H1FY26:

•

•

(Installed capacity and manufacturing unit area up from 18,845MT and 26320 Sq. Mtrs. Respectively. Rest is same as Previous HY)

• We have transitioned to a fully owned 51,671 sq. Mtrs. manufacturing facility at Mehsana, Gujarat during H1 FY26 end, expanding installed capacity to 22,000 MT by H2FY26. This will pave the way for us to grow with greater efficiency and margins.

•

• Target >70% utilization by FY27

• Carbon Fiber Products: Product to be introduced by end of FY2026 in new facility

•

•

CONCALL NOTES:

• India remains one of the fastest-growing markets for composite consumption. Supported by strong traction across infrastructure, utilities, renewable, telecom and industrial applications, the demand environment continues to work in Aeron’s favor.

• FRP REBAR SEGMENT:

o Ministry of Road Transport and Highways under Mr. Nitin Gadkari and NHAI, has actively promoted the adoption of FRP rebar and issued guidelines encouraging its use.

o Each FRP Rebar machine has a capacity of approximately 300 metric tons a year and that would generate approximately anywhere between, depends on the diameter, but it will generate probably around INR5 to INR6 crores. Between INR5 to INR7 crores, I would say, depends on the diameter per machine. (Planning to put 5 machines by year end)

o Sales realization is 140rs per KG.

o It’s been almost just two years since the government has started promoting this product and started accepting this product. And the feedback from the market is also very positive. So, the acceptance is growing at a fast scale. It’s just that people are taking time to, you know, may use in some part of their project, observe and then in the next project scale up the use of FRP rebar.

o Price is lesser than TMT rebars. There are other benefits as well like it is one-fourth the weight of TMT rebar. So, installation becomes faster. The freights are lower. So, there is a labor efficiency and all that.

o TMT rebars to FRP rebar, the difference would be approximately between 10% to 20%, depends on the metal pricing at a given point

o Customers: In Ahmedabad, there are a few developers. One of the big names is Shaligram. And then, on highways, IRB, we are already supplying to IRB. I think that is a good, big enough name to address the highway developers. We are also supplying to L&T.

o So, as I was saying that one of the projects that we are executing right now on rebar is with IRB for their highway in Gujarat. So, this kind of project companies are our customers. Going forward, we will try to align our supplies with this kind of project companies with a long project timelines and good order value.

o COMPETITION: One is Jindal Advanced Material, which is a JSW group company. And then there is Rathi Steel, they are based in Delhi. I think these two have good enough capabilities right now at this point. There are other manufacturers as well with one machine or two machines, but these two are having good capabilities. And probably with our five lines, we will be among the few large manufacturers. Everybody is expanding based on the increase in demand and the clients they are able to convert. But right now, I think Jindal and Rathi would be probably more than 10 machines combined with bend and straight.

o 5 FRP rebar lines/machines will be optimally utilized by FY27

o FRP rebar margins are higher, at least by 4% than our existing line of business.

• CARBON FIBER PRODUCTS:

o These high-performance, high-margin composites aimed at sectors such as wind energy, railways and automotive represent the next step in broadening our advanced material portfolio.

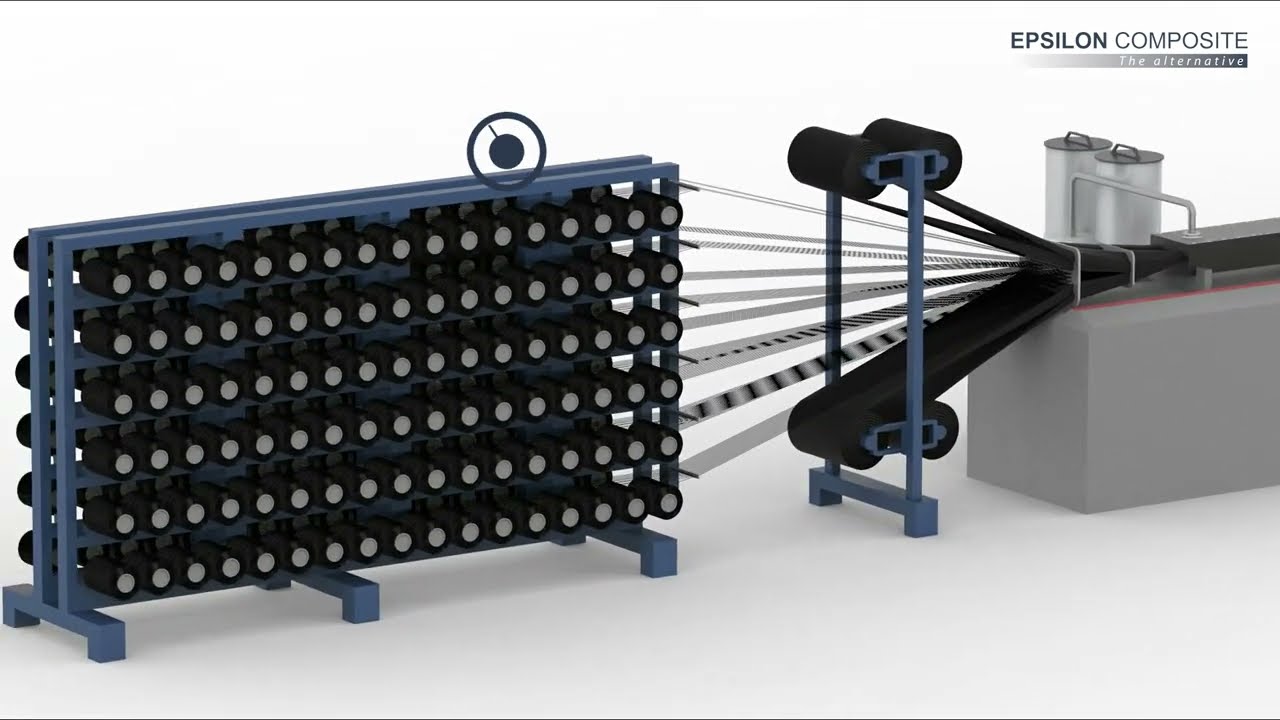

o One is pultrusion process, out of which we will make carbon fiber planks for the windmill blades. Another product from carbon fiber pultrusion would be carbon fiber core rod for the transmission line, HTLS, they call it. And then, the other process in carbon fiber is autoclave process, wherein we can make different kinds of custom molded products for automobiles, railways or defense sector.

o The machines are already ordered for carbon fiber. We are hoping that by end FY26, we have the installed capacity for carbon fiber product.

o Carbon fiber is a more technical product and the approval is also required there. So, we will start approval process and as we go forward with approvals, we can add on capacities in carbon fiber as well.

o We’ll start with one line, then keep on adding more lines as the product gets accepted. Our investment is going to be between INR8 crores to INR10 crores

o APPROVAL TIMELINES: So initially, it is not like we have to wait for all the orders. We can cater to non-approval products. Of course, they will be more competitive, but then approval process is like anywhere between eight to 12 months for higher value applications.

o Carbon Fiber margins higher than FRP Rebar. But then you are waiting there for the qualification and then you have a bigger, much higher margin.

o Pilot plant would be operational by FY27. And it will be fully operational post approvals, mainly FY28

o After approval of the pilot plant and every product, we can scale it up by one-by-one machines, increasing the capacity.

• We are targeting over 70% capacity utilization by FY27 as we implement automation, upgrade manufacturing system and drive-scale benefits across pultrusion molding and UV-cured FRP rods and rebar operations

• With industry tailwinds strengthening, our new facility becoming operational, our strategic entry into new product lines and rising adoption of FRP materials in India and globally. We believe Aeron is well-placed to participate meaningfully in the decade-long up-cycle ahead and deliver sustainable growth in the coming quarters.

• GROWING APPLICATIONS OF FRP: FRP applications can grow. So, some of the examples are like FRP poles for FTTH internet cables. FRP paper profile for treatment projects. So, this kind of applications will grow, which will drive further sustainable growth in the current existing processes which was suggesting us to grow with the capacity and that’s why we needed to shift to the more capacitive premises, wherein we can have strength to explore more capacity. So, that’s why we have planned with the expansion.

• Our current order book is INR45 crores. (Order book is generally for 45-60 days)

• We should be able to achieve 10% EBITDA margin guidance for entire FY in H2.

• WHY CURRENT HY MARGINS WERE LOWER: This was just lowered down due to the fact that we have been shifting our pultrusion process from rented to the new premises. So, it affected our operational efficiency somewhat and the revenue also. Also, the US part somewhat was affected.

• H2 would be much better than the H1.

There are certain parts which we are confident with achievement of that as operational efficiency plus solar plus rent decrease plus we would surely be increasing the revenue part. So, all these proportionately help us to increase the margins and everything

• We’ll be improving margins from 10% going into next FY as operational efficiency and scale kicks in.

• FY27 revenues could be around 300cr

• We’ll be performing much better than 15% growth guidance. It’s a conservative guidance.

• EXPORTS: Western countries have a better demand. Looking to improve exports further as Rupee drops to 90 per USD.

• 4-5cr savings on lease payments. But depreciation will be higher for own facility.

• Trade receivables aging should improve in H2FY26.

• Generally, Receivables are between 60 to 90 days.

• We are still delivering orders in USA. So, it’s not 100% zero for us. The customers are still with us. Meanwhile, if the tariff deal does not get through, then we have already started to talk to outside US customers to improve their offtake from us, basically. And we will be adding new customers to offset that loss of revenue in that case.

• The international global scenario has been flattish with respect to price of FRP products and with respect to the raw material of the major raw materials.

• In India, there is a CBDT hearing going on with respect to antidumping duties on glass fiber products. In that scenario, the price will go up for FRP products as well because the price of raw material will increase for the domestic market only.

• MISCELLANEOUS:

o It is not compulsory to use FRP rebar bends. You can use metal bends along with FRP rebars. We do have capabilities to supply FRP rebar bends as well. And we are also scaling up that particular bend production capabilities along with our straight rebar lines. So, our customers majorly, now we are also delivering project orders. We have been able to deliver straight rebars as well as bent rebars. And in case of site contingencies, there is no problem. You can use metal bent elements along with FRP rebar. Of course, the bent capabilities in India, FRP rebar bent manufacturing capacities in India are still not, you know, enough to suffice the demands that currently have in the project. So, that is getting scaled up.

o FRP rods for optic fiber cables is not very customized. It’s much standardized with respect to different diameters. The major customization is for structural parts that we do, the pultruded sections and all. That we will keep on doing and that segment is also growing year-on-year. And so, the growth will come on, of course, expansion of current product as well as adding new applications for pultruded products.

o In parallel, we continue to build our sustainability edge through the use of our 1.2-megawatt solar plant and by promoting FRP, CFRP and CFRP as low-carbon, corrosion-free alternatives that reduces life-cycle costs for customers.

o FRP rebars are corrosion resistant, but now you can see there are corrosion resistant steel bars also as well as epoxy coated steel bars that also provide the same qualities. So, does that affect us?

FRP rebars with respect to normal TMT bars are cost competitive already. When we add the epoxy coating on TMT rebars, the FRP rebars are getting more cost competitive. So, of course, in a market like India, the cost is a major part, right? So, we become more competitive with respect to the alternatives.

o So, with respect to FRP rebar, it has twice the tensile strength and FRP rebar are right now I mean, as per codes, it is advised to be used on ground level applications. That means highways, parking area, manufacturing floor or warehouses, bridges and all these applications. FRP rebars are not yet included in columns and stacks. One of the reasons is elongation. So, wherever the FRP application is approved, it is still a big market and it is cost competitive with respect to technical as well as commercial.

(My takeaway from all this is that TMT is suitable for certain applications whereas FRP is more suitable/cost competitive in other applications)

o And what is like the optimum capacity utilization for us? I heard management, you mentioned 70%. Why is it much lower than – why is it like 70%? Is there any operational difficulty?

Yes, it is basically the peak time and slower times in the year. So, during the peak time, we are utilizing higher efficiencies. And in the slower cycle, like monsoon or somewhere, the efficiencies are lower. So, this is an average annual efficiency utilization. It includes different dimensions and diameters of the product and all that also affects.

o END USER CUSTOMERS: We work with the big names like L&T in construction. Water treatment would be Wabag. In highways, it will be IRB. So, of course, we work with different EPC contractors. And of course, we work with end users as well in oil and gas, in chemical plants. So, oil and gas, we work with ONGC and then in thermal plants, we work with NTPC. So, it’s a mix of EPC contractors and users both.

We are supplying to optic fiber cable manufacturers. In India, we are supplying few names are Apar Industries or KEC Industries. Then, of course, we are also exporting this product to different countries. One of the big names internationally is OFS, Furukawa Group. They are based in different countries.