivers for Bosch.

About the Company:

Bosch India brings together best-in-class German engineering and Indian entrepreneurship in a portfolio comprising innovative products, services and solutions in Mobility, Industrial Technology, Consumer Goods, Energy and Building Technology. It operates Bosch Group’s largest development centre for end-to-end engineering and technology solutions. The Bosch Group operates in India through twelve companies. Bosch Limited is the flagship company of the Bosch Group in India. It has 6 manufacturing sites, and seven development and application centres.

Growth Strategy:

‘Cordless Matlab Bosch’ is the new slogan of Bosch Power Tools in India as it is set to revolutionize the cordless power tools segment. This addition is set to expand the tools market in India further and increase the market share for Bosch Power Tools.

Their emphasis remains on increasing their active retailers and workshops in line with their “Har Shop Mein Bosch strategy.”

Bosch will invest in developing its B2B e-marketplace, advanced diagnostics, portfolio expansion and upskilling technicians in advanced technologies.

The Company is working to expand its service centres and unit repair centres by 1,000 and 2,000, respectively by 2025 to support customers across India.

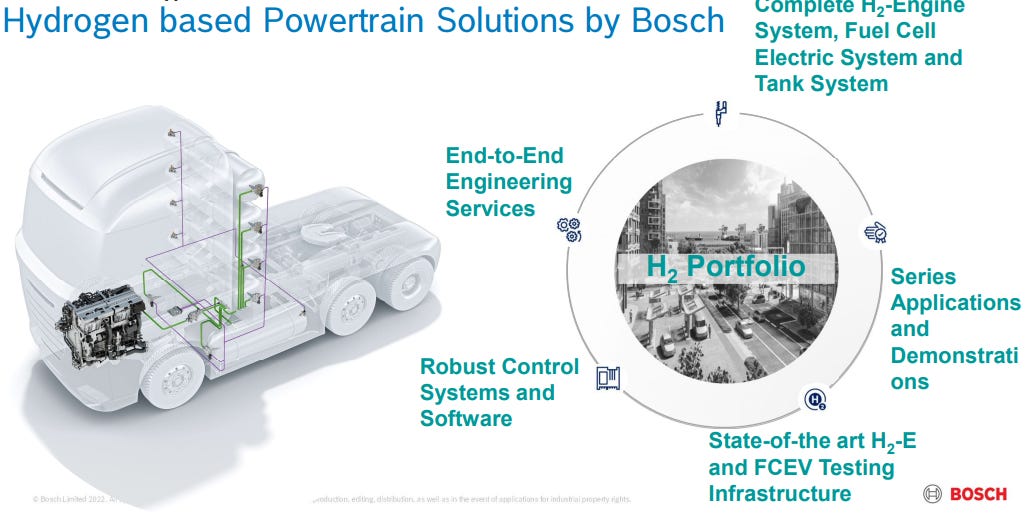

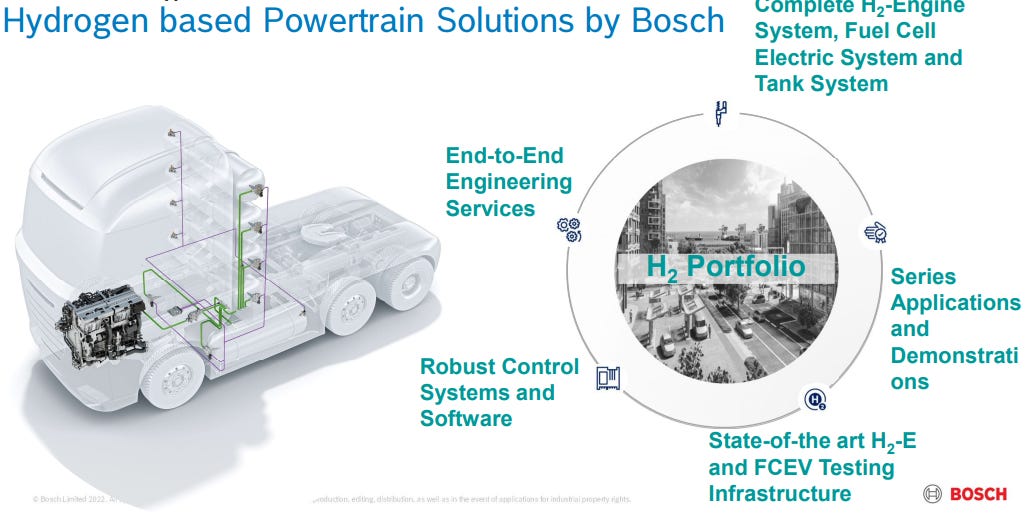

Bosch is focusing its efforts towards the promising field of fuel cells.

In India, Bosch Limited will support OEMs through system expertise and participate in ecosystem partnerships to become a significant player in the electrification ecosystem.

Leveraging a strong global portfolio, Bosch in India is rightly positioned to support Electric Vehicle (EV) adoption across segments.

They will also be involved in the hydrogen ecosystem with complete powertrain modules already in their portfolio. Their target is to continue the transformation of India’s mobility into ‘clean, convenient, and congestion-free.’ While EVs will make inroads into India, the dominance of Internal Combustion Engine (ICE) with a share of 70% - 75% till 2030 is likely.

They have plans to recover the increasing raw material cost and freight charges to sustain their profitability.

They are constantly discussing their acquisition strategies in advanced automotive technologies to maintain long-term growth.

They are planning to expand their consumer goods segment by leveraging the digital ecosystem.

Mobility sector and Bosch’s performance:

Overall, the automotive industry saw an increase of 1.3% in automotive production during FY 2021-22 compared to FY 2020-21 on a low base. This increase was marginal and subdued by supply challenges faced during the year.

After achieving its peak in FY 2018-19, the domestic auto industry has seen two years of decline before recovering in FY 2021-22.

Passenger Vehicles (20% growth) and Commercial Vehicles (29% growth) bounced back compared to a low base in FY 2020-21. At the same time, the Tractor segment remained stable after peaking in FY 2020-21. The Two-Wheeler sector (3% degrowth) declined for the third year.

Bosch outperformed the Passenger Cars industry by growing better than the market, primarily due to market share gains.

The fuel mix effect adversely impacted Bosch’s performance in the Commercial Vehicle market due to the loss of diesel share in overall market volumes. While in the Tractor segment, Bosch outperformed the industry by achieving higher content per vehicle.

Bosch Limited will invest more than 2000 crs in India in the next five years in advanced automotive technologies and in the digital mobility space.

Beyond Mobility Sector:

In the Beyond Mobility space, eCommerce has shown to be a significant driver of growth in the Power Tools and Automotive Aftermarket space which accelerated its business and helped further growth in the market post-pandemic.

Bosch Power Tools in India, with a 30% market share in the tools category, brought in 1,265 crs through sales in FY 2021-22. This turnover is at an all-time high for the business, and it plans to further integrate advanced technologies, e.g., X lock, into its products and leverage digital solutions.

In the Building Technology segment, Bosch has seen a high double-digit growth over a low base, and it has won major infrastructure projects in the public and private sectors. There are set plans to capitalize on the business potential available on the Infrastructure Drive in the next five years across domains like Metro-rail, Airports, Ports, Industrial Parks, and Smart Cities.

Their Automotive Aftermarket business made a strong comeback in the latter quarters of FY 2021-22 to achieve an all-time high turnover with very healthy profitability.

With measures to improve receivables and inventory, their net-working capital is also at benchmark levels for the industry.

Bosch Limited acquired a minority stake of 26% in Autozilla Solutions Private Limited to participate in the digital B2B marketplace. Bosch will integrate Autozilla’s eCommerce platform with its digital platforms to improve the quality of catalogue search, streamline the ordering of spare parts and address the availability of spares with shorter lead times.

Bosch collaborated with:

- Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH in 2021:

They launched a green urban mobility innovation initiative to implement sustainable, inclusive, and smart mobility solutions across several Indian cities. The initiative is under the guidance of the Green Urban Mobility Partnership (GUMP) between the Ministry of Housing and Urban Affairs (MoHUA) of the Government of India, and the German Federal Ministry for Economic Cooperation and Development (BMZ).

- Mahindra & Mahindra (M&M):

They developed the Mahindra connected vehicle platform “AdrenoX Connect” to deliver seamless connectivity and enhanced user experience in the flagship SUV XUV700. This engagement has stemmed from an innovative, immersive, and intuitive solution on the cloud to augment control in the end user’s companion. This work together integrates different partners in the connectivity ecosystem to conceive and develop connected vehicle platforms and corresponding applications on the cloud.

Bosch’s Powertrain Solutions:

Bosch is the market leader in powertrain solutions.

Its customers and partners benefit from superior technologies like fuel-injection systems and ECUs and powertrain solutions for Electric vehicles across 2/3Wh, passenger cars, and commercial vehicles.

Bosch is the global leader in electric power train solutions and estimates that by 2030 every third new vehicle in India will be an EV.

Bosch’s comprehensive services and product portfolio and commitment throughout its product’s life cycle make the Company stand out in the powertrain systems and electrified mobility. This gives the Company the edge where it becomes the go-to partner for hardware, software, and system solutions right from the early stages of the development process.

Bosch has launched the Mobility Cloud Platform (MCP):

It is a launchpad and ecosystem to develop, expand and execute IoT-enabled digital goods for advanced connected mobility solutions.

The platform enables customers to focus on key product features and product differentiation, lowering lifetime product costs and reducing time to market significantly. The platform assists new-age mobility startups, SMEs, and corporates in scaling their businesses with freedom and no lock-in.

The building blocks in MCP could help in providing solutions to vehicles, with updated map data and up-to-the-minute information for route planning. It could help shipping companies, logistics planners, and fleet operators optimize consumption, delivery, and costs with innovative solutions.

It could also help with monitoring the entire vehicle life cycle – with solutions for battery management, innovative technologies that notify drivers in advance of upcoming maintenance to prevent breakdown and malfunction and many more being developed using our tech-stacks.

Bosch’s Mobility marketplace:

The company is piloting its digital mobility marketplace to become a one-stop destination for all mobility-related assets. The platform helps broaden the portfolio of digital assets from APIs to data to end-to-end solutions, applications, and hardware for a range of services in the automotive lifecycle, including road/weather data, telematics, navigation, and point-of-interest services (Parking, EV infra, etc.) and more.

By providing ready-to-use, complementary solutions, Bosch is diversifying its digitally adept buyer segments (OEMs, fleet management providers, smart cities, and logistics service providers, to name a few) and participating in the complete lifecycle of the automobile business.

Bosch’s Two-Wheeler & Powersports (2WP):

Two-Wheeler & Powersports, India (2WP-IN) is the global centre of competence for a small engine development hub, currently offering solutions for Engine Management System (EMS) to the Indian market.

The superior EMS from Bosch includes components for fuel injection and supply, air management, ignition, exhaust, as well as engine control units to facilitate powerful, reliable, and synchronized performance for two-wheelers and three-wheelers. It also allows them to fulfil new emission regulations, globally.

Bosch’s Automotive Aftermarket:

Bosch Automotive Aftermarket is the largest multi-brand car service centre in India with the largest chain for unit repair power.

It has a state-of-the-art digital ecosystem that generates data insights on workshop operations, digitally diagnoses and suggests repairs, as well as helps order spares via e-commerce, it has emerged as the best alternative car workshop.

Bosch’s Power Tools Division:

At present, the facility caters mainly to the India and SAARC markets. It primarily manufactures Small Angle grinders, Large Angle grinders, Marble cutters, Blowers, Drills and two-kg Hammers, along with their motors.

The Plant produces & exports blowers for the entire global market.

Innovative product range:

a. X-LOCK:

This comes from Bosch Patented Technology with a new changing system for angle grinders with over 130 accessories. X Lock has changed industry paradigms by providing a high standard of convenience and safety to its users.

b. BITURBO:

With their new high-performance brushless motor taps the full potential of the ProCORE18V batteries so that users can conquer even the most challenging tasks.

c. Cyclon Technology:

This is the world’s first tech, which removes up to 90% dust from cooling air for up to 3x increased motor lifetime with regular cleaning of dust collection box in case of working in highly polluted environment conditions.

d. Bosch BeConnected :

The Company developed an app to stay connected with its customers and help users access important information on the usage and maintenance of their tools.

Bosch’s Building Technologies Segment:

Bosch is working to emerge as the preferred brand in the building technologies segment, with solutions that seamlessly integrate several systems on a single platform, increasing efficiency and improving user experience with regard to security and convenience.

INTEOX: It has built-in Intelligent Video Analytics complemented by Camera Trainer and the ability to add external software apps. It is an invention of the company incorporated with deep machine learning in cameras to detect objects or circumstances that would otherwise go undiscovered.

AVIOTEC: It is a Video-based fire detection from Bosch. It has proven to benefit facility management. It is utilized in industry, transportation, warehousing, and utilities to reduce detection time while maintaining low false alarm rates.

BOSCH BUILDING INTEGRATION SYSTEM (BIS): A software solution that manages different subsystems on a single platform.

The Company is extending integrated offerings and domain expertise with customized IoT solutions for strategic projects under the key segments of Metro rail and airport projects, Industry and manufacturing and Integrated smart buildings.

Bosch’s Energy Efficiency Solutions Sector:

Bosch provides tailored energy solutions to help clients save money by improving process efficiency, lowering energy consumption, and accelerating their road to sustainability goals.

a) Conduct energy assessment: Bosch’s in-house energy manager conducts a detailed assessment of the client’s facility, in line with the principles of an energy audit to identify potential conservation measures.

b) Design customized solution : Expert design engineers study the energy data and design a customized solution considering clients’ processes and utilities.

c) Plan and procure components: Bosch’s experienced project management team develops a detailed project plan and orders suitable components that meet its quality standards.

d) Manage project implementation : The project management team carries out implementation activities without interrupting the client’s regular operations.

e) Commission to optimize performance: Bosch’s expert team commissions the system and ensures its performance.

Certain innovative solutions provided by the company include:

i) Integrated Heating and Cooling: Bosch provides a customized solution for an integrated cooling and heating system implemented in the processes where high temperature is required along with cooling. The client can experience dual benefits of savings on heating and cooling at a lower cost compared to its existing system.

ii) HVAC Efficiency Improvement: This helps optimize the cooling system’s generation, distribution, and consumption sides. As a result, the specific energy consumption of the chiller system is reduced resulting in a significant amount of energy savings.

iii) Steam Distribution Optimization: It provides solutions to its clients for their steam-generating and utilizing units. The Company focuses on optimizing the generation and distribution system for heat/steam utilization, reducing wastages to deliver fuel and water savings and improving efficiency.

Bosch’s Smart Manufacturing solutions:

Bosch provides digital technologies and solutions that will aid in the development of innovative and powerful manufacturing setups.

Bosch has created a unique visual inspection system called The Automated Visual Inspection System (AVIS), which uses high-resolution cameras on robots that perform a quality check on products over a conveyor belt.

With the integration of Artificial Intelligence (AI), AVIS can perform specific singular tasks which can be programmed. It also provides the user with functions like facial recognition, speech/ voice control, and internet accessibility.

Bosch has developed a connected industry approach that brings in the best approach for processes, reduces operational inefficiencies, and creates value for the end user:

a) Connected Machines: Connect the machines through Manufacturing Execution System (MES) to capture machine data.

b) Platform Connect: Machine data is further transmitted to the end users’ standard platforms for analytics and usage. Bosch supports a platform approach to enable a data-driven improvement organization in its plants.

c) Standard Solutions: Bosch strives for standard scalable applications at all Bosch sites and fits a manufacturing platform and connectivity approach

Getting Future Ready

Bosch is investing in advanced automotive technologies such as fuel cells, hydrogen cells and electric vehicles. Bosch has received the first hydrogen pilot project for the conversion of ICE BS-IV vehicles to hydrogen ICE for commercial vehicles.

In Battery EVs, the company offers complete assembly solutions with components encompassing DC/DC converter, electric traction motor, fuel cell stack, fuel filler, fuel tank, power electronic controller and thermal cooling system along with associated sensors, software and control units.

The company has positioned itself to supply individual components and full-assembly solutions to OEMs based on requirements. Bosch has also developed complete e-Drive solutions for electric vehicles, with electric motors, gearboxes and inverters which are relatively compact compared with an ICE.

The localisation is going to take time and is going to be done in a phased manner.

With the increased adoption of fully electric vehicles, Bosch’s content per vehicle is expected to grow 3 -4x in EVs as compared with ICE vehicles.

Risks:

Bosch has a lot of subsidiaries and the risk of lucrative opportunities getting diverted to unlisted group companies. Bosch’s consumer durable goods being privately held, AI and ML-related research work and the recent purchase of the stake in Sun Mobility are examples.

Faster than anticipated growth of electric vehicles can upset the financial numbers of the company which expects ICE to continue to have an 80% market share by 2030.

Any slowdown in the automotive and industrial sectors in India is going to adversely impact the fortunes of the business.

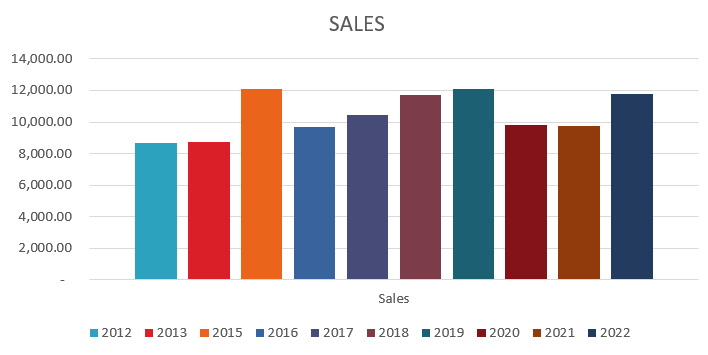

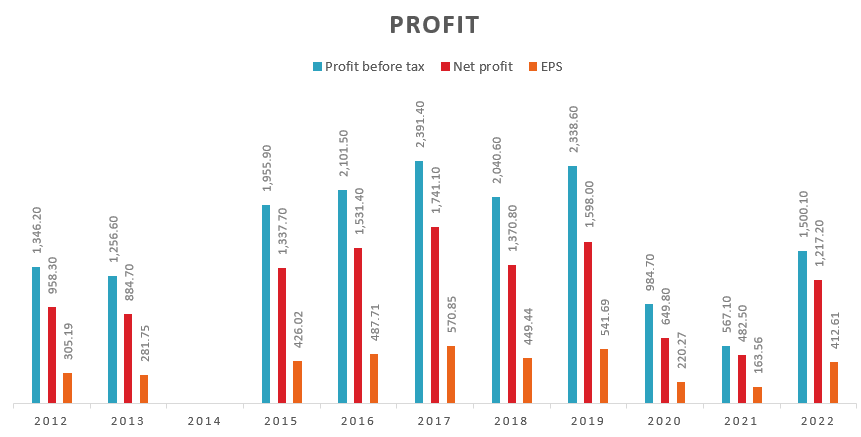

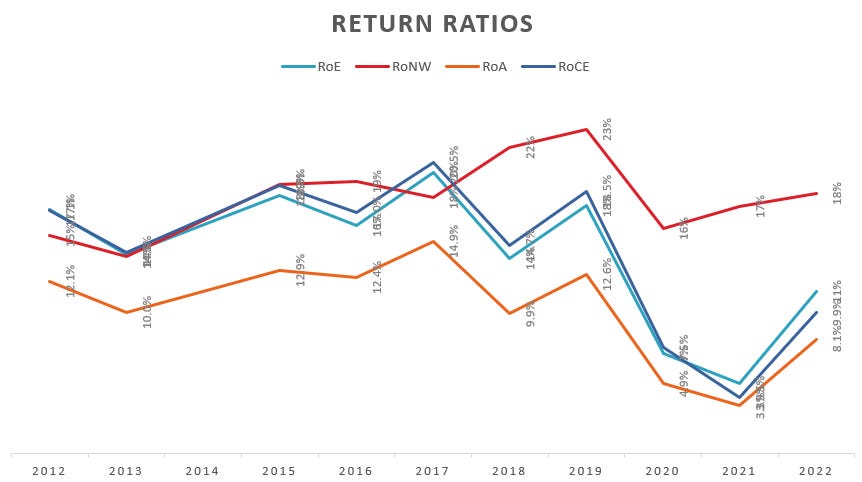

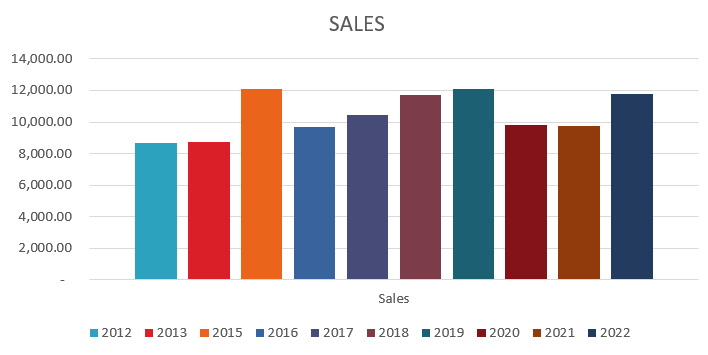

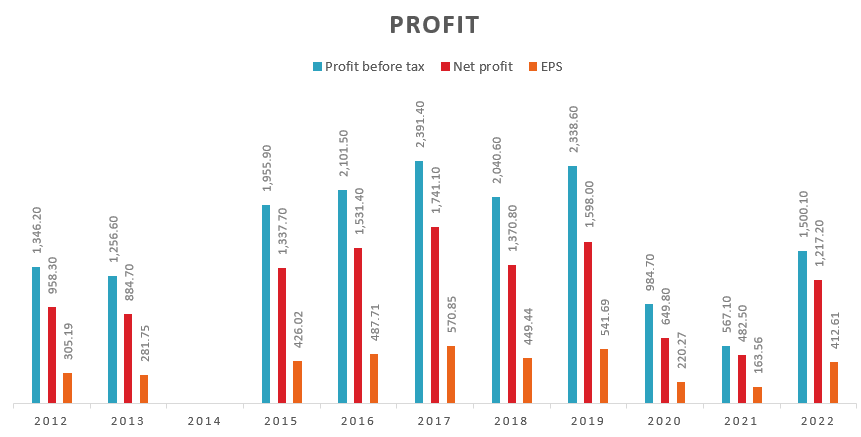

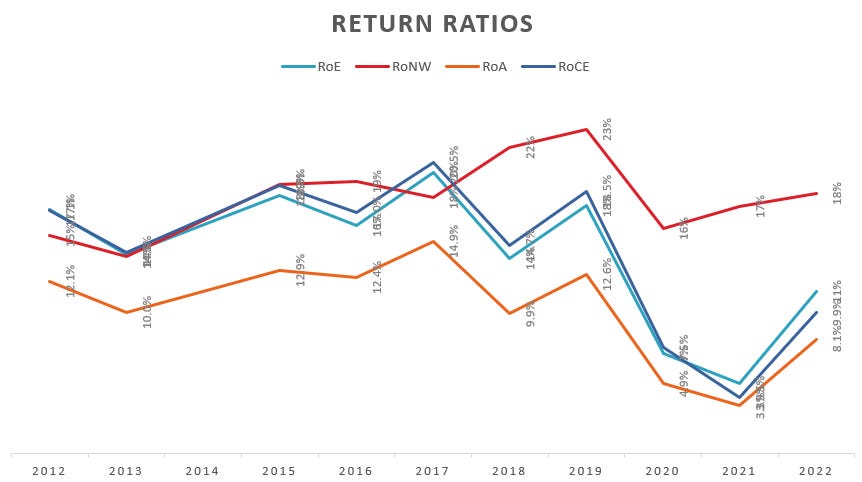

Financials

DISCLAIMER:

- This is for EDUCATIONAL purposes only.

- I regularly study interesting businesses. We keep profiling them. The idea is to keep learning and expanding our knowledge base.

- It does NOT construe a BUY or SELL recommendation on the stock.