Azad Engineering A stock picker’s dream!

A huge TAM, sustainable long-term growth, high margins, significant entry barriers for competition, massive order book and predictable revenue for years to come - what more could a stock picker want?

Are you thinking of low valuations? Unfortunately, that’s not available.

Even though the stock isn’t yet a darling of the market, evident from low FII/DII holdings, and few institutional investors participating in the conference call, the valuations for this ideal business have sky rocketed, perhaps excessively in my opinion.

But the quality of the business demands it to be on the top of our watchlist.

Lets dive deeper into the business of Azad Engineering.

Introduction

Rakesh Chopdar, founder of Azad Engineering, is a first generation entrepreneur, started with just a single computer numerical control (CNC) machine in 2008 and since then this company has gone on to manufacture products which are used in Sukhoi, Brahmos and Boeing 777!

Azad has been in operations for 15 years and we have substantial experience as a tier-1 supplier of high precision forged and machined components. Azad has approximately 45 qualified manufacturing processes and 1,400 qualified parts and components wherein the qualification of each product can take upto 30-48 months.

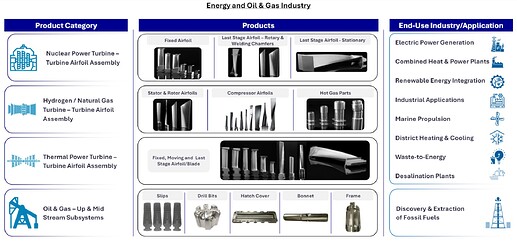

Their products include 3D rotating airfoil/blade portions of turbine engines and other critical components for -

(a) Gas, nuclear and thermal turbines used in industrial applications or energy generation;

(b) Defence and civil aircrafts and spaceships.

Airfoils, constitutes the 70%+ sales for Azad, are the curved or flat surfaces on aircraft wings or other structures that help generate lift or propulsion by interacting with the air and these are highly critical for the performance of a turbine engine.

Fuel efficiency of a turbine is highly dependent on Airfoils and minor deviations in design could lead to significant detrimental impact on fuel consumption. These are the parts never seen in India before Azad and their competition for their product line is with the US, China, Europe and Japan.

Serving gas and nuclear based power plants to aircraft manufacturers, Azad’s high-precision, mission-critical components meet a “zero defects per million” standard, and has made the company a vital link in the global supply chain.

Given the highly regulated industries, Azad enjoys a large addressable market, long-term relationships with high customer stickiness and a high percentage of repeat business, which allows them to have long-term contracts, a stable customer base and strong visibility on long term revenue.

Azad Engineering debuted on the stock exchanges in December 2023, raising Rs. 240 crore through a fresh issue at Rs. 524 per share, alongside an offer for sale (OFS) of Rs. 500 crore. From the Rs. 240 crore raised, the company plans to allocate Rs. 138 crore for debt repayment, Rs. 60 crore for capital expenditure, and the remaining funds for general corporate purposes.

Business Mix

- Energy, Oil & Gas (84% of FY24 revenue, YoY growth of 30%)

- Azad Engineering Ltd. supplies critical components to the manufacturers in turbine

manufacturing industry and drilling equipment to the oil & gas industry. - Azad’s customers control ~70% of the gas turbine market globally.

- Azad’s customers in Energy, Oil & Gas sector include:

- Schlumberger Limited

- Baker Hughes

- Halliburton

- NOV Inc.

- RPC Inc.

- Azad Engineering Ltd. supplies critical components to the manufacturers in turbine

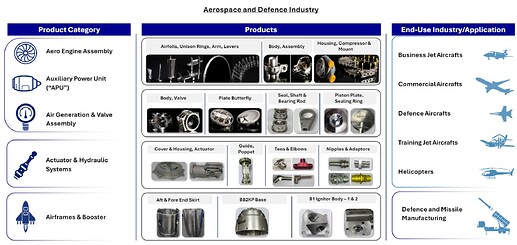

- Aerospace and Defence (13% of FY24 revenue, YoY growth of 95%)

- Azad supplies critical components to major commercial aircraft manufacturers such as B737, B737 Max, B747, B777, B777X, A320, A350, A355, A350 XWB, Gulfstream G550 and are currently in discussions for supply of components for new engine platforms to various kinds of aircraft manufacturers.

- Azad’s customers in A&D sector include:

- The Boeing Company

- Airbus SE

- Collins Aerospace

- Eaton Corporation Plc

- GE Aerospace

- HAL

- Honeywell International Inc.

- Lockheed Martin Corp.

- Safran S.A.

<aside>

💡 Management on A&D Business: “In the coming years, we expect aerospace business to contribute to our revenues on par with energy segments with oil and gas coming in second.”

</aside>

Financials

Link to excel sheet - https://1drv.ms/x/s!AqrzD636mr9hgocNtEtusIRgpovQ9Q?e=mgwqwc

Key Takeaways:

- Growth: The company has shown robust revenue growth at a CAGR of 44% growing from Rs. 123 Cr in FY2021 to Rs. 341 Cr in FY2024, indicating successful expansion and investment strategies.

- Profitability: The growth in revenue has lead to the operating leverage. Gross margins have improved significantly from 63.7% in FY2021 to 88.0% in FY2024, suggesting better cost control and operational efficiency. EBITDA margins have also improved from 22.9% in FY2021 to 34.2% in FY2024, reflecting the company’s ability to manage expenses effectively. EBITDA has grown at a CAGR of 61% and PAT has growth at a CAGR of 72%.

- Investment: The company has been consistently investing in fixed assets (Property, Plant & Equipment), which have increased from Rs. 121 Cr in FY2021 to Rs. 255 Cr in FY2024, indicating capacity expansion and a focus on long-term growth. Company plan to increase the its capacity by 10 times over the next 4-5 years.

Current assets, particularly inventories and trade receivables, have increased significantly, suggesting higher business activity and growth. - Borrowings: Company has significantly reduced borrowings from Rs. 301 crore in FY21 to Rs. 37 crore in FY24. Company used Rs. 120 crore from the IPO proceeds to pay of the borrowings.

- Cash Flows: Operating cash flows have been positive in FY2021 and FY2022, but negative in FY2023 and FY2024, potentially due to working capital requirements for growth.

Overall, the company is experiencing rapid growth and expansion but needs to address operational cash flow management to ensure sustainable financial health.

Addressable Market

The global energy turbine components market for industrial and energy generation was Rs. 283 billion in FY2022 and is expected to remain stable by FY2027. In FY2023, Azad supplied to customers controlling about 70% of the gas turbine market.

The aerospace and defence components market was the largest at Rs. 990 billion in FY2022 and is projected to reach Rs. 1,530 billion by FY2027, with a CAGR of 9%.

The drill bits market was Rs. 280 billion in FY2022 and is expected to grow to Rs. 340 billion by FY2027, with a CAGR of 4%.

The total addressable market (TAM) for all critical parts in which Azad operates is approximately USD 28 billion, with Azad currently holding less than 1% of this market. This indicates substantial growth potential for the company. Despite the overall slow growth in the industries Azad serves, the company’s low market share presents a significant opportunity for expansion. By leveraging its existing capabilities and relationships, Azad can increase its penetration in these markets. This potential for growth is further supported by the increasing demand for specialized components, particularly in the aerospace and defence sectors, which are expected to see robust growth in the coming years.

Entry Barriers

I’d like to share a few reasons why we believe in companies like Azad Engineering and the potential manufacturing prowess that India could develop if we focus on it seriously.

First and foremost, product quality is crucial. We’re talking about a zero parts-per-million defects requirement. These products are used in highly critical and expensive applications, so they must be nearly perfect. Achieving this level of quality isn’t just about having advanced machines; it requires a unique blend of expertise, innovation, quality, and advanced safety controls. Adherence to delivery timelines is also essential—delays can result in significant penalties.

This high standard separates the wheat from the chaff.

Additionally, with increasing geopolitical risks, OEMs closely monitor supplier locations, and India is becoming a strategic procurement destination. Quality remains paramount, but pricing is also a significant factor. Indian suppliers are 20-30% cheaper, which is a considerable advantage.

However, breaking into this industry is no easy feat.

The entry barrier is high due to a lengthy qualification process for energy components, taking 36-48 months to qualify as a supplier, not to mention the time and resources needed to establish manufacturing infrastructure and facilities. Once qualified, substantial investment in design, manufacturing, first article inspection (FAI), and testing and certifications is required.

Similar to the semiconductor industry, the global supply chain in critical sectors like Aerospace and Defense is controlled by a few key players. Control over the supply chain is critical due to the zero tolerance for error. OEMs and Tier 1 players prefer suppliers who can consistently meet production schedules.

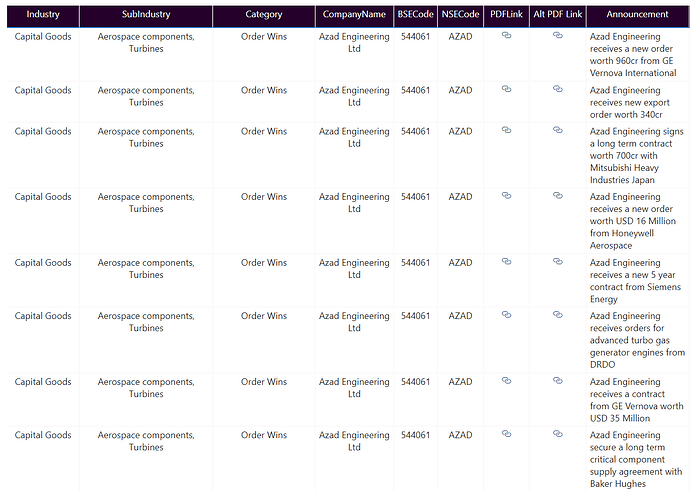

Securing a recent long-term contract with Rolls-Royce, along with being a critical component supplier to Airbus and Boeing, is a significant achievement for Azad. The company has successfully integrated into the tight-knit supply chain of complex component manufacturers for these major players.

Moreover, given the 3-4 year investment by OEMs in the qualification process, they are reluctant to switch suppliers due to high switching costs. They only switch if the current suppliers fail to meet quality, cost, or delivery requirements.

Azad Engineering believes that it would take a new entrant in the industry approximately 15-20 years to achieve their current market position. This head start is a significant advantage for Azad and others already established in the industry.

Customer case studies

- Recently we have partnered with and have entered into a long-term supply agreement with a global OEM which has engaged us for the manufacture of critical rotating parts for nuclear energy turbines. We have received a qualified status from this company pursuant to us satisfying the stringent technical and safety requirements which act as a high-entry barrier for players in this industry. Despite the significant expenses associated with qualifying this manufacturing partner, we have demonstrated efficiency pursuant to machining time reduction, which we believe is our competitive strength against manufacturers from China, Europe, USA and Japan.

- We have initiated a dedicated facility for Mitsubishi Heavy Industries, Ltd. to manufacture airfoils/ blades and other products, a testament to our relationship with this customer. Our Company and Mitsubishi Heavy Industries, Ltd.’s journey commenced in 2012 with a few machines, progressed to an exclusive bay in one of our current manufacturing facilities, and is now evolving into a forthcoming manufacturing facility being setup exclusively for this customer. This facility will be a part of our Company’s upcoming ‘Centre for Excellence and Innovation Centre’. Currently, we manufacture and supply airfoils/ blades and other special machined parts for Mitsubishi Heavy Industries, Ltd.’s gas and thermal energy turbines. We have also received a “Certificate of Appreciation” award from Mitsubishi Heavy Industries in Financial Year 2022 for our efforts and performance.

10x Incremental Capacity

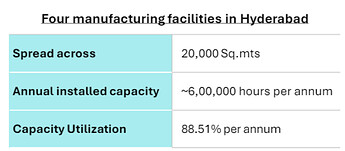

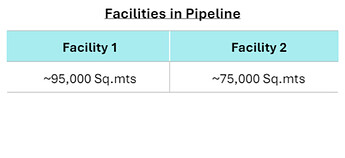

Azad Engineering operates four advanced manufacturing facilities in Hyderabad, Telangana, covering 20,000 square meters. They plan to expand with two new facilities in Telangana, expected to increase their capacity tenfold!

Crucially, these expansions will be financed through internal accruals, despite current negative operating cash flow. This will be a key point to monitor as capital is deployed. For the first phase of expansion starting in FY25, Azad has allocated Rs. 120 crore from IPO proceeds.

The new facilities will feature dedicated production lines for specific customers, focusing initially on producing critical and complex components like airfoils/blades for gas and thermal turbines. Mitsubishi Heavy Industries, Ltd., a longstanding client, will be among the first to benefit from this setup.

Azad also plans inorganic acquisitions to enhance their facilities and offer value-added services. A recent acquisition has led to a subsidiary that will reduce dependency on third parties and lower inventory build-up.

Currently operating at 80-85% capacity, Azad has surpassed its internal topline growth targets in FY24. With a robust Rs. 3200 crore order book (Rs. 1700 crore from Aerospace & Defense, Rs. 1500 crore from Energy/Oil & Gas), management is confident of achieving 25-30% topline growth and 30-35% EBITDA growth, with a 35% EBITDA margin in FY25.

Further, management sees FY26 as a pivotal year for Azad. With the strong revenue visibility driven by contract-based business, they believe the company is poised to outpace its current growth rate of 30-35%. Strategic use of IPO proceeds has fortified the balance sheet, setting the stage for significant capex that will drive this inflection point.

As the product mix shifts towards high-value-added offerings and interest costs decrease, Azad is well-positioned for an EPS surge from FY26 onwards. The combination of strategic investments, robust order visibility, and operational efficiency will make FY26 a transformative year for Azad Engineering.

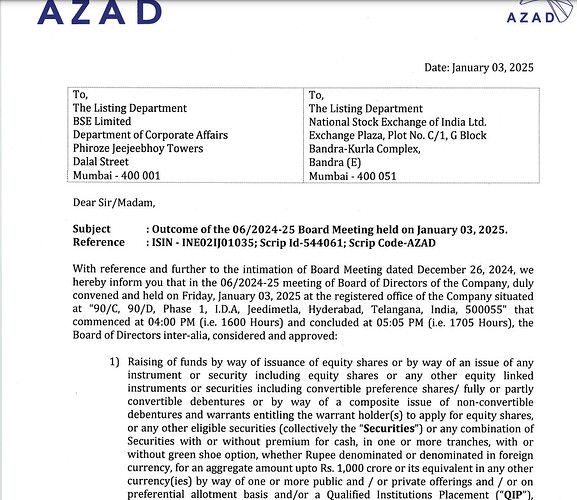

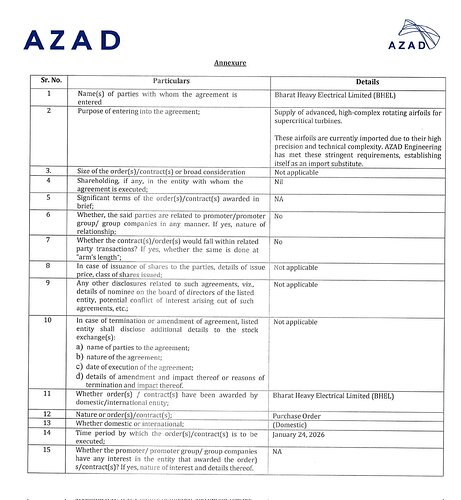

Recent Order Wins

-

Order from GE for 7 years - Signed a contract with the Steam Power business of GE Vernova for the supply of high-complex rotating airfoils for Nuclear, Industrial and Thermal Power industry. This transformative collaboration brings a phase 1 agreement that is valued around USD 35 Million for a period of 7 Years.

-

Order from Rolls Royce - Signed a 7 year contract with Rolls Royce to produce / supply critical engine parts for their Defence / Military Aircraft Engines.

-

Order from Baker Hughes - Entered into a 5 year agreement with a subsidiary of Baker Hughes. This SSA involves the supply of high – complex and critical components for the Oil & Gas Sector. Also signed another 5 Year supply agreement with Baker Hughes to supply medium-high complex precision machined components for Oil Field Services. This contract and is extendable up to 3 and additional 1 Year terms.

-

Order from DRDO - the Defence Research and Development Organization’s (DRDO) Gas Turbine Research Establishment (GTRE) had issued a tender for the development and production of 20 Advanced Turbo Gas Generator (ATGG) Engines, including spares, within 30 months. This tender aims to engage Indian industry partners in creating manufacturing, assembly, and integration technologies. The ATGG, a single-spool turbojet engine with advanced features, is designed for various aerospace applications, including UAVs, drones, and other aircraft.

And guess what? Azad Engineering has been selected as the sole industry partner, and will deliver the first batch by early 2026. GTRE will provide critical engine components and ready-to-fit parts to support this initiative. Do note that the quantum of this order wouldn’t be huge to move the needle immediately in terms of the order book for Azad or the ’in-limbo’ indigenous jet engine project – but it is a start for both.

Anti Thesis (Risks)

-

Long Working Capital Cycle - The working capital cycle of Azad increased from 179 days in FY23 to 220 days in FY24. Company provides 120-150 days credit to their customers. However management guides towards a working capital cycle of 130-140 days FY25 onwards.

-

High Client Concentration - Azad has a client concentration problem.

But, GE, Mitsubishi, and Siemens monopolize 70% of the industry, while Boeing and Airbus snatch up a whopping 91% of the aerospace market. Finding new customers for Azad is like searching for needles in a haystack.

-

Industry Growth - The energy industry, currently constituting major revenue share of Azad, is not expected to remain flat over the next few years, although Azad only has a 1% market share of the $28 billion market size.

Valuations & Conclusion

I expect FY25 revenue and EBITDA to be ₹450 crore and ₹150 crore respectively, incorporating a 30% growth in revenue and consistent EBITDA margins in FY25, as guided by the management. Given the contractual nature of the business and the criticality of the components made by Azad, the management often has visibility of potential orders to be delivered in advance, thereby providing insight into potential revenue growth.

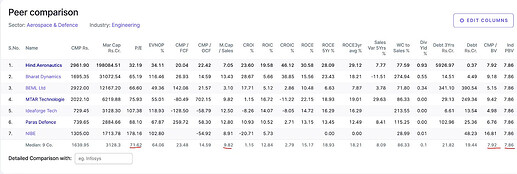

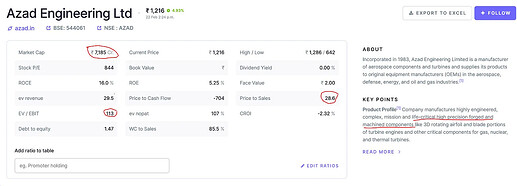

As of June 20, 2024, the company is trading at a forward EV/EBITDA multiple of 77 and P/E multiple of 162, which appears excessive.

The company is guiding FY26 to be an inflection point, with a significant capex of ₹120 crores in FY24. Revenue from the new capacities being built from this capex is expected to be realized from FY26 onwards, resulting in substantial EPS growth. The company has also guided for an asset turnover ratio of 1.5x - 1.7x. Assuming an optimistic scenario, a ₹120 crore capex with a 1.5x asset turn should generate a revenue of ₹600-630 crore and an EBITDA of ₹200-215 crore in FY26.

Thus, based on the FY26 numbers, Azad is trading at 59x EBITDA and 108x PAT, which still appears high in my opinion.

The exorbitant valuation could be attributed to the huge run up in the entire defence theme, and any corrections could present an opportunity to invest in Azad Engineering.

The large opportunity size provides longevity for higher growth rates, and strong entry barriers coupled with low-cost advantages ensure longevity of higher margins. High growth combined with high RoCE for an extended period deserves a high EBITDA multiple, in my view.

Azad may sustain a 30-35% growth rate for a much longer period. Moreover, with a Total Addressable Market of $28 billion and less than 1% wallet share, any incremental increase of 100-200 bps in market share will be a significant topline driver. Additionally, as working capital normalizes, Azad’s return on capital will gradually increase sequentially over time. Commanding gross margins of 82-87% and a strategic focus on targeting complex and critical products make Azad an interesting company to consider.

Disc: Not Holding