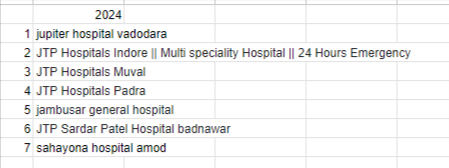

Initiating this thread to talk about Aatmaj Healthcare which runs a small hospital chain of 6 hospitals primarily in Vadodara, Gujarat. The hospital has access to advanced equipment like CT Scan machines and boasts 30 full-time expert doctors as well 50 on-call doctors

The hospital is currently achieving EBITDA margins of 45% and the stock is trading well below its 40 and 200 DMA. Also intrigued by their unique business model.

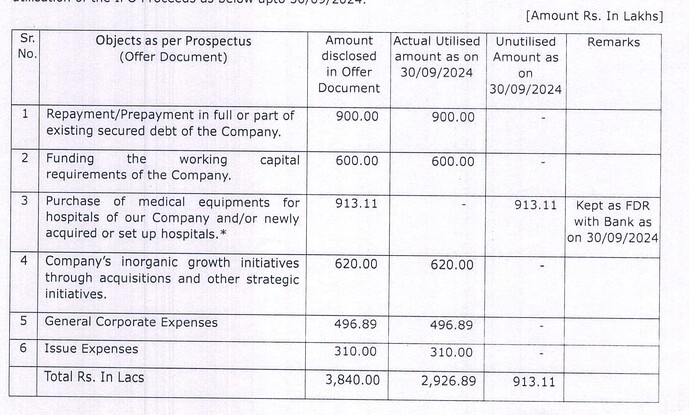

- Current capacity: Infusion of funds from IPO facilitated a significant expansion in bed capacity escalating from 130 to 330 beds with a potential plan to further extend to 430 beds. This expansion was made possible through strategic acquisition and improvement to existing hospitals

- Occupancy rate is variable. Currently at 40-50% due to new capacity, they are planning to increase to 60%

- Business model:

-

They are targeting well-run single doctor or multi-specialty hospitals who are owned by a single doctor or two doctors whose age are above 50 or around 50 and asking those hospitals to merge with their JTP Hospital brand.

-

Company has started acquiring hospitals since 1.5 years from the IPO

-

The hospital is not bought fully but rather taken up on lease and rent/royalty is paid throughout the hospital lifetime. This ensures that upfront investment is low and allows the chain to scale fast.

-

From the concall “And I am a gynecologist from Baroda, so Baroda Obstetrics and Gynecological Society that why doctor don’t getting the revenue or what I am telling you the word royalty is not getting, because the doctor is not selling or disinvesting his practice at proper time. A person at 45 to 50, his practice is at its peak, and at that time he is not thinking about it, and at the age of 60, 65, he wants to either sell his hospital or his business. At that time, his business was going down.

-

So, we are explaining them at this peak, you merge with us. You will get whatever you get now, but what is your advantage? If you are with us, your revenue will be to you till you and after you also. So, on that model, we are acquiring the hospitals. And with so little capital, we can and why is there a less expense? Because the whole hospital is there. We have to only take over it.

-

So, I am giving you an example. We have taken that 50 bedded hospital at Jambusar General Hospital. You know, that doctor’s age is around 48. Okay. He is a well-practicing gynecologist with his team of orthopedic and all that things. Their revenue with pharmacies is around 4 to 4.5.”

-

“We are paying rent for them and for their business. If they are selling us 100%, we pay them the amount and they work in that hospital only as a boss or as a head of the unit, and he will get or she will get his professional fees. They are getting handsome profit, but when we counsel them, they agree, and they slum sell their business. We don’t purchase their building. So, their ownership is there. We are paying them rent”

-

They plan on keeping an asset lite model with the promoter mentioning Lal Path Labs and HCG as the inspiration.

- Margin sustenance

- Company has redirected attention from government healthcare related ventures, enhancing their profit at both EBITDA and net profit level. However, this will slightly reduce their revenues.

- Also, the company claims that they don’t have to pay doctors according to their surgeries as they hire full-time professionals. They only have to pay a fixed amount to them. Not sure how sustainable or true this is for other hospitals.

- Company is betting on IVF for sustaining growth and margins. Company is in talks to acquire one IVF center in Vadodara by March-24 (not yet functional). They have mentioned that IVF is around 1.5 lakh per cycle (for HCG, the cycle cost is 4 lacs per cycle in Bangalore) so people would prefer an established center rather than a new one. As per the concall: IVF is high revenue and high profitability (however, looking at Apollo and HCG, margins would be 17-20% looking which is lower than their hospital margin)

- Capex plan:

- 2 IVF center with capital allocation of around 4-5 Cr

- Planning to increase bed capacity from 330 (done during FY24 only) to 430 in next one year by acquiring single doctors or multi-specialty hospitals from 50+ aged doctors

- Also, looking at Onco radiations units in 3-5 year time frame at 16 Cr setup cost for each (looks to still be evaluating)

- Revenue Guidance:

- FY24: 28-32 Cr

- FY26: 80-90 Cr

- Profit margin: 20%

- Key Risks:

- It’s an SME stock so share liquidity is low

- The business model and capacity expansion of 100 beds requires fundraising, which could lead to equity dilution or debt increase

- The business model of acquiring hospitals and re-branding them might not work as intended as a lot of these regional hospitals depend on the reputation of the local doctors and if their name or association is not there, it might lead to lower patient footfall.

- It can also be a challenge to get doctors to give up their well running clinics

- IVF demand and margins might not pan out as imagined, and can actually lead to EBTIDA margin contraction for the hospital chain. HCG is also planning to sell off its Milaan IVF clinics due to degrowth in revenue and poor margins.

- The MD also talked about Onco radiation units in future plans which could be outside their expertise zone as this is trying to emulate HCG healthcare while MD is a Gynecologist.

- While the PE and EV/EBITDA is very cheap, the cash flow leaves much to be desired, it is currently at 7x CFO which is much higher than bigger hospitals

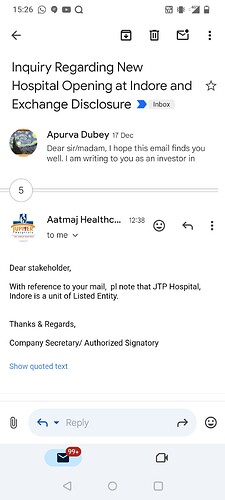

- Company had promised to publish quarterly results in Nov, but that doesn’t seem to be happening

- MD still practices 4 hours a day as a doctor and has himself highlighted that his expertise is not in corporate affairs - this could be a positive and negative depending on outlook

There was an investor meet on 6th Feb, but there doesn’t look to be any notes that I could find. If anyone has any idea or scuttlebutt information from Vadodara, please share

Discl: Not invested, but interested