AMIC FORGING LIMITED

Listed @ 251.35/- on 06.12.2023

IPO Size - 34.80 crs

Fresh Issue - 27,62,000 shares

Cap Price(IPO) - 126/-

3M Profit - 3.5 cr

(June Quarter)

2024 Profit = 3.5cr *4 = 14 cr

(Assumption)

EPS = 13.34

Post IPO P/E = 9.5

(Based on 2024

Profit Assumption)

The company is a manufacturer in forging industry and is engaged in manufacturing of forged Components catering to various industries. They manufacture precision machined components as per customer specifications and International Standard catering to the requirements of various industry such as Heavy Engineering, Steel Industry, Oil & Gas,Petrochemicals, Chemicals, Refineries, Thermal Power, Nuclear Power, Hydro Power, Cement Industry, Sugar and other related industries.

The company is planning to expand via backward integration with starting the manufacturing of Steel Melting & Ingot Casting. This backward integration would increase our product base and also increase our output due to easily availability of raw material.

The company is also planning to pursue forward integration to change the grain size, refine its magnetic and electrical properties to increase the resistance against corrosion as well as against wear and tear. For that, they propose to set up state of art heat treatment plant which is capable of normalizing, annealing volume hardening and flame hardening, etc

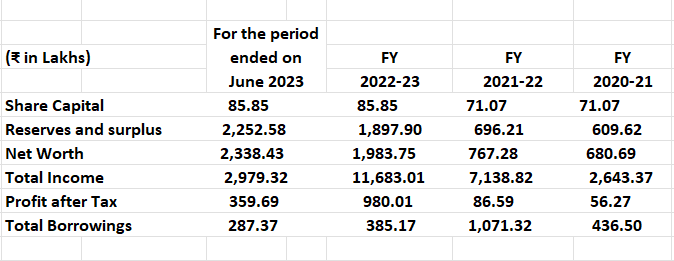

FINANCIALS

Promoters -

- Mr. Girdhari Lal Chamaria

- Mr. Anshul Chamaria

- Ms. Manju Chamaria

- Ms. Rashmi Chamaria

Product Range-

Rounds, Shafts, Blanks and engineering spare parts like Gear Coupling Hub, Round and Flange.

Definitely go through website of the company for further information on products-

https://amicforgings.com/

Clientele-

JSPL, TATA Steel, L&T, Phooltas and many more

Strengths -

- Experienced Promoters

- Integrated Manufacturing Facility

- Brand Positioning

- Quality Assurance

Risks -

- High working capital requirements

- Highly Competitive industry

- Invested in shares of HFCL Ltd worth Rs 3.24 cr.

Market value as on June 2023 is Rs 2.45 cr