i hav bought at 110 (before d recent fall) and my logic for buying was pre buying before bs6 next year and also d scrappage policy. So planning to hold for dis story to play out.

Can somebody explain how this matches Ashok Leylands operations? Is this the beginning of a diversification play?

Any information available on Ashley Aviation? google returns only AL purchase news.

Some major takeaways from Q2 FY18 Concall:

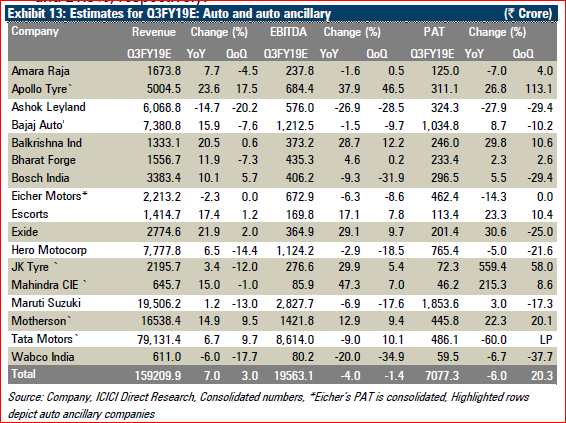

- Total Industry volume for trucks & buses for Q2 was 101768 a growth of 26% YoY. ALL grew faster at 32% with sales of 35628 units.

- Market share: Trucks - 34.3%, Bus - 42%. Overall 35% vs 33.5 in LY Q2.

- Discounting by competitors has been rampant still ALL has been able to win market share and maintain double digit EBITDA margins at 10.6%. This is because of operational efficiency as per Mgmt. ALL increases prices in September.

- There have been some pressures lately like NBFC crisis, raw material price increase & challenges like discounting by competitors. (These issues are likely impacting sales in Q3)

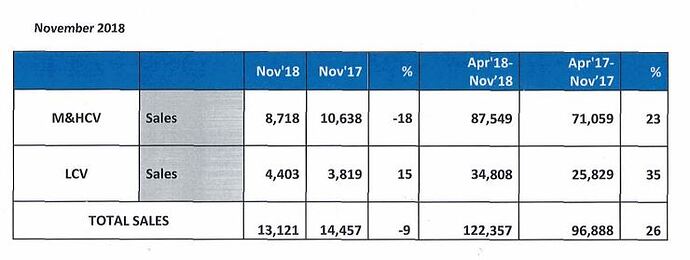

Dec sales:

MHCV : 11K [down 29% from Dec’17 sales of 16K]

LCV: 4K [up 27% from Dec’17 sales of 3K]

Total: 15K [down 20% from Dec’17 sales of 19K]

For the full financial year, Apr-Dec’18, sales for MHCV are up 14% (99k vs 87k) and sales for LCV are up 34%(39k vs 29k).

Total sales are up by 19% for the 9 month period.

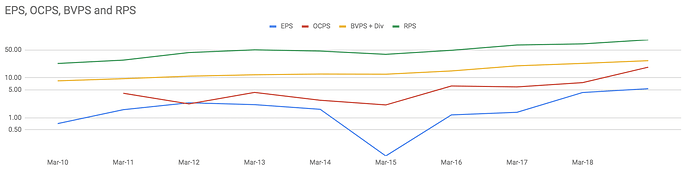

Company’s earnings. operating cash flow, book value+dividend and revenue per share are increasing in harmony over the last 10 years. I’ve seen very few companies able to do that. This shows the company has some competitive advantage.

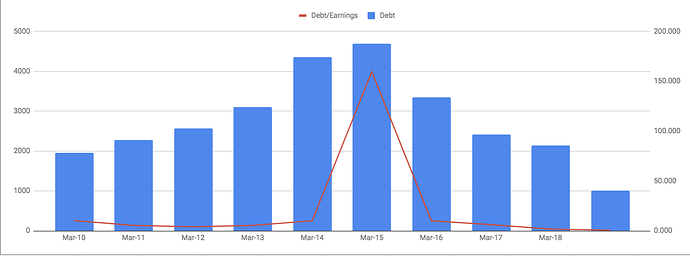

ALL has been a great manager of debts. Every time there is an increase in debt, it has been complemented by an increase in earnings.

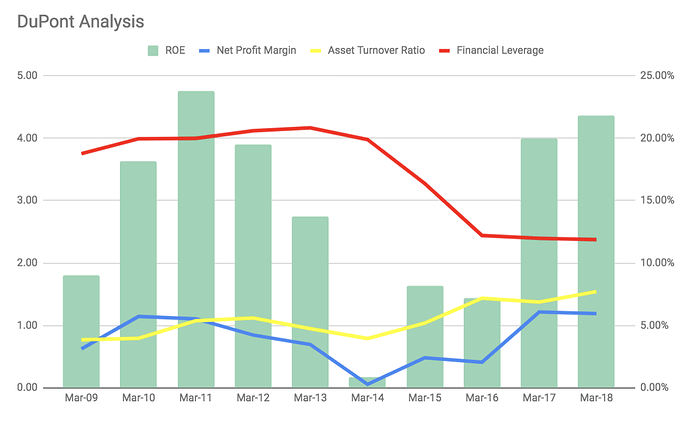

ALL’s ROE has been increasing by lowering debt and increasing asset turnover along with net profit margin. Kudos to the management.

The worries about the recent change in regulation, CEO step down and other factors have brought the price to an attractive level. I think ALL is a pretty solid company by looking at the numbers. You can do a lot worse than this.

Let me know what do you guys think?

The Hinduja group has an excellent reputation as management…the turnaround of the company has been excellent…In next two years main attraction towards automobiles is introduction of BS 6 and scrappage policy proposed by the government…

Also the truck business is closely related to infrastructure sector and India has huge miles to go in that direction…the untouched sector is the defence sector where they have a major participation in India…

I think the current price can be a great Entry point with a really long term perspective of 5 years…

i have started collecting at 108 and further added at 100…now looking for 92…

Hi,

Although the introduction of BS 6 will increase the sales for the year, but then it will already be discounted by the market. Plus this will be one time inorganic growth. It may be followed by the slump in subsequent years.

Is there any previous observation or data with respect to it?

Regards

Priyank

If you follow the concalls , the management has been citing the examples from Europe and other countries where BS6 has been introduced…

Wrt discounting by market, I have my doubts because prices have corrected from 160 to 100…

But in the long term it’s the infrastructure story which should sustain the growth…

In the short term, the uncertainty of next government and their policies along with the new axle norms coupled with exit of management and slump in sales due to increased interest rates, insurance premium will deteriorate the growth rate for automobiles

I have 40pcnt allocation towards automobiles and ancillaries…and these views are supported by my equity adviser

Success of last 5 years must be credited to Vinod Dasari and the team. Cut debt, doubled down on product innovation, abstained from competitive discounting done by market leader, diversified well and is still continuing, international foray, defense foray and the list goes on. The results clearly show.

And credit must also go to Hinduja group for creating an enabling team & giving them maximum autonomy+incentives.

My faith is again in Hindujas to select a capable new CEO who can carry on the journey of growth for ALL.

Obviously a CV players is heavily dependent on economic growth, infra growth, construction sector growth etc but I don’t see India’s growth in these sectors slowing down terminally. There is simply too much infra activity yet to come in the country’s towns and cities. There might be temporary slowdowns due to a variety of reasons like the liquidity dry up etc but these don’t affect the secular growth story.

Plus the mgmt’s diversification efforts have clearly shown results particularly in the LCV space.

In my opinion there’s no reason to be pessimistic about the company unless something fundamental changes.

Disc. : Invested

They also increased stake again in Ashley aviation which now stands at 89pct. Can somebody confirm the nature of business and whether it is a Hinduja group company?

Positive commentary from Mr. Dasari

So expected muted growth in Q3’19 already started to reflect in the declining price of ALL? In spite of positive news coming like recent order win, positive guidance for FY20 growth, it is not supporting price decline, is something else is adverse news is playing out on price part, which market knows better? It is now near to its 52week lows.

I-Sec estimation for other Auto & Auto Ancillary companies for Q3’19.

To the best of my knowledge, company deals in aviation insurance.

I don’t mind if a couple of quarters are bad when we know that the factors are mainly external (apart from the CEO stepping down).

No company can keep on growing at 20% forever and there will be slight bumps on the road.

Plus, it’s not just ALL but the entire industry is underperforming at the moment, be it 2 wheelers, passenger vehicles, other cv players or auto ancillaries.

There are challenges in terms of raw material cost, maintenance costs, vehicle financing challenges due to liquidity episode, competition from EVs, rising petrol/diesel cost, change in truck load norms etc.

As long as these challenges persist, company results will underperform but that is a temporary opportunity offered to long term investors in my opinion.

If EVs are emerging, then wouldn’t the price of oil decrease? Lesser demand for oil makes the price come down benefiting industries dependent of oil?

Well I like ALL for all the reasons you have summarized in your initial posts. Also I concur with your view points about current challenges.

However I will wait for sometime to see some signs of improvement and easing out of sector headwinds. I do understand that its not very easy to time the market and price.

Currently I’m concentrating on growth stories having very good strong fundamentals, which are still having some room to continue the growth trajectory available with reasonable valuations.

Thanks for your viewpoints.