Accent Microcell Limited- Management Meet & Plant Visit Note (7th Nov 2025):

Accent Microcell Limited is a leading Indian manufacturer and exporter of microcrystalline cellulose (MCC) and related cellulose-based excipients, with a global presence in over 75 countries. The company serves multiple industries, including pharmaceuticals, nutraceuticals, food, cosmetics, and industrial applications, and is recognized for its specialized, high-quality excipient solutions.

Company Overview

• Founded in 2001 and headquartered in Ahmedabad, Gujarat, Accent Microcell has established itself as a key player in pharmaceutical excipients, with certifications such as EXCiPACT, US-DMF, GMP, and ISO standards.

• The company has two manufacturing facilities (Ahmedabad and Dahej SEZ), and a new site at Navagam, Kheda, expected to augment capacity soon.

• It caters to 200+ customers across India and internationally, servicing a wide sectoral spectrum from pharmaceuticals to chemicals and textiles

Promoter Family:

• Accent Microcell is a promoter-led organization, driven by the founding Patel family, which remains hands-on in daily operations. The leadership trio - Mr. Vasant Patel (Chairman), Mr. Ghanshyam Patel (MD & CFO), and Mr. Nitin Patel (Executive Director) - collectively combine decades of operational and financial experience.

• Mr. Vasant Patel provides the strategic and cultural compass for the group.

• Mr. Ghanshyam Patel anchors the company’s financial prudence, managing funding and profitability with tight control.

• Mr. Nitin Patel oversees expansion and execution, bringing operational rigor to new projects.

• The company also has functional leaders in finance, business development, and global sales, signalling an ongoing shift from a family-centric management to a professionalized, process-oriented institution.

• Accent’s governance ethos is rooted in discipline without bureaucracy. It blends entrepreneurial agility; rapid response to market opportunities; with a structured compliance framework across GMP, EXCiPACT, US-DMF, and ISO standards.

• Management places an unusually high emphasis on cost vigilance, process integrity, and premiumization, understanding that pharma excipient customers value consistency and certification over low-cost supply alone.

• Capital Allocation Discipline:

o One of the company’s strongest differentiators is its conservative yet growth-oriented capital approach.

o The management’s motto, “Jo bhi kamaenge, dalna” (reinvest every rupee earned), underlines a culture of ploughing back profits into capacity and technology upgrades, not siphoning through high salaries or related-party deals.

o The decision to continue dividends even while raising capital via Rights Issue demonstrates intent to balance shareholder reward with growth reinvestment- a governance marker of maturity.

• Strategic Shift in Capacity Planning”

o Previously, the company waited for 80–90% utilization before committing new capex.

o Now, it starts new plant construction at ~60% utilization, ensuring that by the time the new unit is commissioned (typically ~18 months later), the running units are already at full capacity.

o This proactive model minimizes lost sales due to bottlenecks and better aligns capacity readiness with demand visibility.

o Accent’s culture blends the agility of a small entrepreneur with the discipline of a regulated supplier is a rare combination that underpins its steady scaling without dilution in quality or governance standards.

Operating Footprint, Utilization & Site Impressions

• Unit 1 – Piranha Plant (2,000 MTPA): This is Accent’s first plant, currently running at 100% utilization. It serves as a model of process maturity and has been the company’s learning ground for process optimization.

• Unit 2 – Dahej SEZ Plant (7,200 MTPA): Located in the Dahej SEZ, this plant operates at ~95% utilization and provides a strong export base due to SEZ advantages (duty-free imports and streamlined logistics).

• Together, the two plants form a vertically integrated system where the company controls every step from imported wood pulp to final packaging.

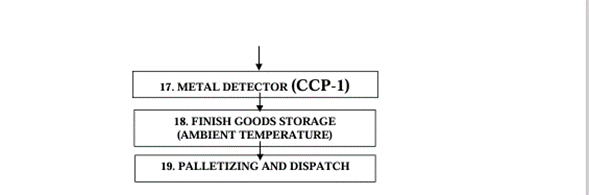

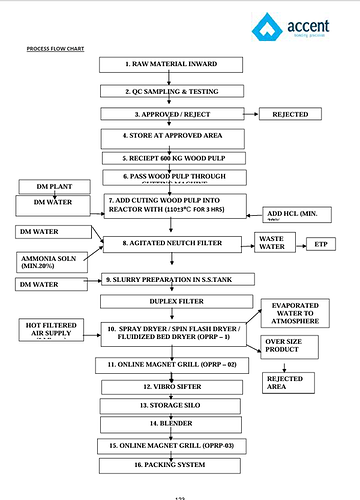

Pharmaceutical-Grade MCC Manufacturing Process: Accent Microcell’s MCC typical process steps are as follows:

- Raw Material Sourcing and Preparation

• Feedstock: High-purity wood pulp is sourced predominantly through imports from the US, Sweden, South Africa, Indonesia, and Canada. Alternative sources may include purified cotton linters or sugarcane residue.

• Pre-treatment: The cellulose content is separated, and extraneous lignin/hemicellulosic material is removed through washing and pulping.

- Alkali Treatment (Optional):

• Some plants (including Accent) may first treat the wood pulp with an alkali solution (e.g., sodium hydroxide) at moderate temperature (25–70°C), aiding in partial depolymerization and facilitating subsequent acid hydrolysis.

- Acid Hydrolysis

• Hydrolysis Agent: Concentrated hydrochloric acid (HCl); typically 2M; process varieties use 25–75% acid by weight.

• Temperature: 80–105°C for 15–30 minutes, depending on the process scale and reactor type.

• Purpose: The acid hydrolysis selectively breaks down the amorphous regions of cellulose, leaving behind insoluble crystalline fragments the “microcrystalline” portion.

- Washing, Neutralization, and Filtration

• Following hydrolysis, the material is subjected to repeated washing to remove residual acid and hydrolysis byproducts.

• Neutralization may be performed using dilute alkali (e.g., sodium bicarbonate/sodium hydroxide) to achieve near-neutral pH.

• The resultant cellulose is filtered and washed until free of soluble contaminants and acid.

- Drying, Milling, and Particle Engineering

• Drying: The microcrystalline cellulose is dried at controlled temperatures, typically 57–60°C, to the target moisture content.

• Milling: The dried product is milled to obtain the required particle size grade (e.g., Accel 101, 102, 105, 200, 301, 302, etc.), tailored for direct compression, wet granulation, or other tablet/capsule applications.

• Optional Modification: Some grades (e.g., SMCC, co-processed MCC) undergo additional blending (with colloidal silicon dioxide) or fluidization steps to further optimize flow and compressibility.

- Quality Control and Packaging

• Each batch is tested for pharmaceutical parameters—purity, moisture content, particle size, microbial limits, ash content (<0.6%), and compressibility.

• Regulatory compliance and traceability (EXCiPACT, US-DMF, FSSC certification) are ensured.

• MCC is packaged in pharma-grade multi-layer bags, with shelf-life and storage protocols for export to regulated markets.

Plant Design and Integration:

• Accent’s sites are optimally laid out for continuous process efficiency. The integration between chemical processing, washing, drying, milling, and packaging minimizes contamination risk and reduces cycle time.

• The in-house analytical, chemical, and microbial QC labs ensure tight control on product consistency; vital for pharma excipient customers where validation cycles can last years.

• Both plants are running near peak utilization - a clear trigger for the next capacity cycle (Unit 3). The infrastructure maturity at Dahej demonstrates scalability readiness and disciplined operations typical of higher-quality manufacturing players.

Expansion Program - Unit 3 (Kheda District)

Phase 1 – Premium Excipients (VAP Line)

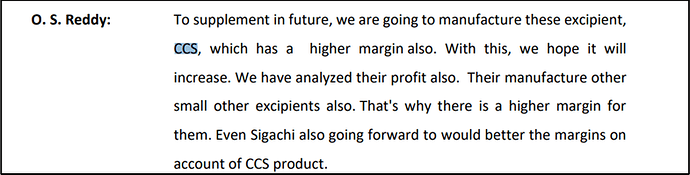

• Products: Croscarmellose Sodium (CCS), Carboxymethyl Cellulose (CMC), Sodium Starch Glycolate (SSG), and co-processed MCC variants (SMCC).

• Capacity: 2,400 MTPA.

• Capex (ex-land): ₹55–60 crore.

• Revised Commissioning: End-January 2026 (from earlier Oct–Nov 2025).

• Phase-1 represents Accent’s move up the value chain as these premium excipients command 3.5–4.0x the realisation of base MCC products and deliver EBITDA margins upwards of 25%.

• Technology Upgrades: Unit-3 features higher automation, glass-lined reactors (for corrosion resistance and process precision), and advanced co-processing lines to enable hybrid grades.

• Orders covering six months of output are already booked (Inquiries from leading pharma chain in Europe for CCS capacity,) rare pre-commercial demand visibility in a commodity-to-specialty transition.

Phase 2 – Large MCC Expansion Line

o Capacity: 12,000 MTPA ; will make Accent India’s largest single-site MCC manufacturer.

o Revised Start of Production: Sep–Nov 2026.

o Construction Start: Within 15–30 days after Phase-1 commissioning.

o Capex: Similar range (~₹55–60 crore).

o Strategic Rationale: Accent currently services part of its demand through trading third-party MCC (~2,500–3,000 MT/year). Post-commissioning, this traded volume will be internalized, providing direct margin accretion and better control over customer supply reliability.

• The combination of VAP margin uplift and MCC volume scale could push consolidated EBITDA margins from ~16% in FY25 to 20–22% post-2026, even before factoring in operating leverage.

Market Dynamics, Demand, Competition & Pricing

• Order Book and Demand Strength: Current visibility includes ~2,000 MT of export backlog and 2.5 months of domestic orders. Export run-rate of 3,000 MT/month marks a strong sustainable base, with demand traction in nutraceutical and excipient applications.

• Sales Mix: Exports form ~65% of sales high for an Indian excipient maker. Accent is now deliberately expanding its domestic MNC customer base to balance currency and receivables exposure.

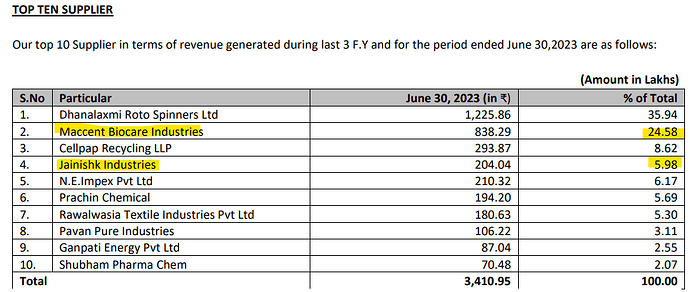

• Customer Concentration: Top 10 customers form <40% of revenue; no single-client dependence a healthy risk spread across geographies and sectors.

• Pricing Strategy: Contracts are a mix of fixed and semi-variable terms with RM pass-through clauses, allowing margin protection against pulp and chemical price movements (with a short lag).

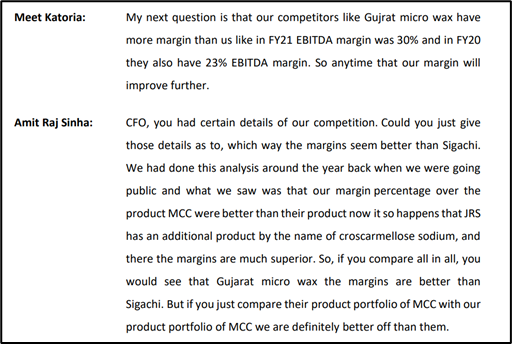

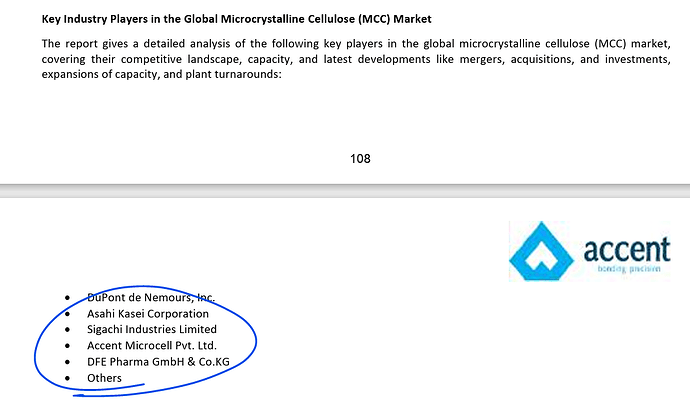

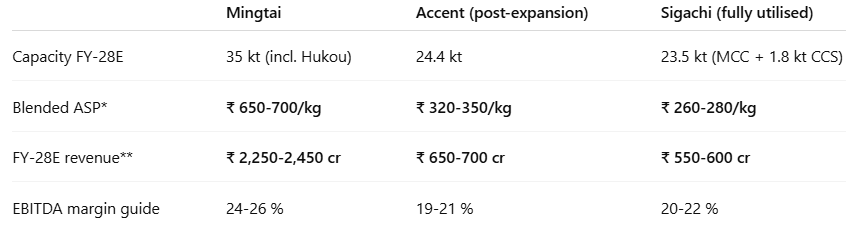

• Competitive Landscape: Global market dominated by:

o FMC (USA): 40–50k MT capacity.

o JRS (Germany): 30–40k MT.

o Mingtai (Taiwan): ~15k MT.

o Indian MCC market is fragmented, with no single plant >15k MT.

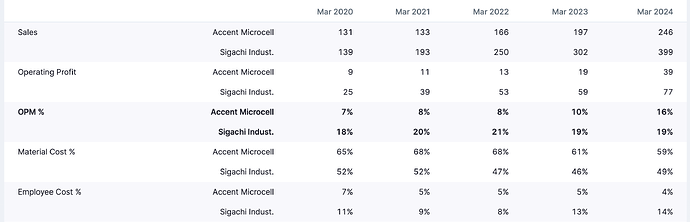

• Peer Disruption Opportunity: Sigachi Industries; one of Accent’s closest peers currently has ~5,000 MT of capacity offline (relocation). This temporary vacuum has already opened share capture opportunities, evidenced by emergency US orders (air-freighted consignments).

• Pricing Gap Advantage: Accent’s MCC priced at ~₹300/kg versus FMC’s ₹500–₹600/kg creates a 50% cost advantage. For large global customers this delta materially impacts procurement cost; accelerating validation decisions.

Demand Drivers for Phase-2 (12,000 MTPA MCC)

• European Client as an Anchor Account:

o Estimated annual MCC consumption: ~10,000 MT.

o Accent’s initial volume allocation: ~1,000 MT (10% share).

o Accent’s price: ₹300 vs FMC ₹500–₹600; a saving of ~₹200/kg (~₹20 crore per 1,000 MT).

This strategic wedge could evolve into a multi-year anchor relationship if quality remains consistent.

• There are few niche emerging vertical in the US and Europe where MCC is used as a controlled-release excipient. Expected demand: 2,000–3,000 MT globally; potentially high-margin, less commoditized.

• Structural Demand Expansion in Pharma & Nutraceuticals: With rising chronic diseases, tablet/capsule consumption continues to grow. Nutraceuticals and functional foods increasingly use MCC as a binder and texture modifier, broadening end-market demand beyond pharma.

• Competitor Downtime and Regional Preference: The temporary capacity reduction from peers like Sigachi provides a rare medium-term opportunity to lock in customers during their requalification window.

• Process, Technology & Manufacturing Insight: Accent’s core product, Microcrystalline Cellulose (MCC), is produced via controlled acid hydrolysis of high-purity wood pulp ; a process that demands consistency, purity, and precision.

Innovation and Continuous Process Migration: Accent is transitioning to a continuous “A-Cocrystal-type” system, offering:

• Better batch-to-batch consistency (tighter RSDs on CoA).

• Lower energy and chemical usage.

• Higher throughput and fewer manual touchpoints.

This is a key enabler for global customer approvals and cost competitiveness.

Product Portfolio & Applications

• Core MCC Line: Used as a binder, diluent, and texturizer in tablets, capsules, and nutraceutical formulations.

• VAP Range: CCS, CMC, SSG, SMCC, and co-processed MCC+CMC - all higher-value excipients with specialized roles in drug disintegration, flow improvement, or controlled release.

• Applications Beyond Pharma:

o Food: texture modifier, bulking agent.

o Cosmetics: stabilizer and texture enhancer.

o Industrial: ceramics, paints, and electrodes; where purity and color consistency matter.

• Strategic Value: Diversified application base insulates Accent from pure pharma cyclicality.

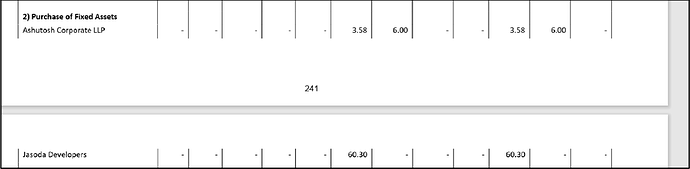

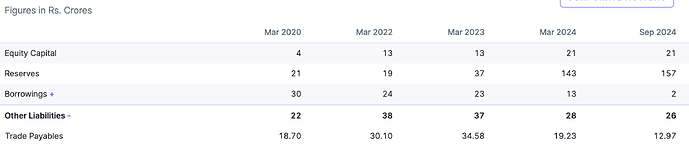

Financials & Working Capital Profile (FY25 Snapshot)

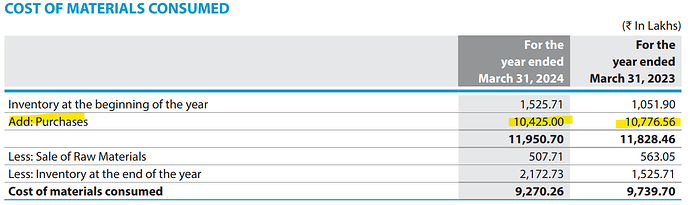

• Revenue: ₹265 crore (+8% YoY).

• EBITDA Margin: ~16% (expected to rise to 20–22% post-expansion).

• PAT: ₹33 crore (~12.5% PAT margin).

• Net worth: ~₹194 crore.

• Debt: Nil ;company is effectively debt-free.

Working Capital:

• Inventory: ~2 months (FG ~1 month).

• Receivables: ~100+ days (skewed by new MNC onboarding).

• RM Sourcing: ~95% imported of Bamboo pulp is from Portugal, Canada, Russia etc; FX hedged via quarterly forward covers.

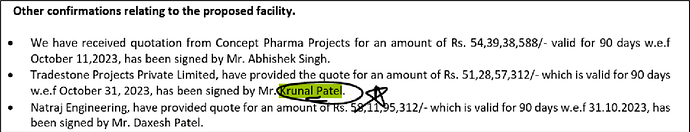

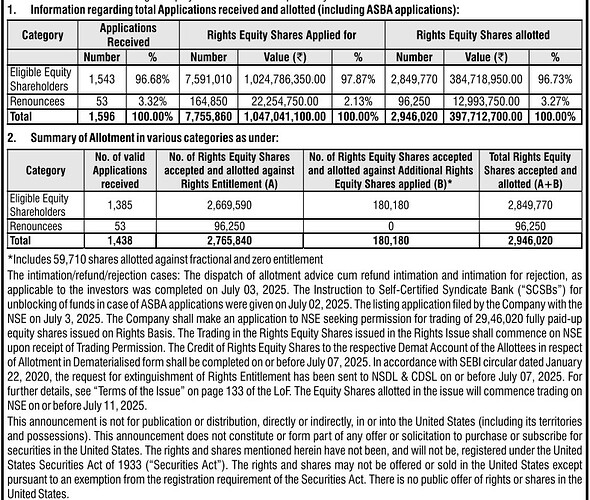

Entire Expansion funded through Rights Issue + internal accruals maintaining a conservative balance sheet while enabling growth.

Cost Levers & Scale Benefits:

• Procurement Scale: At 2,500–3,000 MT/month, raw material purchase volumes enable 3–4% cost reduction through better freight contracts and supplier negotiation.

• Overhead Efficiency: A single marketing team of 11 and shared management resources can manage a significantly higher production base, diluting fixed costs.

• Operational Discipline: Accent consciously limits large new client onboarding for 12 months ;avoiding service dilution for existing customers and ensuring stability during ramp-up.

Risk Profile & Mitigation

• Regulatory Risk: Low fully certified (GMP, EXCiPACT, US-DMF, ISO).

• NGT/Environment Case: Remote, per management.

• Supply Chain: Diversified pulp sources and FX hedges.

• Quality Continuity: High risk if process control lapses; long requalification cycles mean mistakes are costly - hence strong QC focus.

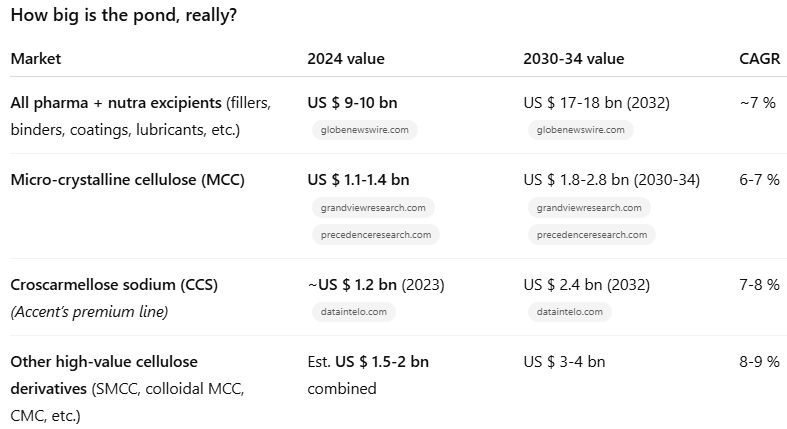

Industry & Growth Outlook

Industry Growth:

Global MCC/excipient demand growing at 6–8% CAGR, supported by healthcare and nutrition trends. whereas company is guiding15–20% CAGR over next 3–5 years via capacity expansion and product mix improvement backed

- Sigachi’s downtime - market share capture.

- New emerging verticals - new application.

- Traded-to-own conversion- margin uplift.

- VAP share expansion - target 25–30% (from ~10%).

Executive Summary- Investment Takeaways

• Expansion-Driven Inflection: Two new phases (VAPs + MCC) will double capacity by FY27 and materially enhance margins.

• Demand Certainty: European client onboarding, new verticals, and Sigachi downtime create clear absorption for new capacity.

• Profitability Upswing: EBITDA expected to rise from ~16% to 20–22% blended, with VAPs yielding ~25%.

• Financial Strength: Virtually debt-free; ₹194 crore net worth; internally funded capex.

• Valuation Angle: Trading at a discount to global peers despite superior balance sheet and upcoming scale.

• Risks: Execution and quality continuity during ramp-up; FX volatility (partially hedged).

• Structural Moat: High purity requirement, long customer validation cycles, and steep entry barriers make Accent a credibility-driven compounder rather than a commodity player.