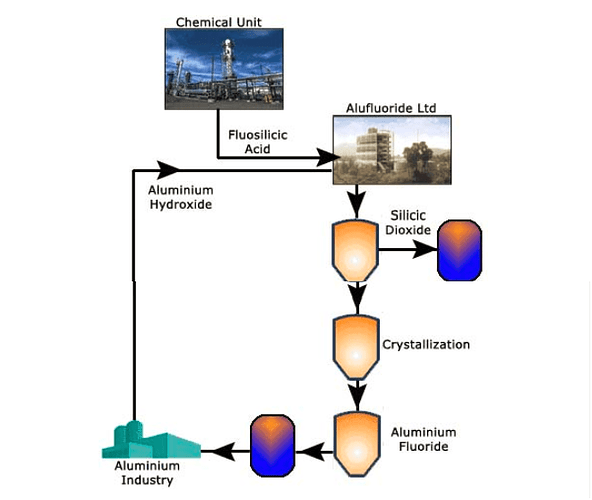

About Company: Alufluoride Ltd (AL) is the only Company in Andhra Pradesh producing high purity Aluminium Fluoride (AlF3) with technology developed by Alusuisse, Switzerland. This technology facilitates conversion of Fluorine effluents from Phosphatic Fertilizer Complex into Hydrofluosilicic Acid and then to Aluminium Fluoride. The project ensues pollution abatement, import substitution, conservation of natural resources like Fluorspar & Sulphur, cost effective production, conversion of waste into wealth and earning valuable foreign exchange to the Nation. AlF3 is used as flux in reducing the melting point of Alumina during the electrolytic process of producing Aluminium. Many Aluminium Smelters in India and abroad are using the Company’s product with repeat orders for increased quantities due to its quality and service.

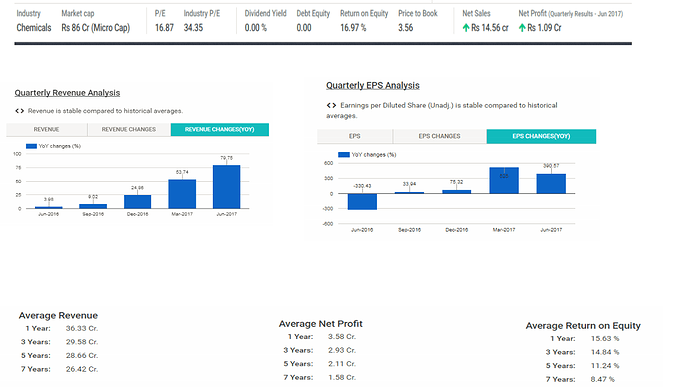

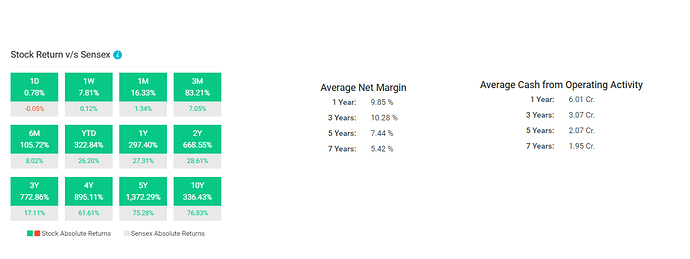

Fundamentals of the Company:

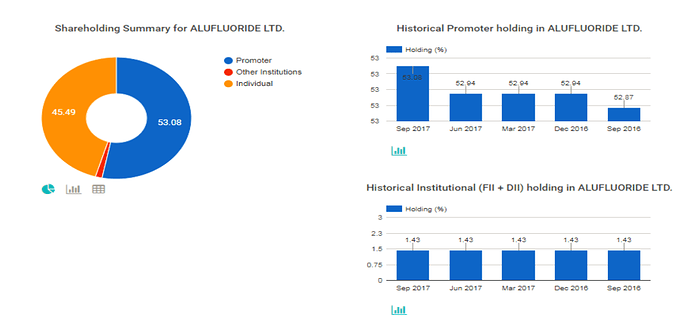

Share Holding Pattern :

Aluminium fluoride(ALF3) :

Aluminium fluoride is the chemical compound with the formula AlF3. It has the consistency of a white powder. AlF3 is refractory, in strong contrast to the other halides of aluminium. Adding aluminium fluoride to the production process of primary aluminium lowers the consumption of electricity required in the smelting process and thereby considerably contributes to the reduction of production costs of aluminium. Aluminium producers (smelters) are the main users of aluminium fluoride.

Aluminium fluoride is used in many industrial processes. It is one of the minor constituents added to the electrolytic cells during the production of metallic aluminium. Aluminium fluoride is used in turning alumina into aluminium.

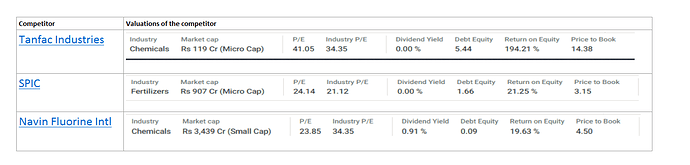

Few Indian Major Players are as under:

· Alufluoride Ltd.

· Mafatlal Fine Spg. & Mfg. Co. Ltd.

· Navin Fluorine Intl. Ltd.

· Southern Petrochemical Inds. Corpn. Ltd.

· Tanfac Industries Ltd.

Market Outlook:

Aluminum fluoride is white colored or colorless solid powder that can be produced synthetically and is also found in nature with minerals such as rosenbergite. Alumina and hexafluorosilicic acid are among the vital raw materials that go into the production of aluminum fluoride.

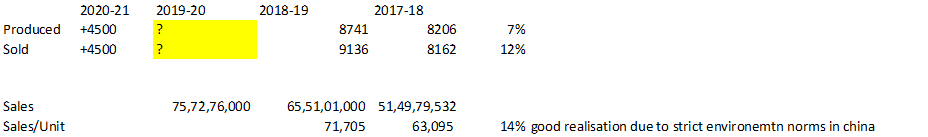

China is the leading manufacturer of aluminum fluoride across the globe and constitutes significant portion of the global market share. Moreover owing to over exploitation of major raw material sources in China, the production is anticipated to decline in the near future. High GDP growth and increasing disposable income in India and China have led to high growth in several end user industries including automobiles, pharmaceutical, packaging, aerospace, construction among others. High growth in end user industries is expected to be among foremost factors driving demand for aluminum fluoride in the region.

Demand for aluminum fluoride in North America and Europe is anticipated to grow at a sluggish rate during the forecast period. Underutilized fluorspar reserves in South Africa coupled with increasing government support to invest in the reserves is expected to drive market growth for aluminum fluoride in the Row region. Moreover, increasing demand for aluminum fluoride driven by high growth in several end user industries in the rapidly industrializing economies of South America and Africa will likely present massive growth opportunities for players in the aluminum fluoride market.

Advantages for company:

• location advantage of 10 kilometers to the Port of Visakhapatnam allows company to adhere to prompt delivery commitment.

• Around 25kg of Aluminum Fluoride is needed per ton of aluminum production. According to CARE Rating research the aluminum production in India is going to touch 3.33 million tons by FY 19-20. The demand for Aluminum Fluoride should increase proportionally and benefit the company.

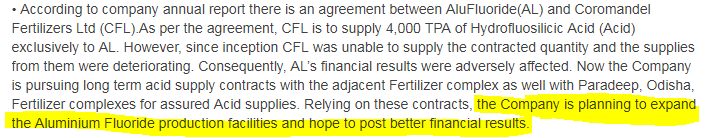

• According to company annual report there is an agreement between AluFluoride(AL) and Coromandel Fertilizers Ltd (CFL).As per the agreement, CFL is to supply 4,000 TPA of Hydrofluosilicic Acid (Acid) exclusively to AL. However, since inception CFL was unable to supply the contracted quantity and the supplies from them were deteriorating. Consequently, AL’s financial results were adversely affected. Now the Company is pursuing long term acid supply contracts with the adjacent Fertilizer complex as well with Paradeep, Odisha, Fertilizer complexes for assured Acid supplies. Relying on these contracts, the Company is planning to expand the Aluminium Fluoride production facilities and hope to post better financial results.

Risks :

• Like any other commodity the price is cyclical in nature. When aluminum cycle goes down the demand will go down.

• Company is relying on fertilizer complex for acid supply, the profitability depends on, the on time availability of Hydrofluosilicic Acid

Investment Opportunity :

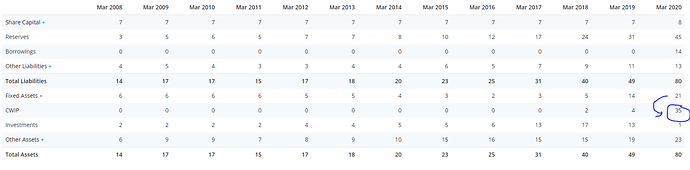

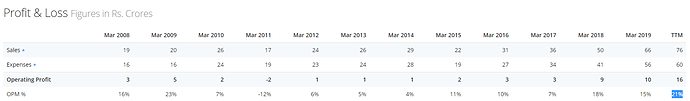

The fundamentals of the company is consistent in the last five years and it is improving every quarter. The company is trading at discount compared to its peers having high debt to equity ratio. Promoters are increasing their holdings, which shows their confidence in the company and in the outlook for aluminum fluoride market. With zero debt in the books , new capex plan and increasing demand for aluminum because of India story, the company should perform well at least for next 2 to 3 years.

Sources :