These are serious headwinds for the sector as a whole…

@ayushmit - please do share your views on avanti … would be really helpful…

These are serious headwinds for the sector as a whole…

@ayushmit - please do share your views on avanti … would be really helpful…

Its very tough to comment. In very brief summary:

Now one needs to see if this is like a temporary storm for the industry and prices improve in India to international levels in reasonable time or not? If they do then things can improve as the farmer can’t switch back very quickly. The farmers were making very high returns so they can sustain for 2-3 weak seasons. But yes, if very low prices continue, it will become a long term problem for industry.

The feedback from industry people is very mixed - some say things are not that bad (as the area had increased a lot so both processors and feed cos continue to do well, its the farmer who is affected maximum for now) as they come out in media…while some say yes, things are affected. Perhaps the feedback is different from region to region as India is a huge country.

Another problem for Avanti is that the company had got a lot of coverage and valuations were rich and the margins were very high last year and now they are normalizing as RM cost have moved up. But most of the people were aware of it.The problem seems to be the current uncertainty on the future given there are so many negative articles given the volatile nature of the industry.

Lets hear the concalls of Avanti and other peers to get more idea about whats happening.

Regards,

Ayush

Soyameal price is the highest in last 2 years. I feel, given MP election due later this year, Govt will not allow price to fall much. In fact was checking last 5 Years data Soya Meal Price vs Avanti Margin- having a direct correlation with a lag

I read the article in telugu newspaper on what andhra CM said. The power cost has been reduced to 2rs from 4rs/unit. CM also said he asked feed producers to reduce prices and they agreed to it (no more details on that). CM also told the unregulated creation of shrimp ponds everywhere and anywhere is not good. He said it would be good to designate specific places for shrimp ponds.

Disc: tracking. Not invested.

In the month of May prices have fallen around 30+%-very sharp reaction. Will there be a technical bounce? Company is still good but there is panic in the market. Key question is who is buying? Should we take a 3 year view? Lot of questions.Already historical PE is 18-19.How far can it go?

Any views appreciated

Disc-invested forms 11% of portfolio

Hi,

Fundamentally the company looks tempting, now available at 16 PE due to today’s correction (CMP 1550). Quarterly results were not good, however it closed the year very well.

Neartime headwinds are going to be there. Prices have fallen down 30% for the shrimp due to competition from international markets. Pls checck the news snippet.

Disc - Invested in small quantity. Waiting and watching to accumulate more.

Yeah , PE looks good but the question is from where the growth will come from ? Raw material prices up which will lead to margins down and if shrimp prices goes down , revenue may also get affected. So overall , both top line and bottom line will get affected. Do the company would be able to cross current EPS next year ? If not , why market will do PE re rating.

Disc : Invested

Amused by the last paragraph in the newspaper regarding MSP. I had expected this would happen in this post.

Isn’t it interesting that everyone wants to be a capitalist when the going is good and wants to turn socialist when the going gets tough?

Agree with you Rohit.

Unless there is a drastic increase in shrimp prices or raw prices go down sharply, we are never going to see the kind of growth we have seen this year. Sadly, company is focusing on bonus shares and spliting instead of focusing on the business challenges.

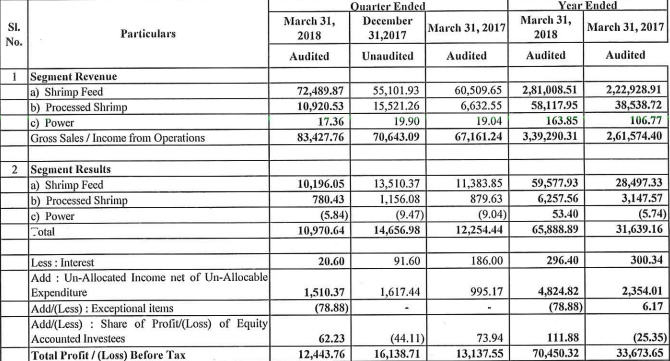

I was checking the segemental revenue, all the streams have shown reducing (shrimps, feeds, power) QoQ and YoY.

Silver lining: Shrimp revenues have improved QoQ and YoY (~ 20%).

It’s trading at 15.55 PE…so d yield is around 6.46 which is almost near the FD rate…d Downside from here is less…give r take 5%…

v vr in this 80%+ RM cost Phase during 09/10…it went till 84% but has survived n grown strongly…let’s d dust gets settled. We might again see bright days again

Here are price trends for Soya meal and fish meal from indexmundi.com.

The data differs from what was said in concall in March. Management said soya meal at that time was 43-44000 per MT, fish meal was 120-125 per KG (both higher than the charts below…it may well be that the transaction price is different)

Below is a very rough calculation for next year, excluding the cash on books of 500cr

Roughly assuming 25% growth in feed for FY19 (Conservatively, because capacity is expanded by 40% and management had guided a 90% utilization if its a normal season), and 600cr for processing (utilization of new plant will go up from 40% to 60-65%), sales could be 4100cr

10% net margin (this was Q4 margin) = PAT of 410cr, 1 year fwd PE at CMP is 17

9% net margin= PAT of 370cr, 1 year fwd PE is 19.2

8% net margin= PAT of 330cr, 1 year fwd PE comes to 21.5

We have to see how the raw material price moves. Let us wait for concall

I had an interaction with the company right now…they were sounding very positive. Feed volumes are as usual , they dont have much problem on the demand side for feed. Feed prices are also constant , no need of reducing the feed prices. Their working capital management is still strict .they dont have to relax their credit terms to support the farmer…so receivables days will still remains tight.

The experienced farmers which are into business since 10 years are not facing great problems as they are still profitable… its the new guys who have aggressively got in taking a debt and paying out huge leases are facing problems. Also they believe such problems are temporary and will get resolved by september ,october.

International shrimp prices have fallen due to extended winter in USA because of which their has been a lower offtake.

The way the market is reacting is as if the industry is coming to an end and shrimp is disappearing from the our planet. This i believe is an extreme irrational behavior from market. Long term perspective still remains intact for the industry and company.

Will be able to get more perspective in the concal.

Disc- invested

Thanks for the update. Did they mention when would be the concall?

Concall will be on 4th june

This type of linear thought process can be harmful!

There has to be some margin of safety for investor. It is common for stocks to correct 50%-60% from their peaks.

He is talking about Earning Yield and not Div yield.

Its a shakedown because of industry headwinds & the fittest will survive. All sector stocks equally down. If you think avanti can’t survive, then do exit!

Thanks for posting the update on Avanti. Can you tell me the time for concal? or is it mentioned anywhere. I checked on BSE and it’s not there.

While taking cognizance of the better looking PE one needs to also note that earnings will probably come down in near term so PE will go higher again.

I think there may be a couple of more quarters of pain but the stock is coming to an price point where risk-reward equation is balanced. It is the best company in a good sector and seems to have much better operating characteristics than the rest of the industry. At slightly lower levels, I would be looking at building a position in this slowly. Long term this has lots of things going for it.

Some good industry data from this Waterbase ppt-

ppt is also acknowledging the recent problems (Page-47)-

Input prices for shrimp feed which remained soft for large part of 2017 have started firming up since the beginning of 2018, the ability of feed producers to pass on price inflation is limited due to heightened competitive intensity and depressed farm gate prices of shrimps

Moderate increase in global shrimp production coupled with increased inventory in US have adversely impacted the farm gate prices during the past few months. While the first crop for farming season 2018 is in progress, sustained weakness in farm gate prices may impact farmer sentiment. However we remain cautiously optimistic and expect the farm gate prices to improve in H2 of FY19