100-bagger return in 6 years! Lucknow lads prove their mettle on D-Street

Over the past decade, the Mittal brothers developed a flair for spotting value bets.

Last Updated: Aug 04, 2017, 03.12 PM IST

NEW DELHI: For years, these two Lucknow men burnt their fingers in the stock market; they picked wrong companies in their desperate hunt for multibagger returns, and the ones on which they got it right, they sold out too early!

Today, the Mittal brothers laugh when they talk about that phase; they look at it as learning. Over time, they have grown as investors and made far more money than what they lost back then.

Ayush Mittal is just 33 and his brother Pratyush Mittal, 29. Over the past decade or so, they have developed a flair for spotting potential value bets among smaller companies and made big money on them.

Their father SP Mittal, now 60, has been a full-time stock investor since 1980s.

Based in Lucknow, a hot bed for Mughlai cuisine consisting of dishes developed in Medieval India at the centre of the Mughal Empire, the Mittal brothers picked sea food manufacturing company Avanti Feeds in 2011 at Rs 7 (adjusted price). Today, that stock trades at Rs 1,700, indicating a 24,185 per cent rise in just six years. And it is still part of their portfolio.

Mittals believe collaborative research can guarantee extraordinary returns in the stock market. Anyone with investing discipline and hard work can generate good returns on Dalal Street, they claim.

The two have since created a tool, named www.screener.in, for investors to do their own research before betting on a stock.

Their father S P Mittal himself made it big in his heydays: picking Cipla in 1985 and DLF in the 1990s. He sold DLF in 2007 after its listing on BSE but still holds Cipla in his portfolio.

Ayush and Pratyush are CA by qualification. They have been investing in stocks since their early 20s.

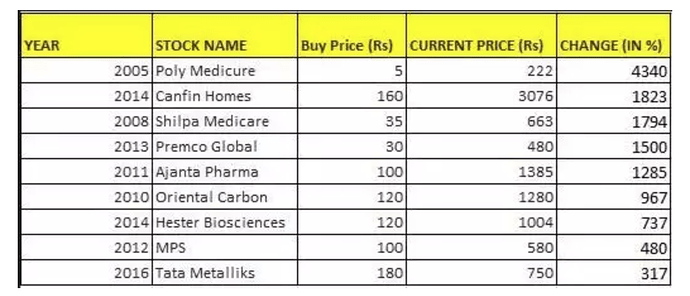

Besides Avanti Feeds, their portfolio consists of stocks like Ajanta Pharma, Poly Medicure, Shilpa Medicare, Oriental Carbon and others (see table).

They invested in Astral Poly at about Rs 25 in 2011 and exited it a few months back at about Rs 425. Today, the stock trades at over Rs 600. The company is a leader in CPVC plumbing pipes and has been a big beneficiary of the switch from GI pipes to CPVC pipes.

ETMarkets.com could not independently verify Mittal brothers’ holdings at present or back then.

Investment strategy

Mittal brothers say they prefer midcap and smallcap companies. They burn midnight oil, trying to identify stocks that can grow at above-normal pace and multiply wealth over time. Usually, such names are not very popular, they claim.

For investors looking for quality business, fundamentals and past track record are important, says Ayush Mittal.

“One has to do some bit of homework, and it is possible to come across promising companies run by some fantastic entrepreneurs,” he said.

And to spot multibaggers, it is essential to understand the underlying business model of a company.

“An investor should look at them like a part owner and try to understand the business and the unique proposition that can drive the company to success,” Ayush said.

Sometimes it is possible to get a quality company at throwaway price due to wrong perception or bad mood of the market, he smirks.

Multibagger returns

The Mittal brothers claim a number of stocks delivered them multibagger returns over the years. Here is a list of stocks that they are still holding in their portfolio.

Advice for new investors

The stock market is like an ocean; it will give you what you seek, says Ayush Mittal.

“You can seek quick money by trading or you can create a lot of wealth by focusing on the longer term and partnering with good companies early. Doing the latter is easier, more knowledgeable and more rewarding,” he insists.

He has a simple tip for new investors. Look around you; most of the products you are using are sold by listed companies. A look at their long-term price charts would tell you that they are massive wealth creators. Look at Maruti Suzuki, Hero MotoCorp, Jockey (Page Industries), Eicher (Royal Enfield) and HDFC Bank – names they grew bigger right in front of you.

“Try to observe good products, businesses around you, check out their financials and if it makes sense, become a part owner when things are in your favour,” says he.

“Don’t come to market with the intention of buying today and selling in a few days, weeks or months. Try to invest in companies for years,” advises Ayush Mittal.

Mittal brothers believe big wealth creation happens when a small or mid-sized company transitions into its next phase. Usually, it happens due to a differentiated business model, focused management and high growth rates. This all can lead to huge re-rating in valuations and create multibagger returns.

One crucial element to look out for is cash flow. Participate in companies that throw out cash. The Mittals prefer companies that have a smaller equity base, do not raise capital from market and have low debt-equity ratios.

For new investors, they strongly recommend Prof Sanjay Bakshi’s blogs at https://fundooprofessor.wordpress.com/

Lessons from failure

They say they met with failure early in life for picking wrong companies that looked great in terms of various valuation ratios, but all of that turned out to be fraudulent or manipulated.

Not allocating enough capital to a stock was another mistake we kept on making in many instances. “In some cases, we sold some excellent ideas too early,” Ayush recalls.