In my previous article on #InvestingBasics, I wrote about RoCE — a metric that can tell you a LOT about a company.

While writing the article, I came across Arkade Developers — a player in the real estate space which displayed some jaw dropping return ratios — especially for a player in the real estate space, which is characterized by high capex and low returns.

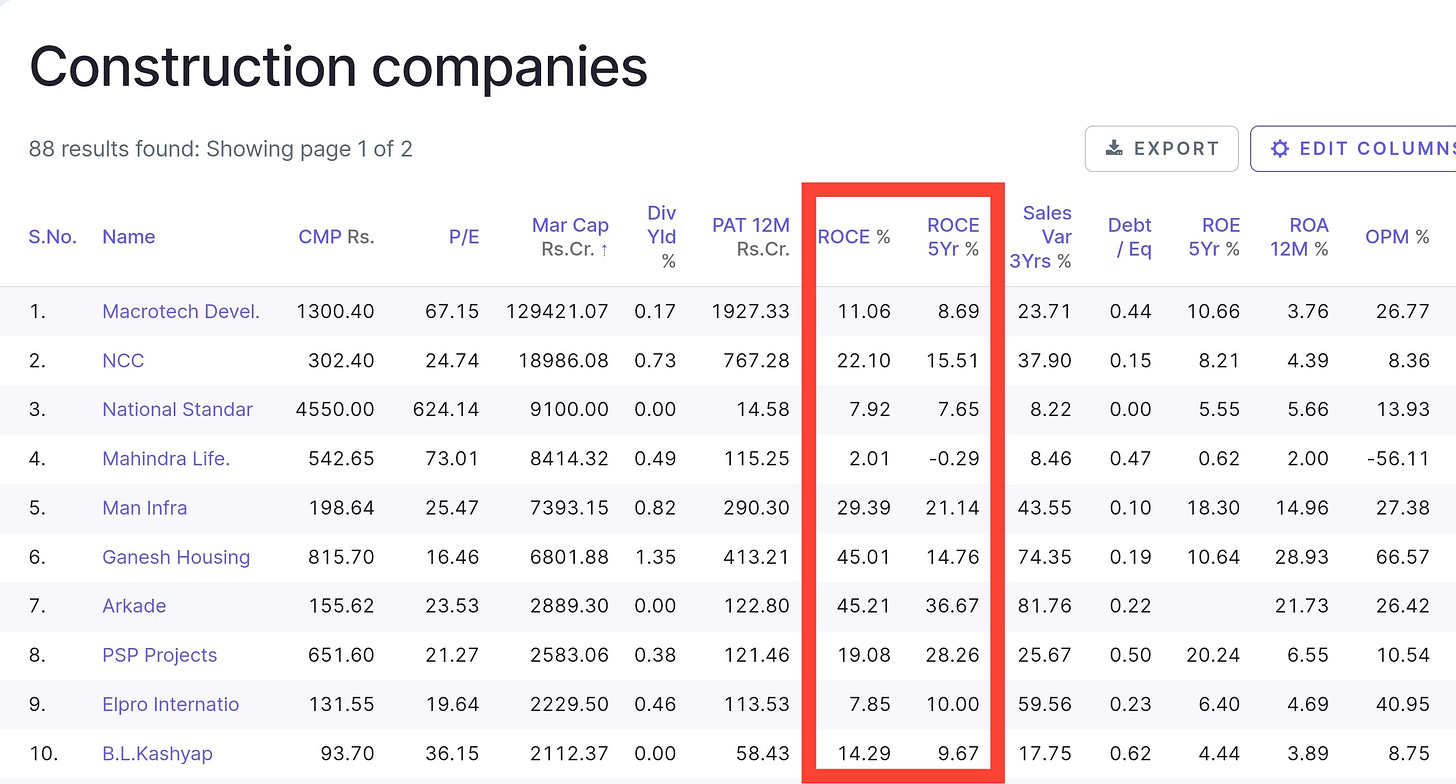

Peer comparison of construction companies [Source: screener.in]

If you look at the 5Y RoCE of Arkade, it is a staggering 36% — which is quite impressive for a real estate player — because this is a business which requires a LOT of upfront money and in some cases, projects get stalled or delayed, which affects the cash generating ability of companies in this sector.

One of the biggest listed players — Macrotech Developers (part of the Lodha Group) has a 5Y ROCE of [just] 8.69%. So, by looking at the chart above we can deduce that Arkade has a record of impeccable execution & deliveries.

It’s possible that because Arkade is undertaking only limited # of projects — it is able to maintain such stellar execution. Is it sustainable if Arkade scales up and finds its working capital spread thin? A more important question is, can Arkade scale up amid intense competition?

If it can grow at the same levels of RoCE, there’s a lot of shareholder wealth that it can create in the future. So, let’s understand how Arkade makes money ![]() .

.

The Business

Incorporated in 1986, Arkade Developers is a real estate company focused on development of premium lifestyle residential projects in Mumbai.

Some of the projects by Arkade Developers. [Source: Arkade’s website]

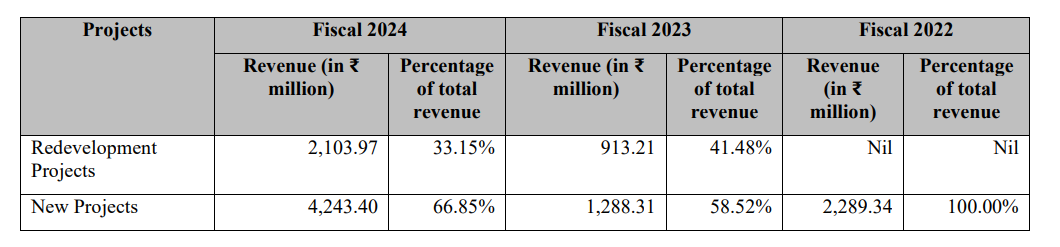

It’s business can be classified into two segments:

- Development of residential premises on land acquired by the Company [New Projects] — which contributes around 67% of topline.

- Redevelopment of existing premises [Redevelopment Projects] — which contributes around 33% of topline.

In this, Arkade enters into redevelopment contracts with housing societies.

Breakup of revenue by segment [Source: DRHP of Arkade]

Some other business statistics:

- Arkade has developed 2.20 million sqft of residential property as on June 30, 2024. Between 2017 to Q1FY24, the Company has launched 1,220 residential units and sold 1,045 units in Mumbai (MMR Region).

- In the last 10 years — completed redevelopment of 10 projects in western suburbs of Mumbai + 1 project in South-Central Mumbai.

- The residential projects it undertakes are generally 2BHK / 3BHK units and includes aspirational life-style amenities.

- It has developed projects at varying price points ranging from INR 1.03 Cr to INR 5.8 Cr.

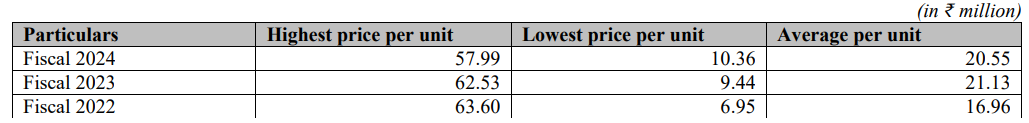

Movement in price per unit over the years [Source: Arkade DRHP]

Buying a home in Mumbai, remains a dream for most of the people living in the city. You can see from the table above, that the minimum price per unit has been inching upwards — a STAGGERING 50% increase from Fiscal 2022.

The Business Cycle

For any real estate developer, the most crucial step is acquisition of land parcels on which to develop a residential / commercial property. This is extremely tough to do in a city like Mumbai, where space is VERY limited.

This is why, most developers also undertake redevelopment projects.

Cycle: Land acquisition > concept design > MCGM approval > RERA registration > Site development & construction > marketing & sales.

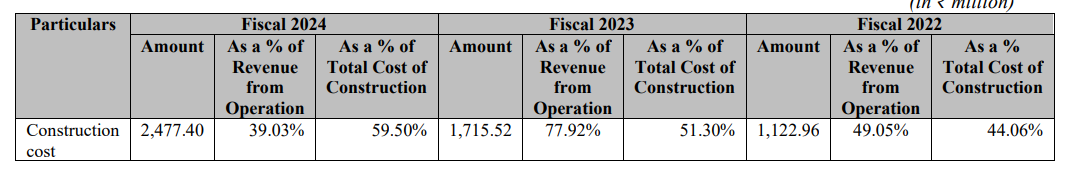

Construction costs towards procurement of raw materials like sand, cement, bricks, steel bars, doors, glass, fixtures & interior fittings form majority of the costs. Increase in inputs costs could negatively impact margins.

Construction costs of Arkade Developers [Source: Arkade DRHP]

The Tailwinds

Now that we have a grasp on the B-model of Arkade, let’s try to decode how it was able to generate such supernatural returns in the construction business.

- Good execution of projects — in the last 20 years, the Company has completed 45 projects (inc. through joint development arrangements) aggregating > 4.5 million sqft catering to > 4,000 customers.

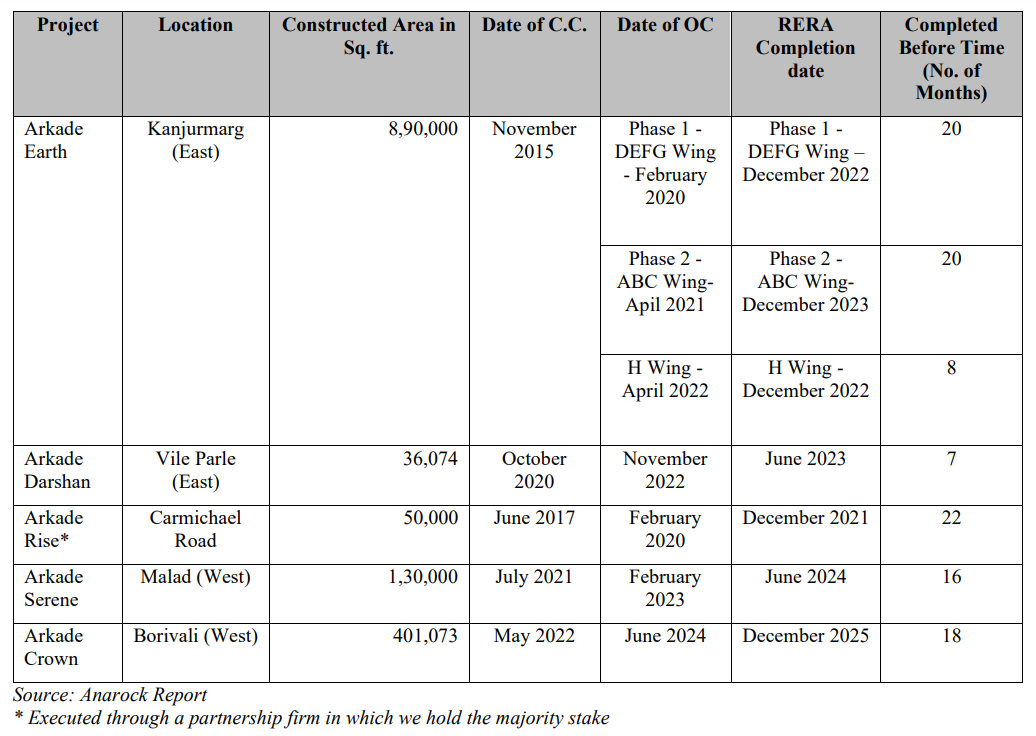

- The company’s average turn around time [TAT] is 3Y — from receiving possession of the land to delivery of possession to the first customer. Certain projects have been executed BEFORE TIME!

Certain projects completed before time [Source: Arkade DRHP]

- The residential projects are general financed through a mix of equity & internal accruals resulting in a low debt to equity ratio [0.22 times]. Again, impressive for a real estate player, which are generally laden with debt.

- Its in-house team is equipped to deal with all aspects of project development — land acquisition, legal, construction, marketing & sales. The company has empanelled various consultants like design architects, structural engineers etc.

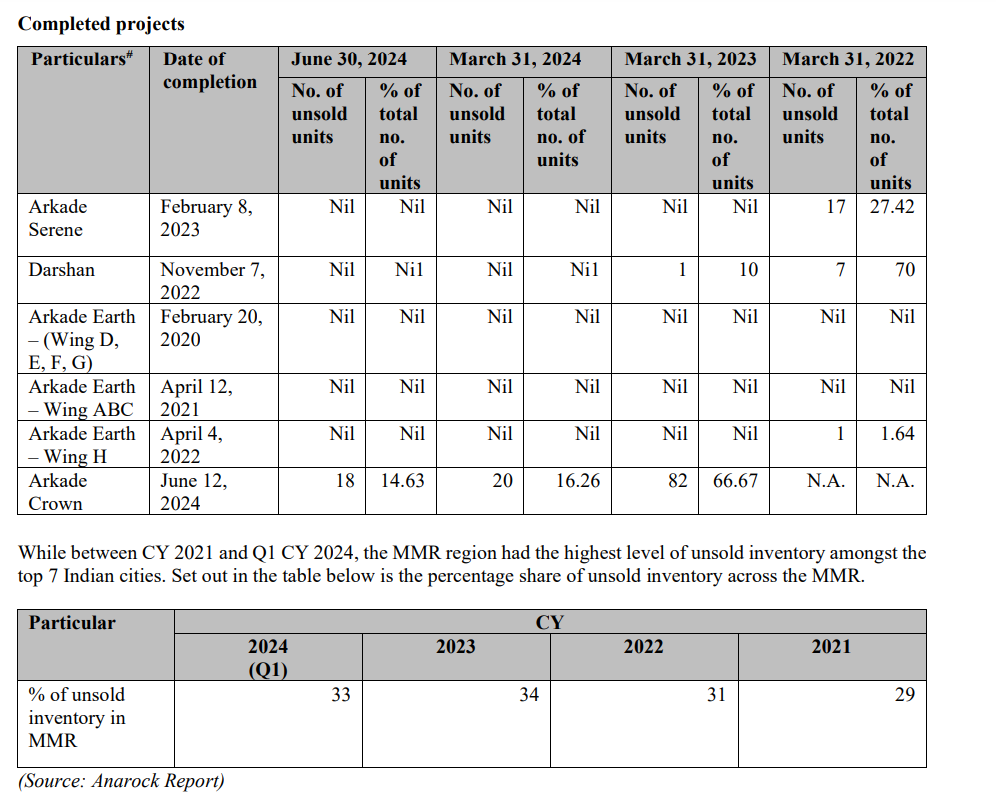

- Arkade has low unsold inventory of units compared to the broader market.

Most projects have been completely sold by Arkade [Source: Arkade DRHP]

- Projects in the pipeline — the company is currently developing 3.7 million sqft across 6 ongoing projects + 6 upcoming projects (for which development agreements have been executed and approval process is underway) .

- Out of the 6 ongoing projects — 3 are new projects & 3 are redevelopment projects.

- In addition to the 6 upcoming projects, the company has received letter of intent for 2 redevelopment projects for which contract execution is pending. This gives Arkade a good order book to grow the topline.

- Potential to grow market share in select niches of Mumbai — Arkade derives majority of it’s business from micro-markets in Mumbai like Borivali (W), Goregaon (E), SantaCruz (W) and is amongst the top 10 developers in these niches. The company has been steadily growing market share in these micro markets.

- Borivali (W) micro market — 2% market share in the total supply of units.

- Goregaon (E) micro market — 8% market share in the total supply of units.

- SantaCruz (W) micro market — 4% market share in the total supply of units.

- Future growth drivers :

- Expansion in the eastern region of MMR — it wants to target select eastern suburbs like BKC, Andheri, Powai, Vikhroli — which is seeing a growth in commercial activity.

- Developing premium / luxury residential projects — it wants to move up the value chain by catering to projects that are developed over a larger area to enable it to construct more premium properties. These could lead to higher revenue + margins in the future.

- Continue to focus on the blended b-model — entering into redevelopment projects enables the company to stay capital efficient (since they don’t have to spend money on land acquisitions). The abundance of such projects in housing societies in the western / eastern regions of MMR, Mumbai — means that the company can do good business without the need to acquire land parcels.

The Points of Concern

I couldn’t find a lot of concerns with Arkade [due to lack of information available], apart from the fact that I don’t know if they can significantly scale from here. Mumbai’s real estate market is extremely competitive with a lot of organized / unorganized builders & it will be challenging for Arkade to grab market share.

What would be interesting to watch, is whether they can maintain their execution / turn around time as they undertake more projects & capital gets allocated to more projects.

Some general concerns to note:

- Limited availability of land parcels — even if Arkade wants to scale up its operations, the availability of new land parcels in the MMR Region is limited & expensive. Mumbai is the most expensive real estate market in India.

- Increased competition could lead to shortage of land parcels & restrict it’s ability to expand faster.

- Ongoing litigations — certain criminal / civil legal proceedings are going against the company which could have a negative financial + reputational impact on the company. However, the management believes that the chances of these litigations materializing against the company are quite remote. But, I wouldn’t believe everything that the management says.

- Cyclical nature of the biz — real estate biz is cyclical in nature and sales are not evenly spread out throughout the year. It is intricately linked to the growth of the economy and if there are any economic shocks reducing per capita income, demand could go down for residential units. As things stand, it is already a herculean task for a normal person, to buy a house in Mumbai.

Conclusion

Arkade Developers got listed on the stock exchanges on 24th September 2024 — about a month back and has dropped around 8% from the listing day. At a PE of 23, at a market capitalization of INR 2,800 Cr, I think the company is fairly valued and can unlock a lot of shareholder wealth in the future IF it can scale up with the same level of execution.

There’s a lot to like about the company — good execution, low unsold inventory, good order pipeline and a growing market share in the MMR niche markets. Operating margins are on the rise.

FY wise performance of Arkade [Source: screener.in]

However, there are serious concerns regarding the scalability of the business. Competition is intense. Land parcels are scarce in Mumbai. Certain legal battles are ongoing.

Some unanswered questions that the management needs to address:

- What is the FY25 revenue guidance for Arkade? What is the base level OPM?

- Breakup of gross margins / operating margins from new projects & redevelopment projects — to get an understanding of which revenue segment would push margins higher.

- Why is the company not targeting other areas of MMR? Why is the company not targeting South Mumbai? Is it because Macrotech Developers (Lodha) has a BIG presence there?

- Does the management have the capability to branch out of Mumbai and look for other areas in Maharashtra? What is the strategy to unlock future growth substantially?

It is still early days for Arkade in the markets, and we will keep a close watch on the quarterly performance to see how the business shapes up.

Disclosure: Not invested, tracking. Will invest in the company if it drops another 10% from current levels.