FY19 Q2 Results:

Duty drawback rate increase to boost textile exports from India

Duty drawback rates have been raised by up to 70 per cent across all varieties of textile value chains

again a set of disappointing results. company talks about spending money into R&D and developing specialised yarn and all but that does not reflect in the results.

Textile industry might be going through a rough phase but even Sarla Performance ( a listed peer) gave 15 % OPM.(DEC quarter)

Agreed. Disappointing again. Let us hear in concall when the BCF lines are coming onstream.

Concall Notes Q3 FY19

-

Almost all the capex is done now and the company is at peak debt. Expect debt to be reduced from FY20 onwards. 40-50 Crores of repayment of debt can be expected. No new capex to be done now. Maintenance capex is 5 Crores and another 5 Crores maybe invested opportunistically. In terms of comfortable debt levels- Debt/EBITDA of 2-3x is a comfortable level.

-

Volumes in this quarter were lower, however things have begun to improve. Increase in volumes is a major focus for the company. The volume increase will be driven by the recent capacity increase in BCF, new products, Improvement in Palghar and also to some extent in the nylon polyester segment. The capacity increase in BCF is ~ 60% - of this 60% - half of it is mono colour which is what they have been doing so far. The other half is tri colour , which they are still trying to get new customers to sign up for. Confident that they will be able to utilize the majority of the expanded capacity in this FY

-

This quarter the company saw some inventory losses.

-

Margin levers - Volume increase, Change in product mix, Cost reduction and productivity improvements and reduction in some of the costs which have shot to unsustainable levels.

-

Seeing good traction in the new product segments - industrial, auto, these are doing volumes of 100/tonnes per month. However still very low in terms of overall contribution

-

First focus of the company is to get to double digit margins in terms of EBITDA.

-

The co. Will try to hit 10% ebidta Margins in 3 quarters… meaning by q2 fy20.

-

Promoter may convert the warrants which will give arnd 35 crs. (He says he hasn’t given it a thought as conversion deadline may still be some time away)…so, assuming the co. Maintains same cash levels n uses warrant money also to pay back say 50cr. debt , the cash profit generated for FY 20 may be 15 cr (is that a fair assumption?)…as also 10% ebidta Margins will be hit only by q2 fy20.

Edit: this is wrong actually. 40-50cr. Debt they can pay off through internal accruals since depreciation is a non-cash item.

Disclosure: invested.

-

BCF capacity increased by 60%. Asset turnover of 1.8 iirc over CapEx of 60 cr iirc , meaning 110 cr. Of Annual new capacity in BCF. Also meaning existing BCF was 110/0.6 = 180cr. Of 950cr. Annual Revenue (assuming BCF lines were used at 100% utilisations)

-

If we work with 1000 cr. Revenue , 10% margins n 75 cr annual out-go for interest plus depreciation , we get to 25 cr. PBT.

OPM - 8.66% , seems like EBITDA margins are returning back to low teen levels. Can be interesting once they touch that. With so much of depreciation and interest costs great leverage can play out in the future.

The Company generated a PAT of ~5.86 Cr and operating profit of 71 cr in FY19. It has a debt ~266 Cr. Credit Rating is A from Fitch with a negative outlook.

Unless the company maintains margins, the company may find it difficult to service the debt.

Dividend from this company appears to be quite sometime away.

AYM SYNTEX AR 19 NOTES

Net sales at 992 cr vs 850 cr

EBITDA at 77.5 cr vs 69.3 cr

PAT at 5.8 cr vs 7.9 cr

Export turnover at 35 % vs 32 %

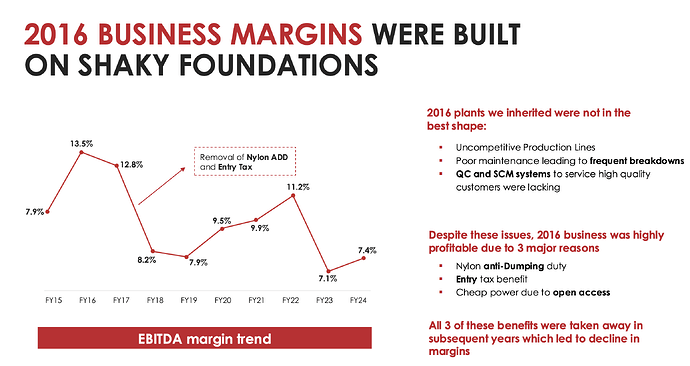

Company facing strong headwinds in last 3 years

Domestic and export demand disrupted due to GST , demonetization, other political factors such as Turkey Coup.

Wildly fluctuating RM prices – tune of 50 % within a quarter also.

Sharp drop in realizations due to sudden increase in domestic supply as well as imports as a result of non-continuance of duties.

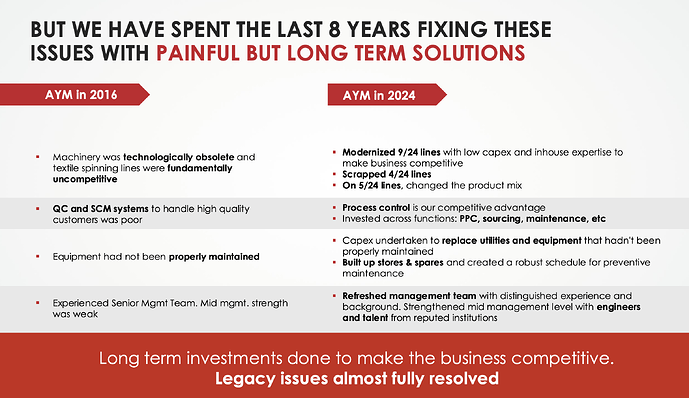

We are improving quarter on quarter with better asset utilization, cost rationalization, improved product mix ,etc.

Our volume of strategic products as well as share of exports have started to contribute to overall share of volumes and profitability.

More than 100 cr capex has been commissioned particularly in IDY, BCF , Cabling & Heat setting new capacity has been added in the form of special industrialized yarns as well as tricolor BCF yarns .

Palghar business performing below potential . can increase through put here by 10-15 %.

Last year BCF capacity increased by 50 % . Capacity remains unultilized here. will be able to fill our lines by Q2/Q3 this year .

Improvement initiatives in Textile Division in Rakholi , can increase volumes here by 10-15 %.

Overall the management believes the company stands at an inflection point.

No major capex planned , so focus will be on debt reduction and generating healthy operating cash flows.

Nylon and Polyester

there was sluggishness in demand as well as volatile RM prices.

There was influx of increase in capacity leading to supply demand mismatch.

Rising power costs in Silvasa has also negated the effects.

Company has increase production in IDY , which will result in better product mix going ahead

Conventional Dyeing

Palghar plant was run well below capacity due to shortage of RM, less domestic demand, frequent power tripping.

Maharashtra Gov has announced power concessions in textile policy , benefit of which will start accruing in FY20.

Company expects disproportionate returns on any incremental sales and production

Bulk Continuous Filament

Capacity expansion by 50 % , entry into new products like Comfeel and dyed Nylon, stabilizing new line expected to directly boost bottomline.

Overall company seems to be an interesting point, where better capacity utilization and healthy cash flows can lead to better margins and better bottomline. Lot of scope of operating and financial leverage at this point.

Disc - Invested

Q2 F20 Results:

Decent growth in operating profits 18.26 Cr to 25.2 Cr

My takeaways

* Nylon was really bad since prices were down drastically. Chinese imports have increased by 200%. In response some lines were converted to polyester. If nylon prices increase again, the lines will be converted back

* Polyester is doing well currently. In fact demand for them is more than supply. They are also outsourcing some production

* Debt was reduced marginally and the plan is to continually do this until announcement of new Capex

* Capacity Utilization rates - Spinning = 90%, texturising = 78%, BCF = 82%

* Palghar sales have been below potential. It's an execution problem by AYM and they are working on it. Sales can increase by 30% and all of it will flow straight to the bottomline since fixed costs have already been covered

Also, like he has mentioned before, we are in a situation of peak debt (all Capex has been done) and peak sampling. Bottomline may increase meaningfully going ahead if one of the following triggers play out

- Palghar doing well (Operating leverage)

- Interest costs going down

- Some new order comes through with all the sampling

- Increase in exports (39% currently). The orders seem more non-commodity here

Disclosure: Invested

Q2 FY21 Results - https://www.bseindia.com/xml-data/corpfiling/AttachLive/68d70325-dd05-4388-95dc-60d710bc4cb1.pdf

Breakeven on QoQ. Not good numbers - YoY.

Looks like AYM has ‘finally’ turned the corner. Revenues are higher leading to operating leverage kicking in. Concall will be interesting to gauge if this growth is likely to be sustainable

Dis: Invested

Q4FY21 Earnings Call notes

-

In terms of tonnage, we did almost 16,800 tonnes in Q4, which was volume terms was highest ever from last all quarters in the past few years, bettering our last next performance, next best performance, which was recorded in Q3.

-

Exports in the March quarter was at INR 132 crores as a percentage of revenue was almost at 38%. On a yearly basis, the exports have increased to 42% as compared to 39% last year.

-

Exports continues to drive profitability. MORM in the Gate stock business was also rated by rising raw material prices in the second half of the business.

-

The EBITDA pattern has also seen an improvement with almost INR 25,000 per tonne in Q4 as compared to INR 19,600 per tonne in the same quarter last year and around INR 22,000 in the last quarter.

-

There was some CapEx incurred of around INR 20 crores during the year, which was partially on the repine plant improvement, operational CapEx and rest on some debottlenecking CapEx to service the future demands.

-

Happy to announce that we have hit record profitability this quarter after having the best-ever quarter in the in general, I am pleased with the shape the business is starting to take, and I’m happy that some of the past initiatives have started to pay dividends . However, at the same time, I would like to caution everyone against extrapolating last quarter’s results .

-

There were a few tailwinds that might or will not continue going forward. Nylon prices have been continuously increasing for the last 6 odd months. Since we are always long raw material relative to customer order backlog, this results in an artificial improvement in profitability until prices stabilize. Demand for export and domestic was absolutely on steroids . As we speak, while exports continue to be strong, domestic demand has been completely annihilated . Our domestic utilizations have been down about 60% or 70% since the end of April. And I don’t think the situation is changing in the next few weeks. This is now a disruption worse than what we saw during GST and demonetization, and demand will get impacted in this ongoing quarter. Unfortunately, a financial year without such drastic demand disruption continues to remain elusive fifth year in a row. That said, the business is heading in the right direction.

-

Our outsourcing strategy for commodity products is continuing , and we continue to build capability through better MIs and systems to manage this additional activity. Product development and commercialization is on steroids right now, and we form a lion’s share of future new product launches at a few of our customers as a result of the launch of several of our patent-pending products in the last couple of quarters. We continue to develop and file new patents. Our operational excellence program is also on in full swing. We had the opportunity to benchmark our key plant KPIs against the competition. And I’m going to be brutally honest. It is a bitter-sweet feeling when I say that we are fairly behind. Bitter because our factory should be running far better than the level at which we are running. Sweet because this presents us with a huge opportunity for some low-hanging food. The good thing is that we already have a direction, and action plan, with the help of which we believe we can bridge this gap.

-

As a result of these continuing initiatives, we can, one, significantly reduce our waste downgrade and left over levels. Two, improve the quality consistency of our products . And three, most importantly, there is a significant scope of production gains that we can achieve by improving speeds, impacting directly on the bottom line without marginal cost or CapEx .

-

Our throughput improvement initiatives are still on track. We started with a plan when we were running at around 60 to 70 tonnes per day in spinning. I’m glad to say that we have touched as high as 90 tonnes per day on a few days in March. I feel that we can increase this further with the initiatives that we have in the pipeline. Our cost initiatives are also on track, and we have begun to realize the impact of this on the profitability, particularly of the Palghar plant.

-

We have also begun Capex, as Himanshu said, in a calibrated manner. We are mainly looking at shorter payback opportunities across the 3 businesses. We are strictly looking at investments where the overall margin profile of the business can improve from the current level. And also, they need to be strategic in nature. Or if the payback is – if they are either of the 2, then the payback has to be lesser than 1.5 to 2 years. We have several opportunities for Capex. We would have ordinarily done, but are deciding to outsource instead as it doesn’t add capability to our organization, nor does it improve the level of our specialization. The idea is to keep finding an upward slope of specialization through the CapEx that we incur and outsource the rest.

-

So while on nylon, we have a tailwind, we have a little bit of a headwind on polyester. But certainly, there were some net benefits which have accrued to us as a result of this nylon price increase. Perhaps this – the reason for – one of the reasons for the gross margin to remain the same. We might have – because of the throughput initiatives, we might have had slightly extra production of the regular commodity products. And that also might have led to, let’s say, the gross margin remaining the same.

-

some updates on the Palghar, how the initiatives on increasing the capacity utilization in terms of the new products being marketed is taking place? And how do you look at FY '22 from Palghar perspective?

-

So we’ve been struggling with Palghar for the last 2 years, 3, 4 years. And in the last couple of quarters, I have mentioned that I think the business is starting to see a turnaround. So both in terms of the cost and the second in terms – on the sales front. So I think in both – on both the angles, I think we will do – even as a business, I think we will do significantly better in 2021, '22 as compared to, let’s say, I will not compare with 2021 because that’s an abnormal year, but let’s say, as compared to '19, '20.

-

The new products that we had launched, again, because of the lockdown now, it slowed down a little bit in the last couple of quarters, but some of the [indiscernible] issues that we had faced until as late as the last quarter, this quarter, we seem to have – after almost 2, 2.5 years, we seem to have come out of some of those issues, and we have a slightly better sense of the quality and what needs to be done going forward.

-

So while the sales are not significant in these couple of new products that I have spoken about last time Ecose and Silkenza. But I am hopeful that they will start picking up. Just like all the other products that we have launched, it’s a 2, 3-, 4-year cycle, sometimes.

-

So even with Comfeel the same thing that happened when we launched 1, 2 years, there was only sampling, no commercialization. And then suddenly, when the program started to come, it became it started coming quite rapidly. So I’m hoping that the same thing happens in – with Ecose and Silkenza and Palghar also. But all in all, I think I’m happy with the direction in which we are headed in Palghar.

-

-

So if we look at some of the other listed players who have announced their results, most of those players are, let’s say, they focus more on the volume products, mainly commodity products where – let’s say, they are high-volume commodity products, which there is no, let’s say, strategic relationship between the buyer and the seller in general. And it’s very price-driven and very, very commoditized, let’s say, in nature. So what happened in that case is most of the margins have come as a result of improvement of the delta. So let’s say, the delta between the melt costs and the delta between their finished goods. So let’s say, the delta between the raw material and the finished good. In most of those commodity players, that delta has expanded. And as a result of that expansion, the margins have come substantially higher as compared to before. So for example, we buy a lot of POI, polyester POI for our Palghar plant. Now if you look at pre-pandemic, the margin between the, let’s say, the melt cost and the finished POI, used to be, let’s say, between INR 6 and INR 8 a kilo, which has gone to almost INR 20, INR 21, INR 22 a kilo in the month of March, which is now down to, let’s say, INR 4 or INR 5 a kilo as we speak currently. So I believe and it is arguable, but I believe that INR 20 to INR 22 to that’s not a sustainable price at which people are going to continue to sell POI,

In our case, that proportion of the business is extremely small. So the only part where we get that kind of benefit is the nylon part .

-

So there is very limited impact of price in our profitability. Most of what we are selling or a large part of what we are selling, we have fixed contracts with the customers. these are customers we’ve been working for many years, and there are fixed – they are more strategic in nature, and they are a fixed business kind of thing. It’s not the kind of business where, let’s say, for a [ $0.01 ] or [ $0.02 ], they will count at a different supplier. So there, you have a long-term kind of agreement, and you don’t – you’re not able to take advantage of these short-term demand supply gaps that come up, which you’re able to do in nylon and neither do you want to. You don’t want to be in that position. And we have to also remember that there are a lot of impacts on cost that we’ve had in the last quarter. On the negative side, also like freight and packing material, where all the prices have gone up. And we’ve been able to – we have tried to pass on as much as we could, but we are not always able to pass on 100%, except the raw material. So I think maybe that answers your question of why some of the other commodity players have had wonderful margins and our margins are the same.

-

So whenever you have a period where 1, 1.5 months, you don’t sell anything, certainly, somewhere there is a pent-up demand, which fully should come back strongly. So we’ve seen that in demonetization during GST during the sharp volatility that we saw in again, the first wave of covet. And hopefully, now even in the second wave of cohort, we should hopefully see the same if you have 1, 1.5 months, your plan to shut, definitely, the – there is a pent-up demand which comes back strongly, and we are hoping that it will come back in our case also. When it comes with anybody’s guess, but we are hoping that it will come back.

-

I do think that operating leverage has played out. So there is a certain element of improvement of profitability that has already happened. If you compare with the previous quarters. Number two, we must remember that from the base, when we, let’s say, if you look at pre-COVID, let’s say, pre-COVID the average nylon raw material prices were somewhere close to $1,600. Today, that same raw material is roughly close to $2,400. So while the delta in rupee remains the same, but the top line has increased more than what would it otherwise have increased as the raw material prices remain the same. So in effect, what we need to look at is more the volumes as opposed to the sale price because the sale price is impacted by a very volatile oil-based raw material price that fluctuates from quarter-to-quarter. And it’s not entirely accurate to look at, let’s say, the margins on, let’s say, an increased level of raw material and compare it with the margins of, let’s say, the pre-COVID era where the price was almost 60% lower.

-

So tricolor is just one part of the new product development. And definitely, we are utilizing the tricolor line to make tricolor products has come much more compared to, let’s say, the previous quarter. So this quarter, we’ve done some good business on tricolor. And I feel that we’ll continue to do so. We are working on some very interesting products on that tricolor line, very, very unique products. And I’m very, very hopeful of getting a good response from the customers on those products. In general, the product development activity is in full flow and we have a good requirement of sampling requests from some of our customers on these new products. And I’m hopeful that in the next year or 2, at least some of them should be commercialized and see the light of day.

-

so how long is the development cycle of these new products starting from conceptualization of the new products to commercializing and then also getting the clients to validate your technology and your process and your product and then finally achieving commercial sales? What’s the time line there?

-

So typically, it could be anywhere between 3 and 5 years. So the most complex ideas can take up to 5 years. So there are some projects that I had taken up in 2016, which are literally just getting commercialized. So it’s been almost 5 years since we’ve been working on that product.

-

So when you think of an idea, by the time it gets converted in a product, it generally takes at least 1 to 2 years, in this case, it took as long as 5 years. And then you’ve got at least a year to 2 years by when you can show it to a customer, the customer shows interest, calls for, let’s say, a sample of a finished product. He sees the finished product. Then he says that, okay, send me some yarn. You’ll send a bobbin of yarn. We’ll try it out on his sample machine then he say, okay, I like it, please send me a creel load, you send a creel. He’ll run it on his bulk machine. We like it. We’ll take it up with his customer, maybe 50% of the time, the customer will say, okay, it’s a great product. 50% of the time, the customer – his customer will say, no, it has no value. So in that case, the product has dropped the time where it works, let’s say, after that, he’ll say, okay, I want to do a bulk commercial trial, maybe he’ll call for 4 or 5 deals. But then after that, he’ll probably make convert it into a program. So that exercise also could be anywhere not 1 to 2 years, I would say it could be anywhere between 1.0 to even 3 years. and in the meanwhile, sometimes a person in the company will change, you’ll decide, okay, [Foreign Language]. So those kind of situations also can happen.

-

So it’s a very uncertain, long-winded difficult process. In general, I have noticed in my experience when you’re able to bring the cost down for a customer. So let’s say, if you’re offering a product at X rupees. And you’ve developed a new product where by consuming your product, he’s able to bring his cost down. Those get commercialized faster . Where you’re trying to seek a premium. There, it takes a little bit longer to get commercialized. So where you are, let’s say, offering a property, an extra property or you’re offering something that other products are not offering, and you’re expecting him to pay a little bit more as compared to the product that is existing in the market. There, it takes a little longer time to convince and commercialize the product as compared to the others.

-

-

we have – in the last 3 or 4 years, we have launched products where we have developed new polymers. Sorona is an example. While we don’t have any significant volumes, that is definitely an example where we’ve taken a new polymer, which nobody in India was using and put it into a new product that has not been seen before. Or, let’s say, it’s not been seen before by an Indian company. It’s been seen before otherwise

AYM is consistently improving performance and is moving up the value chain specialty yarn products

Few good insights in the latest credit rating report of AYM - India Ratings and Research: Most Respected Credit Rating and Research Agency India

AYM Snntex highlights from the latest credit rating report. India Ratings and Research: Most Respected Credit Rating and Research Agency India

Ind-Ra has affirmed Long Term Rating at ‘IND A’ with a stable outlook.

-

AYM’s revenue increased 14% yoy to INR7,811 million in 1HFY23 (FY22: INR14,915 million; FY21: INR9,474 million; FY20: INR10,280 million), backed by an 8.7% yoy rise in the volumes and an increase in the blended realisation.

-

the company’s EBITDA declined 30.5% yoy to INR517 million in 1HFY23 (FY22: INR1,617 million; FY21: INR914 million; FY20: INR943 million; FY19: INR716 million), mainly due to the higher raw material cost.

-

In 1FHY23 , AYM recorded total sales volume of around 32,683 metric tonnes (mt; 1HFY22: 30,052mt ; FY22: 63,031mt; FY21: 50,031mt; FY20: 55,862mt).

-

The share of exports in the revenue increased to 47% in 1HFY23 (FY22: 45%; FY21: 42% ). Ind-Ra believes the export demand to continue to be strong over the medium term, amid improved availability of containers and moderating shipping and freight costs.

-

AYM’s sales book is largely order backed and the management stated that it typically maintains a two-to-three-month order book in strategic segments, thereby providing near-term revenue visibility.

-

Company’s overall debt level, including accepted letters of credit (LC), decreased to INR3,763 million in 9MFY23 (FY22: INR4,040 million.

-

Capex

-

AYM plans to incur discretionary capex largely in the strategic segments of INR700 million in FY23 . The company had incurred INR600 million for capex as of 1HFY23 (including maintenance capex). The capex would largely be funded by debt and the balance through internal accruals. The management expects the project to become operational in FY24-FY25 as only the required machinery is to be imported.

-

Over FY24-FY25 , AYM plans to incur additional capex of around INR750 million to enhance the capacity further including maintenance capex.

-

-

AYM plans to move into forward integration. The government has approved Production Linked Incentive (PLI) Scheme for the company but the project is at a nascent stage. The company plans to set up a fabric manufacturing plant, where the end-product will be niche activewear . The management expects the project to start in 1QFY24 and will have a gestation period of 18-24 months .

-

The company’s key export destinations include Australia and New Zealand, which account for roughly 23% of the overall exports, followed by the European Union, the US and the UK.