Brief Business Overview:

• The Company specializes in providing end-to-end engineering services tailored for aviation infrastructure including firefighting trucks, runway rubber removal machines, friction testing machines, runway sweeping machines, spare parts and other equipments.

• They perform sourcing, supervising, quality control, transportation, and installation of equipments for airports (80% of revenue), government, municipalities and refineries (20% of revenues)

• They have long term collaborations with leading OEMs worldwide and deliver bespoke solutions that meet the needs of their clients.

Currently revenue source is as follows:

Commission (They procure orders from its clients majorly airports and other refineries, municipalities etc. for its suppliers Rosenbauer, Bucher Municipal, Winter Grun etc. and charges a commission on it. Operating margins through this source are the lowest.) - 15%;

Spare parts (they source spare parts and provide installation services for the same) - 45%;

AMC (The Company provides maintenance services for vehicles and other services provided to airports.) - 40%.

This mix is expected to change drastically over the next 2 years as the assembly line of vehicles starts

Why you should look at this Company

• In-house assembly of vehicles:

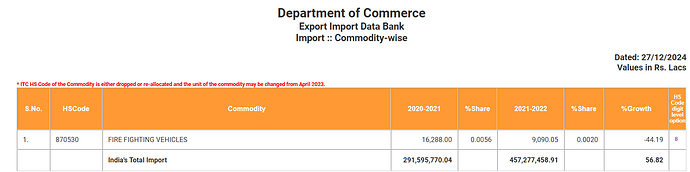

Up until now, Anlon was an exclusive distributor for its OEMs in India. It used to earn a commission on its sales and then an annuity revenue in the form of AMC charges for those vehicles. What changed for the Company in May 2020 was the announcement of Atmanirbhar Bharat where the government announced all global tenders below Rs 200 would not be allowed for government procurement. As most of the vehicles that Anlon was supplying in India were high value-low volume they were all below Rs 200 cr so this caused a problem for the Company moving forward.

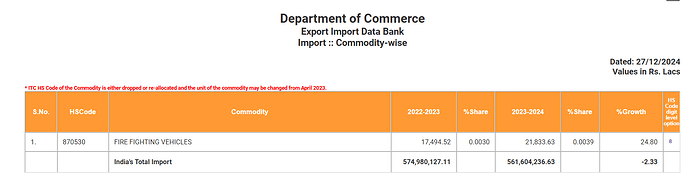

Since Anlon has been the sole AMC player for these vehicles in India for ~15 years, it was able to convince its European counterparts to build assembly lines in India for those vehicles and sell them as Made in India (similar to what is happening with iPhones).

The Company raised Rs 15 cr in its IPO to set up its assembly unit in Bengaluru that was inaugurated at the end of February 2024 and production is expected to start by June 2024.

The vehicles rolled out from this unit are expected to be about 25% cheaper as compared to the CBUs that were being imported till now. The vehicles will now be indigenized for eg. the chassis will be sourced from Bharat Benz, Ashok Leyland etc. though the core or critical components will still be imported from Europe/USA.

• Industry dynamics:

By 2030, India is projected to have about 230-240 airports up from 148 now. With most of the metro/bigger cities in India already being well-connected by air, major growth is expected to come from tier 2 towns and below. Anlon also acts as a Consultant to its clients and will be able to customise the vehicles will the requirements of each airport

India has an aircraft fleet size of ~750 currently that is projected to grow to 1,200-1,400 by 2030

Air passenger traffic is expected to grow to 42 cr by 2030 up from 14.5 cr today

• Long term relation with suppliers provides export opportunities:

Anlon has been the exclusive supplier for Rosenbauer, Bucher Municipal, Winter Grun etc. in India for over a decade and a half now thereby maintaining excellent relations with the OEMs. Anlon prefers keeping its OEM network consolidated and working only with the best. Over the next 12 months Anlon has an opportunity to showcase its skills and expertise by assembling these vehicles in India with similar quality standards as its European OEMs would have. If they are able to prove their mettle as a manufacturer, this presents an opportunity to Anlon to become an export hub for these vehicles in the future.

QIP

The Company recently raised Rs 25 cr from investors at a price of Rs 382.

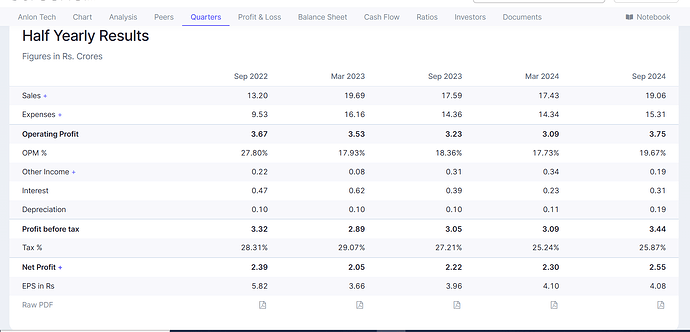

The Company holds orders received in Feb 2024 from Delhi and Cohin airports. They also received an order from AAI worth 22 cr to be supplied during FY25 (to put things in perspective their FY24 revenue from services stood at Rs 35 cr)

Risks

➢ Airport infrastructure growth in India slows down leading to fewer number of tenders for these vehicles.

➢ Anlon is not able to assemble these vehicles at the same quality as its European OEMs.

The Company faces competition from foreign OEMs who also apply for these tenders though Anlon has a high market share and long standing relationships with their clients.

The stock is in the SME category and volumes are less so volatility is a bit high

Management

➢ Unnikrishnan Nair P M (Chairman & MD)

He is the promoter of the company. He holds a Bachelor’s degree in Engineering – Mechanical from Bangalore University. He has more than 28 years of experience in the industry. At present, he is responsible for the overall management, day to day affairs and is the guiding force behind the strategic decisions of the Company. Hearing him on the concall, he seems very focused on quality of his products rather than just chasing growth numbers

Disclosure: I am invested in this Company

Link to IP - https://nsearchives.nseindia.com/corporate/ANLON_28052024113647_IP.pdf

Link to 1st earnings concall May 2024 - https://nsearchives.nseindia.com/corporate/ANLON_30052024131700_Transcript.pdf