Retailers may soon feel the pinch of the trucker’s strike

Not all the companies could be judged by valuations. Looking at the aggressive expansion process and future earnings generated through their business model, I would bet on Dmart for long term. Also mngmnt is a key for trusting this company.

Disc : Invested.

Since the stock is listed 1 year back so no Annual Reports are available prior to 2017 !

The screener has Data for the last 10 years which is the basis of my study !

Cash flow from Operations in last 10 years are 1787 Cr

Total Capex done during the same time is 2774 Cr

Net Free Cash flow is negative around 1000 Cr

Adding to it is the interest payment during the period = 450 Cr which leads to total deficit = 1450 Cr (A)

To fund this deficit , the company took 1480 Cr debt + 1870 Cr IPO Proceeds + 180 Cr of other income which corresponds to 3530 Cr (B)

Net gain (A)-(B) = 2080 Cr

Depreciation accounted around 570 Cr (C)

Overall net flows (A) - (B) + (C) is around 2650 Cr which is invested / remained as 1740 Cr of cash (increase in Cash and eq. in last 10 years) and 900 Cr in Inventory (Increase in same time period) amounting to 2640-50 Cr.

Note: Receivables / Payables figures are not that significant so excluded.

The point is that the business model is very different and these negatives can be ignored here. While in other business models , these factors make one worry about capital intensive nature of business. Here new stores opening will need huge Capex till the time company is growing and expanding into different parts of the country and may bear great fruits in future especially in form of dividends. No doubt on the promoter’s capability too.

But the Net profit margins are very low just around 3% of the sales. Also the business does not have any entry barriers. Too many competitors are there such as Big Bazar , Reliance Fresh , V-Mart and others too may emerge in future ! Online Mall’s is also growing at a good pace. The point i am making is that no matter how good the model is , does this deserves this kind of valuations.

I disagree. Valuations are very much important for any business in my opinion. That defines your returns !

Currently , it’s one of the street’s favorite/most wanted pick so it may be hard to digest my viewpoints !

One of the biggest barriers to etailing in India is the prevalent consumer buying behaviour of “touch and feel.” In the grocery segment, it has a high impact in the way consumers shop. There will be a huge segment of D mart shoppers say the 35+ yr group which will not shift to Amazon Pantry overnight.

Maybe the younger consumers who are more comfortable with online shopping will be the 1st ones to migrate to Amazon Pantry. In any case that was never the core TG of DMart. So, for me the DMart story is still safe for some time.

I also use Amazon pantry however have to buy in local market also due to unavailability of lot of things over there and also, because of delivery times(ranging from 1-3-4 days). Also lot of my relatives who are business men , I ahve observed they like buying in cash (and also look and feel) - they never want to shift to e-retailers. so, in short, the market is so huge , every player will have a BIG opportunity.

I did some comparison of grocery prices between amazon pantry and DMart. Following are my observation…

- Price are 10-12% cheaper in DMART than Amazon Pantry.

- Varieties of Grocery products in Amazon pantry are very less. There are very less options of choosing the best and cheapest.

- For free delivery Minimum order price is Rs 600 for Amazon Prime Member. Delivery fee is Rs 30 for Prime customers and Rs 59 for Non-prime customers.

But my thought is here that How long Amazon continue to bear mammoth losses (year on year) incurred by the company due to their India operation? This quarter Amazon did better in International Operation that is also due to Improved margins in Europe, Japan which help Amazon offset India losses. Indian consumer behavior is very different from other countries due to their food habit . Here consumer prefer ‘touch and feel’ during buying groceries and apparels also.

Good set of results from Dmart again. Net Profit up by 43%. Margins have also improved. Q1-19 PAT margin stand at 5.48%. In Q1-2018 they were 4.83% and in 2018 they were 5.2%. Gross margin has dipped slightly indicating that they are trying to bring down prices further down.

| Item | Q1-2019 | Q1-2018 | 2018 | Growth |

|---|---|---|---|---|

| Revenue | 4573.67 | 3621 | 15081.53 | 26% |

| COGS | 3847.35 | 3041.99 | 12648.88 | . |

| Gross Profit | 726.32 | 579.01 | 2432.65 | . |

| Gross Margin | 15.9% | 16.0% | 16.1% | . |

| EBITDA | 4136.74 | 3294.95 | 13671.56 | 26% |

| OPM | 9.6% | 9.0% | 9.3% | . |

| Finance | 10.02 | 24.33 | 59.41 | . |

| Depreciation | 40.33 | 33.71 | 154.65 | . |

| PAT | 250.61 | 174.77 | 784.68 | 43% |

| PATM | 5.48% | 4.83% | 5.20% | . |

| EPS | 3.96 | 2.76 | 12.41 | 43% |

Best

Bheeshma

They have a moat. Their cost of operations is the lowest which helps in keeping the product prices the lowest. This drives customer loyalty. This is not an easy thing to do - and no doubt that’s the reason they have the highest profitability. Further, they have been successfully scaling with this model with higher and higher profits. Think of the opportunity they have to expand to all-India and it may become a HUGE cash-generating machine going forward. They are already earning close to 800cr profit a yea now. I won’t be surprised if this becomes 10,000cr in next 8-10 years.

Regarding e-commerce, they will also exist i think - but till when they can continue to operate WITH losses. How long they can continue to dole out discounts just to win customers. The day they decided to become profitable(and lessen discounts) - they will see a big shift to companies like DMART - whose prices , lowest prices are sustainable. Moreover, DMART has also started a pilot e-commerce thing - its not that they are ignoring it. Sustainability is the key.

But not all 65% of the population is earning. Stats always hide more than they reveal.

Is Dmart accepting sodexo card payments now? previously when sodexo was issued in form of denominations/coupons…they were not accepting them…and i stopped going to Dmart as i cant use them…

A d’mart is near my home (<2km) but I hardly go there. I will tell you how to beat d’mart prices for most of the month. BigBasket has an ongoing offer of 20% cashback on Citi Cards for the first 5 days of the month. We use two cards on 1st and 5th of the month to stock up except veggies. I save on fuel cost, save at least 1-2 hrs of time which is more valuable for me and avoid lots of pushing and shoving during the billing time. I have a feeling that BigBasket will be a survivor in the online space.

Disc : No holding as of now

What if after say 1 year this Citi scheme(or other eCommerce dole outs) stop?will you continue to be with BB(or other e-commerce companies)? or will you also look for other options like DMART?

I think this thread is being cluttered with the soft-side of business which is very subjective. While Bigbasket does offer some good deals from time to time for the customer, as a business it is piling up losses both at the wholesale and at the retail level (they file separately) at a rate proportional to its growth which means that they still have not cracked the supply-chain.

D-Mart is a brilliant business whose moat is its supply-chain management - the way they maintain their inventory, pay their suppliers on time, get the best prices from the suppliers, ensure quality, pass on the gains to the customer wherever they can and so on. They have great consistency in debtor days, inventory turnover and other return ratios which are enviable in the retail business and they can sustain this growth for a while via internal accruals and some responsible debt if necessary.

Comparing this with cash guzzling businesses that are yet to turn profitable and spelling doom is imprudent - perhaps only someone who has never stepped into a d-mart can write such a premature obituary. I think online grocery shopping via Amazon pantry and Bigbasket may have a niche in tech-savvy shoppers who shop with a list. For the others who can’t care less about poking at the pixels and like to walk the aisles and browse to find what they need, compare the options, touch and feel the product before buying, brick and mortar retail isn’t going away in India at least, anytime soon. A look at the section of the populace that shops in d-mart would affirm this.

With all that said, it isn’t in my blood to pay the valuation it demands.

Here are the things I observed:-

- Dmart prices are lower than Amazon and bigbasket (except credit card offers). Amazon and BB are losing money. It’s like uber and ola in the initial days. After somedays, they will look for profitability.

- Amazon and BB are competing with local stores. Local stores are facing lot of heat with Amazon, bb, more, reliance fresh and dmart.

- The spending by Amazon and BB will help the big stores like dmart. Because the local stores are going away. In Hyderabad, even in small streets also, more is opening outlets in rented places which will increase their real estate cost. But dmart is not having much real estate cost. It can sustain for years.

- Valuation of dmart is very high. The stock price will come down or it will stay at this level only for years if there is no big growth.

Disc : invested at higher levels.

Currently, in my view , the market has priced dmart to deliver an ROE of ~25% going forward.

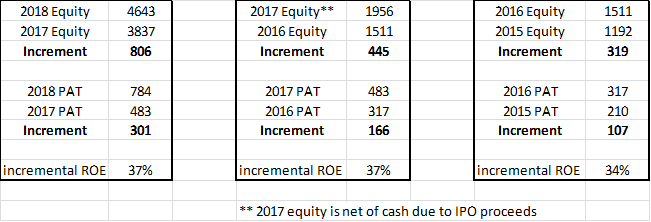

In the last 3 years - Dmart has delivered an incremental ROE b/w 34% to 37%

Given this past record, this is in the realm of possibility and if this record is maintained it may surpass 25% in the coming years too. Ofc all these are projections and extrapolations of past into the future and it may not unfold like that so thats a risk.

I think one should consider these stellar numbers and factor them into valuations.

The basic thesis is that here we have a business which has demonstrably redeployed shareholder capital at 35% return yoy in the past and there is a strong likelihood that it can do so in the future. It may not be 35% or anything like that but to me 25%-30% doesnt look out of line at this point

Best

Bheeshma

Another stellar number is: After owning the store- to generate 100 crore of sales they need only 5 crore of capital. Competition needs at least 40-50crore capital for 100crore sales.

On customer side, existing customers keep repeating and new additions keep happening.

Market share is less than 0.5% - so huge opportunity ahead.

I see a HDFC Bank of early 2000s in this company, where Analysts would always feel it is overpriced but it will keep going up a few percentage points after results and stay expensive.

For anyone who is planning to buy new into dmart should listen to Mr Rajeev , (listen from 15 minutes …) and understand well what you are paying at this rate.

It isn’t that simple. According to Mr. Thakkar’s explanation, to get 20% return you need 5 PE stock (using the EP ratio theory) PPFAS mutual fund doesn’t own even one 5 pe stock and will only own one by chance when a financial crisis hits the world. So these talks are like hathi ke daat, for new folks who want to know the theory. And the theory of anything is good to have a reference , but the flight of practicality tells 5-10 PE is mostly crap or a cyclical in down cycle.

One additional issue I have following Thakkar is their inclination to time the market and keeping cash in hand up to 25-30% . So if you too have or want to have a similar strategy, valuation by theory book is highly recommend, but again he holds Bajaj finance and Facebook etc which seem overvalued in theory as well. My point is there are no rules and those who preach the rules don’t follow themselves.

Here is a challenge - can anyone show a Dmart location listed on google with less than 1000 google reviews and less than 4 star review?

Also Mr. Thakkar talks about competition. So lets find a single reliance store with 1000 google reviews and a 4 star review with that.

I feel its a matter of time DMart overtakes Reliance Retail in revenue. Profits , it might be ahead already:)