Waaree Energies

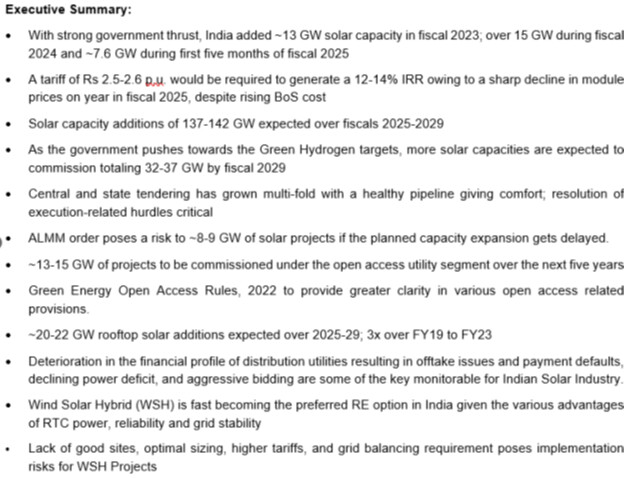

INDIAN SOLAR POWER MARKET

Review of solar energy capacity additions in India

Review of solar energy capacity additions in India

a) About 5,000 trillion kWh per year of energy is incident over the land area.

b) Most parts receiving 4kWh to 7 kWh per square meter per day.

c) The National Institute of Energy estimated the country’s solar potential at 748 GW, assuming solar PV modules cover 3% of the geographical surface.

d) India has 300 days of sunshine each year, with daily peak electricity use being in the evenings and a seasonal peak in the summer.

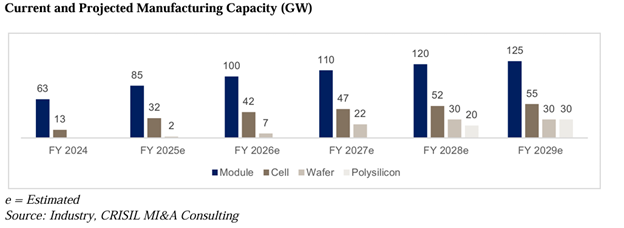

e) Currently, 80% to 85% of the solar modules need be imported as domestic capacity is inadequate to meet demand. India does not have a manufacturing base for polysilicon ingots and wafer; hence, players import these components, incurring high cost.

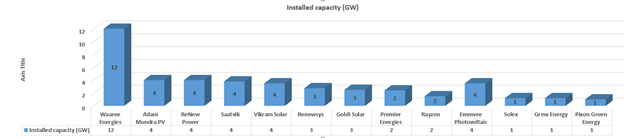

Waaree business position:

A manufacturer of solar PV modules in India.

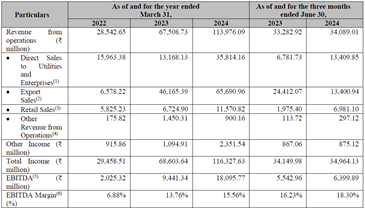

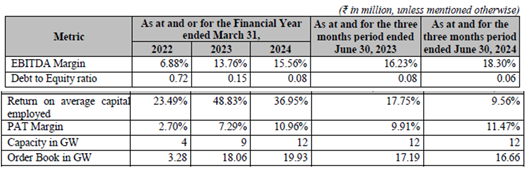

- Aggregate installed capacity of 12 GW and utilized capacity of 43.37%, as of and for the year ended March 31, 2024

- Aggregate installed capacity of 12 GW and utilized capacity of 45.01%, as of and for the three months ended June 30, 2024 (on an un-annualized basis).

Solar energy products consisting of the following PV modules:

(i) Multi-crystalline modules

(ii) Monocrystalline modules

(iii) Top-Con modules, comprising flexible modules, which includes bifacial modules (Mono PERC) (framed and unframed)

(iv) Building integrated photo voltaic (BIPV) modules

Operate one factory each, located at Surat, Tumb, Nandigram and Chikhli in Gujarat, India and the IndoSolar Facility, in Noida, Uttar Pradesh.

Total spread over area is 143.01 acres for having 12 GW capacity.

Key domestic solar module manufacturers with capacity

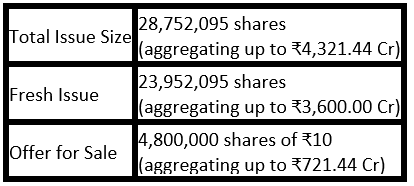

IPO offer size:

|a)|Rs. 27,75 Cr will be used to part finance the cost of establishing the 6GW of Ingot Wafer, Solar Cell and Solar PV Module manufacturing facility in Odisha, India.|

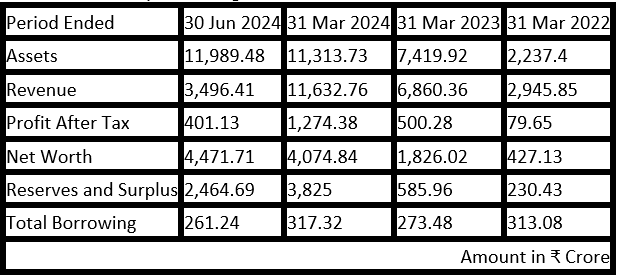

|b)|Waaree Energies Limited’s revenue increased by 70% and profit after tax (PAT) rose by 155% between the financial year ending with March 31, 2024 and March 31, 2023.

|c)|There are no outstanding litigations involving our Group Companies, which may have a material impact on our Company, in accordance with the Materiality Policy.

|d)|Rs. 2033.5 Cr is the estimated amount of contracts remaining to be executed on capital account (net of advance) of the group.|

|e)|Combined Installed capacity is 12 GW but Effective installed capacity is only 3.1 GW and out of this the utilization is only 45% at 1.4 GW production. |

|f)|Cost of Material consumed is in range of 95% to 80% of total expense in Q1 FY25 this is at 60%|

Internal Risk Factors

- Business is dependent on certain key customers and the loss of any of these customers or loss of revenue from sales to any key customers could have a material adverse effect on our business, financial condition, results of operations and cash flows.

- Customer agreements include terms relating to liquidated damages and we have paid liquidated damages and other related claims in Fiscal 2023 and Fiscal 2024 and the three months ended June 30, 2023 and June 30, 2024. In the event waaree is unable to reduce such liquidated damages and other related claims their business, financial condition, results of operations and cash flows may be adversely impacted.

- Export sales make operations subject to risks and uncertainties of various international markets, in particular the United States. Further, revenue from operations is significantly dependent on export sales and there is no assurance that they may be able to continue our export sales going forward.

- Chikhli has 9.66 GW of Mfg base alone.

- Decline in the price of solar PV module prices may have an adverse impact on our business, results of operations and cash flows.

- Transportation freight, duty & handling charges is 3.32% of Revenue from Operations in Q1 FY25.

- The Exports sales in Q1 FY25 has reduced by 45%.

- Other risks in RHP

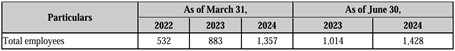

Number of employees in Company:

Key performance indicators (“KPIs”) for Waaree Energies:

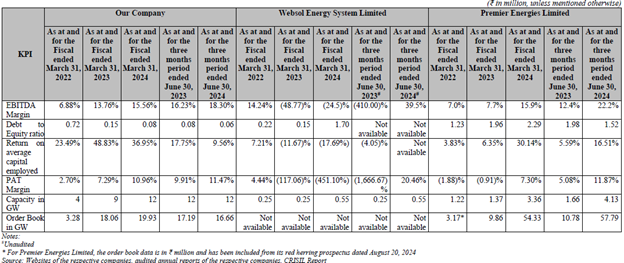

Comparison of KPIs with other listed industry peers:

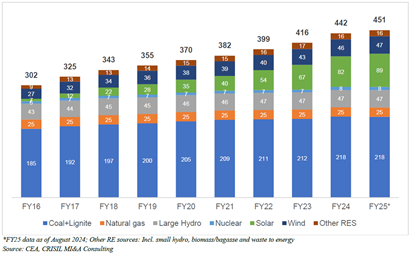

Fuel-wise installed capacity in past 10 years (GW)

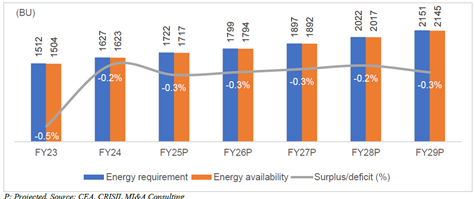

Energy demand outlook (Fiscals 2023-2029)

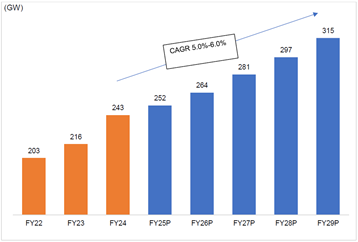

Peak demand outlook (Fiscals 2021 to 2029)

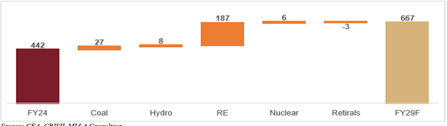

All India installed capacity addition by Fiscal 2029 (in GW)

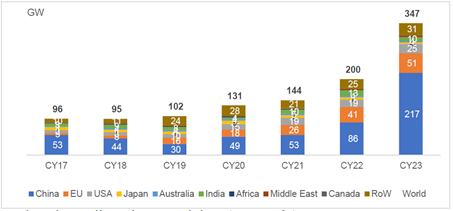

Annual solar capacity additions in major economies

IRA to boost demand for solar value chain in US

The US Inflation Reduction Act has allocated approximately US$ 400 billion for clean energy. It is expected that it will lead to critical implications for climate change, trade, security, and foreign policy. The tax credits provide financial incentives to both domestic solar demand and supply.

For solar modules the credits are expected to include:

Solar Cells – 4 cents per WDC capacity

Solar wafers – $12 per square meter

Solar grade polysilicon – $3 per kilogram

Polymeric backsheet- 40 cents per square meter

Solar modules – 7 cents per WDC capacity

China Plus One strategy

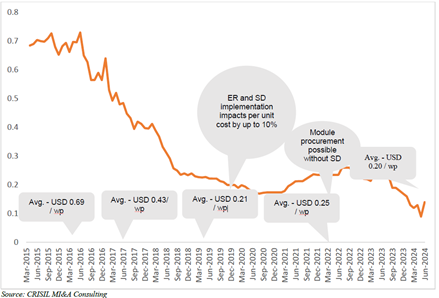

Decline in the prices of Modules

|a)|Module prices started to fall in 2023 owing to the ramp-up in the production of upstream components.

|b)|Prices of modules fell to $0.15-0.20 per watt-peak in April-November 2023 from $0.23 per watt-peak in January 2023. |

|c)|This has eased some pressure on capital costs in Fiscal 2024. Global solar module prices have reached a historic low, standing at just $0.09 per watt-peak in June 2024, which is expected to stimulate growth in solar power capacity. |

|d)|Prices are expected to remain stable over the medium term due to supply glut and relatively weak demand internationally. |

|e)|In line with this trend domestic prices too fell to $0.14 per watt peak maintaining a steady premium over landed cost of imported modules. |

|f)|MNRE has reinstated the applicability of Approved List of Module Manufacturers (“ALMM”). |

|g)|ALMM enlisted manufacturers can supply cells and modules to government and government-assisted projects. Projects under open access and rooftop solar by private parties are also brought into the ambit of ALMM. |

|h)|All the fall in prices across the value chain is expected to be arrested in Fiscal 2025.|

Review of project economics and leveled tariffs for solar PV power plants in India

|a)|5 Acre of land is required to install 1 MW of solar park.

|b)|Equipment cost of ₹ 38 million to ₹ 42 million per MW (including DC side overloading at 40%) for a project based on domestic make modules. – Note: the labour cost and other accessories are extra.|

|c)|If the tariff of solar power is Rs. 2.6 P.U then the IRR on investment is 12-14%.|

Waaree Energies business Forecasting

| All Data in Rs Cr otherwise stated | FY25 | FY26 | FY27 | FY28 | FY29 |

|---|---|---|---|---|---|

| Solar Module in MW (business growth at 20% Y0Y) | 5600 | 6720 | 8064 | 9676.8 | 11612.16 |

| Revenue (@ Rs. 2.435 Cr per MW) | 13636 | 16363.2 | 19635.84 | 23563 | 28275.6 |

| PAT @10% | 1364 | 1636 | 1964 | 2356 | 2828 |

| No of Shares post listing | 28.73 | 28.73 | 28.73 | 28.73 | 28.73 |

| EPS in Rs | 47 | 57 | 68 | 82 | 98 |

| PE @ 50 | 2373 | 2848 | 3417 | 4101 | 4921 |

IPO offer price of Rs. 1503 per share is value for money.

Disc: Invested