Brief -

The company is one of India’s leading Omnichannel payment solution providers. It is the second-largest company in India in terms of revenue from ATM-managed services and also the largest deployer of POS terminals at petroleum outlets in India.

Segments -

- **Payment solution (79% of revenue)**a. Cash payment solution (63% of revenue)-I. ATM & Cash Recycling Machine outsourcing - The company is responsible for sourcing sites and owning, deploying, maintaining and managing the ATMs and related assets.II. ATM & Cash Recycling Machine management - Banks own the ATM & company responsible for site sourcing, switching and transaction processing.b. Digital payment solution (16% of revenue) - Point of sale machine deployment (majority at pertol pumps) & also integrate a variety of payment channels, including internet payment gateways and several mobile payment systems, to route, switch and process electronic transactions even across non-banking segments.

- Banking automation solution (11% of revenue) - It involves sale of machines and related services to customers in the retail, petroleum and colour segments.

- Other automation solution (10% of revenue) - Automating fuel pump machines by installing tags on car to identify car & refill the tank. The payment is deducted from the tag.

What’s brewing currently for the company?

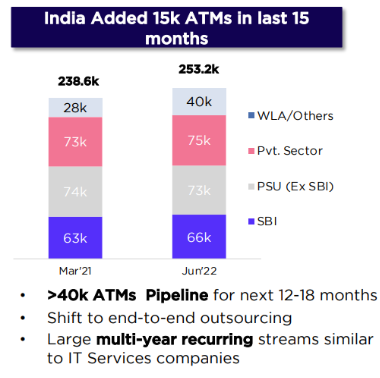

- Strong tender pipeline & concentration in industry - The PSU banks have a good tender pipeline of ATM which will be outsourced to players.

- Stricter RBI norms - The RBI has been tightening norms of ATM management with key norms being -a. Minimum net worth requirement of 100 cr networth, secured van with specification of safety & protocols to be followed.b. Cassette swap requirement - Cassettes (tray which holds cash in ATM) with banks need to be refilled from bank vault & directly placed into the ATM. This will increase capital requirement & ATM management & outsourcing players will benefit as realization per ATM will increase due to higher capital required.

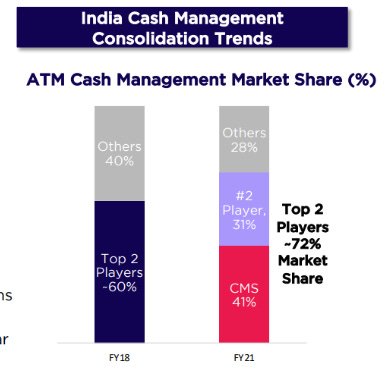

- Leading to consolidation in the industry - Globally the ATM management & outsourcing business is concentrated with few players. In India the industry seems to be moving towards global norm.

- Leadership in PoS (Point of sale) machine deployment at Petrol pumps - The company’s management claims to have 50% market share in the petrol pump PoS segment with strong order book for the segment.

Risks -

- Digital payments (specially UPI) increased usage.

- RBI - imposed ban on AGS Transact on opening new white label ATM (the machines established, owned, and operated by non-bank entities.)

- Vulnerability of IT system - as majority of back end is digitalized, any attacks or loss of data makes company vulnerable.

Management -

- Ravi Goyal - Chairman and Managing Director - He is responsible for the management of the overall operations of our Company and our Subsidiaries. He holds a Bachelor of Engineering degree from Mumbai University. He has approximately 26 years of experience in the field of technology. He has previously worked with DCM Limited and Byte Systems Private Limited. Prior to establishing our Company, he established Advanced Graphic Systems, a proprietary concern, to market computer-aided textile designing software.

Peer review

CMS infosystems -

CMS Info Systems Limited is India’s largest cash management company in terms of the number of ATM points and retail pick-up points as of March 31, 2021. The company is engaged in installing, maintaining, and managing assets and technology solutions on an end-to-end outsourced basis for banks, financial institutions, organized retail, and e-commerce companies in India.

Revenue split

- Cash management (69% of revenue) - End-to-end ATM replenishment, Cash pick up and delivery & Currency movement inter/intra city for Banks

- Others (31% of revenue) - Sales, deployment, and maintenance of ATMs, Brown label ATM Deployment, Managed Services for bank-owned ATM networks, Management and personalization of cards, Software solution & AI based Remote Monitoring.

CMS infosystem highlights -

- Current order book (as on Q2 FY23) - at 2800 cr (to be implemented over period of time)

- More public banks outsourcing ATM operations

- Company to grow 18% yearly basis to reach 2500-2700 cr revenue target by FY2025 along with maintaining current PAT margin

- Cassette swap implementation to increase realization per ATM

- AI based remote monitoring has a strong order book of 10,000 ATM.

- 80% of revenue recurring & 20% from services business

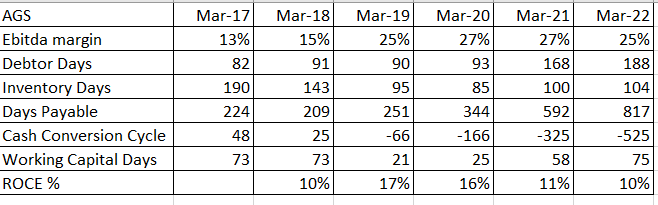

Key ratio comparison -

What future holds for AGS Transact?

The company reduced debt from the IPO proceeds (indirectly) which will lead to reduction in interest cost saving of 100-150 cr on a annual basis but at a cost of diluted equity capital.

Given the recurring revenue nature of business with consolidated industry seems good for future growth visbility. What acts on ice on the cake is - increasing PoS machine deployment (majorly at petrol pumps), increasing outsourcing by banks of ATM & increasing automation in banking to put a lid on costs. Company is targeting 10-15% revenue growth & 25% EBITDA margins for FY23.

Soruce - Screener,

As both CMS & AGS have listed in past 1 year the valuation comparison isn’t meaningful. But if one considers management guidance of 10-15% revenue growth with 25% margins there seems to be decent upside from recent levels but a miss on EBITDA margins would be key to watch out for.

Disclosure - invested as tracking position.