All

I am new to Valuepickr, however must say very impressed with the input people provide, and all most all shares I had identified and increased were mentioned by one or the other on this forum

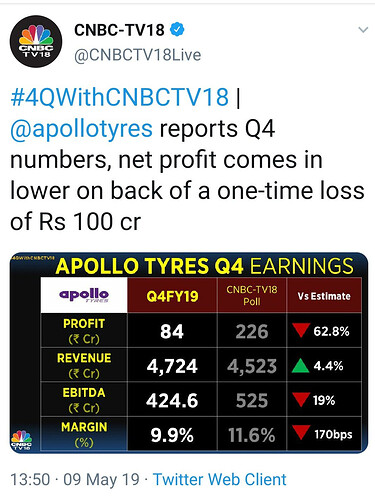

Just want to write about Apollo Tyres.

Few Details

Market Cap 8000 Cr.

Debt Approx. 1200 Cr.

Enterprise Value 9200 Cr.

Last Year 2015 EBITDA 1800 Cr.

EBITDA in 2011 972 Cr. and continuous growth year on year.

Profit for 2015 977 Cr.

Profit in 2011 440 Cr. and continuous growth year on year.

Current plans of the company

Setting up a plant in Hungary to supply in High value European market.

Increasing capacity in Chennai for radial tyres

company has closed down its South African loss making operations resulting into lower turnover but higher margins

Market Dynamics

Rubber prices are at its lowest resulting into higher margins, which may be difficult to sustain

Chinese imports of commercial vehicle tyres is increasing at an alarming speed and has now increase to around 10% of the total market for commercial vehicles and Passenger cars, it may spoil the margins in the short run, as Govt has not done anything to protect the interest of Tyre companies

While the plant in hungary can be an opportunity and can increase substantial margin, however it is only a marginal player and any adverse market condition can wipe it out

Ownership

There is a clear succession plan in the company and chairman son is being groomed to take over the chairman position

It is number 2 player in the Indian market and as the market grows it should benefit major players

I had bought this stock and it form 10 percent of my portfolio however in huge loss,

Would need expert advise from senior members of what had gone wrong with this stock, which has givens CAGR growth of more than 40 percent in last 5 years is being quoted at less than 10 PE