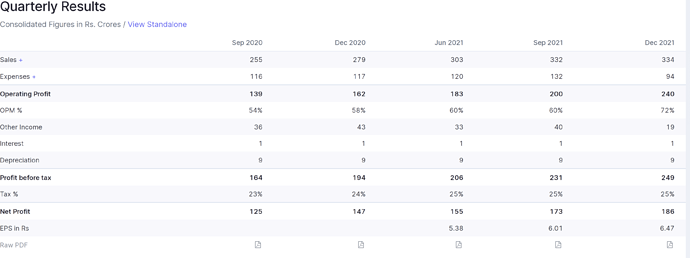

Aditya Birla AMC has been underperforming (in terms of stock price) since listing. Price has gone down from 700 to 500 since listing. During that time, company has come out with very good numbers, with major improvement in margins. The FY22Q3 margins of 72% may not be sustainable as it contains a write back provision on employee costs which will now be incurred through ESOPs. However, 60-65% operating margins should be doable (in-line with Nippon AMC)

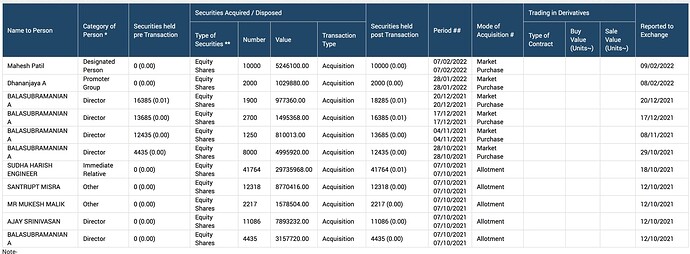

Its also rare to see company employees subscribing to the IPO, then buying shares regularly through open market post IPO.

This is a very high quality business throwing out a lot of freecash flow and being reasonably valued. Its good seeing employees regulary buying shares through secondary market (rather than through ESOPs).

Disclosure: Invested (position size here)