Can someone please share their insights into what the future prospects of beta Drugs looks like??

Hi @Pragnesh @pranavpallod12, can you please share your current thoughts on beta drugs please, since you’ve been tracking it closely, would love to hear from you.

Annual report FY24:

• While the company expects revenues to double in the next three years it does not foresee any major capex for the same period. We expect significant operating leverage to payout which will lead to expansion in our operating margins.

• There was an increase of 22.90% in median remuneration of employees during the financial year.

The number of permanent employees on the rolls of the Company is 371 for the year ended March 31, 2024. (vs 315 yoy)

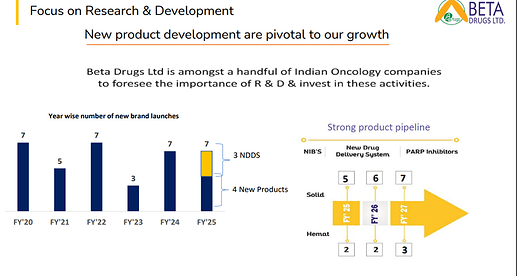

• The expenditure incurred on Research and Development: 1.45cr vs 2.5cr yoy

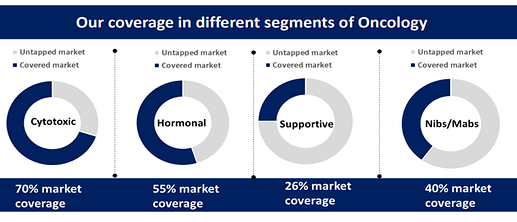

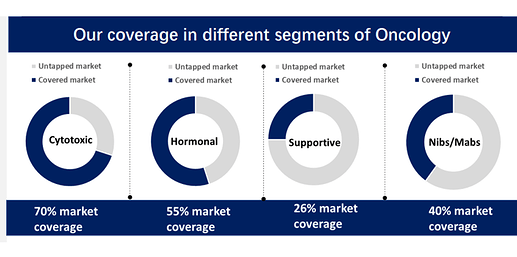

• Oncology is forecasted to grow the fastest in terms of global spending at a CAGR of 13–16% through 2027. Oncology is projected to add 100 new treatments over five years, contributing to an increase in spending of $184Bn to a total of more than $370Bn in 2027 and facing limited new losses of exclusivity. While most major therapy areas have seen growth in medicine use in the last decade, oncology usage has far exceeded the others with a 10-year CAGR as of 2021 of 15.3%.

• Going forward Beta will continue to focus on building a solid franchise in the domestic market through robust brand building initiatives focusing on patient outcomes and strong clinical differentiation.

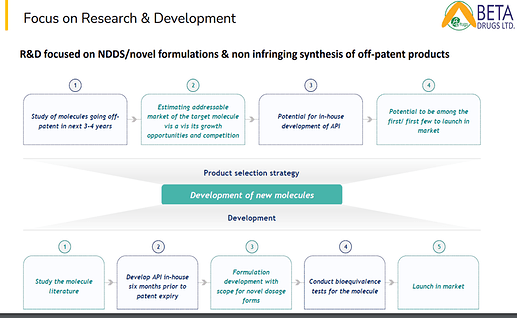

• Beta’s R&D strengths are in developing novel molecules that are going off patent in non-infringing processes, scaling complex chemistry challenges and novel formulation development.

• To achieve leadership position in the cytotoxic market the company is focused on building Rs 10 Cr & above brands. It is also strengthening its Hemato & Uro Oncology presence and is trying to increase customer base by launching new NDDS formulations and supportive care products. R&D in-house is already in advanced stages

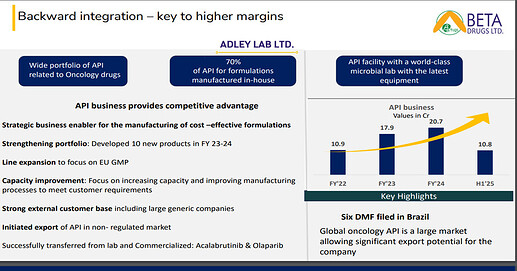

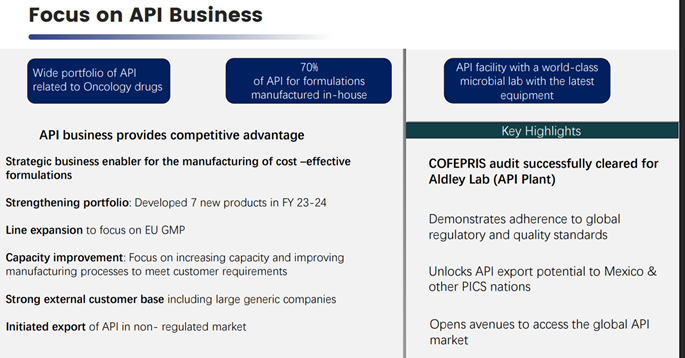

• Going forward API development will be core to launching of new products and maintaining market leadership in select products. We also plan to export APIs to improve the operating leverage in the API business.

• In India the Oncology drugs market is expected market to grow in double digits for the next many years to come. Therefore, Beta Drugs being a leader in the oncology segment has long runaway ahead both in terms of opportunities and growth.

• Rate of interest – 7.5 – 8.5%

Nice result by beta drugs in Q2 2025

Some points from concall :

- company expects to grow overall at 25-30 percent for many years to come (over 3 yrs) and

CDMO will have a much bigger growth and expects exports to grow around ~50% YoY with

EBIDTA margin ~25% - operating profit margins back to 22% compared to 18% last time (last time platin prices were

high which caused margin impact) - Currently focus is on EU and in 2-3 yrs to expand in USA as well

Disc : Not invested , tracking.

**Any views on price range to enter supporting the valuations? **

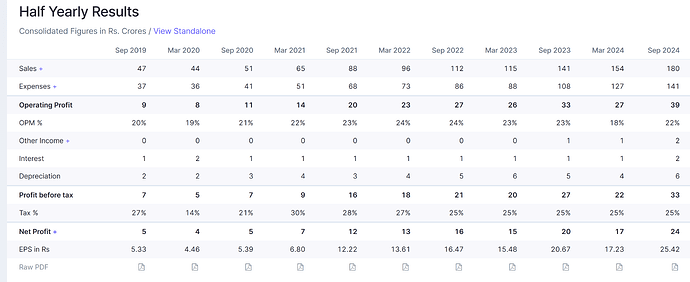

H1FY25:

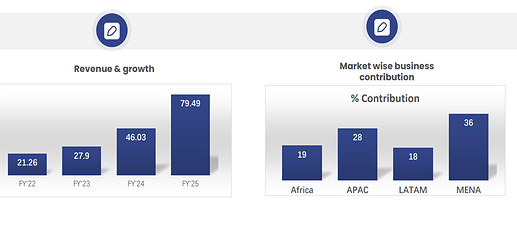

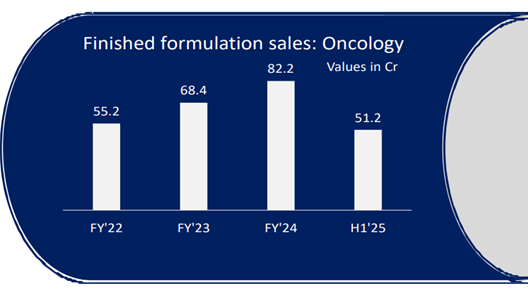

• Growth: Export sales - 141%. Own Brand – 30%. (Including cosmeceutical sales, 26% oncology growth). API Business – 20%

• Gross Margin rose to 42.35% from 40.44% compared to the same period last year, primarily due to rigorous efforts to control raw material costs.

• GUIDANCE FOR SECOND HALF: Management expects revenues for Fy25 to be in the range of Rs 370 to 380 crores while the EBITDA margins will be in the range of 22-23%. The company expects Own Brand sales both Domestic and International to continue to grow at a higher pace.

• The company has scheduled a COFEPRIS and EU audit for its plant in Q425.

• ZAZIBONA audit successfully completed

• New ₹5 crore term loan secured in FY’25 for development of R&D and new corporate office site (worth Rs.15 Cr)

• Domestic Own Brand Business:

More than 1500 prescribers.

Added 200+ new prescribers in H1’25.

10 brands are in top 5.

Deeper penetration in private, corporate & government hospitals.

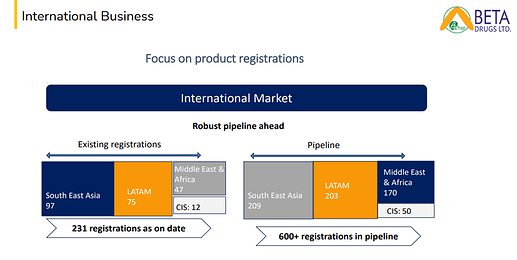

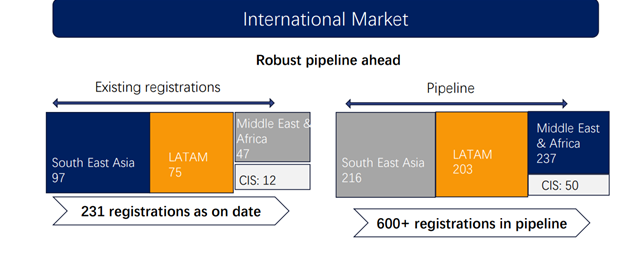

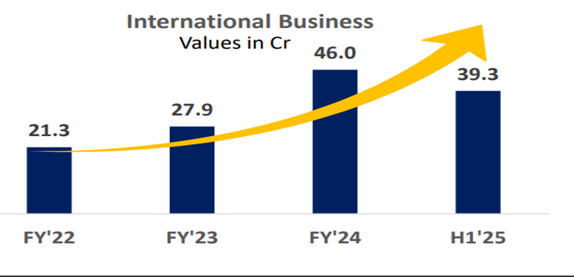

• International Business:

Geo expansion: Initiated commercialization in 3 major countries: Algeria, Peru & Philippines. Plan in H2: Colombia, Mexico, Azerbaijan, South Africa, Malaysia, Vietnam, Thailand, Zimbabwe, Morocco, Namibia, Botswana

ZAZIBONA approval: It will lead to geographical expansion in Zambia, Zimbabwe, Botswana & Namibia

Key regulatory Achievement in H1’25: 193 new dossiers shared to respective countries. 29 dossiers submitted to MOH. 14 new registration approvals which will open up a market of USD 5 Mn.

(600+ Registrations in pipeline vs 350+ in H2FY24)

• Global footprint- Present in 46+ countries.

Domestic market - Prescence in 85% corporate & govt hospitals

Employees: 1000+ employees

Products 125+ products in Oncology

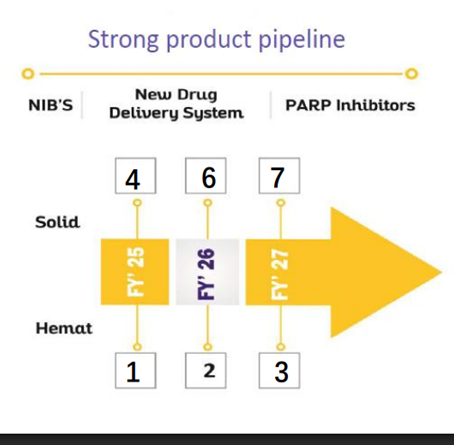

• Product pipeline: More than 25 products will be launched in next 3 years (vs 23 in H2FY24)

•

•

(8 NDDS Formulations vs 15 in H2FY24)

•

•

(Product Pipeline – 7,8,10 in FY25,26,27 vs 7,6,6 in H2FY24)

•

•

• NDDS formulations are giving competitive edge to grow in domestic market

• Strengthening our product basket. It will help to get more business from each doctor

• Our products are cost effective due backward integration. It is helping us to get entry in a greater number of Govt & corporate hospitals

•

CONCALL NOTES:

•

- CDMO

o CDMO business has shown a growth of 2%-5%.

o Going forward the numbers will increase. Expecting 7-10% growth yoy for FY25.

o We have not lost even a single CDMO partner

• EXPORTS:

o We have started filing dossiers in all the 4 countries which are covered under ZAZIBONA.

o The number of the people in regulatory side has been increased from 6 to 10 to enable easy and faster filing of the dossier. We have a complete plan to penetrate Asia, LATAM, CIS and African market.

o We expect around 50% growth on the export business for coming 3 years to 4 years down the line. The EBITDA margin will be in the range of 23% to 26%.

• API: We have also developed 3 new molecules which will be filed for approval and expected to get an approval by next financial year.

API Exports: Till date, our export business is almost negligible in terms of API’s concern. It is not even 1% of the total revenue what we are putting right now. So, the idea about the plan and the strategy behind API business is first to make the facility state of the art which we are continuously doing. Second is to prepare a strong DMF which we can give to our partners or to the suppliers who can file the dossier along with it. So, this strategy is working very effectively as we have started preparing those DMF which we can file in the regulated markets. So, the idea is to start with beta so that the beta can file the dossier based on the DMF made by Adley lab. And the second strategy is to hire a person where we are in continuous researching out for a person who can handle the API international business where we have the best DMF and start exporting it to the international market.

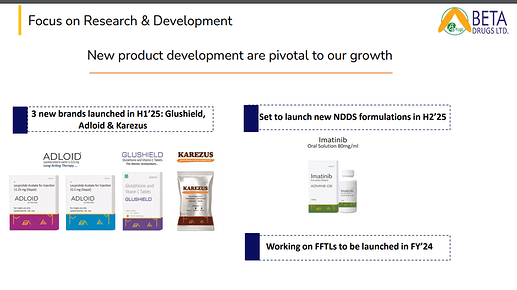

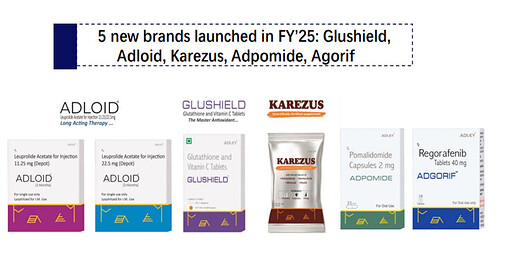

• PRODUCT LAUNCHES: This half-yearly we have successfully launched three new molecules in formulations and parallelly developed APIs in the backward integration. Going ahead we are on a verge to launch 5 new molecules and NDDS by next year. Those will be one of the first time in launch in India for the next 5 years

• There has been addition in R&D team, QC team, QA team and regulatory persons to enable the audits and filings on time.

• Recently company has also received 6 COPPs for which the opportunity for direct export is open in many countries.

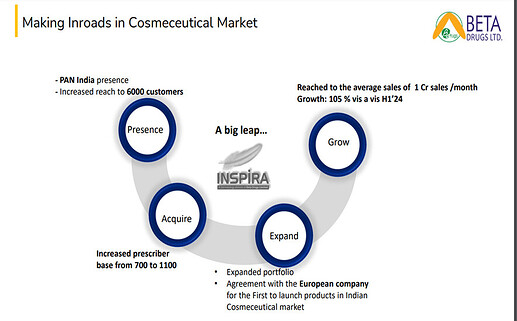

• COSEMTICS & DERMA: We have tied up with a European company that basically from Italy to launch some unique products in the Indian market. The product has already put into the registration and the registrations are expected to be out by December end.

The sales number for Derma for the first half was INR6.4 crores and the EBITDA was a negative of INR1.3 crores. So that means that EBITDA number which you are seeing right now that is 22.36% that comes to 24% if I exclude Derma thing.

As of now our major objective is to have more number of prescribers to which we are working and from 700 we have now around 1,100 prescribers. This is one strategy. And by the end of this year, we want to make it at least 1,300 to 1,400. And in next financial year, we want to make it at least more than 2,200 prescribers who will be supporting to us. So, 2,200 means almost more than 30% of the coverage which we have

Point number two, we will be launching at least five more drugs in cosmetology.

So, in terms of numbers, probably this year we will land somewhere close to around INR13 CR which will be doubled in next financial year. So next financial year, we are expecting around close to INR26 to INR30 CR with launch of new molecules

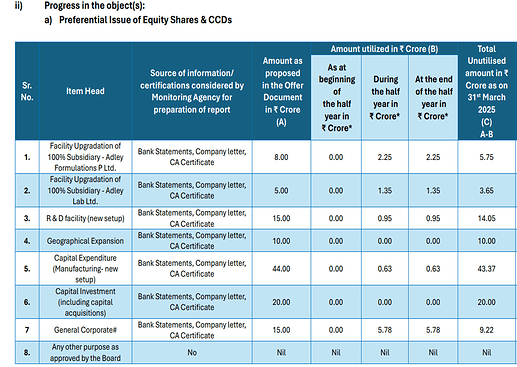

• QIP: QIP fund were raised with a vision for growth in next 5-7 years.

The funds will be primarily used for the following purposes:

o R&D Facility: Number one, we are creating a state of heart R&D facility both in formulation and API. This will give us an edge in the cytotoxic market as there are large number of molecules becoming off patent in next 4 to 5 years. This will enable us to file the dossier in future in the regulated markets. R&D has a key role in filing a dossier where you can have a proper DMF. We have to do a lot of product development both on the API and the finished formulation side.

o Intermediate plant: The second main investment will go towards our KSM plants. We are going further and backwardly integrated where we have planned to come up with our own production for intermediates to support API and prepare the best DMF for filing dosage and direct export to regulated countries. This will further help to increase our margins and bottom lines.

o Foray into recombinant proteins and Biosimilars: Lastly, we are also planning to foray into the recombinant proteins. As we all are aware that Beta has put a substantial mark in the oncology cytotoxic market. Now getting into the biosimilar line is the future. So, to start with biosimilar, we have planned to get into the recombinant protein side. As we have established ourselves well, we have to foray into some new novel technologies and new products for our future growth.

Investors/partners: Marquee investors like HealthQuad, which is India’s best healthcare transformation fund backing innovative models to radically improve healthcare access, affordability and quality of care. This fund is backed by experienced GPs such as Quadria Capital and LPs such as U.S. Pharma Giants, Merck and J&J, Johnson & Johnson. The second partner is Tanas Capital is an Asiabased private investment firm with an aim to participate in the growth of emerging corporates. The third partner is a generational capital fund.

• We will grow at a pace of 25% to 30% for the next many years to come.

• US MARKET ENTRY: In next 2, 2.5 years, we do have a plan to get into the U.S. market. First is the EU. So, after the EU, we’ll start filing the dossier for Europe market and then gradually we’ll, by the development and the upcoming facility in R&D, we’ll start the product developments and the DMF for the U.S. market as well.

• Hormonal therapy in cancer treatment. So, as of now, we do have hormonal therapy for which the covered market is somewhere close to around 55%. The remaining hormonal therapy like Apalutamide, Degarelix, darolutamide, Exemestane, all these products we don’t have which has a good market scope and we will be launching these products in next 2 years time. So, we have shortlisted a few of the hormonal drugs and not only the hormonal drugs, but for us the next growth driver will be supportive care products wherein as of now our presence is very less and the third growth driver for us is biologics. So, we are trying to tie up with a couple of companies for the biologics. So, it’s not only the hormonal, but supportive as well as the monoclonal antibodies we are targeting for our future growth.

• NDDS DETAILS: We have total of one NDDS which we launched in the month of February. And there is one more NDDS which will be launched in the month of either January or February depending on the approval. And one NDDS is already in pipeline which will be launched in the month of June next year.

We are filing three more NDDS in the DCGI which will take approximately 12 months to 15 months for an approval. The product development and everything is already done. These three which we are filing now that will be launched in the financial year 2026-2027.

Next year total will be two NDDS and three new molecules which will be launched in next financial year

The total market size: the two molecules which we are launching by next year, the market size will be close to around INR70 crores and we tend to increase the market size by introducing these NDDS as we have illustrated this by launching our first NDDS in the month of January this year.

I’ll just give you one small example. We just launched one product that is megestrol acetate suspension. The total market size was less, but when we launched this NDDS, the market size has been increased and apart from what the tablet which was selling in the market, we have created a parallel market size with this NDDS. So, the market size are there and everyone is looking for an opportunity to have something new in the market. There are patients who cannot swallow tablets because most of the oncology tablets, they are big in size. So, to reduce the burden of taking a tablet, we are converting into suspensions and we are coming up with these NDDS.

• There are a lot of products which are becoming off-patent. So, we are trying to develop all these molecules and do even CDMO for some international players, what we are anticipating that when we are working out on these molecules, we might get some CDMO for this also. So, the R&D expense right now may be around 2% to 3%, but it will eventually go up to 4% to 5% after coming up with this facility.

• Intermediate plant details: So, the total investment we are planning to have for an intermediate facility will be close to INR15 crores, INR20 odd crores initially. The idea of getting into the intermediate facility was right now our total procurement of intermediates like 60%, 70% of the intermediates is procured from China. So, we have today as per the today’s scenario, we have got a good manpower in R&D side where we can develop the products right from initial steps. So, intermediate facility will give us a boost to support our API plant which will further go for the EU regulations. Tomorrow, we have to file our dossier in the regulated markets. So, this intermediate facility will also come in the scope of EU GMP approval plus our API plant will be boosted by the intermediates which will be sourced from this intermediate facility. So, not only this when we are producing intermediates which are being sourced from China which will be done in-house, this will add on another 10% to 15% margin in our total revenues.

Initially it will be for our internal only, but we have spoken to a couple of companies in India who are already producing API in Cytotoxic API. They have also shown a keen interest in buying those intermediates from us.

We are planning to have close to around 20 to 25 products. – initially it will be around 18 and gradually it will be increased up to 25 to 30 products.

• CDMO market size: The cytotoxic market in India is close to around INR3,000 crores for our product range plus there are a lot of products which are becoming off patent. This market will eventually grow to 4,000, 5,000 Cr by 2028 and 2030.

INR5,000 crores at end customer sale value. So, at manufacturer value, it will be close to INR1,500 crores, INR1,800 odd crores.

THINGS TO TRACK

• CDMO PERFORMANCE: Will it bounce back in H2?

• EXPORTS DIVISION PROGRESS: In terms of Dossiers filed and approvals received and products launched and sales started in newer geographies/

• DOMESTIC BRANDED DIVISION PROGRESS: In terms of prescribers and hospitals covered. And products launched.

• BIOLOGICS SEGMENT PROGRESS: As this is more complex and a new space for the company, can it successfully develop and launch products in this segment?

• INTERMEDIATE PLANT PROGRESS: Can they successfully commission it on time? What impact will it have on margins? How many Product launches?

• R&D FACILITY DEVELOPMENT: Will new R&D increase product development speed and result in increased product basket?

Informative, thanks for sharing

Is there any update on the company’s transfer to the mainboard exchange?

No updates were there in H1 Presentation or concall

Hi Utkarsh, great report. I am also researching this company. Can you tell me the source from where you got the revenue split category-wise? I have been looking for the split but can’t find it.

BETA_26122024105016_migration_write_up.pdf (168.9 KB)

I believe, not an immediate impact, let’s see how story develops on Russian anti-cancer vaccine.

This vaccine will be for people already suffering with the disease.

Anything, anyone wants to add on this?

https://indianexpress.com/article/explained/explained-health/russia-vaccine-cancer-9744034/

Disclosure: Invested

Issue of Bonus Shares in the ratio of 1:20

Migration of listing / trading of equity shares of the company from Emerge platform of National Stock Exchange of India Limited (NSE) to main board of National Stock Exchange of India Limited as well as on main board of BSE Ltd.

Board meeting outcomes

- Approving the alteration of the memorandum of association of the Company to increase the authorized share capital of

the Company; (PART-A) - Issue of Bonus Shares in the ratio of 1:20 i.e. 1 (One) new Bonus equity share of Rs. 10/- each fully paid up for every 20

(Twenty) existing equity share of Rs. 10/- each fully paid-up held by the Members of the Company as on the Record Date

(will be declared in due course), subject to approval of the Members of the Company. (PART-B) - Appoint Mrs Monika Jain as an Additional Non-Executive Director on the Board; (Independent)-(PART C)

- Appoint Mr. Lalit Kumar Watts as an Additional Non-Executive Director on the Board; (Independent) –(PART-C)

- Resignation of Mrs. Seema Chopra (DIN: 08510586) Whole time Director of the company from the Board of Directors of

the company.-(PART-D) - Migration of listing / trading of equity shares of the company from Emerge platform of National Stock Exchange of India

Limited (NSE) to main board of National Stock Exchange of India Limited as well as on main board of BSE Ltd. - Considered and approved the Postal Ballot Notice for approval of members

- Appointment of Mr Dinesh Bhandari, Practising Company Secretary as Scrutinizer for the Postal Ballot Event.

Any tentative time frame for the Migration of Beta drugs from NSE to both (NSE & BSE)?

It usually takes 90 days for migration.

My query is Even if US imposes hefty tariffs on Indian Pharma, there could be limited impact on Beta drugs since it has almost nil exports to US? Is my reading right?

H2FY25:

• Own Brands grew by 25.28% (29% including cosmetology), while exports grew by 72.69% during the year.

• Consolidated EBITDA stood at Rs 81.04 crores, with EBITDA margins at 22.37%. Excluding the dermatology segment loss of Rs 3.08 crores, EBITDA rose to Rs 84.12 crores, with EBITDA margins for the Oncology segment at 24.03%.

• The company continues to be one of the fastest-growing, scaled-up players in the Indian branded oncology pharmaceutical market, gaining share from larger incumbents.

• Outlook for FY26: Management projects revenues exceeding Rs 450 crores in FY26, with consolidated EBITDA margins between 23% to 24%. Over the next three years, Beta aims to double its revenues and become one of the top five players in the Indian cytotoxic oncology market.

• The recent COFEPRIS approval for Adley Labs (API facility) marks a key milestone in strengthening Beta’s API export business and establishing end-to-end supply chain control. This will enhance margins, ensure consistent quality, and reduce reliance on third-party API suppliers. The approval also paves the way for registration of APIs and formulations in other PIC/S nations, expanding Beta’s global footprint.

• Additionally, the company has applied for an EU audit of its formulation plant, expected by December 2025.

•

• Domestic Oncology trade business surpasses ₹100 Cr milestone. Oral therapy contribution (48%)

• 6 out of top 10 brands are ranked amongst Top 5 in domestic market

• Increased our international presence in 46+ countries

•

• Strong Product pipeline: More than 25 products will be launched in next 3 years. (25+ PQ)

135+ products in Oncology currently (125+ PQ)

•

•

•

(same as PQ)

•

(Same as PQ)

• 8 new NDDS formulation to be launched in next 2 years (same as PQ)

•

•

CONCALL NOTES

• We have started the process of migrating onto the Mainboard. We’ll be migrating between June and August this year.

• Beta’s consolidated revenue stood at Rs. 362.35 crores, which is 22.5% increase from Rs. 295.71 crores of the previous year. We would have achieved a top line of more than Rs. 375 crores, but in March, we had an audit from Mexico, which took almost 10 days of our production, with a very low production in both API and formulation plant.

• The new export person who has recently joined has a vast experience in API Oncology internationally. This will boost our presence globally in the API as well.

• The Onco EBITDA has grown to 24.03%, which is highest ever since it launched.

• COSMETOLOGY: On the Cosmetology side, yes, this is a concern, but now we have received some registrations as an in-licensing from a European Company for fillers, which will be commercialized in the next 2 months. Also, this month and the last month, we have been almost at break-even. So, this division in the next half year, in September, we might be having some profit from our Cosmetology division as well.

The EBITDA loss has reduced from Rs. 4 crores to Rs. 3 crores this year. The Company has increased its prescriber base from 1200 to 2600 as compared to last year. The PCPM of this division has also been increased from Rs. 75,000 to Rs. 1.25 lakh, which is a very positive sign. Also, with the launch of those in-licensing products will boost the sales for this financial year.

Sales: Rs. 12.30 crores this year and Rs. 6.83 crores last year.

We expect to do between Rs. 18 crores and Rs. 20 crores this year. By next financial, we are expecting to touch Rs. 30 crores. And after that, we are expecting to touch between Rs. 45 crores and Rs. 50 crores.

On the new products: Since last 1.5-2 years, we have been working with this Company very aggressively. So, this Company is from Italy. They have developed some fillers in the Cosmetology market. And Indian Cosmetology spend, as on today, is increasing day by day. Every person who is going to a cosmetologist, they are working on their skin part. So, these fillers are from Europe market, and we have just got them registered. So, the overall process, it took us around 8-10 months to get these products registered in India. So, we have just got our registrations out last month. Now, we are working for the procurement. On the margin side, we are maintaining around 65%-70% GC, so that we are able to create some volume and on the bottom line also. See, we as a Company are not focusing on the top line to be very honest. Our main focus is always along with the top line, the bottom line has to be there. That’s why we always keep our EBITDA margins at the same level. But in case tomorrow, with the launch of these products, also the EBITDA margins will be further added.

What is the potential for this filler drug product? The potential is huge. Every day, it’s increasing. Today, every lady or every person is going to a cosmetologist for their skin treatments and these fillers are the most important thing nowadays. So, in fact, Botox is not only the option, but these fillers create some value. So, the market is huge. The total overall market size is close to around INR 2,500-INR 3,000 crores. But it is primarily dominated by the Korean market, but we have got these products from Europe, so this will have an impact on the sales.

• In own brand, we first time created a brand more than Rs. 8 crores, which is NDDS, that is New Drug Delivery System, and was launched first time in India.

• We have successfully launched 6 products apart from these 2 NDDS, and are in the process to launch another 6 products in this financial year. There are 2 more NDDS, which we will be launching in this financial year, followed by 2 NDDS which will be launched in FY '27

• CDMO DIVISION: Growth of CDMO business will continue between 5%-10% every year. There is competition present in CDMO segment.

For CMO, it was Rs. 140 crores last year, Rs. 148 crores this year. So, it is a 5% growth.

This year, we added 3 more clients. So total, we have around 30 clients.

Do you have any plans for international clients on the CDMO side? Yes, we do have plans for that since we are now planning to go for the EU inspection. After EU GMP approval, we are looking for clients whom we can do some CDMO for European market or for some regulated markets.

• EXPORTS: We have recently got around 48 new registrations and have filed close to 130 new dossiers in different geographies. Also, there are more than 200 new dossiers which are getting ready to be filed in the next 4-12 months.

The Company has been focusing more on LATAM and APAC regions, where there is less competition and where there is entry constraint. Since we have the approvals, since our dossiers are on the line, so we can hope to have some more registrations in these regions very soon.

There has been extensive traveling and branding on the export side to increase the volume 3x in the next 2-3 years. So, we intent to 3 times our sales in next 2 to 3 years down the line from the export side.

And the margins, of course, once today most of the sales are coming from the unregulated or semi-regulated markets. Once our dossiers are registered in the regulated markets, especially Brazil, Mexico, Philippines, Thailand, Vietnam, so these countries will eventually increase our margins further.

On the licenses that you have received in the regulated market, when do you actually start seeing revenue pick from those geographies? We will be seeing that market picked up in FY '27, starting of FY '27, maybe by May, June 27. Because the reason is once the approval is there, then the dossiers have to be done. Then there is a registration timeline. So, every country has a different timeline. Maybe some country has 12 months, most of the countries the timeline of registering a dossier is between 18 to 36 months. So that’s why it takes time.

Mexico market: The overall Mexico market is very big, very huge. So, it depends on the number of dossiers we file. As on today, we have filed around 23 dossiers, out of which 12 have already gone to the FDA for registration process. 12 are under evaluation that will be submitted in the next 2 or 3 months. So, another 12-15 are in pipeline, which we will be sending them in the next 2, 3 months So, the total Oncology market size of Mexico is concerned to around 140 million. So, we expect that we should have a good number out of it.

• API BUSINESS: We have developed and commercialized 4 new molecules last year. We are in the process to launch 6 new molecules. This will be followed by 20 new molecules in the next 3-5 years.

• R&D: The current team in our R&D is around 10 people in both API and formulation. Our current R&D spend is almost 2%, which is giving the main boost for the Company.

• EBITDA margins for the Company overall are projected between 23% to 25%.

Current OPM margins for each of the segments:

Branded business - 34%-35% EBITDA margin

CMO - 15%-16%;

Exports - 27%-30%

API - 19-20%;

Derma - gross margins of around 67%.

• Own brand business will keep on growing at 25%

• NDDS: The NDDS which we have launched last year, we have expanded the overall market size. For an example, Megestrol acetate, the total market size was close to Rs. 6 crores. After the launch of our brand, the total market size is now more than INR 16 crores, out of which we have the lion share. And we did close to around INR 9 crores, plus the tablet market. So overall, we have expanded the market.

For the future NDDS formulations, we expect to get the share from the existing market. It will not expand the market, but we will be getting a share from that. So, there will be 1 product which has a market size of around 70 crores. So, we expect good share from that particular market for the NDDS formulation.

• We are making one new corporate building, where we are shifting the entire regulatory office and all the R&D there at one place. Where the office, R&D and regulatory will be sitting in one place, because for the future filings and future developments.

• We are looking for a land or a plant, which is on sale to manufacture intermediates. Today, major of the products are manufactured from N-2, N-3 stages, but we want to start from the basic KRM, the basic plant base. So, we are looking for that, and in next couple of months you will see that some other thing will be shaped up, and we will be having some plant with us.

• So, tomorrow if we find a good M&A in terms of any good branded sales, so we will definitely look out and we will evaluate that proposition.

• I just want to have a vision for the next 5 years of the Company, at what scale and revenue and profitability would the Company be? Rahul Batra: See, we have a budget, we have our plans laid down for next 3 years. So, it is for 2025-26, 2026- 27 and 2027-28. So, till 2028, we have our revenue projections till Rs. 750 odd crores. But after that, we are doing some other talks also. We might get into immunotherapies. We are working on many things. Actually, there are lot of things which are on card. So, you might see some or other development in the year 2028, where we will be one of the generics to launch, one of the mAb which is not prevalent in the generic market. So, all these things are happening and it is under discussion. So, 3 years, we have already given you, and next 2, 3 years, we are just framing it up, once all those conversions or once all those agreements are in place.

• Although, we have got around 17-18 people working in our regulatory team, but still, we find constraints to send the dossier timely. We are doing our level best. And we have already filed as I told you 130 dossiers for registration, which the registrations are yet to come out.

• EU AUDIT: We have already started the process. Earlier, we were going only for a plant approval, but going for a plant approval was not making sense. So, what we did a change inside was that for every line, we are starting preparing a new dossier for Europe. So, in another 3 months, the dossiers will be ready and we will be filing it. We are expecting the audit to come between October and December this year only. So maybe after audit, it takes 6 months to get a certificate out or to get the registration out of that particular product. So we just have to wait for another one year for this EU certificate.

Revenue part from Europe will start after 2.5 years.

• We would just like to say that, yes, we have a very robust pipeline for coming 3, 4 years down the line. We are going to maintain the same pace which we have been doing since last 4, 5 years. And keep trusting us and we will be delivering our best to best of our potential. Thank you.

THINGS TO TRACK

• COSMETOLOGY PERFORMANCE: Will it turn profitable this year? What would be the impact of Italian company products on overall cosmetology sales? How would margins shape up?

• EXPORTS DIVISION PROGRESS: In terms of Dossiers filed and approvals received and products launched and sales started in newer geographies.

• DOMESTIC BRANDED DIVISION PROGRESS: In terms of sales, prescribers and hospitals covered. And products launched.

• API DIVISION PROGRESS: In terms of new products commercialized and new products developed and External sales growth.

• BIOLOGICS SEGMENT PROGRESS: As this is more complex and a new space for the company, can it successfully develop and launch products in this segment?

• INTERMEDIATE PLANT PROGRESS: Can they successfully commission it on time? What impact will it have on margins? How many Product launches?

• R&D FACILITY DEVELOPMENT: Will new R&D increase product development speed and result in increased product basket?

With multiple growth drivers taking shape, Beta looks set for healthy compounding growth for many years to come.

DISCLOSURE: INVESTED (One of core holdings)