[ Comment too short ]

Current market price 340

The company is taken over by international paper mills ltd. I am attaching a presentation by the company

Sorry, My computer was not working properly.

Andhra Paper Mills Limited Market Cap 1345 Crores Current Price 340

Equity 39.77 Crores B.V 145.67, International papers open offer @ 544.20

The Company is targeting a EBIDTA of 423 crores in Fy 12-13, which could translate an EPS of 40 -45. (Source: The Invetor Day 2012 report by the company).

Bullish Viewpoints

- Industry Structure:Top 10 Producers account for 30% of the total production, Small and Mid Sized Mill (<33000 TPA) Acccount for 60 %

- The per capita GDP of India is $ 1675 which will rise to $2175 per capita

- Labour force of 0.5 Billion, growing @ 2% p.a, Soon to be the Largest working Population on The planet.

- Indian Paper & Pkg Market is 11 mm tons and growing by 1mm tons per annum(China is 90 MM ton Market). 12.5 million tons consumpation, Low per capita consumption at 10 Kg (vs 250 Kg in USA, 50+ Kg in China)

- Two Mill Sites( 12 Km Apart)

Rajahmundry Mills 210 m Ton Pulp and 210 m ton Paper

Coastal Paper Mills: 35 m ton recycle paper and 65 m ton paper

Sufficient power supply and effulent treatment for Potential expansion.

- International papers is very aggressive on paper Industry future and it will be the potential platform for Growth in India.

- Only paper company which has near double the raw material to its current paper mfg capacity

- India will Become #3 Global market in Uncoated Free sheet.

- The Company’s Target is to surpass the current cpapcity and achieve 20%+ Ebidta Margins(years 1-2)

- If confident of IP capability then Maximize output from current mills with high return projects(years 3-5)

- Expansion projects not in current 75$ mm Ebidta potential.

The above data is from the company presentation. This comapny can give Decent returns with a 2-3 years view if it remains Listed.

VIEWS INVITED

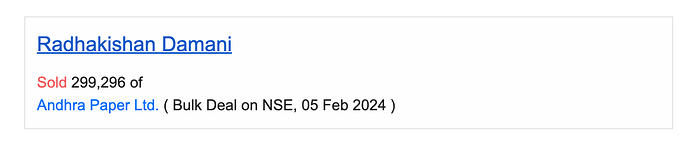

International paper app is an MNC with 75% promoter holding apart from Mr. Dilipkumar lakhi is holding more than 7% holding and is increasing it.

Recently company has transferred it’s reserves to p&l account, purpose is unknown. Can any one confirm the same.

Paper is a commodity

I have been to Andhra Paper in 2019

I have seen the outside and plantation area of the plant in Rajamahendravaram in Andhra Pradesh

The plant is away from major trading points.

It has a good reputation in the markets it sells

Lot of people use the paper that is produced from this mill in and around that area. The population in India is so huge that we need Paper mills I feel

They make copier and all other kraft and cardboard paper too.

Cisco recently upgraded their workflow

They have a new and focused management in place

The EU has lifted the ban on export of raw materials for Paper print and paper production, which we are dependent on.

Overall, after the massive bull run in all other irrational sectors, paper is set to shoot and this stock is coming up on many screener.in top screens for favourable to invest kind of stock.

Demand is high, sector tailwinds due to increase in demand from NEP, Colleges, reopening after CV19.