3-4 minutes read time

3-4 minutes

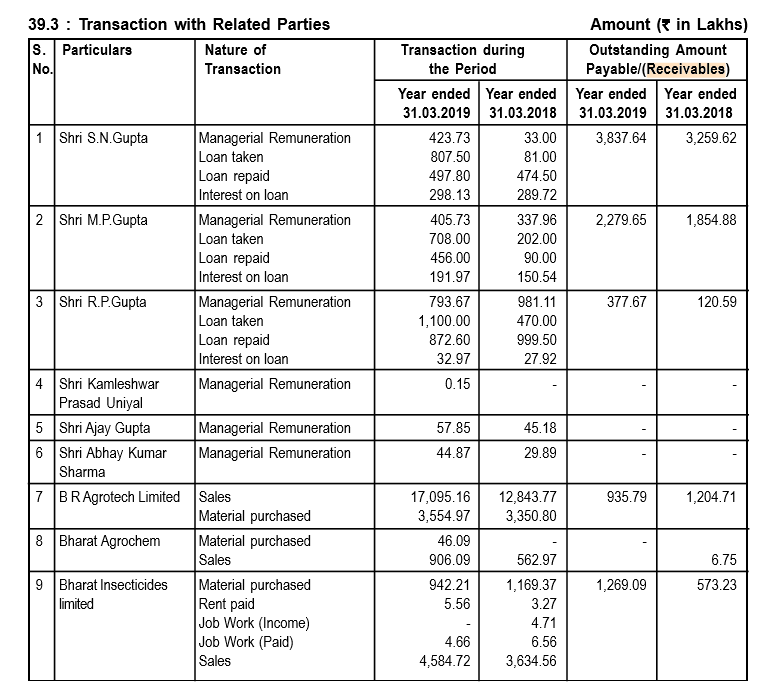

Hi, can you please share the source of “Receivables from Promoter Group”?

Hi Mayank,

Receivables from promoter group are taken from the annual reports of the company. You can add the receivables due from both the group companies from related party transactions in the annual report.

Hi Ankit,

Thanks for your reply

I am bit confused about the direction of flow in the attached related party transactions

In Payable/(Receivables), for BR Agrotech it is written 1,204.71. So is it Payable for Bharat Rasayan or Receivable for Bharat Rasayan?

If it is Receivable than what is it in the case of Shri S.N. Gupta?

Hi.

Mentions in the AR are from point-of-view of the company. so a phrase like ‘loan taken’ implies the company has taken the loan (and not the other way around)

in your post, the company ‘owes’ to Sh. S.N. Gupta (for the loan taken from him) an INR 3837.64 Lacs as on 31.03.2019 . . . .it’s not in “( )” because the company doesn’t have to receive anything, rather has to pay him back on net basis!

So similarly company owes to BR Agrotech?

Yes! All the non-bracketed amounts are what the company (BRL) owes to others . . .however, u should take the note of the fact that in case of BA, BA, and BIL companies owes on net basis for regular business it conducts with them (sale / purchase) and not for any loans etc. (Like is the case with promoters who have given loan to BRL)

most of the demands of the industry are self explanatory…

Can some please throw some info/light on why the agrochemical industry wants compulsory registration of technical grade products in the country prior to granting registrations for imports of readymade pesticides formulations (finished products ) which is a practice followed by major agricultural nations.

and what is the significance of the para shared below:::

“The policy guidelines introduced in 2007 allowing imports of readymade pesticide formulations without registering technical grade products in the country, has done considerable damage to the growth of the Indian pesticide industry. The policy only helped to create monopolies of importers, who stopped manufacturing of technical grade products in India. The policy has discouraged registration technical grade products in India, resulting in no availability of technical grade products to MSMEs in India, who are mainly formulators and major exporters. Farmers also looted by farmers as imported products sold to them at premium prices and at profit margin of 100% to 200%. There has been no new investments in the sector during last 10 years due to surging imports of finished products.”

regards

divyansh

Lot of good names being added , Bharat rasayan is one of them… This might get it some exposure to deeper pockets …

Regards

Divyansh

A must listen/watch recording of a webinar on Agro-Chem industry; has great industry insights, current status of industry during pandemic, and views about India taking over business from China!. . . . Especially, watch from 32 min to 50 min, insights by Mr. Abhishek Aggarwal (President, Strategic Alliances & Corporate Sales, of Bharat Rasayan Limited)

Mr. Abhishek’s Profile:

http://www.bharatgroup.co.in/groupcompanies.aspx?mpgid=47&pgid1=48&pgid2=50&pgidtrail=53

Ministry of Agriculture & Farmers Welfare has issued Addendum to Notification Dated June 10, 2020 excluding Export of 27 Pesticides under ambit of Proposed ban. It has also given time of 90 days instead of 45 days to submit objections and suggestions.Addendum.pdf (189.2 KB)

BHARATRAS_26062020162643_AFR_31_03_2020_BHARATRAs Q4 N FY 20 NOS.pdf (4.4 MB)

SUPERB NOS AND BIG IMPROVEMENT IN CASHFLOWS ,.DEBT REDUCED BY 150 CR.

ALL apprehensions of doubters laid to rest .

Co shud get rerated further with both EPS & PE increasing amd also being included in Nifty 500,Nissan tieup catching attention of several instt…

Thats why attending AGMs really important specially of taciturn management.

Discl- Invested since last 5 years and havent sold any shares & kept averaging on upside.

Numbers summarized below

| INR crs | Q4 FY 20 | Q4 FY 19 | FY 20 | FY 19 |

|---|---|---|---|---|

| Sales | 271 | 272 | 1,215 | 992 |

| Other income | 8 | 0 | 17 | 3 |

| Total Revenue | 279 | 272 | 1,232 | 995 |

| EBITDA | 57 | 48 | 246 | 190 |

| EBITDA Margin | 20.3% | 17.7% | 20.0% | 19.1% |

| Operating EBITDA (excl other income) | 48 | 48 | 229 | 187 |

| Op EBITDA Margin % | 17.9% | 17.6% | 18.9% | 18.9% |

| PAT | 36 | 29 | 158 | 112 |

| PAT Margin | 13.0% | 10.8% | 12.8% | 11.2% |

| Debtor days | 74 | 101 | ||

| Inventory days | 69 | 111 | ||

| Payable days | 17 | 23 |

| Key cash flow numbers | FY 20 | FY 19 |

|---|---|---|

| Net cash flow from operations | 262.5 | -52.3 |

| Capex & Investments | -69 | -48 |

| (Reduction)/Increase in debt | -153.1 | 118.6 |

| Interest | -15 | -15 |

| Dividend | -0.74 | -0.74 |

| FX differences | 14.8 | 1.69 |

| Other misc items | 0.54 | 0.02 |

| Net change in Cash | 40 | 4.27 |

All cash flow issues addressed

Hi Vivek, Congrats to holding stock past 5 years… I am new to ValuePickr Forum community… seeing charts around 2014-2015 most of the chemical stocks trend got changed. Kindly tell us your insights how you are able to find this stock 5 years back. Thank you.

Build your on conviction by attending AGM & closely tracking the sector. Going thru this wonderful thread here also helps. Investing is all about betting on ethical promoter with growth mindset & executing nicely and tailwinds shud also be there in sector. One shud remain cool & take advantage of volatility. Easier said then done.BR gave wonderful buying opp too on dips & one cud average upwards post good results.

Good thread on BR addressing most concerns on co

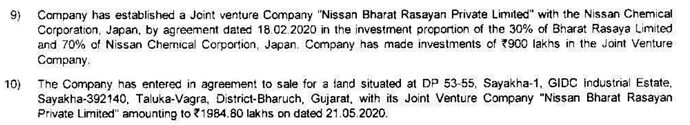

Sayakha land would be sold to the JV,

Total capex for Bharat would be anywhere between 90-100 crores, if my understanding is correct

disclosure-

Entered in last 30 days, no recommendations

In view of Govt’s proposal to ban 27 pesticides/ herbicides for Domestic Consumption, is it possible to find, which companies will be benefiting from this action as there must be some products, which will be filling the gap, once the ban becomes effective.

Good piece.

Difference of opinion is a pre-requisite for offering value on table.

Scripts with proven track record and quality barely comes to mouthwatering levels barring economic catastrophes, majorly due to lack of difference in perception about quality.

BR: Learnt from a third party report that high debtor days is due to offering of relaxed payment terms to foreign buyers in order to establish long term relationships. However, should come down in the long run with scaling business operations.

Companies change character over time due to internal or external factors, amounting to varying opinions; however facts may not change always.