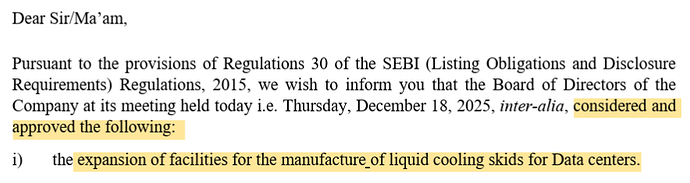

Overview

Aeroflex Industries is a Mumbai based manufacturer and supplier of metallic, flexible flow solutions including corrugated hoses, assemblies, and fittings; catering to both domestic and international markets. The company has shown consistent growth and is strategically shifting towards higher-margin assembly businesses and specialized applications.

Its products cater to diverse sectors such as oil & gas, steel, fire safety, solar energy, and emerging industries like electric vehicles and semiconductors. Aeroflex operates as part of the Sat Industries conglomerate.

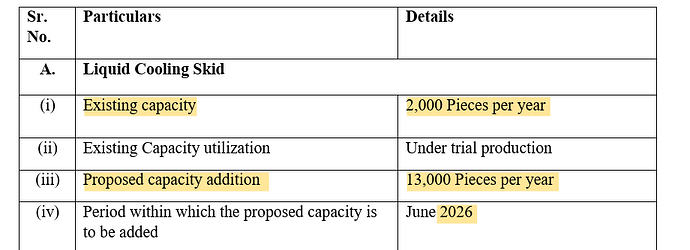

The company is planning significant capex to expand capacity and diversify its product range into miniature metal bellows.

History

- Aeroflex Industries Limited was incorporated on October 19, 1993.1 Originally established as Suyog Intermediates Private Limited.

- The company underwent name changes to Aeroflex Industries Private Limited in 1998 and subsequently became a public limited company in 2006

- A significant milestone in its history was the acquisition by Sat Industries Limited in April 2018.

- Acquired Hyd Air in 2024 for 17 Cr, finances through internal accruals and IPO proceeds. This was done to facilitate entry into new sectors such as railways and shipbuilding.

Product portfolio

- Specializes in the manufacture and supply of environment-friendly metallic flexible flow solutions

- Stainless steel flexible hoses (both braided and unbraided)

- Assemblies, fittings, braiding, interlock hoses, composite hoses

- Future capital expenditure - miniature metal bellows

Assemblies and fittings accounts for highest revenue amongst others (~33% in FY 24). It is a high margin business and the company is focused to bring the assembly and components revenue share to around 80% over the next three years. With this change they are targeting EBITDA margin of ~27-28% over next three years.

Export focus

The company has a significant international presence, exporting its products to over 80 countries, with a substantial portion of its revenue derived from these exports. Exports accounted for 80.60%, 84.53%, and 80.90% in FY23, FY22, and FY21, respectively. his trend continued into FY24, with exports constituting 84% of the total revenue.

The company has witnessed an increasing demand for its products in international markets, particularly in developed economies. The company exports to over 80 countries, with a majority of its sales originating from the Americas and European regions.

They are strategically focusing on supplying solutions for specialized applications in industries such as semiconductors, aerospace, and pharmaceuticals. These specialized applications typically offer higher margins and face less intense competition.

Growth drivers

Aeroflex Industries operates within a sector benefiting from several tailwinds. There is an increasing demand for flexible flow solutions across various end-user industries, driven by infrastructure development, industrial growth, and the growing need for reliable and safe fluid transfer systems.

The global market for stainless steel flexible hoses is substantial and is projected to expand to US$ 38 billion by 2027. The Asia Pacific region is a leading exporter of stainless steel hoses, with significant growth coming from China and India. PLI schemes are also expected to support growth in the company’s end-user industries. Emerging sectors like electric vehicles, solar energy, and natural gas pipeline infrastructure are anticipated to further drive demand for flexible flow solutions.

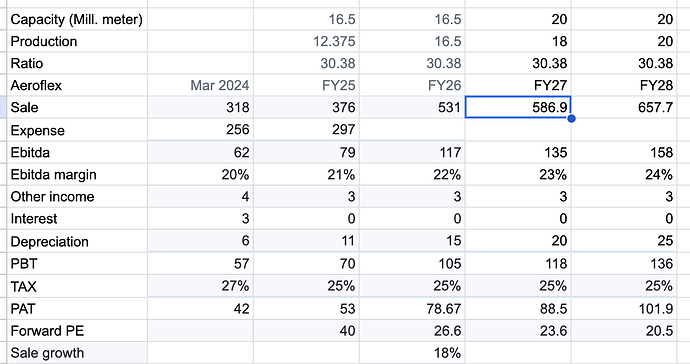

Planned Capex

The company is planning ~100 Cr of capex in the coming years

- 54 Cr for increasing the capacity in stainless steel hose and braidings from 16.5 Million meters to 20 Million meters, along with increasing assembly stations from 40 to 70 and installation of automized welding stations

- 23 Cr for foray into miniature metal bellows

- 18Cr in Hyd air for new machines and equipments

Challenges

- The industry is competitive, necessitating continuous innovation and cost competitiveness.

- Fluctuations in the prices of raw materials, primarily stainless steel, pose a potential challenge to profitability.

- Given its substantial export and import activities, Aeroflex is exposed to volatility in foreign exchange rates.

- The current uncertain scenario due to fluctuating tariffs, wars and de-globlization can lead to demand and supply disruptions.

- Inherent risks associated with the introduction of a new product line, specifically miniature metal bellows, are subject to various risks, including market acceptance, production challenges, and competition from existing players in the niche market.

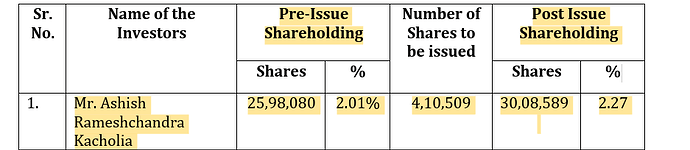

Valuation

The company’s TTM revenue stand at ~350CR with an EBITDA of ~77.6 CR at an EBITDA margin of 21.7%. Net profit stands at ~50CR.

The company has guided a revenue of ~650-675 Cr from assembly business after two years. From Hyd air, they are expecting a top line of 40-50 Cr in next couple of years (no specific timeline).

From miniature metal bellows, 25-30 Cr revenue is expected (again no specific timeline)

Along with this, they have guided an EBITDA margin of 24-25% by FY 27.

If we take a revenue estimate of ~725 Cr by FY 27 with an EBITDA margin of 24%, this gives EBITDA of ~174 Cr, and net profit of ~111 Cr.

The current PE is on a higher side for the industry, if we take a more conservative PE of 25 by FY 27, this gives an 18% upside from the current market price.

If the company continues to do good and enjoys a higher PE of ~30, it gives a potential ~42 % upside from the current market price.

Conclusion

While the current valuation seems to price in a good portion of future growth, potential remains—especially if margins improve as guided. That said, investors should be mindful of risks and maintain a margin of safety when considering Aeroflex Industries as an investment opportunity.

Disclaimer: Not holding right now, considering taking a starting position and will monitor future developments.