This is my first write up and open to learn if mistakes are there.

Allied Digital Services Limited(MCap 740Cr) was established in 1984 under the name of Digital Data Services and was then incorporated as Allied Digital Services Private limited (ADPL) in 1995. Later in 2006, the company was converted into a public company. Mr.Nitin shah, Chairman and Managing Director of ADSL holds a degree in electrical engineering and a PG Diploma in computer Management with an experience of more than four decades. The company offers a wide range of IT services which include cybersecurity, Infrastructure management services, software solutions, workplace management, software solutions and cloud services to various across 35 countries like Torrance, Wilmington, Dublin, London, Milan, Helsinki, Madrid, Brussels, Singapore, Sydney, India etc and subsidiaries in eight countries around the world. System integrator mainly includes services like digital workspace services, digital enterprises infrastructure transformative solutions, cybersecurity services, cloud services and support to multi lingual, multi-channel service desks etc. The key customers of the company include names such as Tata Motors, Vedanta, Accenture, Air India and Infosys among others. group is a leading player in providing Smart City Solutions for various state governments in India. The group has completed various Smart City project in the past as a systems integrator in cities like Pune, Aurangabad, Rajkot, Varanasi and Kalyan-Dombivli currently Solapur, Lucknow, Amritsar, Sultanpur and Jalandhar smart city development going on.

revenue streams: -

Cloud services, cybersecurity, Integrated solutions(Smart City) (Amongst the few in the country to be recognised as a Master System Integrator (MSI)), Smart city solutions, Infrastructure management services, software solutions(We have created two robust software which have gained immense recognition. This includes ADiTaaS (ITSM/ESM platform), an SaaS-based cloudready service platform and FinoAllied), management services.

Clients: -187 ( 10 Fortune 100 customers )

12 Smart/safe cities delivered

Our Top 25 Customers account for 75% of our revenue, and 51 of them are milliondollar clients (>USD 1 Mn in total contract value).

Revenue :-

91% from services(we focus on providing continuous, long-term support to our clients. These services are of an annuity or recurring nature, with clients engaging in ongoing contracts to receive consistent and reliable assistance)

9% Solutions(we deliver one-time implementations tailored to address specific needs or challenges faced by our clients. These projects could include transformative initiatives, upgradation projects or setting up infrastructure at new locations)

India, we have won major multi-year contracts including for five smart cities and a pureplay IT services deal from an Indian FMCG major.

we have entered the US market as an MSI, on the back of our strength in smart cities and IP-based projects.

won 10+ new accounts for ADiTaaS, taking our total count to more than 100 customers who are using it directly or through our services.

International business accounts for the majority of our revenue (78% in FY 2022-23)

KEY INDUSTRIES WE SERVE

BFSI

Healthcare

Pharma

Manufacturing

Oil / Energy / Utilities

Retail

Government

Automobile

FMCG

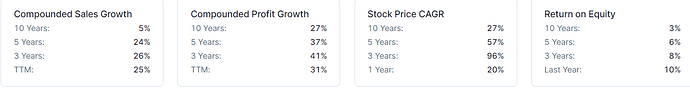

Financials:-

-

OPM growth was erratic from 2014 to 2017 but stable (12%–14%) after 2020.

following the sale of their hardware company in 2020. -

The sold IT hardware during FY23 was the cause of the net profit decline.

-

Over the past five years, profits have increased by 37% while sales have grown by 24%.

-

Debt is being progressively reduced by the company (from 100 cr in 2016 to 35 cr in 2023).

-

The company’s IT hardware and peripheral segment division operated at a poor profit margin.

(Stopped doing business exclusively selling IT hardware and accessories.) -

The last ten years have seen the lowest cash conversion.

-

CFO to PAT is 87.5%, and CFO to EBITDA is 54.

Presence in Japan, Brazil, and China. We had only entered these markets a year ago, and on the back of our technology and service excellence, we have successfully won several new clients. This year, we have entered the Mexico market which positions us for cost-efficient near-shore services to clients in the US.

While industry attrition rates are in the range of more than 23-25%, we have a low attrition rate of 13 % and have added around 1000+ employees during the year in question(FY 21-22)

While industry attrition rates are in the range of more than 20%, we have a low single digit (8%) attrition rate.( FY 20-21)

we have also exited the traditional IT hardware and peripherals business. It was a highly capital intensive and low margin business with a long collection cycle, impacting our cash flows. With this strategic move, we can better allocate resources to more crucial service lines.

Indentified risk’s

-

Continued growth of intangible assets

-

Customer concentration (25 Customers account for 75% of sales)

-

Working capital operations of the group are intensive 294 days in FY2022 as opposed to 352 days in FY2021.

-

Majority of revenue (70+%) is coming from North America.

-

State governments and payments for smart city solutions are the segment’s debtors.

Such projects are delayed past the available credit period. -

Fail to comprehend the fluctuation of taxes

From Lastest Concall:-

One large Insurance company in India has taken our services contract for their 3 Data centres and Network services

A very large agriculture product company with retail outlets all across south India, we are going to manage their end user devices as well as their enterprise services

• A large central USA airport is going to be managed by us as a critical infrastructure.

seven top retail brands in the USA are signed up for using ADiTaaS for their IT service operations.

On very high increase in the employee cost

we had informed earlier also that we have missed out certain opportunities in the US market. A couple of big accounts which were supposed to be in our kitty, we did not get that and a couple of renewals also did not happen. But however, having said that, we had a pool of talent ready for those projects

Any timeline when we do hope to close the deals?

Nehal Shah: Rajeshji, on the order book, what I would want to also add to this is that while the order book is there for Rs. 1,700 crore that we have already booked and we are going to be billing it for the next 3 years, the thing is that there are a lot of customers that are still ongoing with us and there are renewals also happening time and again and there is additional business that we get or what we call in our parlance as farming of additional business in the existing customer accounts. All of that is not accounted for in this number. Absolutely in terms of the top line, the increase is going to be very good. I would not want to just say or give a message to everyone stating that Rs. 1,700 crore is the only order book that we are looking at. There are certain other things that are also being added to it on a quarter-on-quarter basis. And second, from the order execution perspective, we feel that most of these orders that we book are generally booked for a period of 3 to 5 years, which are renewable for another 3 to 5 years. That’s how the cycle works in our industry. When a customer is taken into, the margins in probably the first 4 or 6 quarters is typically less because we are investing a lot of our energy and money and time into knowing the customer and having the services delivery put into account. But as time goes on, we keep on improvising on our costing and our margins.

The biggest lever for that is our software ADiTaaS that we feel will be a game changer for us because whenever we sell our software as a product to customers, we see a lot of good bottom line and good margins on that. So, that could be the biggest lever for us to improve our margins going forward

Dis:- Have position