Hi all,

I see a lot of newcomers here and given the market volatility, this can be a little nerve wrecking for someone. I have been in market for last 12 years as a part time investor and sometimes really find it difficult to track companies for direct investing. After a lot of thought, I am proposing an all weather portfolio of active mutual funds. I believe that this portfolio can be of ‘fill it, shut it, forget it’ type with an SIP approach. I recommend 20% of monthly SIP number in each of these funds below with the logic.

- All funds recommended will be multi cap ones - with different underlying theme.

- Highest weightage is given to fund manager / AMC pedigree.

- Keeping the fund, market cap agnostic, trying to find different approaches to market to ensure adequate diversification.

- 20% allocation to debt to help contain volatility a bit more.

- Conservative approach.

- No star rating, but solid long term performance of the fund manager is considered.

- Relatively smaller fund size - As I believe that large size does hamper stock selection.

- All Direct plans - minimum investment horizon of 7 years.

- 5 funds - starting allocation of 20% each.

Fund 1) PPFAS Long term equity - Unique play of US equity and strong AMC / Fund Manager pedigree. Good results in the first 5 years of the fund. Ethical and focussed AMC.

Fund2) Quantum Long term equity value fund - Excellent long term performance and very good down side protection. Ethical AMC and good pedigree.

Fund 3) ICICI Pru Multi Cap: Bet on S Naren. He recently took over as fund manager of this fund. Relatively small fund from ICICI stable but with Naren at helm, this should do well, I hope.

Fund 4) Franklin India Focussed Equity: As other funds are with value investing theme, this one is more focussed on high growth companies. Franklin India pedigree and very strong 10 / 5 / 3 year plus performance. Even though the fund was launched at market peak in 2007, this fund has managed to give very good returns in last 12 years.

Fund 5) ICICI Banking and PSU debt fund: To get flavour of debt in the mix. Banking and PSU are relatively safer categories and the fund is unharmed from the recent issues. Approx. 8% long term historical returns. Future returns could be a bit lower due to general lowering of interest rates.

Any periodic excess funds can be parked with Liquid funds at any of the fund house above and to be used in case of market dips / crashes to move to equity in above allocation of 25% each.

Critique / suggestions / feedback - Welcome!

3 Likes

Even if one spends only part time in the market, 12 years is a long time so why not a coffee can kind of stock PF instead of this MF PF? And could you be more specific as to why you chose these funds apart from the quality and pedigree you see? And why no HDFC funds, considering they are one of the best AMCs?

1 Like

Yes Sir! I agree with 12 years is a long time. But off late the job is too hectic and I think that it is worth focusing more on the same for now given the stage of my career. I do have few stocks of coffee can style in my direct equity portfolio (ITC, Nestle, HDFC Bank, Bajaj Auto, KRBL, TVS Srichakra, Wonderla holidays, etc.) but I find MF better to deploy regular monthly cash specially to participate in sectors where I have no expertise to understand the business - Infra, metals, cyclicals, PSU, International stocks, etc. I would rather depend on Mr. Naren / Mr. Rajiv and other professionals to select such stocks for me.

As to why no HDFC AMC - Well, most of their funds are very large already. I normally would like to avoid funds with very large size. This is my personal bias.

Hope this clarifies.

1 Like

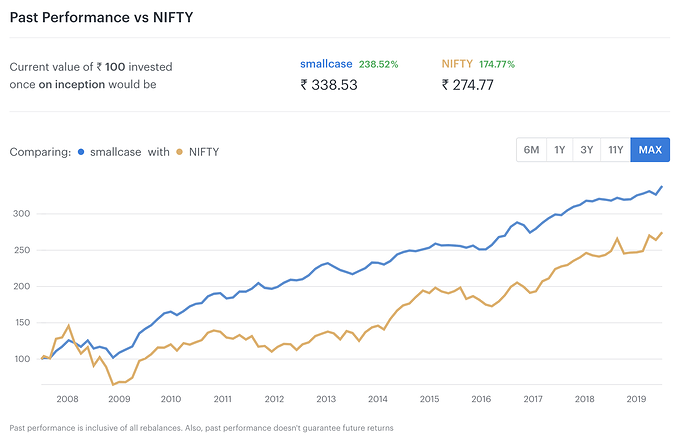

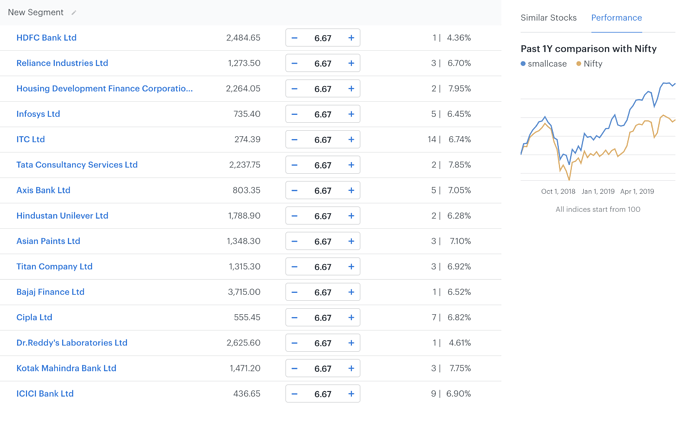

Why not simply ETFs (Index + Gold + Liquid), you can see a mix of this in one of the smallcase by zerodha.

You can see the performance from pre 2008 crash.

Another idea is, you can take nifty 50, get rid of all uncomfortable stocks like PSUs, cyclicals and cos with major corp governance, that itself outperforms nifty by 5-6% easily. Since ETFs are not modifiable, being retail has added advantage, we can be nimble, allows one to easily remove the companies with questionable corp governance issues from our own list.

Here’s an example:

PS: The corp governance issue is something judgemental, what I see as a red flag, may not be a red flag for others, vice-versa.

6 Likes

Both these are great ideas too. Thank you very much!

1 Like

i liked your second option…infact this is what my portfolio primarily comprises of

1 Like

Is the risk worth it for 2 %? Sovereign rated instruments in liquid funds such as from ppfas / quantum may give 6 odd %. Since this is a buy and forget portfolio, peace of mind may be worth more than 2% alpha in debt fund imho. Another option is to invest in T bills as they are absolutely safe with sovereign status.

Overall this portfolio may do much better than most of us here.

1 Like

Thank you Vijay ji. I thought Banking and PSU funds are also safe as they are short term and invests in banks and PSUs debts. May be I was wrong in my assumptions. Your point is very well noted and will make correction.

Thanks for your positive review on other funds.

I am not a sir, so please don’t call me that.

So you do have a stock PF consisting of some some good names, alright. If you are at such a stage of your professional life, and MF investing is the only way to go then I suggest you look at freefincal.com which has hundreds of articles on MF, in case you didn’t know, I am sure you can enhance your vision.

And I am not sure if you can bet on one person when it comes to MF, fund managers may move to other AMCs or simply quit, Ajit Dayal quit Quantum. So if you are in such a position that you are not dependent on the returns of your MF PF for many more years and has an asset allocation in place, you can look at Nifty Next 50 index which more or less has given returns comparable to multi cap category, only market risk exists here, no manager risk. Although, Quantum equity fund has good downside protection, some investors complain that it gives lesser returns, so it suits people with a conservative expectation, I presume you are one.

And Banking and PSU funds are not safe either, they can invest 20% in risky bonds, one fund that I held invested in IL&FS and I lost money. Quantum liquid comes close to a safe fund as it invests mostly in Government bonds and PSU instruments.

1 Like

Thanks Chaitanya ji. Appreciate your guidance. Will definitely work towards your recommendations.

I hope to continue to build my stock portfolio but the problem is that the coffee can names are not cheap anymore and I don’t have bandwidth to learn about non consumer sectors as of today. Hopefully after a few years I will be back to learning mode again.

Point well noted on Banking and PSU. This should be replaced with Liquid funds from either Quantum or PPFAS. I will also explore Freefincal more and check nifty next 50.

Thanks again.

Yes, ETFs is a better way to go, and also will allow you to invest in Nasdaq if you wanted to invest now. Also, some structured products are coming out which also need to be avoided since they are full of commission fees of the sales person.

KKP Investor

Hello,

I have a question regarding PPFAS 's tax saving fund. Is there any benefit of buying during the nfo period vs buying after nfo is over.

Thanks

Nah no difference. And I hope you know that PPFAS tax savings fund can’t invest in foreign securities like its Long Term Equity Fund does.

2 Likes

At NFO you will get the units at the face value (Rs. 10) and after NFO and the underlying NAV. It makes no difference actually.