Park Hotels India is engaged in the hospitality business operating under the brand names of "THE PARK ", "THE PARK Collection ", "Zone by The Park ", "Zone Connect by The Park " and "Stop by Zone ". The company also owns the iconic brand Flury’s which is present in 82 outlets pan India.

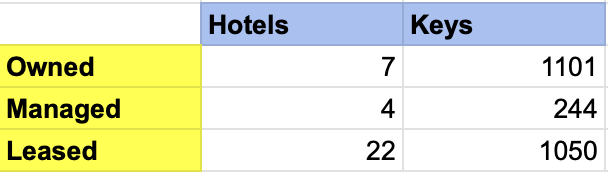

Presence: The company currently operates 27 hotels, which are spread across different categories such as luxury boutique, upscale, and upper midscale. These hotels are present in various cities in India including Kolkata, New Delhi, Chennai, Hyderabad, Bangalore, Mumbai, Coimbatore, Indore, Goa, Jaipur, Jodhpur, Jammu, Navi Mumbai, Visakhapatnam, Port Blair, and Pathankot, offering a total of 2,395 keys as of Mar 31, 2024. The company has 6 hotels scheduled for launch in the next 12 months, with a total of 228 keys. The Kolkata project alone is expected to generate around Rs. 100 crore

of cash annually for the next three years, starting FY 2025-26.

The promoters of the Company are Karan Paul, Priya Paul and Group companies. The company raised Rs 920 crore via an IPO in Feb 2024, out of which Rs 550 crore has been utilized to repay the entire outstanding debt of the company

Key Financials

| Mar-22 | Mar-23 | Mar-24 | Mar-25E | |

|---|---|---|---|---|

| Sales | 255 | 506 | 579 | 598 |

| Operating Profit | 46 | 159 | 192 | 235 |

| OPM % | 18% | 31% | 33% | 39% |

| Other Income | 12 | 18 | 13 | 15 |

| Interest | 60 | 62 | 66 | 14 |

| Depreciation | 40 | 49 | 51 | 61 |

| Profit before tax | -42 | 65 | 89 | 175 |

| Tax % | -33% | 27% | 22% | 35% |

| Net Profit | -28 | 48 | 69 | 114 |

| EPS in Rs | -1.61 | 2.75 | 3.22 | 6.50 |

| Net Worth | 508 | 555 | 1198 | 1312 |

| Total Debt | 654 | 617 | 100 | 125 |

Key Strengths of the company:

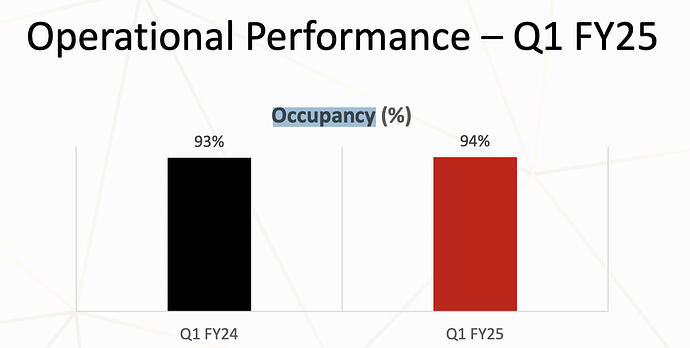

Highest Occupancy Rate in Industry: The company has one of the highest occupancy rates in India with ~90% occupancy across all its major hotels.

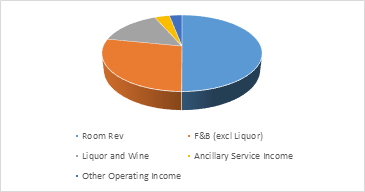

Growth in F&B income: The share of F&B income in ASPHL’s revenues has historically been high (43% in FY2024) compared to its peers. Addition of Flury’s brand where the company is looking to aggressively expand number of outlets will further support the 10% historical growth in this segment

Deleveraged balance sheet: Its net worth improved to Rs. 1,198.0 crore as on March 31, 2024 from Rs. Rs. 555.7 crore as on March 31, 2023, and the gearing reduced to 0.1 times as on March 31, 2024 from 1.1 times as on March 31, 2023. Company is currently net cash and has unutilized funds of ~Rs 12 crore from the IPO.

Key Weaknesses:

**Expansion plan:**The company has planned greenfield hotel projects, on its existing owned land, in Kolkata (EM Bypass) and Pune. which will have 250 and 200 rooms, respectively. While the Kolkata project is to be entirely funded from the proceeds of real estate monetisation, the cost of the Pune project will also be ~Rs. 200 crore. Since the company is already operating at 90%+ occupancy at its existing hotels, further revenue growth in the hotel segment would be contingent on project execution of these two projects

Cyclical Industry: The operating performance of hotels remains vulnerable to seasonality, general economic cycles and exogenous factors, the company will need to continue investments in renovation and

refurbishment of hotels to ensure delivery of high quality of service.

Key Operational Metrics

| Q4 FY23 | Q3 FY24 | Q4 FY24 | FY24 | |

|---|---|---|---|---|

| RevPAR | 6414 | 6562 | 6847 | 6170 |

| Occupancy | 93.20% | 90.10% | 91.70% | 92.10% |

| ARR | 6884 | 7286 | 7463 | 6699 |

Valuation: The company is trading at 34x 1Y fwd P/E which is at a discount to existing players. Company has appreciated 15% from the IPO price but still has a good runway for growth, and is now significantly deleveraged, which will help support expansion plans. EV/EBITDA is also reasonable at 16x.

Disclosure: Invested.

Links

https://www.bseindia.com/xml-data/corpfiling/AttachHis/ea3a792e-c58c-4f30-bef8-1e284b0ad9c8.pdf