Quarterly results out. Though there is topline growth, expenses and debt seems to be pulling it down. Net profit of 5.60 crores.

Good set of numbers posted in Q2:

Good Results…

PAT up 79% in Q4FY19

Investor Presentation

hi all, some interesting points here.

I studied the business, and I do not have a lot of conviction on the 2 most important metrics -

Sales per square footage in case of pantaloons (cannot do this for Madura since it sells wholesale too) have been quite stagnant as can be seen from below -

| Particulars | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|---|

| Total area under coverage (mn sq. ft.) | 1.7 | 2.0 | 2.3 | 2.9 | 3.2 | 3.7 | 4.0 |

| Pantaloons revenues (Crs.) | 1,285 | 1,661 | 1,851 | 2157 | 2552 | 2862 | 3194 |

| INR revenue per square foot per annum | 7,560 | 8,306 | 8,047 | 7,438 | 7,975 | 7,735 | 7,985 |

| increase by | 10% | -3% | -8% | 7% | -3% | 3% |

despite heavy ad spends and expanding store footprint, sales per square foot have not increased substantially over the years.

further, the reported SSSG too has been quite volatile for the short time that the company has made disclosures of -

| Particulars | 2017 | 2018 | 2019 |

|---|---|---|---|

| Pantaloons | 5% | 14% | 1.4% |

| Madura | 5.3% |

Here is my dilemma – what makes one apparel retailer better than the other - Is it cost control or better purchasing / design? If it is cost control, the likes of fashion trends, thoughtful sourcing and brand perception do not seem to be quite relevant. However, this defies the success of company’s own legacy brands like Louis Phillippe which have been maintaining a premium offering over last so many years. Yet, ABFRL continues pouring money on expanding value segment and opening newer retail outlets, while reducing sales mix through wholesale route, which is down to 58% from 65% in 2018. The wholesale route in my understanding was asset light and monetized brands, instead competing only on real estate).

Not only ABFRL, but the best company in the lot, V-Mart Ltd., also has been incredibly cost savvy, with rentals at 4% of sales compared to ABFRL’s 14%, while striving to sell through its own outlets eschewing wholesale completely in order to focus on the buyer experience. Does any apparel retailer then, ever have a competitive advantage? I think I have found myself in a place where an analyst often is – 10 feet away from the truth, one that probably only a business owner grasps, albeit instinctively. I for now conclude, that a good retailer has to have 2 essential ingredients – deft sourcing (non measurable) and cost control (measurable) to earn above average returns.

This analysis is a useful reminder of an important lesson that working capital requirements and uses are very specific to certain industries, and whether a company has good working capital management or not can be gauged only by comparing its peers from the same industry and not across sectors. In a similar vein, high cash conversion cycle does not tell us anything about the financial health of a business, some businesses simply end up having negative working capital, despite being lousy (case in point is PVR, the food vendor).

here is the link of my entire thesis on ABFRL -

happy reading!

ABFRL NCD.pdf (654.8 KB)

I believe this stock got rerated back in 2018 due to significant increase in their margins. Does anyone has any idea on what lead to that increase in margin and what did they do differently?

I have got few shares named “Aditya Birla Fashion Rights” in my demat balance.

I thought that usually we have to subscribe for the rights issue if needed.

Not sure how it got added to demat balance without subscribing the rights issue.

How do we pay for these newly added shares ?

Please someone clarify

you need to go their site and pay 50 percent cost, and jan 21 thirty percent and remaining later of the year, it is allotted at the price of 110 rupees, you have three option 1: buy it, option 2 :ignore it option 3 :sell the rights before expiry today at 23 rupees at your desired cost

thanks for the reply

There are two options online and offline.first online u need to go to linkintime.co.in(registrar)and click on R-wap and fill the details of ur demt ac and make the payment through netbanking or upi.

For offline u can download the form the registrar website by filling the details and submit at a bank branch who are eligible.

I had done my work on V-Mart recently I would agree with your thesis completely. It is about inventory and costs. However having said that to get there there are many small small things that a retailer may do. Using technology, store opening strategy/location strategy etc.

Understanding V-Mart and listening to their con-calls has been a brilliant education in understanding this space.

Couple of points which observed while doing my work

-

Sales/Sq ft for a V-Mart (Tier2/Tier 3 player) v/s a Pantaloons is broadly the same. I think thus everyone is slowly realizing that the opening stores in smaller towns makes more sense as you would anyway get the same kind of throughput in terms of sales per square foot. No wonder everyone is going after the value segment from the Citykarts to Pantaloons to Max.

-

Pantaloons they have consciously reduced the size of their stores over the last few years

You can also sell these Rights on the market.

Rights are trading under the symbol ABFRL-RE-BE @27-28Rs.

hi @rohitbalakrish_

here was some more data that might be helpful in determining what VMart is doing differently. Below is the sales per square feet for different companies -

| Particulars | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|

| ABFRL - Pantaloons | 8,047 | 7,438 | 7,975 | 7,735 | 7,985 |

| Trent | 8,791 | 9,132 | 9,581 | 9,980 | 10,225 |

| Vmart | 9,504 | 9,072 | 9,588 | 9,876 | 9,660 |

Although it may appear that both Vmart and Trent sell similar amount in revenue, it is gets much more interesting while looking at average bill size -

| Average Bill - INR | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|

| Trent | 1860 | 2029 | 2197 | 2332 |

| Vmart | 663 | 713 | 750 | 756 |

what i interpret from the above is that its not just that VMart derives a structural advantage by being a smaller town, and i am of an opinion that Vamrt is an outlier to achieve the same kind of throughput as Trent / ABFRL and this may not be the norm for other small town garment sellers.

In this industry, i have found it very hard to identify the deft sourcing, or what you would call as the art of merchandising to be apparent for any company except relying on the above proxies.

does it make sense?

What about reliance Trends? I found the number of Reliance Trends increasing in small towns. Merchandise Positioning wise Trends, Max and Vmart look similar. In towns where there is zero presence of ABFRL, we can find Reliance trends. Without including Trends,picture of the small town organized apparel retail is incomplete. One more evolving (yet to be confirmed) aspect is Central and other future fashion stores going the Reliance way. Its going to change the market dynamics a lot.

Actually Umang others are also having a similar Sales per square feet please see below

| V-Mart | 8,132 |

|---|---|

| V2 Retail | 9,129 |

| CityKart | 7,854 |

| India1 Mart (Nysaa Retail) | 6,000 |

| V-Bazaar | 4,500 |

| Bazaar Kolkatta | 8,634 |

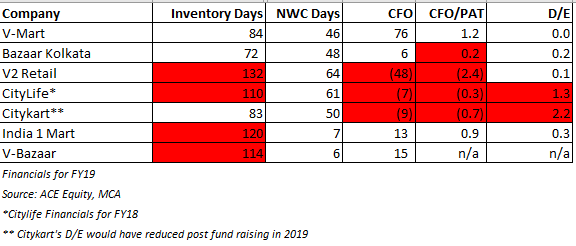

The more interesting issue and the most important factor in this business is the turns of inventory and the overall working capital. If you see that for V-Mart it is one of the better ones and if you further put that into perspective with the fact that they operate their stores in places where infrastructure is not that great so being able to replenish the stores twice in a week is quite a feat.

I read about Amazon invesment in Future Retail and was afarid of how cane ABFRL retail can beat in online sale with Amazon before 1-yr. now Walmart backed Flipkart deals ,im convinced about the future of this company both online and offline sales …

Please post your views.