Banswara Syntex dates back to 1976 , when Mr. R.L.Toshniwal laid the foundation for the company and set up a spinning mill in the rural Bamboo forest town of Banswara, Rajasthan. Since then, it has grown to become a vertically integrated textile company , specializing in the production of yarn, fabric and readymade garments. It is one of the largest single-mill set ups of fibre-dyed yarn in ASIA. Over the years, they have forayed into markets in over 60 countries including the U.S., U.K., Canada, Spain, Germany, Japan, France, UAE, and Turkey. It has won several awards over the years, including the SRTEPC award for 8 years in a row.

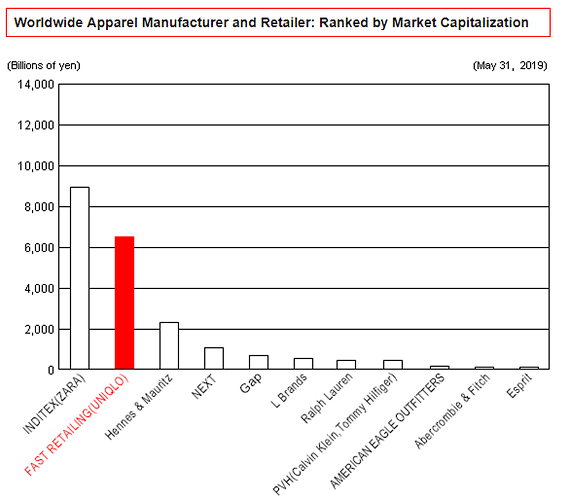

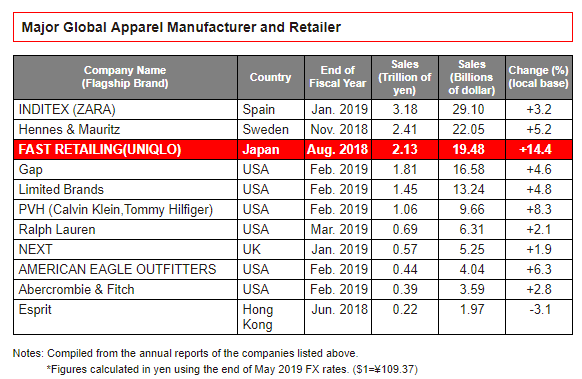

They have diversified offerings in textiles and technical fabrics. Due to our varied and highly specialized product range, we are able to service a number of highly reputed fast fashion brands like Uniqlo, Zara, GAP, Marks and Spencer, Next , etc.

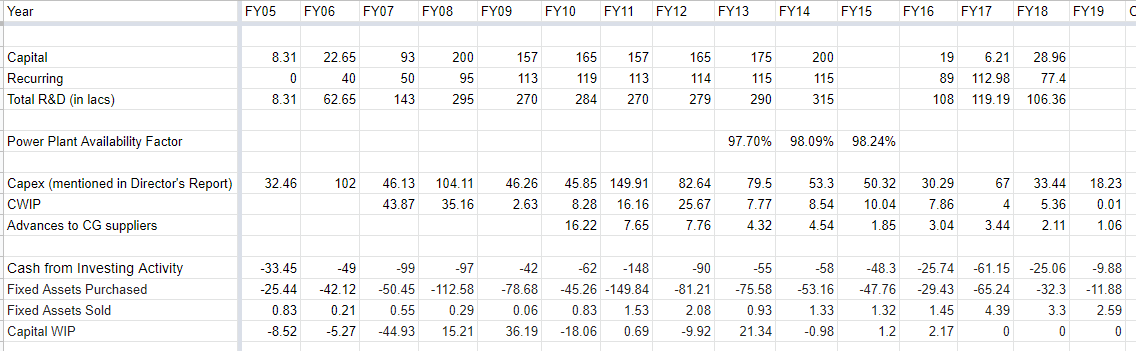

It has its own thermal power plant , which generates 33 MW of captive power for the mill. For our next step, we intend to move to solar energy.

Corporate Video of the company (Created 8 years ago):

TL:DR version

Investment Rationale:

Closer to a cyclical bottom than to a top given the multiple headwinds over the last 3 years - demonetization, GST, Turkish lira devaluation.

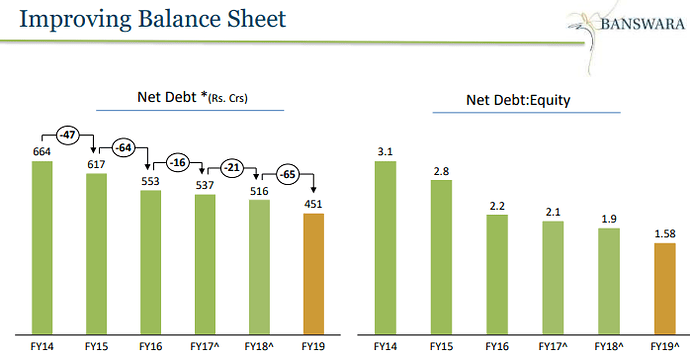

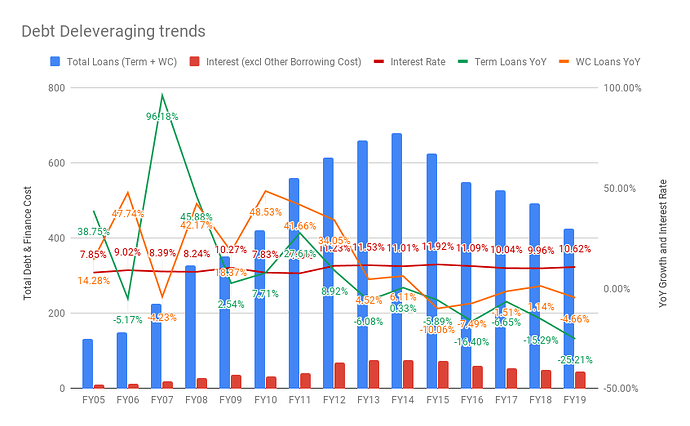

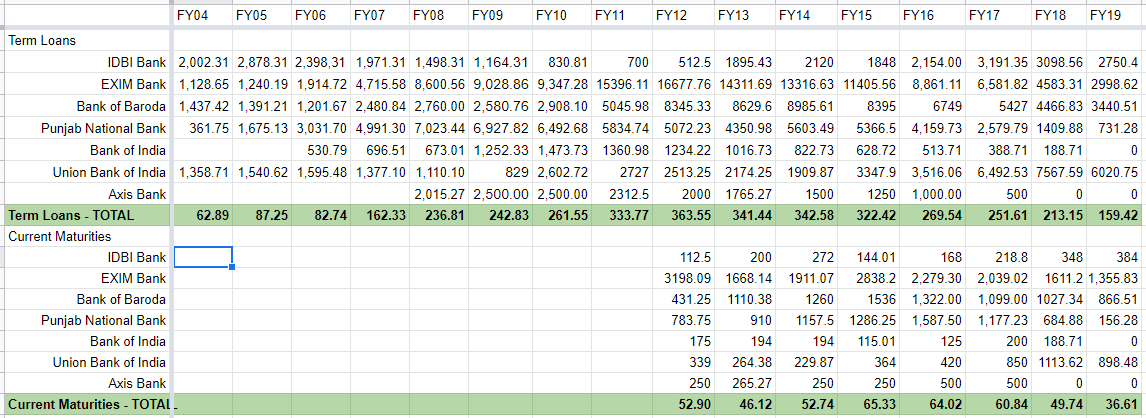

Deleveraging and Committed to repayment of around INR 60 crores every year.

*Net Debt includes Current Maturity of Debt

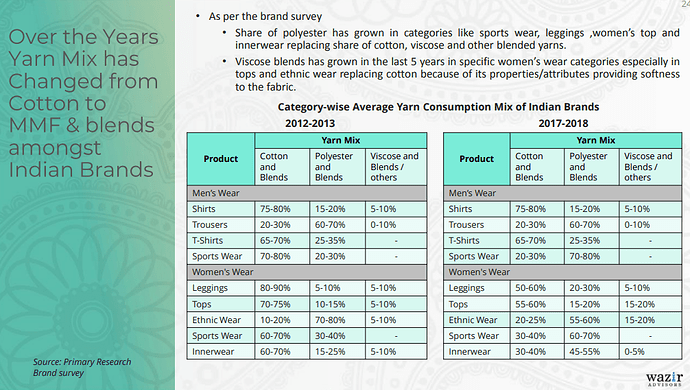

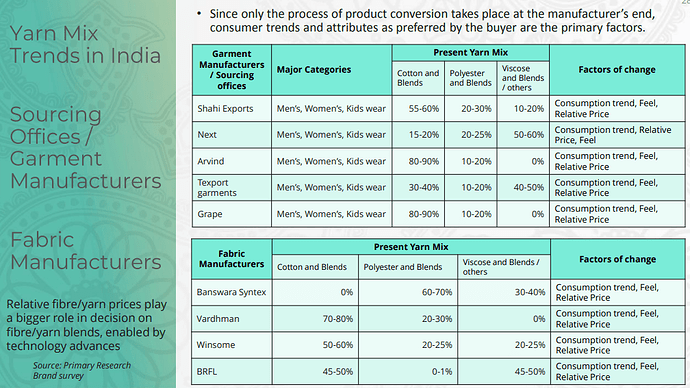

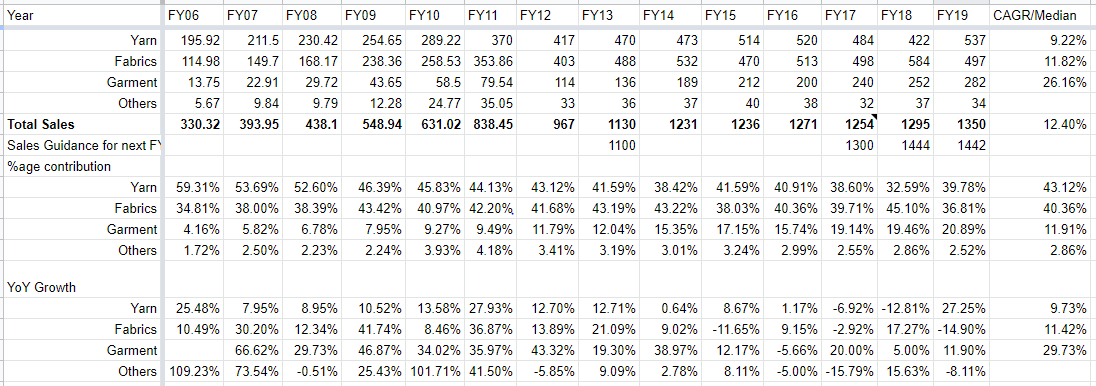

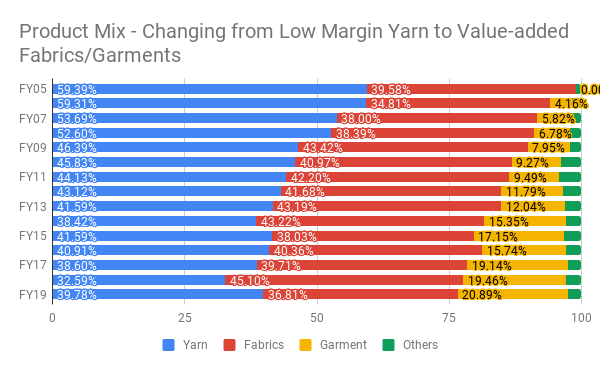

Changing Product Mix

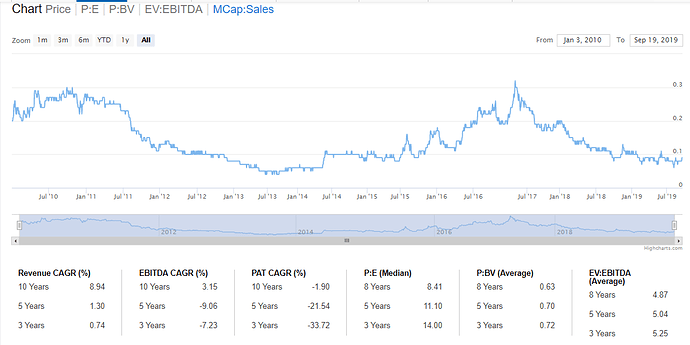

Seems to be pretty undervalued

Undervalued across multiple parameters - Mcap/Sales (captured below), EV/EBITDA @ 5 and Mcap/FCF < 1 (Mcap = 125 cr and FCF of FY19 = 128 cr)

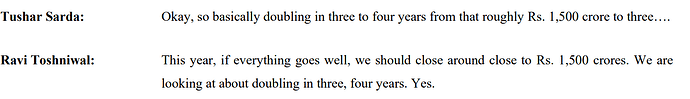

Completion of an elongated capex phase. No major capex planned for next 2-3 years, at least until they reach a topline of 1500 crores.

As per mgmt the maintenance capex would be INR 30 crores.

Even adjusting the FCF for the above maintenance capex figure the MCap/FCF is still around 1.2

Fabric manufacturing is capital intensive and requires significant investment in plant and machinery. A typical modern fabric-manufacturing (weaving) unit with ~100 looms will have a capital cost of ~Rs. 70 crore to ~Rs. 90 crore, depending on the nature of expansion, i.e. greenfield or brownfield. The high fixed capital intensity is also reflected in average operating income/gross block of ~1.5-1.7 times for fabric manufacturers.In addition, fabric manufacturing operations are working capital intensive with a gross operating cycle (receivable + inventory turnover period) of ~4 to 5 months

ICRA LimitedSpinning is a highly capital intensive industry requiring significant investments in plant and machinery. A typical spinning plant with ~25,000 spindles involves a capital outlay of ~Rs. 85 to 95 crore, depending on land cost, degree of automation and nature of expansion, i.e. greenfield or brownfield. A spinning unit of this scale has the potential to generate revenues of ~Rs. 90 to 110 crore depending on the fibre usage and yarn count being produced by the mill

ICRA Limited

Taking the above figures for Replacement value calculation.

1.6 lac spindles would cost 540 crores (1.6/0.25 * 85)

400 looms would cost 280 crores.

Total Replacement Value = 540 + 280 = 820 crores (v/s 549 crores actual capex over the last decade as captured above) which gives significant Margin of Safety (40%) compared to the current EV of 580 crores.

Detailed Version:

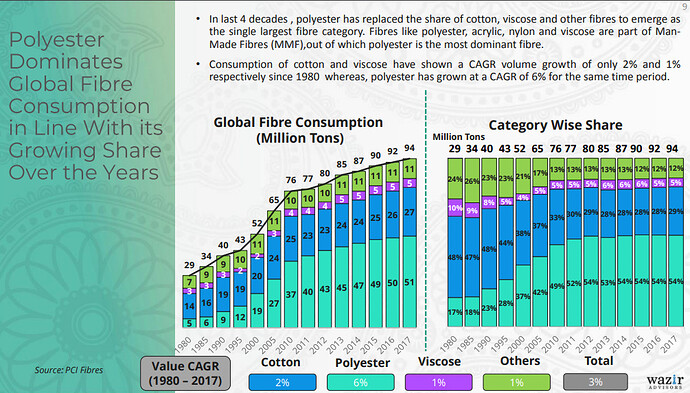

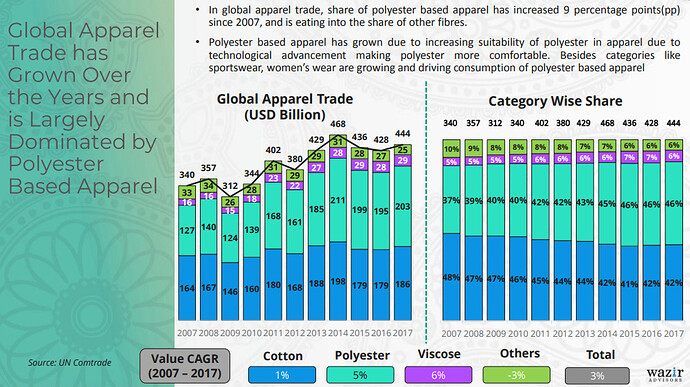

Durability - Can we have a fair expectation of their products still being used 5-10 years from now? Will they continue to have a significant role in the value chain?

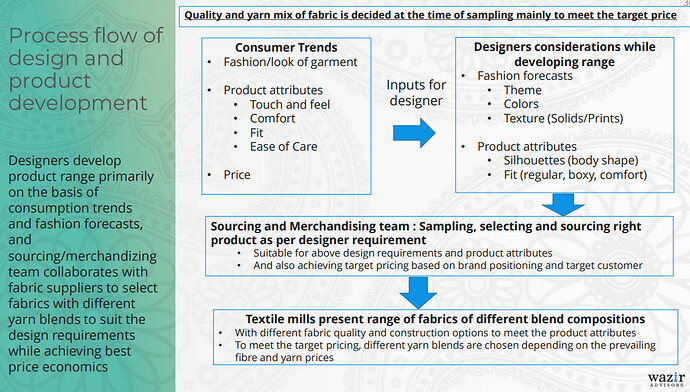

Based on the above my understanding is that Banswara Syntex will continue to play a vital role in the textile supply chain especially when they design 100% of their fabric collection in-house. It would mean they provide an option to Brands to outsource their fabric development to them while they focus on the actual design of garments.

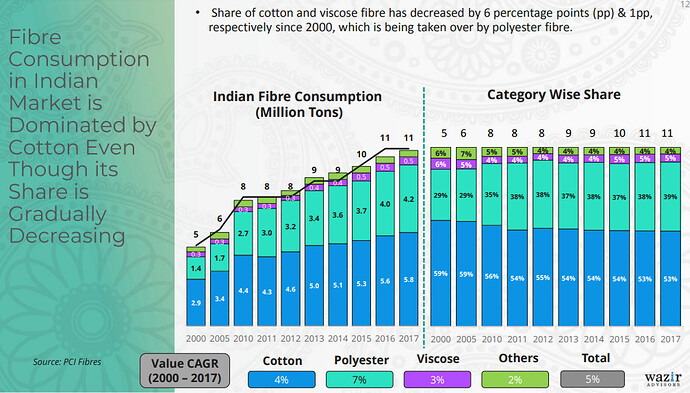

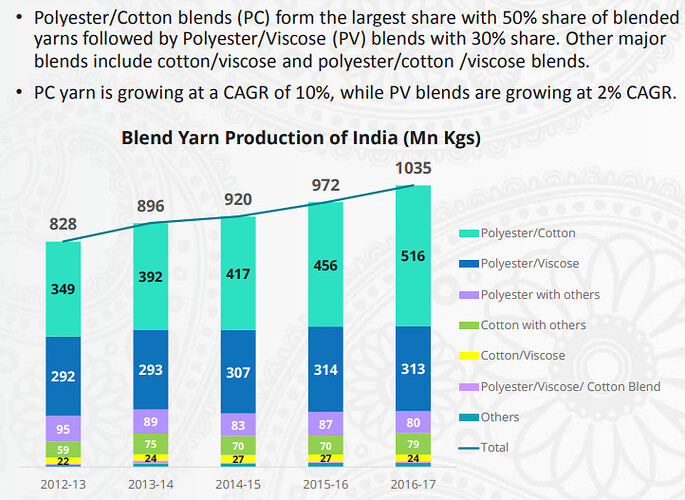

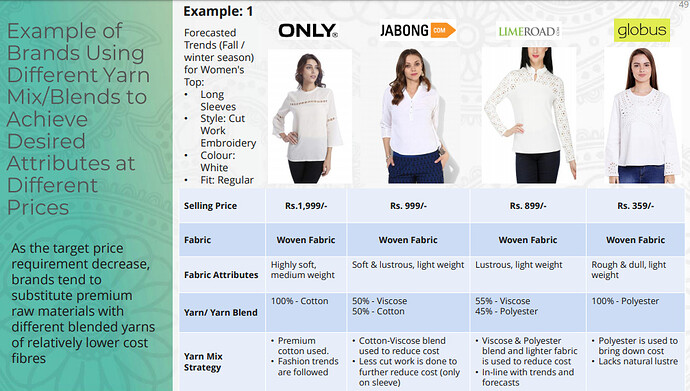

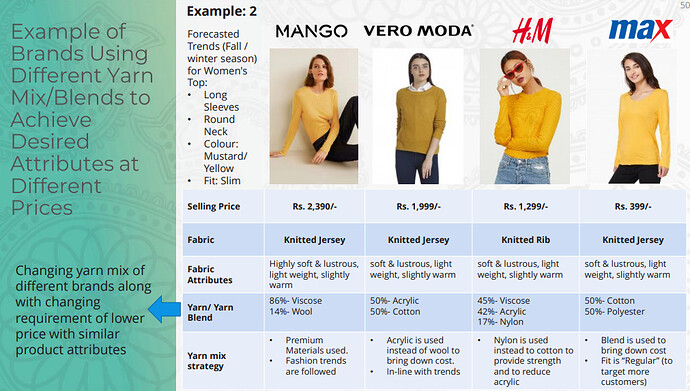

Moreover the trend towards using synthetic blends away from 100% fibre fabrics is a structural one.

Fast Fashion: Procurement from local suppliers for Zara, H&M, M&S. Currently the local procurement is negligible

Key Trends:

- Unlike traditional fashion seasons which have 3-4 turns, fast fashion have higher turns of 8-12 where there is a completely different store display every 4-8 weeks.

- Shorter lead times which require lower inventory levels and faster inventory turns.

- Very efficient supply chain logistics with “just in time” delivery

Peer Comparison - How does Banswara Syntex compare with its peers?

Banswara Syntex is among the three largest polyester viscose dyed yarn (PV yarn) manufacturers in India with Sutlej Textiles and Industries Ltd. and Sangam (India) Ltd. as key competitors.

Banswara Syntex produces 3 times more PV Lycra based yarns/fabric compared to the nearest competitors.

Like Sutlej, Banswara too is certified by INVISTA for usage of Lycra.

Sangam is a supplier of some of the yarns to Banswara Syntex.

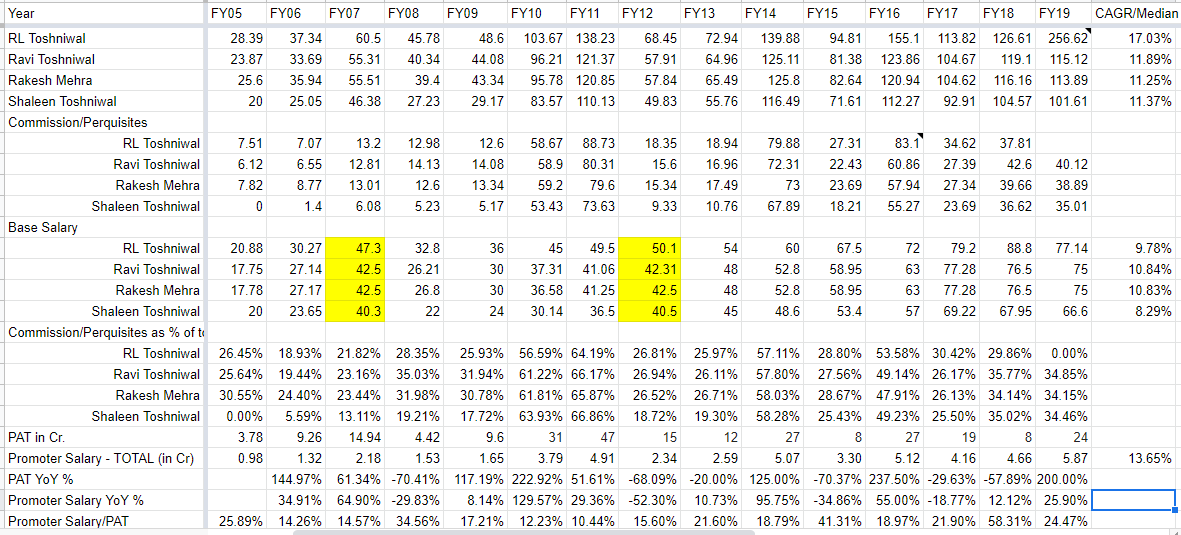

| Banswara | Sangam | Sutlej | |

|---|---|---|---|

| Employees | 14245 | 9000+ | 14736 |

| Spindles | 158632 | 238608 | 276406 |

| Fabric Weaving (mmpa) | 36 | 30 | - |

| Fabric Processing (mmpa) | 60 | 72 | 9.6 |

| Garments (mn pcs) | 4.91 | 3.6 | - |

| Sales - FY19 | 1350 | 1874 | 2642 |

| EBITDA - FY19 | 120 | 168 | 240 |

| Contribution | |||

| PV Yarn | 39.78% | 44% | 95%* |

| PV Fabric | 36.81% | 19% | - |

| Garments | 20.89% | 2% | - |

| Exports | 43% | 26% | 34% |

*Sutlej Yarn figure includes the cotton melange yarn contribution as well

| Mar 2008 | Mar 2009 | Mar 2010 | Mar 2011 | Mar 2012 | Mar 2013 | Mar 2014 | Mar 2015 | Mar 2016 | Mar 2017 | Mar 2018 | Mar 2019 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| OPM % | Banswara Syntex | 11.57% | 14.76% | 15.58% | 16.50% | 14.20% | 13.47% | 14.70% | 11.26% | 12.72% | 10.78% | 8.59% | 8.90% |

| RSWM Ltd | 7% | 1% | 12% | 16% | 6% | 13% | 12% | 12% | 14% | 11% | 8% | 6% | |

| Sangam India | 12.93% | 9.64% | 15.29% | 16.82% | 10.95% | 14.12% | 13.20% | 14.23% | 15.03% | 11.03% | 7.77% | 8.67% | |

| Sutlej Textiles | 10% | 4% | 11% | 15% | 10% | 12% | 14% | 12% | 13% | 13% | 10% | 9% | |

| Fixed Asset Turnover | Banswara Syntex | 1.57 | 1.69 | 1.86 | 1.78 | 1.89 | 2.12 | 2.35 | 2.44 | 2.67 | 2.55 | 2.81 | 3.23 |

| RSWM Ltd | 1 | 1 | 2 | 2 | 2 | 3 | 3 | 3 | 3 | 3 | 3 | 3 | |

| Sangam India | 1.4 | 1.22 | 1.51 | 2.18 | 2.27 | 2.53 | 2.66 | 2.61 | 2.57 | 2.44 | 2.34 | 2.89 | |

| Sutlej Textiles | 2 | 2 | 2 | 3 | 3 | 3 | 4 | 3 | 3 | 2 | 2 | 2 | |

| Debt upon Equity | Banswara Syntex | 4.1 | 4.05 | 3.8 | 3.55 | 3.91 | 3.59 | 3.27 | 2.83 | 2.25 | 2.14 | 2 | 1.61 |

| RSWM Ltd | 3 | 4 | 6 | 4 | 5 | 5 | 4 | 3 | 2 | 2 | 2 | 2 | |

| Sangam India | 3.77 | 3.91 | 3.65 | 3 | 2.87 | 2.23 | 1.79 | 1.66 | 1.48 | 1.43 | 1.53 | 1.34 | |

| Sutlej Textiles | 5 | 7 | 6 | 3 | 3 | 2 | 1 | 1 | 1 | 1 | 1 | 1 | |

| ROCE % | Banswara Syntex | 8.55% | 12.40% | 13.83% | 16.03% | 11.71% | 12.01% | 14.62% | 10.78% | 13.60% | 10.96% | 8.42% | 10.01% |

| RSWM Ltd | -3% | 8% | 20% | 3% | 16% | 18% | 14% | 15% | 11% | 6% | 3% | ||

| Sangam India | 5.38% | 2.17% | 8.50% | 15.32% | 10.32% | 14.89% | 13.56% | 14.59% | 16.80% | 11.04% | 5.87% | 7.03% | |

| Sutlej Textiles | 5% | 0% | 9% | 20% | 11% | 16% | 22% | 18% | 16% | 14% | 9% | 8% | |

| Sales | Banswara Syntex | 434.84 | 547.32 | 628.96 | 805.35 | 923.84 | 1,093.85 | 1,208.73 | 1,222.65 | 1,261.53 | 1,240.48 | 1,291.99 | 1,350.93 |

| RSWM Ltd | 1,256 | 1,428 | 1,647 | 2,120 | 2,123 | 2,637 | 3,111 | 2,983 | 2,933 | 2,987 | 2,940 | 2,962 | |

| Sangam India | 692.45 | 747.08 | 851.47 | 1,171.45 | 1,416.47 | 1,477.75 | 1,431.90 | 1,467.75 | 1,503.98 | 1,593.94 | 1,637.91 | 1,873.63 | |

| Sutlej Textiles | 789 | 848 | 1,143 | 1,577 | 1,530 | 1,672 | 1,872 | 1,867 | 2,074 | 2,249 | 2,453 | 2,562 | |

| Employee Cost % | Banswara Syntex | 9.87% | 9.89% | 10.72% | 11.34% | 11.61% | 11.96% | 13.31% | 14.77% | 15.51% | 17.59% | 18.25% | 17.54% |

| RSWM Ltd | 8% | 9% | 8% | 8% | 8% | 8% | 8% | 9% | 11% | 12% | 12% | 12% | |

| Sangam India | 6.45% | 6.53% | 6.75% | 5.77% | 5.85% | 6.38% | 7.35% | 8.08% | 9.30% | 10.02% | 10.61% | 10.02% | |

| Sutlej Textiles | 9% | 9% | 9% | 7% | 7% | 8% | 8% | 9% | 11% | 12% | 12% | 12% | |

| Material Cost % | Banswara Syntex | 49.70% | 45.83% | 45.18% | 46.01% | 45.89% | 49.75% | 47.91% | 50.28% | 48.48% | 47.50% | 48.19% | 49.43% |

| RSWM Ltd | 56% | 62% | 57% | 56% | 67% | 59% | 62% | 60% | 55% | 57% | 58% | 60% | |

| Sangam India | 61.58% | 62.85% | 58.31% | 56.01% | 54.14% | 55.32% | 57.00% | 57.77% | 54.56% | 57.19% | 57.69% | 58.54% | |

| Sutlej Textiles | 56% | 61% | 59% | 62% | 66% | 64% | 61% | 61% | 58% | 56% | 57% | 59% | |

| Inventory Turnover | Banswara Syntex | 4.59 | 4.79 | 4.22 | 3.72 | 3.5 | 3.86 | 4.04 | 3.86 | 4.08 | 4.01 | 4.05 | 4.52 |

| RSWM Ltd | 6.26 | 6.77 | 5.58 | 5.17 | 6.94 | 7.46 | 7.36 | 7.11 | 6.17 | 5.5 | 6.17 | ||

| Sangam India | 4.75 | 4.8 | 5.32 | 5.65 | 6.45 | 7.12 | 6.4 | 5.88 | 5.38 | 4.87 | 4.57 | 5.27 | |

| Sutlej Textiles | 3.89 | 3.8 | 4.7 | 5.04 | 4.79 | 5.48 | 5.37 | 5.3 | 5.52 | 4.69 | 4.73 | 4.83 | |

| Interest coverage | Banswara Syntex | 1.89 | 2.23 | 2.97 | 3.13 | 1.74 | 1.79 | 2.19 | 1.71 | 2.29 | 2.12 | 1.88 | 2.13 |

| RSWM Ltd | 1 | 0 | 3 | 4 | 1 | 3 | 3 | 3 | 3 | 3 | 2 | 1 | |

| Sangam India | 2.28 | 1.4 | 2.74 | 3.49 | 2.33 | 3.04 | 2.86 | 3.11 | 3.53 | 2.76 | 2.03 | 2.44 | |

| Sutlej Textiles | 2 | 1 | 2 | 4 | 2 | 3 | 5 | 4 | 6 | 6 | 4 | 4 | |

| Debtor Days | Banswara Syntex | 30.2 | 37.25 | 35.71 | 40.42 | 52.61 | 50.94 | 46.62 | 41.24 | 46.81 | 46.54 | 51.61 | 44.15 |

| RSWM Ltd | 48 | 42 | 36 | 37 | 33 | 31 | 30 | 24 | 46 | 46 | 54 | 56 | |

| Sangam India | 71.66 | 57.94 | 55.97 | 47.2 | 32.24 | 43.34 | 51.2 | 62.6 | 65.79 | 59.11 | 72.67 | 70.99 | |

| Sutlej Textiles | 36 | 31 | 31 | 31 | 27 | 31 | 30 | 27 | 37 | 39 | 48 | 43 |

Business Quality

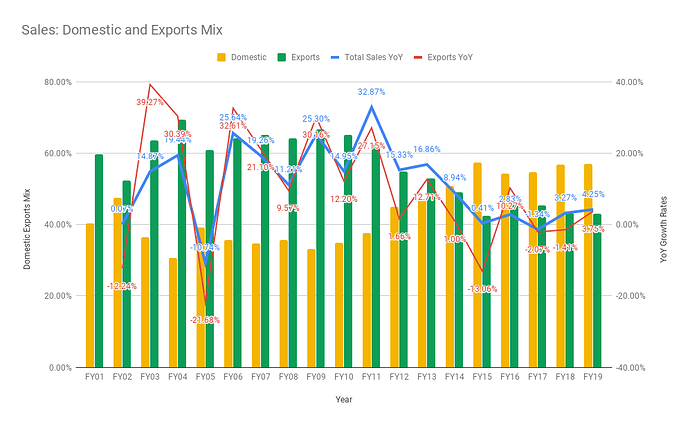

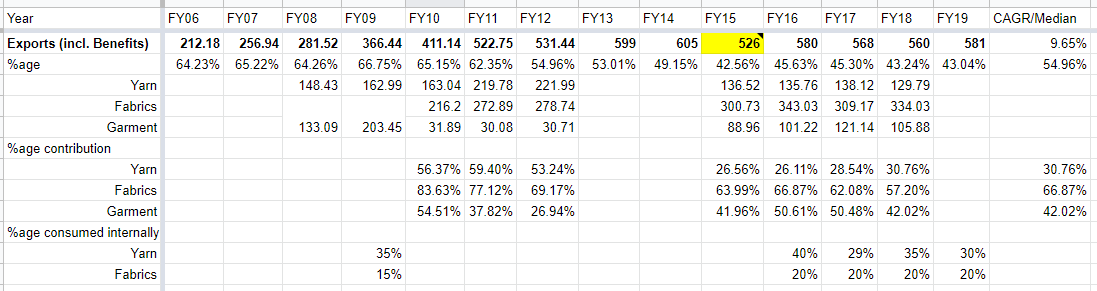

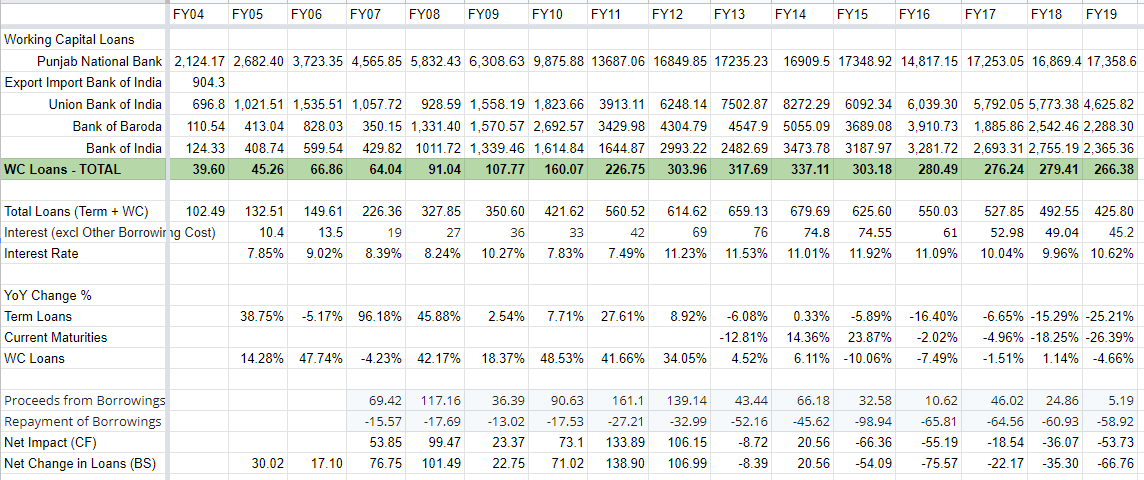

Exports share in revenues has gradually declined to 45% levels having stayed consistently above 60% in FY01-FY11.

A good indicator of increasing competitiveness globally and the regulatory headwinds since FY11 with various policy changes.

Significant portion of Fabrics/Garments are exported.

Fabrics comprise the lion share of exports with >50% contribution.

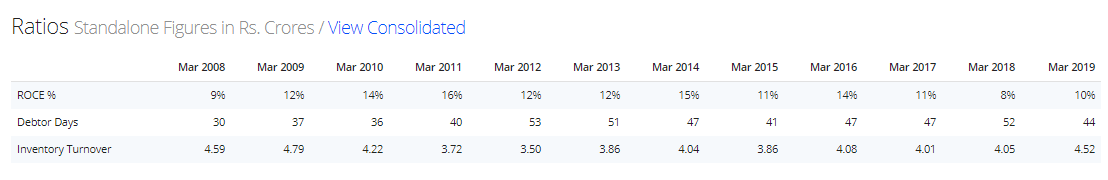

Given the fact that their cost of debt is between 9-12% for their various loans, the RoCE does not look good. However they have scope to improve it to 13-15% levels.

Improvement in RoCE is another trigger for re-rating.

Debtor Days are consistent in a range.

Inventory Turns are improving and as indicated by the management increasing contribution from fast fashion customers should translate to higher turns.

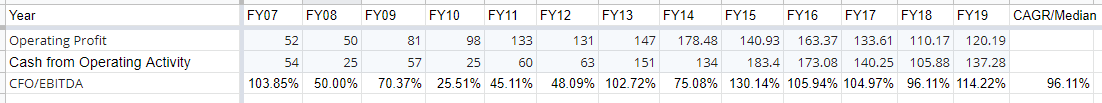

No CFO Leakages over the last 5-7 years.

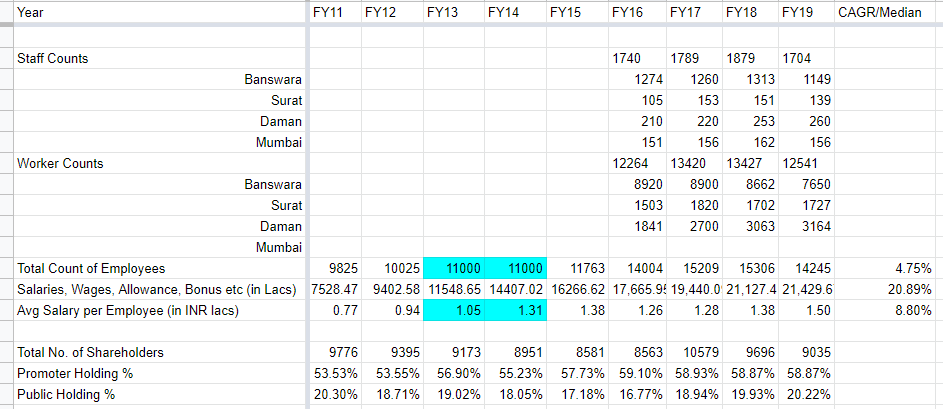

Decrease in Worker counts in Banswara which corroborates with the efficiency and automation improvements being undertaken.

Increase in Worker counts in Surat/Daman as Garment (being labour intensive) contribution increases.

It also explains the recent increase in employee wages on average.

Overall debt reduction of 60 crores per year consistent with mgmt commentary.

Net debt reduction of 35-40 crores per year.

Interest rate for loans taken are expensive in comparison to peers such as Sutlej. Mgmt has commented that TUFS loans taken after April 2016 do not have interest rebate but only capital subsidy.

Couple of discrepancies between the above stated figures from AR and mgmt commentary in concalls.

US: Mgmt claimed that revenues from USA is around 150 crores. Needs to be clarified.

Japan: Contributed revenues of 27 crores in FY17. I am assuming that it has been clubbed with South Korea.

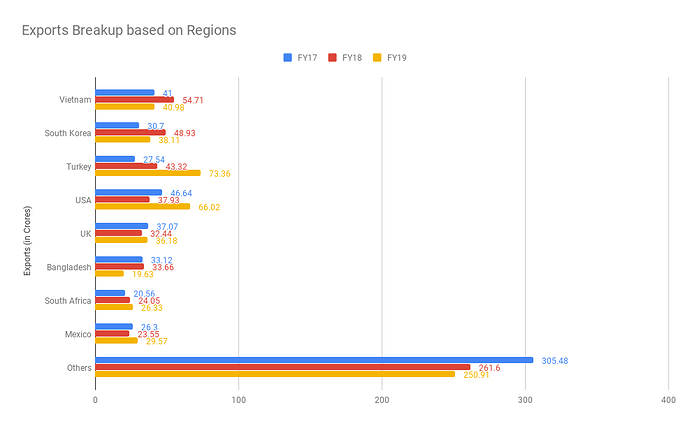

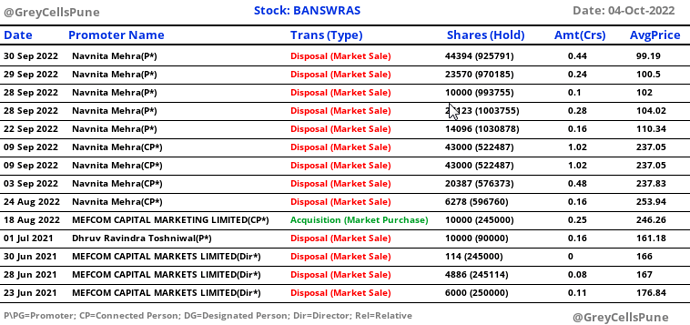

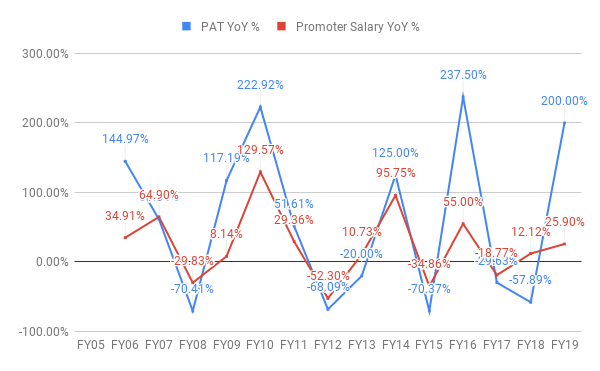

Management Quality

Promoter’s Salary rises and falls in line with changes in PAT.

Also, overall Salaries has increased at a CAGR of 20% v/s 14% increase in promoter group salary.

As mentioned during the concalls they do seem to spend on product development and cost innovation through their R&D spends and Design Studio setup in Mumbai/Paris.

Although R&D spend as % of Sales is less than 0.1%

Also the capex figures mentioned in the Director’s Report are roughly in line with the figures mentioned in the Cash flow statements.

About the Founder who passed away this year in Feb.

Born on 22, November, 1933, Mr R L Toshniwal is graduated in Textile Technology from VJTI Bombay, in 1954. He has done his Masters in Textiles from Leeds University, UK, in 1957. Before setting up his own business- the Banswara Group, Mr Toshniwal has worked as Chief Executive and as the Director for OCM India Ltd for five years. He has also been Chief Executive for Aditya Mills Ltd for nine years. His professional profile includes sound experience as a Production Manager in Birla Cotton Mills Ltd and in Sutlej Cotton Mills Ltd, where he was responsible for setting up projects at Bhawanimandi & Kathua. For six years, Mr Toshniwal has successfully chaired The Synthetic & Rayon Textile Export Promotion Council (SRTEPC). He has been President of Rajasthan Textile Mills Association. He has also held the post of President in Indian Spinners Association (ISA) for ten years. He is the Committee Member of Federation of Indian Export Organization (FIEO), and for Confederation of Indian Textile Industry (CITI) which was formerly known as Indian Cotton Mills Federation (ICMF).

As captured above he was a technocrat as is the case with the 2nd generation - current MD and elder son who graduated B. Tech. (Chem.) from IIT, Mumbai and a OPM from Harvard University.

Younger son: Shaleen has been brought up in Mumbai and has studied at GD Somani School in South Mumbai. He did his junior college from HR College and completed his Bachelors in Management from Bentley College in greater Boston area in the US.

They seem to be close-knit and without issues going by the 2011 interview.

Moving Parts/Business Dynamics

Value Proposition of Banswara Syntex:

European quality at Indian prices with shorter lead times.

Traditional fashion brands:

- Have 2 turns due to 2 seasons lasting 6 months.

- Pricing is fixed for 6 months.

- Any short-term increase in RM Costs cannot be immediately passed on. Will need to wait for repricing of the next season to pass the price increases.

- Since fast fashion brands would have higher turns of 6-8, it would mean shorter duration pricing contracts and quicker transmission of RM cost variations.

- Also faster inventory turns would mean lower working capital requirements

Logistics Challenges:

- Banswara to Port - 7 days

- Port to Vietnam - 14 days

- China to Vietnam - 6 days from factory to factory

- GST will hopefully reduce the logistic timelines.

- Customers love the quality. It is perfect.

- But they cant accept these lead times as they need to change store displays very very quickly.

Biggest competitors

Asia - China and Vietnam (garments)

Europe - Morocco and Turkey (fabrics)

RM Inventory cycles:

- Polyester - 20 days

- Viscose - 40 days (have to store dyed viscose from Grasim)

- Wool - 90 days (since it is imported)

- Inventory is FIFO method

Valuation

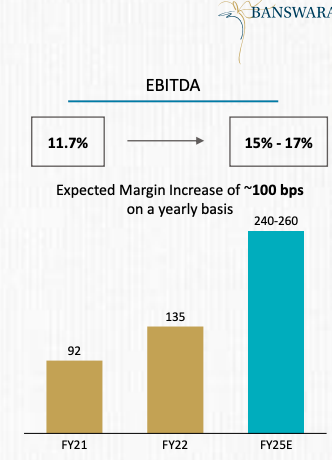

Considering the below 3 factors, there is a potential of re-rating if the mgmt delivers on changing the product mix:

- Even if there is no further growth (Additional revenue growth is a bonus)

- Deleveraging of long term loans leading to reduction of interest outgo.

- Higher contribution from Fabrics/Garments leading to increase in EBITDA margins to 16% which is the target of the mgmt. This should translate to increase in RoCE.

- Increasing contribution from Japan/S. Korea through Takisada marketing tieup & Europe through Riopele tieup.

Risks:

- Dependence on Crude Prices since PSF constitute key RM. Wool is imported. Fuel costs for thermal power plant since the feedstock is imported coal and petcoke. Viscose is 100% recyclable procured from Grasim making it a single supplier risk.

- Lengthening of lead times can affect customer relationships especially the Fast Fashion clients like ZARA.

- Regulatory risk. Need to see how the replacement of MEIS with RoDTEP will affect the export incentives.

- Labour risk especially with the Yarn & Fabric plant in Banswara. Faced some issues during demonetization with absenteeism and overtime pay. Could aggravate if efficiency improvement continues.

- Diversification into Direct Retail venture which mgmt has indicated that they are not prepared to venture at least for next 2-3 years.

- Foray into a new capex phase with additional debt for setting up fabric/garment mills in overseas locations such as Ethiopia.

- Further decline of revenues which were stagnating between FY14 to FY18 along with declining margins.

- Forex risk. Turkish lira devaluation affected some of the sales to European customers who were getting a cheaper product with same quality from Turkey.

Sources

Concall Transcripts, Annual Reports

Mr R L Toshniwal - Chairman & MD | banswara-syntex | Banswara Syntex Ltd | Face2Face | Fibre2fashion.com

Ravi Toshniwal - MD of Banswara Syntex Ltd, Face2face interview with Fibre2fashion

Print this story

https://www.birlacellulose.com/pdfs/media/Viscose_Naturally.pdf

https://cdn2.hubspot.net/hubfs/2115505/events-insights/R-Vue-Report.pdf

Industry Ranking | FAST RETAILING CO., LTD.

https://www.youtube.com/watch?v=yY_cRGsa_s0

SoundCloud - Hear the world’s sounds

Disclosure: Invested >10% of Portfolio over last 2 months. Not a SEBI Registered Analyst. Not a Buy/Sell/Hold Recommendation. Please do your own due diligence.