Axis bank is the 3rd largest private bank and is trading at a discount to its peers.

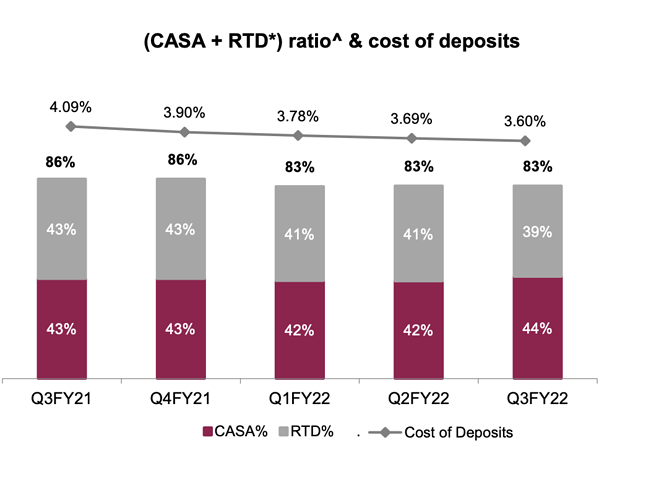

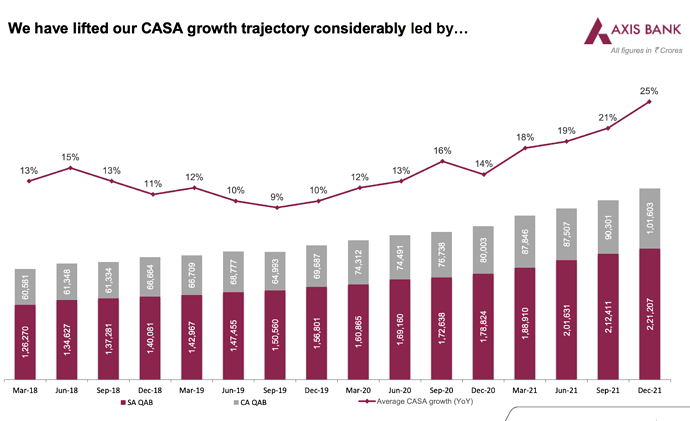

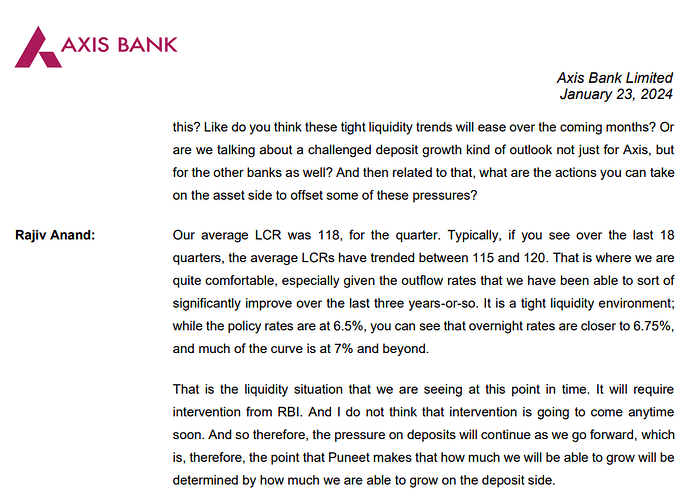

On the liability side their CoF is just 3.6 with a good number of CASA accounts.

The SA accounts have high AMB’s lead by the Burgundy franchise. They tie ups with the armed forces which can be a sticky source of low cost funds

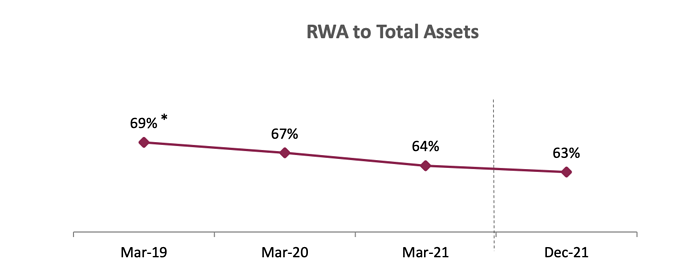

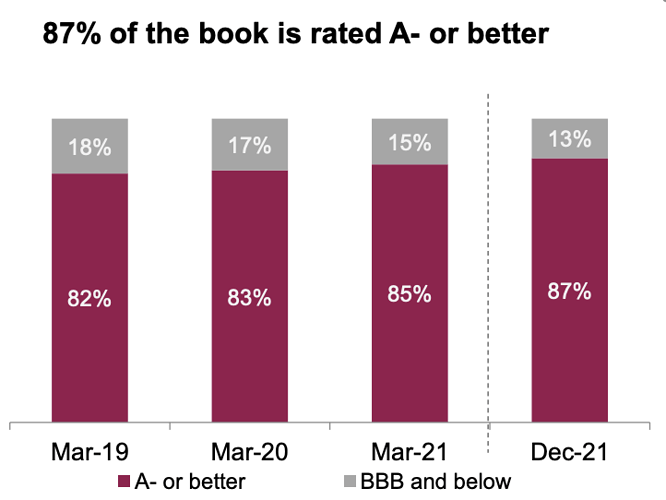

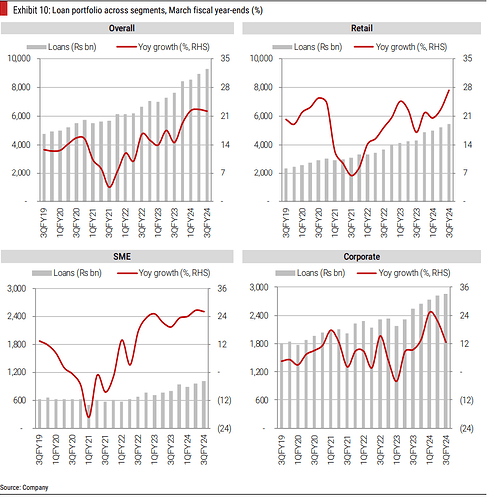

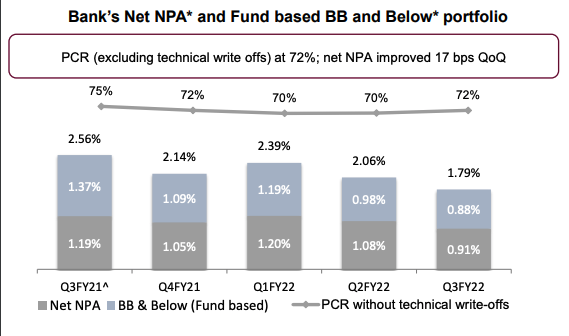

On the asset side they have massively improved over the last few years, the BB and below + net npa pool is now 1.79% and 80% of retail advances are secured. The RWA to total assets have also declined steadily indicating improving safety of lending Retail advances are 55% of total advances. Gross NPA’s are less than 1%, restructured loans are 0.63% of gross customer assets the lowest among top Private Banks and the bank is sitting on 13,400 crs of unutilised covid provisions that will act as a stabiliser to the future earnings

The total assets are > 10 lakh crores and they are well on their was to achieve a sustainable 1.5% RoA which would mean a yearly run rate of 15000 crs in profits. Just valuing this at 2x book (the banks current valuations) would lead to a market cap compounding of ~15%. Also the leverage of the bank is currently ~10x so the assets can compound at 15% as well.

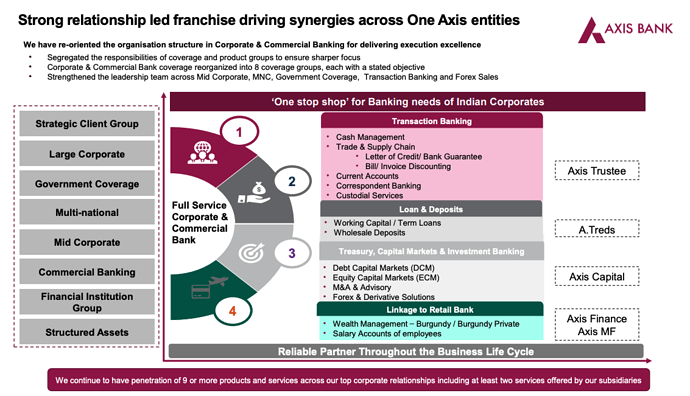

And this is without taking the valuation of the subsidiaries like axis amc, axis securitues, axis finance, A.Treds and axis trustee which in addition to valuation help deliver a seamless one stop solution for both retail and corporate clients and aid in fee income to the core bank.

Currently 3.8% of assets are low yielding RIDF bonds that axis bank holds because they could not meet prior priority sector lending in the past, the gradual run off of these bonds will lead to a NIM expansion. Repo rate hikes will increase the yields on the home loans that are 37% of retail advances.

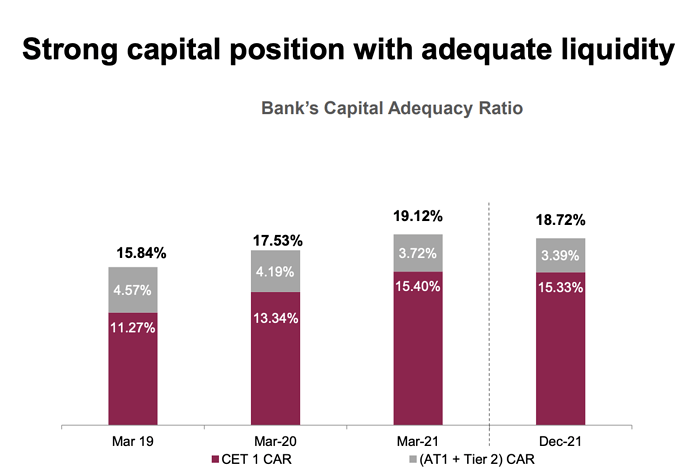

The bank is well capitalised at 15% core tier 1 and 13k crs of excess provisions. This is combined with the fact that axis can raise AT1 bonds domestically and abroad incase needed

In my view the bank is well capitalised and fully ready to take advantage of the capex recovery when it happens. The bank has completely transformed itself from the bank that got into the NPA mess in the mid 2010’s. Mr Amitabh can continue for the next decade. Even without a significant valuation rerating there is good scope to compound at 14-15% over the next decade.

Headwinds:

- Legacy accounts like srei could pose an issue down the

- Government could offload its SUUTI stake at higher valuations

- Without a capex recovery the excess liquidity and capital will drag down RoE’s

sources

Disc invested